Fintech vs Banking: Which sector controls the future of money?

There could be trouble ahead at the top of the financial market arena.

In the red corner is Banking — one of the world’s most pre-eminent industries represented by a handful of stalwart banks, who’ve been around for centuries and considered the bedrock of a modern financially-savvy society.

In the blue corner is Technology — in the form of a cloud of hovering tech firms, buzzing around consumers and serving up the most connectible and value-added premium products ever seen. Most innovations that have improved financial services have been down to “financial technology” or “fintech” for short.

Separating the two is a wall of compliance and a patchwork of regulatory rules that struggle to span borders and jurisdictions; while tech innovations and the funding to make them a reality, can sprout pretty much anywhere.

Combined, technology firms are generating astonishing revenues as their devices permeate the pockets of billions of people. The rate of growth is equally matched by the efficiencies tech firms have brought with them, to the extent that their operations are eclipsing the commercial margins of banks.

ApplePay is forecast to facilitate US$200 billion in payments by 2021 and already handles US$50 billion annually. Meanwhile, Amazon is preparing to cut the ribbon on its first chequing account feature by partnering with JP Morgan, a leading US bank.

According to the Australian Financial Review, 84% of millennials would consider banking with a tech giant like Google or Apple. This indicates that the average consumer puts more trust in their search engine provider than their internationally-recognised regulated Tier 1 banking institution, which only reaffirms the scale of the problem banks are now facing.

Being a big bank has never meant so little

Banking giants, as well as their central banking overseers, have been rattled by the global financial crisis (GFC) in 2007, the effects of which are still lingering on today’s balance sheets at major banks.

Their near-fatal wobble around ten years ago has been amplified by a market threat being vaunted by tech firms. Tech platforms could potentially handle banking services better than banks can and their services are proving it, exemplified by PayPal and Google.

And who can blame them? Considering the demand for alternative currencies, more efficient means of storing and transferring money, and transparent banking services keeps growing due to trust being mangled by the banks in 2008, which has not been rebuilt since.

The balance of power is potentially shifting. The world’s five largest firms in the form of Apple, Facebook, Amazon, Google and Microsoft by market capitalisation are now all US-based technology firms (whereas before the GFC, it was banks, oilers and carmakers).

And having conquered their respective fields of online shopping, ubiquitous software, social media and e-commerce, these cash-rich tech giants are now slowly venturing out from their home turf and staking their flags in market territory traditionally occupied by the big banks.

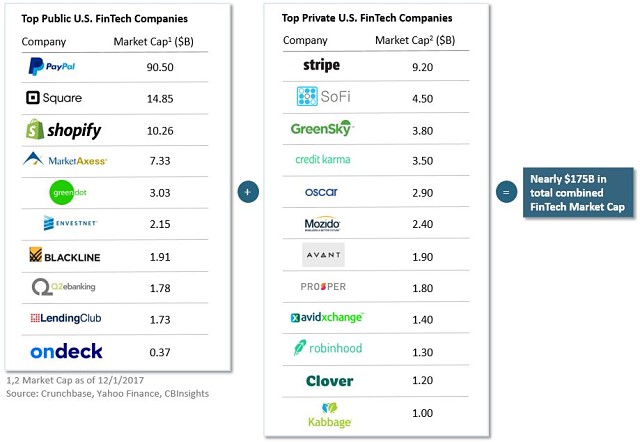

US fintech market cap for both private and public companies.

Tech market dominance has not only been felt in tech firm valuations. Its effect has impacted consumers just as much as investors.

Google attracts around 40% of all digital advertising spend; Amazon handles around 30% of all US online sales; Facebook processes over a fifth of all mobile internet traffic; Microsoft’s products lurk in at least 70% of all consumer digital devices and corporate networks.

With this kind of hypermarket integration, the next stage could inevitably be full-blown banking services — and the banks are worried.

The commercial battlefield bordered by compliance

If the field of battle is the global online powered marketplace, then the weapon of choice between these cross-industry titans is financial technology.

Fintech has arrived on the scene in parallel with the growth of online connectivity, but in the space of just twenty years, fintech stands on the verge of making the banking industry redundant and surplus to requirements.

Some senior banking figures have gone as far as to say that there is an “existential crisis facing banking,” according to Raman Bhatia, Head of Digital for HSBC, speaking in an interview with CNBC Europe.

The prime reason is cost — or the lack of it as far as fintech companies are concerned. The huge cost savings made possible by fintech products has been the main value driver enabling tech firms to start their encroachment on banker market turf. The other key factor has been accessibility.

Technology has levelled the playing field and expanded it by several multiples as a by-product. Fintech is not only a corporate tool; its malleability means it can provide breath-taking services for anyone with a mobile phone, which includes billions of people in developing countries.

Both for consumers and businesses alike, seamless integration of every aspect people’s lives with automated features and blockchain-enabled AI-controlled apps is occurring as we speak.

Consumers benefit by receiving robust financial services and devices that magically know what the user wants or needs, simply by responding to the 20+ sensors now installed as standard in modern devices.

By the same token, the same technology can manage huge data centres, secure corporate networks and reorganise huge datasets to help streamline all aspects of modern business.

This could be a match made in heaven or a marriage from hell…

Open banking first impressions

Open banking is the concept of allowing third-party companies the ability to provide payment services while accessing various layers of data provided by banking customers.

The overlap has the potential to reap supreme benefits for consumers, but if the two industries clash, could end up leaving consumers in the middle of a sector turf war with tech firms and banks vying for the same business, only through different channels according to patchy regulatory rules.

In Australia, online banks and cryptocurrency market propulsion has been slow to take off the ground and has a slew of eyebrow-raising enquiries to wade through over the coming months which has zapped enthusiasm for any new-age fintech solutions just yet.

However, it’s not all doom and gloom for Australian fintech solutions. Peer-to-peer lending has been a hit through entities such as SocietyOne, backed by Kerry Stokes, Lachlan Murdoch and James Packer. The company says it has a grown its loan book to the tune of $200 million and has lent out $350 million since the service went live in 2012, which at least means Australian consumers find the concept popular.

In the UK, several digital-only “challenger banks” such as Starling, Fidor and Monzo have gained momentum, leading to questions over whether such digital alternatives could weaken the position of high-street banks.

In China, Alibaba and WeChat have sprung up to challenge the traditional state-backed behemoths such as Bank of China and China Construction Bank, having grabbed an 80% market share in online payments already. Figures show that Alibaba’s Alipay and WeChat Pay processed US$3 trillion in 2016 with last year’s figures likely to be significantly higher once they become available.

Digital payment growth in China, 2012-2016. (figures in USD)

WeChat’s social media app recently surpassed 1 billion monthly users, which is second only to Facebook in terms of user numbers.

WeChat’s parent company Tencent is fighting it out with Baidu and Alibaba for the trillion-dollar-sized Chinese consumer market.

One of its largest weapons is its payments app WeChat Pay, which allows users to book services, transfer money and shop online — effectively replacing cash as we know it.

According to analysts, there are already more than 10,000 shops and restaurants in Australia accepting WeChat Pay with an estimated 2.5 million Australians using the app.

According to Mr Bhatia, “there are many players that will co-exist and there could be many models that could build on top of the bank’s model and co-exist with what banks have to offer.”

However, exactly how the two sectors will merge for the benefit of consumers remains in real-time development. And while technicians work on new products, regulators are sharpening their pencils.

Banker sponsored resistance

Several banking figureheads have spoken out against the influence of commercial muscle-flexing tech firms.

Former US Treasury undersecretary Timothy Adams, currently serving as CEO of the Institute of International Finance (IIF), says that retail giants and platform companies that encroach on traditional banking activities like financing payments and wealth management should be restrained from doing so.

“It’s time for regulators to pay attention and understand potentially what systemic risks these institutions and platforms pose to the system.”

He added that “if it’s the same risks, it should be the same regulatory structure.” Ominous words indeed.

Growing tidal wave of technology

The US-born, but now global, tech giants of Apple, Google (Alphabet Inc.), Microsoft, Amazon and Facebook, are the five biggest companies in the world by market capitalisation, netting a combined US$3.7 trillion in market capitalisation.

Their increasing dominance is fuelling concerns about customer security and data privacy, not to mention the potential effects on competition, passporting, tax avoidance and conflicts of interest issues.

So far, the impact of fintech has been most pronounced in wealth management, payments services, peer-to-peer funding, and the elephants in the room: cryptocurrencies.

As avant-garde tech products have surfaced, possibly the most divisive stumbling block preventing true holistic integration into global markets has been ‘compliance’.

Can ‘unregulated’ tech firms be trusted to hold, move and pay interest on client money? It’s a privilege only banks are legally bestowed with, but with the advent of instantaneous bank-free online payments, e-currencies and cryptocurrencies – regulators are seeing a polarised landscape: either tech firms are starting to provide functions they may not have the experience to handle, or, they’re providing services regulators can’t account for and trace.

If judging by the recent debate regarding cryptocurrencies and their place on the regulatory alter, regulators in all G20 countries are worried about the latter.

Government budgets stand to gain billions of dollars, if the millions of private crypto accounts can be brought to heel to government legislation — and all indications are, legislation is on its way. With or without regulation, disruptive tech firms have set a huge gauntlet for banks to either negotiate or fail under — banks better shape up or move on out.

Exactly how this market-topping clash hits the canvas is still far from clear, although if it does finally arrive, we may see an all-mighty sell-off as privacy-conscious trend followers swipe their winnings from the table, scrambling to preserve their fintech-powered crypto-amplified earnings.