Weekly review: Australian floats set to pump up the IPO pipeline

WEEKLY MARKET REPORT

Share market floats are officially back in business after the highly successful launches of Adore Beauty and personal protective equipment maker CleanSpace.

In a very encouraging sign that should see the pipeline of new Australian IPO’s continue to swell, online beauty retailer Adore (ASX:ABY) opened up 9% on its offer price to $7.40 before settling more than 2.5% ahead at $6.92.

Workplace respiratory protection equipment provider CleanSpace (ASX: CSX) had an even more impressive debut, gaining more than 60% on its initial offer price of $4.41 to close at $7.42.

Adore was perhaps the most hotly anticipated listing of the year, with the online beauty retailer’s platform of premium products including Aspect, The Ordinary and Aesop attracting a strong following.

Fancy multiples overshadowed by growth potential

However, some fund managers had warned that the Adore offering was very fully priced at 3.9 times forecast 2020 calendar year revenue of $158.2 million and a forward price to earnings ratio of around 185 times.

Such concerns were ignored by the market, which instead focussed on the significant growth potential for the company and admiration for the company’s business model, management and the fact that Adore’s co-founders Kate Morris and her partner James Height retain significant stakes in the business.

E-commerce businesses are particularly strong and Adore has demonstrated significant customer loyalty, with high rates of repeat business.

That should allow the company to extend to extend its product categories, expanding the offering to the loyal customer base and increasing sales.

Australia also has much lower penetration rates for e-commerce beauty products than many overseas countries, allowing for significant organic growth.

Respiratory protection growing strongly

Similarly, CleanSpace is in a “hot” market, with the COVID-19 pandemic causing a rush on respiratory protection equipment for both healthcare and industrial end markets.

It is using the float to push growth in sales and marketing and also increase production after the US became the company’s biggest market.

CleanSpace chief executive Dr Alex Birrell said the company wanted to provide workers with its next generation best practice respiratory protection.

Dr Birrell said CleanSpace products offered significant benefits including higher protection, greater user comfort and cost-effectiveness, with the company now in a position for sustained growth.

She said Australian and international experience had shown that while hospital workers were highly vulnerable to COVID-19 infections, community care workers in aged care and disability were at the highest risk.

Adore raised $269.5 million at $6.75 a share, including $40 million in new shares with private equity heavyweight Quadrant while CleanSpace raised $131.4 million at $4.41 per share.

Overall market down but recovers some losses

The strong float action happened despite an easing on the overall share market with the ASX 200 closing Friday’s session down 0.1% to 6167 points – a 0.2% fall for the week which left behind the 6200 mark.

The final presidential debate between President Donald Trump and former vice president Joe Biden saw the market down 0.3% as it started but it rose during and after the debate to close down just 0.1% or 6.80 points.

Initially the ASX 200 fell as much as 1.5% on concerns about Russia and Iran interfering in the US election process before recovering as the National Cabinet decided to reopen Australia by Christmas.

All four of the big banks were stronger, helping the financials sector to rise 0.5% but it was a bad day for the miners with the materials sector down 1% and BHP (ASX: BHP) down 1.3% to $36.

A steep 4% drop in global oil prices depressed the local producers, Oil Search (ASX: OSH) down 3.7%, while Woodside (ASX: WPL) and Santos (ASX: STO) both dropped 1.6% after releasing higher quarterly production updates.

Shares in fund manager AMP Ltd (ASX: AMP) fell 5.5% after releasing a quarterly update showing that Assets Under Management (AUM) fell 0.4% to $189.2 billion for its AMP Capital division with net cash outflows of $1.1 billion, while its Australian wealth business saw a slight lift to $121.4 billion.

Blood plasma giant CSL (ASX: CSL) led the healthcare sector lower, closing down 0.5% to $294.82.

Small cap stock action

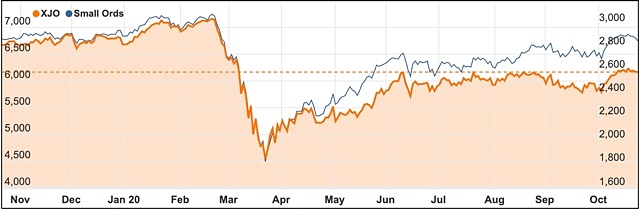

The Small Ords index fell 1.91% this week to 2858.5 points.

ASX 200 vs Small Ords

Small cap companies making headlines this week were:

Sultan Resources (ASX: SLZ)

Junior explorer Sultan Resources has secured a drilling contractor for a 12-hole program starting next month at its Tucklan epithermal gold target along the Lachlan Fold Belt in NSW.

Induced polarisation results also received this week returned a high chargeability and resistivity response, elevating Tucklan to a high-priority, drill-ready target.

The company’s field team is now preparing for the maiden program.

Kleos Space (ASX: KSS)

Kleos Space is eyeing a November launch date for four of its scouting mission nanosatellites aboard an Indian space program.

The company’s team arrived in India last week and quarantined for six days before making final checks to ensure the nanosatellites are correctly deployed into orbit.

Kleos also announced this week that it had signed a contract with Netherlands-based ISISpace for a second cluster of four satellites for the Polar Vigilance Mission set to launch in mid-2021.

Strategic Elements (ASX: SOR)

Pooled development fund Strategic Elements has confirmed its subsidiary Stealth Technologies will use existing 3D mapping technologies to develop an automated weed detection and management device for the agricultural industry.

The device will fit onto a standard combine harvester and automate the capture and integration of multiple forms of data to produce 3D location maps of agricultural weeds.

The technology could help reduce the industry’s reliance on chemicals for weed control.

Zenith Minerals (ASX: ZNC)

Perth-based Zenith Minerals has defined a large bedrock shear zone extending over 2km in strike at the Dulcie laterite pit within its Split Rocks project near Southern Cross.

A reverse circulation campaign is being planned to drill test the area.

Zenith’s geological team has previously identified 18 targets over a 18km strike length in the north-eastern section of the project surrounding Dulcie.

Esports Mogul (ASX: ESH)

Esports Mogul has partnered with video gaming giant Super League Gaming to deliver a novel streaming service and ultimately, a better tournament experience, for Mogul players.

Players will be able to live stream and record simultaneously via cloud-based infrastructure, with the footage available for distribution to platforms such as YouTube and Facebook.

Brand partners will benefit from improved levels of player engagement and opportunities for content creation.

Resources and Energy Group (ASX: REZ)

NSW-based Resources and Energy Group has announced the discovery of a high-grade, economic mineralisation zone at its East Menzies gold project in WA.

A 1m section assaying 76.4g/t at the Gigante Grande prospect was in the first hole in a round of follow-up drilling and suggests the prospect may host a large gold system.

In the recent exploration program, 32 holes have been drilled, with 30 across Gigante Grande and Chronos prospects and a further two at Goodenough. Results are pending for 27 holes.

The week ahead

In Australia, the main economic news is the September quarter readings on inflation but there are some other statistics to look forward to.

Among them, the State of the States report could show how Victoria is faring due to extended lockdowns compared to other states, while there are trade, consumer confidence, credit and debit card spending.

While the market has settled on a cut in the official interest rate to 0.1% on November 3, a speech on Tuesday by Reserve Bank Assistant Governor Michele Bullock will still be analysed for any further details.

On Thursday data on export and import prices will be of interest with the big volume exports such as oil, iron ore, LNG and coal all carrying the potential to move the Australian dollar.

Quarterly business data released on Thursday has been fast tracked to show how the pandemic has hit business.

Internationally, US home sales, durable goods orders, home prices, consumer confidence and economic growth will feed into the election campaign while Chinese industrial profits and purchasing manager indices will also be of interest.