Weekly review: big vaccine deal just the tonic the market needed

每周市场报告

News that an extra four million doses of Pfizer COVID-19 vaccine was on the way to Australia was just the tonic the share market needed to bounce off a two-week low and manage a marginal weekly gain.

The vaccine swap deal with the UK will enable the pace of vaccinations in the hard-hit states of NSW and Victoria to pick up, bringing forward the date when the states plan to inoculate 70% and 80% of the population over the age of 16.

That was just the shot in the arm the share market needed with the promise of an earlier end to damaging lockdowns, pushing up the prices of a wide range of companies.

Market continues to inch higher

A new record high for Macquarie Group (ASX: MQG) and price rises for Commonwealth Bank (ASX: CBA), NAB (ASX: NAB) and big blood products and biotech group CSL (ASX: CSL) all did their part to push the ASX 200 up 0.5% to close at 7522.9 points – a 34 point rise for the week.

Also helping to erase a two-day slide was a slew of new records on Wall Street and a recovery in the big miners despite softening iron ore prices.

BHP (ASX: BHP) jumped by 1% from a nine-month low to hit $42.35, Rio Tinto (ASX: RIO) was up 2.5% to $111.37 and Fortescue Metals (ASX: FMG) rose 0.7% to $20.85.

Other miners joined the party including lithium stocks and energy companies such as Whitehaven (ASX: WHC) which jumped 6.8% to $2.84 and gains also for Woodside Petroleum (ASX: WPL), Viva Energy (ASX: VEA) and Beach Energy (ASX: BPT).

There were some technology weak points such as Afterpay (ASX: APT) which fell 2.8% to $130.71 and Xero (ASX: XRO) which dipped 1.2% to $151.01, but on the whole it was a great day on the market as investors looked forward to a time when Australians would live without lockdowns.

There were some company specific moves too with shares in enterprise software firm TechnologyOne (ASX: TNE) up 3.5% after it announced an agreement to buy UK company Scientia Resource Management which services the higher education sector.

The acquisition will cost about £12 million, starting with an initial payment of £6 million and further earn-out payments.

ClearView Wealth (ASX: CVW) announced a strategic review of its business as it looks to unlock some value for shareholders – potentially through a takeover.

The move was supported by largest shareholder, Crescent Capital Partners, which saw ClearView shares rise 13%.

Small cap stock action

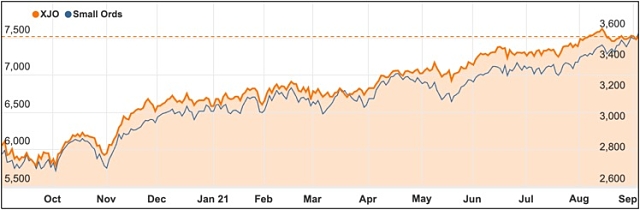

The Small Ords index rallied a strong 2.5% for the week to close at 3594.1 points.

ASX 200 vs Small Ords

Small cap companies making headlines this week were:

Pan Asia Metals (ASX: PAM)

Pan Asia Metals has applied for five lithium-tin special prospecting licences, which will make up part of its Kata Thing project in the Thailand’s Phang Nga Province.

The licences are believed prospective for lepidolite-style lithium and tin.

Historic rock chip results from one of the licences have returned up to 2,700ppm lithium oxide.

Once the licences have been approved, Pan Asia plans to work with universities in Thailand to design exploration programs.

92 Energy (ASX: 92E)

During its maiden drilling program at its Gemini uranium project in Canada, 92 Energy has uncovered a zone of elevated radioactivity.

A handheld spectrometer identified a 5.3m zone in hole GEM-004 of the drilling program, with radioactivity readings exceeding 500 counts per second (cps) and averaging 760cps.

Within this was a 0.7m subinterval which averaged 1,500cps.

This drill hole was targeting a conductor identified from a VTEM survey with assays anticipated within four weeks.

Gemini is in Canada’s highly prospective Athabasca Basin, which hosts major uranium operations including Cameco’s McArthur River mine 27km away.

Cash Converters (ASX: CCV)

As credit demand recovers, Cash Converters has reported strong earnings growth for FY 2021 with a 136% rise in EBITDA to $45.3 million resulting in a $16.2 net profit after tax despite COVID-19 challenges.

The $16.2 NPAT compares to a $10.5 million loss in FY 2020.

Cash Converters managing director Sam Budiselik told Small Caps the strong growth had been driven by online lending and retail.

“Pleasingly, we saw online principal advanced increase 13% and online retail sales increase 18% against the prior financial year,” he said.

RooLife Group (ASX: RLG)

Another company to post a large rise in FY 2021 revenue was RooLife group with revenue and income rocketing 183% to $9.61 million.

This is expected to be added to with $510,000 of deferred payments which are due in the current financial year.

Driving this growth was ongoing investment and refinement of RooLife’s technology, which connects brands and producers directly to online consumers in China.

High demand for its products was also experienced after COVID-19 pushed consumers more online with a focus on fresh food and health products.

Wide Open Agriculture (ASX: WOA)

WA-based Wide Open Agriculture also had a record FY 2021 after revealing a 198% rise in revenue to $4.3 million.

The company attributed the near triple revenue increase to growing demand for regenerative and ethical food and beverages as well as its effective commercial scaling strategy.

Wide Open Agriculture expects this growth trajectory to continue with new products under development and plans to expand nation-wide and into international markets.

To fund its growth initiatives, the company had $12.98 million in the bank at the end of June.

Wellnex Life (ASX: WNX)

Two of Wellnex Life’s nutritional brands are set to be available in Coles supermarkets Australia-wide next month.

Coles Group will stock Wellnex’s Wakey Wakey and The Iron Company products.

“These national retailer commitments give us great confidence that we are producing and bringing to market health and wellness products that are in demand and address clear consumer needs,” Wellnex chief executive officer George Karafotias said of the Coles agreement.

It is expected the supermarket launch will complement Wellnex’s existing distribution agreements with pharmacy groups and wholesalers in Australia including Chemist Warehouse, Terry White Chemmart, Australian Pharmaceuticals Industries and Symbion.

TNG Limited (ASX: TNG)

TNG Limited is set to develop green hydrogen projects in Australia in collaboration with Malaysia’s AGV Energy and Technology.

The companies have signed a project development agreement and will assess an initial hydrogen project opportunity in northern Australia.

AGV will use its HySustain hydrogen production technology, which produces green hydrogen and oxygen using electrolysis of demineralised water and renewable energy.

Other green hydrogen opportunities will be jointly evaluated by the companies, with AGV already in advanced discussions with potential offtake parties.

The week ahead

The big thing to watch this week is Australia’s Reserve Bank, with the board meeting more important than it looks, given that official interest rates will almost certainly not budge from the current 0.1%.

With lockdowns still a feature of life for a big slice of the population living in Canberra, Melbourne and Sydney, the RBA is tipped by some to delay tapering or to even extend its bond buying program.

Such a move would mitigate the continuing lockdowns by helping economic growth.

Many RBA observers were surprised by the August announcement that the RBA would cut its bond buying from $5 billion to $4 billion a week beginning in September.

Now analysts are split over whether the RBA will delay that taper due to the economic damage caused by the harsh lockdowns and also offshore Delta damage and a slowdown in China.

The other domestic issue follows a particularly robust profit reporting season which saw a record $38 billion in dividends announced for shareholders.

The question which remains to be seen is how much of that money finds its way back into buying more shares.

While the excellent pay-outs and $18 billion in share buybacks is very positive for the market over the next couple of months as the money hits bank accounts, the lack of forward guidance from most companies amid the uncertainties presented by the Delta variant of COVID-19 is a real negative.

Continuing lockdowns threaten a double dip recession but, on the flipside, the recovery following on from the last lockdowns was particularly strong.