The world’s most prominent social media network Facebook has announced plans to take its global dominance to the next level through the launch of its own cryptocurrency, Libra.

Libra is a financial technology (fintech) solution, or cryptocurrency, that will allow users to buy goods and services on a worldwide scale, to send money with greatly reduced fees, and possibly most interestingly, the new cryptocurrency could potentially deliver financial and banking services to billions of “unbanked” users.

Despite the growth of financial market coverage, a large amount of the world’s population is still left behind — 1.7 billion adults globally remain outside of the financial system and do not have access to a traditional bank.

The evolving trend of better financial services is simultaneously creating inequality of service given that one billion have a mobile phone and nearly half a billion have internet access.

It is far easier to obtain access to a smartphone than a bank account – and that’s exactly what Facebook is seeking to leverage as it prepares to cut the red ribbon on Libra.

Delivering on user demand

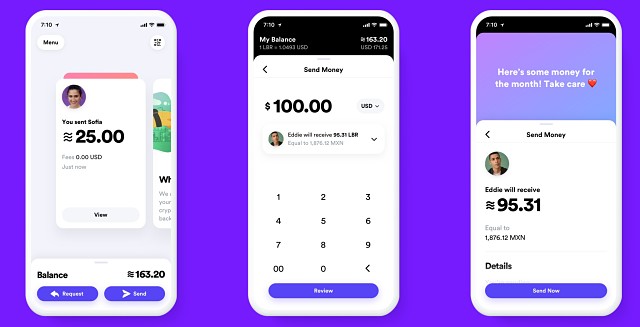

According to Facebook, the company plans to create a parallel subsidiary called Calibra in order to handle users’ financial transactions and to ensure a separation between financial and social media profiles.

Users’ real identities will not be tied to their publicly visible activity – a move that was clearly designed to address lingering privacy concerns that continue to overshadow the social media giant.

Yesterday, Facebook released its white paper explaining Libra and its testnet for working out the kinks of its blockchain system before a public launch in the first half of 2020.

The Calibra wallet will be built into WhatsApp, Facebook Messenger and possibly other applications over time – assuming the cryptocurrency proves popular. This across-the-board integration fits into broader plans to streamline the Facebook ecosystem as a whole.

“The existing blockchain systems have yet to reach mainstream adoption,” the white paper stated.

“Mass-market usage of existing blockchains and cryptocurrencies has been hindered by their volatility and lack of scalability, which have, so far, made them poor stores of value and mediums of exchange,” according to the white paper.

The ultimate aim is to make an early stake in the rapidly developing digital payments and crypto market niches that have captured the imagination of both consumers and businesses around the world.

A broader theme that’s also worth noting is the growing tussle for financial market supremacy between banks and fintech firms.

The world’s most popular and liquid cryptocurrency is Bitcoin, having arrived on the scene in recent years as an alternative to traditional currencies and offering financial autonomy. However, in addition to wielding a unit of exchange and a store of value, there is also the issue of access and payments.

The Libra Association

With the intention to make Libra usable, reliable and functional, Facebook has confirmed it doesn’t intend to fully control its soon-to-be-launched cryptocurrency.

The multibillion-dollar company will get just a single vote in its governance like other founding members of the Libra Association, including Visa, Uber and Andreessen Horowitz, which have invested at least US$10 million each into the project.

Facebook claims that its new fintech project has backing from 28 market-dominant companies, or so-called founding partners including PayPal, Uber, Visa and Vodafone among others that make up the non-profit Libra Association.

The association will promote the open-sourced Libra Blockchain and developer platform with its own Move programming language, plus sign up businesses to accept Libra for payment and even give customers discounts or rewards.

One of the operational quirks is that Calibra and other founding members of the Libra Association will earn interest on the money users cash in that is held in reserve to keep the value of Libra stable.

Financial backing

The Libra project is said to be different from typical crypto coin launches that have routinely taken place in recent years. The biggest fear for investors when considering a cryptocurrency is the possibility of failure which is inherently linked to what underlying asset the coin is based on.

The group stresses that its Libra currency is different because it’s backed by a “reserve” of real assets, including short-term securities from central banks.

Facebook stated the assets will be distributed on a “custodian infrastructure” located around the world.

Money for the reserve will come from people who use Libra and Libra Investment Tokens that are bought by founding members of the non-profit association. Interest on the assets in the reserve will help cover costs for maintaining the system with only the association having the ability to create or delete Libra currency coins.

Looking forward to the future

To help the market visualise what Facebook is offering via its Libra cryptocurrency, the company’s white paper draws parallels between today’s financial system and telecommunications networks before the introduction of the internet.

About 20 years ago, the average price to send a text message in Europe was 16 cents per message. Now everyone with a smartphone can communicate across the world for free with a basic data plan.

“Back then, telecommunications prices were high but uniform; whereas today, access to financial services is limited or restricted for those who need it most — those impacted by cost, reliability, and the ability to seamlessly send money,” the white paper reported.

The dislocated nature of the financial ecosystem means that people with less money tend to pay more for financial services.

This inherent inequality creates excellent market opportunities for new market participants to plug the gap.

For users, their transactions continue to be eroded by fees, from remittances and wire costs to overdraft and ATM charges.

Payday loans can charge annualised interest rates of 400% or more, and finance charges can be as high as 30% – outrageously high fees that would be a lot lower if the market was less fragmented.

When people are asked why they remain on the fringe of the existing financial system, those who remain “unbanked” point to not having sufficient funds, high and unpredictable fees, banks being too far away, and lacking the necessary documentation.

With Libra to be launched in early 2020, Facebook has let the market know that it intends to not only duel for market supremacy with the likes of WeChat, but even more poignant, the social media giant is seeking to take on the fintech industry including the likes of Bitcoin and PayPal in order to continue its vertical and horizontal growth trajectory.