Weekly review: Aussie battler market holding on as outlook remains uncertain

WEEKLY MARKET REPORT

There is little doubt that global share markets are going through a really tough time at the moment and Australia is far from immune but we have held up reasonably well.

Friday was a great example with a rough night on global markets initially leading to futures pointing to a down day.

It didn’t help when the banking regulator, the Australian Prudential Regulation Authority (APRA), then threw a spanner into the works by seeking to have several senior IOOF (ASX: IFL) executives and directors, including chief executive Chris Kelaher and chairman George Venardos, banned from acting as superannuation trustees for not being fit and proper people to run a super fund.

Along with that, APRA is seeking to impose additional licence conditions on IOOF, a move that could cripple the wealth manager right as it is in the middle of expanding by buying ANZ Bank’s superannuation business.

IOOF shares crunched

That announcement saw IOOF shares crunch hard, down by more than a third and ANZ scramble to explain what it meant for the sale.

IOOF shares take a major hit, losing 35.84% on Friday.

ANZ (ASX: ANZ) also put out a statement about the issue but seemed to sail through the controversy, with its shares firming 4c or 0.16 per cent per cent to close at $25.71.

All of this bad news combined with weaker oil and commodity prices still saw the Australian market rebound, perhaps sensing that the late reversal on the US market to largely wipe out large losses on the day was a harbinger of better things to come.

Indeed, the market as measured by the ASX 200 managed its first weekly improvement in a month, rising 24 points on the ASX 200 or 0.4 per cent to 5681.5 points.

Banks all up

The banks traded well, led by Commonwealth Bank (ASX: CBA) which closed up just above one per cent or 70c at $70.37.

Westpac (ASX: WBC) was also up 6c to $25.73, NAB (ASX: NAB) was up 6c to $24 and ANZ (ASX: ANZ) was up 4c to $25.71.

Macquarie Group (ASX: MQG) also added $1.27 or 1.133 per cent to $113.32.

Troubled fund manager AMP (ASX: AMP) followed IOOF down, losing 3.3 per cent or 8c to $2.33.

Commodities take a hit

As you would expect resources stocks generally fell in line with lower commodities and oil prices with BHP (ASX: BHP) down 22c to $31.18 but Rio Tinto (ASX: RIO) bucking the trend to rise 11c to $72.32.

Woodside (ASX: WPL) was down 52c and Santos (ASX: STO) fell 3c to $31.03.

Origin (ASX: ORG) was up 21c to $6.94 as it held an investor day and Virgin Australia (ASX: VAH) announced higher revenue and rose 8.33 per cent or 1.5c to 95c.

Global blood products group CSL (ASX: CSL) added $4.66 or 2.6 per cent to $183.90.

Retailers were also firmer with Coles (ASX: COL) up 50c or 4.13 per cent to $12.60 with Woolworths (ASX: WOW) up 21c or 0.72 per cent to $29.23.

Small cap stock action

The Small Cap index took a hammering this week, down 3.49 per cent and almost 8 per cent in the past three months, to close at 2,549.4 points.

ASX 200 vs Small Cap index.

Despite the market trend, numerous small cap stocks had notable news out this week:

Resonance Health (ASX: RHT)

Australian company Resonance Health has received FDA clearance for its artificial intelligence-based machine learning solution FerriSmart for gauging liver iron concentration.

FerriSmart can automatically analyse MRI images and return liver iron quantification result in seconds.

The clearance paves the way for Resonance Health to market FerriSmart across the US. It can be deployed via channel partner platforms which enables the technology to be seamlessly integrated into radiology workflows.

FDA clearance follows Resonance Health’s regulatory approvals from Australia’s Therapeutic Goods Administration and the EU’s CE Mark, which were gained earlier this year.

State Gas (ASX: GAS)

Queensland explorer State Gas has achieved “good gas shows” within the second well of its current drilling program at its 80%-owned Reid’s Dome project.

The company stated data obtained during drilling of the Nyanda-4 coal seam gas and conventional gas well revealed gas content rose overall with depth and indicated the well was still in gas shows at a 1,200m depth.

Additionally, a 150m cored zone sampled 12 seams of good quality coal with gas observed bubbling from the coal.

State Gas chairman Tony Bellas said Nyanda-4 had “exceeded” the company’s expectations by confirming a “significant” coal seam gas project within Reid’s Dome.

Estrella Resources (ASX: ESR)

Nickel focused Estrella Resources has pulled up “spectacular” intersections during a maiden drilling program at the Spargoville project in WA.

Close to WA’s nickel producing region Kambalda, the Spargoville project has given up 15m at 10.45% nickel, 0.78% copper, 0.20% cobalt, 0.87g/t lead and 1.15g/t platinum from 20m.

Estrella chief executive officer Chris Daws said the nickel results were some of the best nickel sulphide intersections he had seen while exploring in WA.

Other intersections were 5m at 11.32% nickel, 0.54% copper, 0.21% cobalt, 0.42g/t palladium and 0.22g/t platinum from 61m; and 3m at 12.90% nickel, 1.37% copper, 0.29% cobalt, 1.86g/t palladium and 0.67g/t platinum from 69m.

Impression Healthcare (ASX: IHL)

Impression Healthcare has collared an exclusive licence agreement to commercialise the US’s first-ever authorised cannabis medicine Dronabinol in the US, Canada, Australia and New Zealand.

Under the agreement with Resolution Chemicals, Impression will support the production, registration and commercialisation of Dronabinol tetrahydrocannabinol capsules throughout these countries.

Impression anticipates it will distribute Dronabinol under Australia’s special access and authorised prescriber schemes.

Dronabinol can be used to treat numerous health problems including loss of appetite in people suffering from HIV and AIDS. It also can help those with nausea and vomiting following chemotherapy.

Leigh Creek Energy (ASX: LCK)

Another gas developer with positive news this week was Leigh Creek Energy, which is on the verge of achieving commercial flow rates of synthesis gas (syngas).

The company’s namesake project in South Australia has been flowing continuously from the pre-commercial demonstration facility for more than 50 days.

Leigh Creek anticipates the operation will enter commercial gas phase before the end of the month.

Once commercial flow has been achieved, Leigh Creek will begin updating the project’s current 2,964PJ 2C resource and convert a portion of the resource to proven and probable reserves.

Additionally, a new deal with one of the world’s largest contractors will enable Leigh Creek to invest in large-scale infrastructure beyond in-situ gasification in South Australia.

A draft heads of agreement with the China Communications Construction Company will allow both companies to co-operate on developing projects such as ports and railways.

UltraCharge (ASX: UTR)

Disruptive technology developer UltraCharge has teamed up with Israel-based Roadix Urban Transportation.

The deal paves the way for UltraCharge to design, develop and manufacture a lithium-ion battery that will be fully compatible with Roadix’s three-wheel electric scooter.

According to UltraCharge, its batteries will enable Roadix’s scooters to have more range, power and torque.

As part of the deal, Roadix will help UltraCharge with commissioning and testing of its proprietary batteries. However, UltraCharge will retain all intellectual property rights.

Bryah Resources (ASX: BYH)

Bryah Resources’ winning streak at its Bryah Basin project in WA is continuing with reconnaissance sampling unveiling up to 54.5% manganese.

A sampling program was carried out in outcrops near the Horseshoe formation and returned manganese grading between 45.4% and 54.5%.

Bryah managing director Neil Marston said a shallow drilling program at the new manganese targets will be carried out in the new year.

“Given our dominant landholding over the Horseshoe Range, [we have] an excellent opportunity to define shallow economic manganese resources in the near future,” Mr Marston noted.

Paradigm Biopharmaceuticals (ASX: PAR)

As Paradigm Biopharmaceuticals continues to collect real world data on the effect its injectable Pentosan Polysulfate Sodium has on osteoarthritis knee pain, results remain consistent with more than a 50% reduction in pain.

To-date 183 people have been treated with injectable Pentosan Polysulfate Sodium through the Therapeutic Goods Administration Special Access Scheme.

Paradigm anticipates the results will advance the treatment’s progress towards commercialisation, with results from the phase 2b trial due before the end of the month.

IPOs this week

Small Caps readers who want to view upcoming IPOs or see the stocks that have listed in 2018 and how they are performing can now do so.

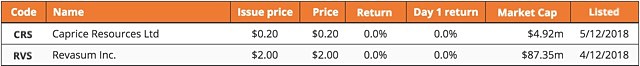

The latest companies to make their way onto the ASX this week were:

Revasum (ASX: RVS)

Semi-conductor manufacturing technology developer Revasum was the first stock to join ASX ranks this week with the company opening its first day of trade at $1.90 before settling at $1.86.

Via its IPO, Revasum raised $30.7 million by issuing more than 15.35 million CDIs at $2 each.

The company plans to use its fund to grow the business and launch two new products in 2019. Revasum is developing technologies in automotive, 5G and Internet of Things markets by using its technology and manufacturing equipment to create devices found in these industries including microchips, sensors, LEDs, as well as RF and power units.

Revasum closed its first week on the ASX at $2.

Caprice Resources (ASX: CRS)

Mineral explorer Caprice Resources raised $4.5 million by issuing 22.5 million shares at $0.20 each and was admitted to the ASX’s official list on Wednesday.

IPO funds will be used to advance the Wild Horse Hill and Northampton projects, which are prospective for gold, silver, lead and copper.

Wild Horse Hill encompasses 231 square kilometres in the Northern Territory’s Pine Creek gold region. Meanwhile, the Northampton project in WA hosts historic silver, lead and copper mines that date back to 1850.

Caprice opened its first day of trade at $0.205 before dipping to close at $0.195. The company then ended the week at $0.20.

The week ahead

After last week’s rush of figures, we are in for a quieter week with the main features being some important information on consumer and business confidence and some speeches from the Reserve Bank.

The Reserve Bank (RBA) is releasing its quarterly Bulletin and speeches are being made by Assistant Governor (Financial Markets) Christopher Kent and Marion Kohler, Head of Domestic Markets.

Mr Kent’s speech in particular could be interesting, given the title “US Monetary Policy and Australian Financial Conditions”.

On Monday the Australian Bureau of Statistics is releasing data on housing finance, with investor lending expected to decline due to weakening demand and falling house prices in Sydney and Melbourne due to greater regulatory oversight of bank lending practices.

Owner-occupied home lending is expected to rebound as first home buyers return to the market.

China is announcing a range of information encompassing inflation, retail sales, industrial production, investment and house price data.

In the US, there will be statistics released on inflation, industrial production and retail sales data.