Weekly review: Crowdfunding laws approved, Myer posts first loss since 2009, JP Morgan warns of coming crisis

WEEKLY MARKET REPORT

Australia’s employment market continues to outperform, adding 44,000 new jobs in August, well ahead of the forecast 16,500 figure.

Meanwhile the unemployment rate remained steady at 5.3 per cent, the lowest level since November 2012.

Despite the number of people seeking full-time work decreasing, the overall job seek rate improved as those seeking part-time employment rose substantially.

Retailers will be hoping the positive sentiment sees the newly hired workers dispose of their incomes in their stores.

Retail rollercoaster ride continues

Department store chain Myer (ASX: MYR) rallied this week 32 per cent to finish at $0.595 a share despite the company reporting an annual loss of $486 million, which is the first in its history since listing on the ASX in 2009.

Recently appointed CEO John King announced a change in strategy going forward, saying the company will rely less on discounting and more on selling items at full price.

Mr King took advantage of the midweek dip purchasing $43,500 worth of Myer shares on the market.

Also softening the blow and leading the midweek share price bounce was news the company had refinanced its debt, adding another two and a half years of breathing room.

Whilst the new strategy sounds good in theory, it is yet to be seen how consumers will react with the digital age of discounted retail prices and heavy online competition becoming the new norm.

Supermarket retailer Woolworths (ASX: WOW) had a week it would rather forget, being hit with a $100 million class action lawsuit for when it delivered a shock downgrade to its profit outlook in 2015.

The supermarket chain is being charged with breaching continuous disclosure obligations and engaging in misleading conduct.

Furthermore the company is likely to take a sales hit in the near term after metal pins were found in a number of its strawberry produce. Adding salt to the wounds, a number of Woolworths customers were targeted in an online loyalty rewards scam.

Meanwhile competitor Coles, owned by Wesfarmers (ASX: WES), is experiencing success with its mini collectables marketing campaign generating plenty of buzz and increasing sales. Wesfarmers is set to spin off the supermarket asset later this year in November.

Equity crowdfunding laws to boost private sector

Companies in the private sector seeking to access capital received positive news this week.

The passing of the Corporations Amendment (Crowd-sourced funding for proprietary companies) Bill will legalise the ability of proprietary, or private, firms to raise money from the general public in return for a stake in their companies.

The equity crowdfunding legislation comes into effect next month and will allow proprietary (or unlisted private) companies with annual turnover or gross assets of up to $25 million to advertise their business plans on crowdfunding portals that carry an ASIC licence.

Companies will be permitted to raise up to $5m per year to carry out business plan, with individual investors allowed to each contribute up to $10,000 a year – a cap designed to minimise risk to an unlimited number of ideas.

Proprietary companies taking on equity crowdfund investors will be required to prepare annual financial reports and directors reports in accordance with accounting standards.

Also if a crowdfunding passes the $3m mark the company will be subject to an audit.

Only large proprietary companies – defined as those with any two of either $25 million turnover or above, $12.5 million of gross assets or more, or 50 employees or more – have previously had to prepare such reports.

JP Morgan warns of coming financial crisis

It’s hardly an anniversary worth celebrating, but with the 10 year passing of the 2008 financial crisis JP Morgan announced this week that it expects the next crisis to hit in 2020.

The good news is that it is unlikely to be as devastating.

Whilst the collapse of Lehman Brothers is long gone from many investors’ memories, its important to note that these events can and do occur.

Since the last crash, JP Morgan created a predictive model that calculates outcomes based on the length of an economic expansion, the likely duration of the next recession, the degree of leverage, asset-price valuations and the level of deregulation and financial innovation before the crisis hits.

Among the predicted outcomes:

- a 20 per cent slide for the US equities market,

- US corporate-bond yield premiums rising 1.15 percentage points,

- base metals slumping 29 per cent,

- energy prices taking a 35 per cent hit,

- stocks in emerging markets slashing 48 per cent,

- and a 14.4 per cent drop in emerging currencies.

The warnings have been echoed by others, including the chief economist Mark Zandi of ratings agency Moody’s, saying that “2020 is a real inflection point.”

Former Federal Reserve chairman Ben Bernanke backed up concerns saying that the US economy may face a ‘Wile E. Coyote’ moment in the same year.

Small cap stock action

The Small Caps index recovered ground this week after several days of losses the weeks prior to finish the week up 0.97 per cent at 2,831 points.

While the larger indexes ASX 200 finished the week at 6,165.3, up 0.6 per cent and All Ords at 6,276.3 points, up 0.58 per cent.

A number of small cap stocks with notable news this week include:

Explaurum (ASX: EXU) and Ramelius Resources (ASX: RMS)

Ramelius Resources kicked-off the week with an unsolicited takeover bid for Explaurum on Monday morning.

Gold producer Ramelius bypassed Explaurum’s board and went direct to shareholders with an all scrip offer valuing Explaurum at $0.123 per share, which was a 66.2% premium to its 7 September closing price of $0.074.

The news spurred Explaurum’s share price to close Monday at $0.105 – up more than 41%.

Explaurum’s board responded by advising shareholders to “take no action”. The company also stated the offer was “inadequate” and “undervalued” its underlying assets and future prospects.

The Food Revolution Group (ASX: FOD)

It was a big week for The Food Revolution Group, which collared a $20 million Chinese distribution deal and welcomed two major institutional investors to its share register.

The Food Revolution Group signed a binding subscription deed that allows Careline Australia-led investors buy up $20.25 million worth of its shares.

Additionally, the agreement allows for Careline to target at least $20 million in extra sales of The Food Revolution Group’s products into China.

Meanwhile, Australia’s largest wealth manager Perpetual and award winning boutique fund manager SG Hiscock have scooped up a 40 million block of The Food Revolution Group’s issued capital.

Australian Vanadium (ASX: AVL)

Australian Vanadium has completed the first drilling phase of its pre-feasibility study at its flagship Gabanintha vanadium project in WA, while pegging up more ground close to the deposit.

The drilling campaign included 14 reverse circulation holes for 1,089m and aimed to convert inferred resources to indicated status.

A diamond drilling program has now begun to underpin the resource and resolve key parameters for a long-term open pit design.

Meanwhile, the new vanadium tenement covers 49.7sq km and overlies a 9.5sq km section at the southern of Gabanintha.

Australian Vanadium anticipates the licence may host extensions to the vanadium deposit and is also prospective for gold, copper and uranium.

Real Energy (ASX: RLE)

Real Energy has reported it will begin fracture stimulation of two wells within its Windorah gas project in Queensland.

Fracture stimulation of the Tamarama-2 and Tamarama-3 pilot development wells is expected to start in the next few weeks with the aim of proving commercial flow rates and progressing to pilot production in 2019.

Real Energy’s reservoir modelling indicates flow rates within the wells should exceed 3 million cubic feet of gas per day in each well.

The wells have incorporated new designs to enhance productivity via alignment flow technology. The designs are a result of the University of Queensland’s Prof Raymond Johnson’s extensive research.

Medlab Clinical (ASX: MDC)

Medlab Clinical has been given the green light to export medical cannabis, paving the way for the company to export its medical cannabis-based NanaBis and NanaBidial cancer pain management medications.

Australia’s Office of Drug Control granted Medlab the licence enabling the company to legally supply cannabis oversees, facilitating the company’s trade discussions.

Medlab chief executive officer Dr Sean Hall said the licence will now enable the company to research, manufacture, trial and supply its products within Australian and overseas.

NanaBis has been used to improve pain in cancer patients who have not responded to traditional opioid analgesics, while NanaBidial was developed to help patients with chemotherapy induced nausea and vomiting, as well as in patients suffering seizures.

Lithium Australia (ASX: LIT)

Lithium Australia has secured 100% of the Sadisdorf lithium-tin-tungsten project in Germany after satisfying all the conditions for transferring the licences into its wholly-owned German subsidiary’s name.

As part of the acquisition, Lithium Australia will pay the vendor Tin International €500,000 in cash and €1.5 million in Lithium Australia shares.

Recent drilling at Sadisdorf revealed lithium-mica intersections up to 78.1m thick.

Sadisdorf has a maiden resource of 25Mt at 0.45% lithium, which Lithium Australia plans to “significantly expand” through ongoing exploration.

Lithium Australia also plans to ship its lithium-iron phosphate cathode powder to China. The material was generated at the company’s recently commissioned VSPC pilot plant in Queensland.

Skyfii (ASX: SKF)

Skyfii has secured a new contract in Brazil to provide its IO Platform data analytics services to Latin America’s largest medical services provider Dasa Group.

Through the agreement with Dasa, Skyfii’s platform will initially be used in 92 of Dasa’s centres in the region. The contract can also be extended to roll out the platform across an additional 161, once the initial deployment has been successfully completed.

Skyfii’s IO Platform includes: IO Connect, IO Insight and IO Engage.

It is a cloud-based solution that uses existing Wi-Fi infrastructure, video cameras, web traffic and social media to analyse behaviours and gain a better understanding of a business’s visitors.

The week in IPOs

For readers interested in the latest ASX debutants and upcoming IPOs, Small Caps has you covered.

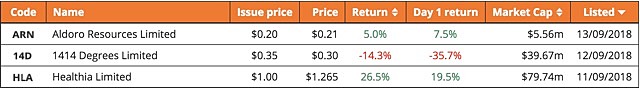

The latest stocks to make their way onto the ASX this week include:

Healthia (ASX: HLA)

Healthia joined ASX ranks on Tuesday 11 September after raising $26.8 million via the issue of 26.8 million shares at $1 each.

The fully underwritten IPO saw the company close its first day of trade at $1.195 – up 19.5%. During trade on Wednesday, the company’s share price was pushed up to reach a $1.33 peak.

Healthia was established to combine its allied health brands including My FootDr Podiatry and Allsports Physiotherapy, with both brands possessing numerous podiatry and physiotherapy clinics throughout Australia.

The company plans to continue expanding through further acquisitions of complementary allied health businesses.

Aldoro Resources (ASX: ARN)

Nickel and cobalt focused Aldoro Resources made its ASX debut on Thursday, with the company closing its first day of trade at a 7.5% premium to its $0.20 issue price.

The company raised $4.5 million to advance its nickel and cobalt assets in WA.

Funds from the IPO will go towards acquiring and exploring the projects that include Ryan’s Find, Leinster, Kalgarin and Cathedrals.

Initial exploration will include ground and airborne surveys to firm up targets for drilling.

1414 Degrees (ASX: 14D)

Energy storage focussed 1414 Degrees entered the ASX club on Wednesday after raising $30 million.

The company issued 125 million shares at $0.35 each giving investors a chance to secure exposure to it s energy storage technology.

1414 Degrees’ technology stores energy generated from electricity or gas and supplies the heat and electricity back to consumers.

During its first week of trade, 1414 Degrees dropped to a low of $0.205, but continued climbing afterwards to finish the week at $0.30, below its issue price.

The week ahead

On Tuesday the Reserve Bank is set to release its meeting minutes with the central bank having decided last week to keep the official cash rate on hold at 1.5% for the 25th consecutive month.

Assistant Governor Christopher Kent will give a speech on Thursday regarding the decision, his words may determine the short term outlook for our markets, with the Aussie dollar continuing to lose ground against the greenback in 2018, down 10.07%, currently sitting at 71.5c.

A number of reports are due to come out of the US likely to show continued business optimism. On the flip-side, US data on housing starts, building permit and home sales for August are expected to signal the market is cooling down. As is China’s housing price data also out next week forecast to come in at 4.8%, down from 5.8% the month prior.

Strong inflation data is expected out of the UK, with the Bank of England this week keeping rates on hold at a low 0.75%. Developments on Brexit are to be watched closely.

Globally the wildcard to look out for is continued trade wars, with China asking the World Trade Organisation (WTO) to impose US$7 billion sanctions on the US for non-compliance related to a ruling regarding US dumping duties, with China having won a similar claim last year across several industries.

Whilst the figure is somewhat insignificant, the hostilities between the two leading nations has been intensifying in recent times. Adding fuel to the fire, President Trump is threatening to pull the US out of the WTO.

The global trade wars are well underway.