Once again, Australia’s relative lack of technology stocks has seen the local market fail to keep pace with strong offshore leads.

On Friday after all three major US equity benchmarks reset new highs, weakness in mining and energy stocks in Australia dragged the ASX 200 index down by 0.2% or 11.4 points, to 7770.6 points.

Despite that failure, the local index still closed out the week up 1.3% after plenty of hectic trading around a raft of central bank meetings.

A weaker oil price sent local oil stocks down a hefty 1.3% after a stronger US dollar sent oil prices lower.

Woodside and miners head south

Oil and gas major Woodside Energy (ASX: WDS) was a big influence, with shares down 1.8% to $29.73 while Ampol (ASX: ALD) shares fell 0.8% to $40.29 while Santos (ASX: STO) staged a late recovery to close even for the day at $7.50 a share.

It was a similar story for the big miners with the materials sector closing down 0.9% after iron ore futures fell 3.1% in Singapore to US$106.40 a tonne on the April contract.

Predictably, that sent BHP (ASX: BHP) shares down 0.8% to $40.29 with Rio Tinto (ASX: RIO) shares down 0.48% to $120.56 and Fortescue Metals (ASX: FMG) down 2.15% to $24.64.

There have been some broker reports claiming that iron ore prices may be approaching a floor although in market tussles between the big miners and China, it is anybody’s guess who ends up getting the better deal.

Weaker gold price dents gold miners

Another downward influence on the market was an easing in the gold price to US$2,180 an ounce after it set a record high which had an outsize effect on the share prices of many gold miners.

Some of the worst hit were Bellevue Gold (ASX: BGL) shares which fell 5.3% to $1.885, Genesis Minerals (ASX: GMD) shares which dropped 6.3% to $1.80 and Liontown Resources (ASX: LTR) hares, down 3.2% to $1.21.

There were some exceptions, with Northern Star (ASX: NST) shares spending most of the day underwater before poking above par at the close by just 1c to reach $13.72.

Fisher & Paykel runs hot

There was some positive corporate news with Fisher & Paykel Healthcare (ASX: FPH) rising an impressive 7.7% to $24.18 after the company upgraded its full year earnings guidance to a range of NZ$260 million (A$239.1 million) to NZ$265 million.

That was up from the previous net profit forecast of between NZ$250 million to NZ$260 million and this performance led the healthcare index to a hefty 1% rise for the day, with Fisher & Paykel the best performed stock of the day.

Some other good performers included shares in laboratory testing company ALS (ASX: ALQ) which added 2%, Cleanaway Waste Management (ASX: CWY) up 1.9% and global packaging giant Amcor (ASX: AMC) up 1.4%.

Another positive sector was the real estate investment trusts (REITS), which was up 1.4% as investors continued to return to the formerly unloved sector on the back of potential interest rate falls.

Small cap stock action

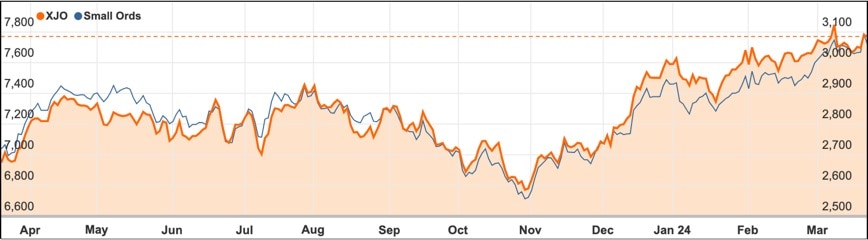

The Small Ords index rose 0.9% for the week to close at 3061.1 points.

Small cap companies making headlines this week were:

Genetic Technologies (ASX: GTG)

Genetic Technologies announced a breakthrough in risk assessment with its new GeneType technology, which is a world-first in identifying over 200 genes for hereditary disease risks, enhancing tests for common cancers, cardiovascular disease, and type-2 diabetes.

Chief executive officer Simon Morriss highlighted that the technology could identify nearly 100% of individuals at risk, significantly beyond the limitations of family history.

The GeneType test offers a comprehensive evaluation of genetic predispositions to serious diseases, incorporating both hereditary and sporadic non-hereditary diseases, aiming to improve patient outcomes through personalised care.

This innovation, based on a non-invasive saliva test, targets the US healthcare market, where demand for genetic risk assessments is growing, with the genetic testing market valued at approximately $11.3 billion in 2022.

Altech Batteries (ASX: ATC)

Altech Batteries announced positive findings from a feasibility study for its Cerenergy sodium chloride solid state battery project in Germany, aiming to pioneer sustainable energy solutions with a projected $260 million investment for a 120 1MWh annual capacity facility.

The study predicts a net present value of $281 million, with anticipated annual net revenues of $176 million and an EBITDA of $84 million, highlighting the project’s economic viability with a capital payback period of 3.7 years.

Following these results, Altech’s board approved advancing to the funding phase, buoyed by the projected growth of the grid storage market.

The Cerenergy project, a joint venture between Altech and the German institute Fraunhofer IKTS, aims to capitalise on a market forecasted to expand significantly, with expectations of reaching over 3000GW by 2050 from 20GW in 2020.

Lion Energy (ASX: LIO)

Lion Energy has received approval from the Queensland government to develop Australia’s potentially first city-based hydrogen generation and refuelling hub at the Port of Brisbane, with construction beginning in Q2 2024.

The facility aims to support heavy mobility fleets, including public buses and trucks, with an initial production capacity of 420 kilograms of green hydrogen per day, scalable to meet demand.

This hub marks a significant step in Lion’s strategy to create a network of hydrogen refuelling depots across eastern Australia, leveraging the port’s strategic location near major transport routes and bus depots.

The project will utilise renewable electricity sources and includes investments in key infrastructure such as electrolysers and solar power to ensure a reliable supply of green hydrogen.

Universal Biosensors (ASX: UBI)

Universal Biosensors has received FDA 510(k) approval and a CLIA waiver for its Xprecia Prime coagulation analyser, marking the device as class II and allowing its sale to healthcare professionals in the US.

This portable unit facilitates on-site prothrombin time and international normalised ratio (PT/INR) testing, crucial for managing oral anticoagulation therapies like Warfarin, directly affecting patient care by preventing bleeding or thrombosis risks.

Chief executive officer John Sharman described the FDA’s clearance as a historic milestone, showcasing over a decade of R&D and the significance of being the first coagulation device to achieve a CLIA waiver by application.

This approval opens up a significant market opportunity for Universal Biosensors, positioning the company to penetrate the US healthcare market, with expectations for Xprecia Prime to align with existing Medicare, Medicaid and health insurer reimbursement codes.

Lord Resources (ASX: LRD)

Mineral Resources (ASX: MIN) (MinRes) has expanded its portfolio by entering a farm-in agreement with Lord Resources for the Horse Rocks lithium project, following a recent acquisition of the Lake Johnston nickel concentrator plant to bolster its battery metal processing capabilities in Western Australia.

The Horse Rocks project, close to the Mt Marion lithium mine, shows promise with identified lithium-caesium-tantalum pegmatite swarms, positioning MinRes to potentially increase its stake in the lithium sector.

Under the agreement, MinRes has the option to first acquire a 40% interest in Horse Rocks by funding $1 million within 18 months, with opportunities to further increase its interest up to 85% through additional investment stages.

The collaboration aims at joint development, with Lord managing exploration activities and MinRes contributing geological expertise, marking a strategic move to consolidate MinRes’ presence in critical minerals for battery production.

The week ahead

There is little doubt that the big announcement in Australia this week will be the monthly consumer price index (CPI), which is out on Wednesday.

Inflation remains one of the key factors in bringing on a fall in official interest rates and for the estimated one in 20 home loan borrowers that are suffering from negative cash flow due to high mortgage rates, that day cannot come soon enough.

The expectation is that there will be a 0.3% lift in headline CPI for February, taking the annual growth rate from 3.4% to 3.5%.

Swifties will also be keenly watching the February retail trade report, with expectations that Taylor Swift’s sellout concerts may have boosted otherwise weak consumer activity.

If they have, perhaps the song to play would be You need to calm down.

Some of the releases to watch out for overseas include the US inflation numbers, new home sales and consumer confidence.

Chinese industrial profits are also due and will likely be weak.