Once again central banks have re-asserted their grip on world markets, forcing the local ASX 200 down 1.7% for the week.

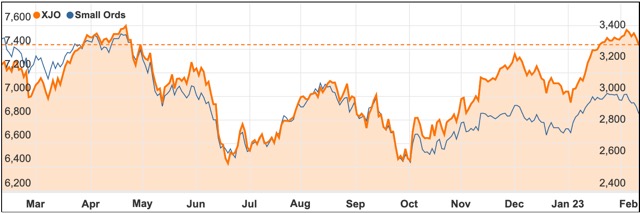

The ASX 200 index fell 0.8% on Friday to 7433.7 points, with the weekly fall the first for 2023 which removed some of the impressive froth that built up over the holiday season and put the market within reach of record highs.

Eventually the hawkish comments from US Federal Reserve Bank governor Jerome Powell followed up by equally hawkish comments by the Australian version in Philip Lowe was enough to send shares back to a three week low as investors lowered their expectations.

That followed Wall Street, with the S&P 500 index down 0.9%, the technology-focused Nasdaq down 1% and the Dow Jones Industrial Average losing 0.7%.

Defensives resist the fall

As you would expect with a pullback, the defensive consumer staples sector was the only one to resist falls on Friday, with tech the worst, with utilities, communications, energy and materials also following the bearish lead.

Coal miners were particularly weak, with New Hope (ASX: NHC) falling 8.6% to $5.31 and Whitehaven Coal (ASX: WHC) fell by 3.7% as thermal coal prices continued to correct.

Following on from the blockbuster $24 billion bid for Australia’s biggest gold miner Newcrest (ASX: NCM) by the world’s biggest miner Newmont, the gold sector continued to calm down and erode the takeover premiums that had suddenly been added to some stocks.

Gold premium fades

Evolution Mining (ASX: EVN) and gold mine consolidator Northern Star Resources (ASX: NST) both dropped more than 3% as the gold price fell back to hit a six-week low.

There were some stocks that swam against the tide, with shares in Treasury Wine Estates (ASX: TWE) rising 1.6% as the chances of China removing wine tariffs continued to improve.

Companies that were reporting earnings continued to struggle with News Corp (ASX: NWS) shares down by 6.9% on plunging earnings and soft advertising which have led to 1250 across the board job cuts.

Similarly REA Group (ASX: REA) reported a 9.6% fall in net profit for the December half due to weaker advertising, with higher interest rates and costs crushing consumer sentiment.

Adding to the gloom, the Reserve Bank Statement on monetary policy warned of more interest rate rises to come as it forecast inflation to remain higher for longer.

Small cap stock action

The Small Ords index dropped a massive 4.01% for the week to close at 2895.7 points.

Small cap companies making headlines this week were:

CleanSpace (ASX: CSX)

Respiratory protection solutions provider CleanSpace has won three healthcare distribution contracts for North America and the US.

Two of the contracts are with group purchasing organisations (GPOs) and one is with Medline Industries, which is a medical equipment distributor.

US healthcare improvement company Premier Inc is one of the GPOs and will offer its members access to CleanSpace’s Halo respirator range.

The contracts will provide access to a network of purchasing and distribution channels for most of the 6,000 hospitals in the US.

CleanSpace’s chairperson Bruce Rathie said the deals represent important milestones in the company’s healthcare sales and distribution strategy.

Aguia Resources (ASX: AGR)

Aguia Resources has produced a “sizeable” measured and indicated mineral resource estimate at its metallic green copper project in Brazil.

The estimate is 22.6 million tonnes grading 0.43% copper and 2.11g/t silver, plus an inferred total of 3Mt at 0.43% copper and 1.85g/t silver.

The estimate was based on recent infill drilling of 25 core holes for 2,646 meters.

Aguia described the resource statement as a “significant milestone” for its copper story and a step towards a pre-feasibility study and environmental impact assessment. The company will review the current resource model to determine the optimum reserve pit and improve the engineering of the project.

The metallic green copper resource estimate is believed to be “just the beginning” for Aguia’s copper potential.

Pure Hydrogen (ASX: PH2)

Australian clean energy company Pure Hydrogen has partnered with Singapore-based CAC-H2 to develop an “emerald hydrogen” plant in Queensland.

The plant will use technology to produce hydrogen from woody biomass that would otherwise be burnt or discarded.

Pure Hydrogen will initially fund 25% of the construction, costing around $3.2 million, with the option to fund an additional 25% if desired.

The goal is to fast-track development and secure hydrogen for supply to customers in southeast Queensland in 2024.

The Moreton Bay hydrogen hub is the first of many planned across Australia’s east coast by the joint venture partners.

Memphasys (ASX: MEM)

Australian reproductive biotechnology company Memphasys has developed a device called the Felix system, which outperforms conventional sperm preparation methods for human in vitro fertilisation (IVF) procedures.

The system is superior to the widely used density gradient centrifugation method in terms of selecting cells with low DNA damage, according to two articles by key opinion leaders (KOLs) in the field

The KOLs, from five centres around the world, studied 29 human semen samples and found that preparation with Felix significantly improved sperm fractions in terms of progressive motility, sperm DNA fragmentation, and oxidation.

Felix is a patented, automated device that separates high-quality sperm from a semen sample in six minutes, compared to 40 minutes for the conventional method.

Kalamazoo Resources (ASX: KZR)

It was a big week for Kalamazoo Resources, which unveiled an updated resource estimate for its Ashburton gold project, along with lithium discoveries at its Marble Bar asset.

Both projects are located in WA’s Pilbara, with Ashburton now hosting a resource of 16.2Mt at 2.8g/t gold for 1.44Moz.

The updated figure represents a 10% uplift in grade and provides increased confidence in the interpreted major lodes at the Mt Olympus deposit – leading to an optimised pit shell.

Over at Kalamazoo’s Marble Bar project rock chips collected from outcropping spodumene bearing pegmatite dykes returned up to 2.8% lithium.

The company now plans to evaluate the spodumene-bearing dykes further with joint venture partner Sociedad Química y Minera de Chile SA (SQM).

The week ahead

For the coming week the biggest influence on markets is likely to be the continued release of profit results.

So far in Australia, there have been more disappointments than upside surprises but that could easily turn around.

On the statistical side, there is not much that is likely to change the narrative.

The Household Spending Indicator might give some guide of how resilient consumer spending might be, as will the consumer confidence figures.

Australian jobs data could be more influential, particularly if the job market is starting to weaken, while an appearance by the Reserve Bank governor Philip Lowe appears before the House of Representatives Standing Committee on Economics in Canberra could provide more detail on interest rates and inflation.

Some US figures might also be influential, with consumer prices, producer prices and export and import prices giving some indication of inflationary pressures.

However, with profit reports hitting full stream this week, they will be a big driver of individual and sectoral movements.