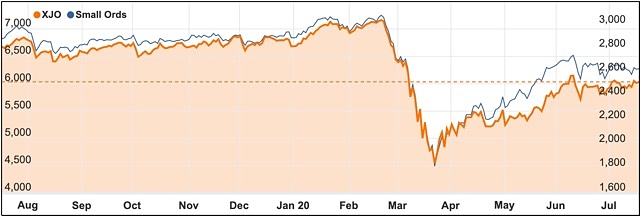

Like a sprinter lunging towards the finish line the Australian market enjoyed a late surge on Friday to help the ASX 200 index to finish the week 1.9% higher.

For most of Friday the market was subdued and waiting on more news on COVID-19 but a late surge in the last ten minutes saw it close up 22.7 points, or 0.4%, higher at 6033.6 points.

During the week there has been a tug of war going on around COVID-19 with promising reports on a vaccine lifting markets while fairly discouraging infection updates from NSW and particularly Victoria held back gains.

COVID cases rising in Victoria and NSW

NSW Premier Gladys Berejiklian announced a further tightening of restrictions on restaurants, cafes and bars, which will soon be required to limit group bookings to 10 people while Victoria hit a new daily record for coronavirus cases of 428, along with a further three deaths.

One of the forces pushing up the Australian market was the performance of the big iron ore miners with news that strong Chinese demand had seen Rio Tinto (ASX: RIO) lift its shipments of iron ore during the June quarter seen as very good news.

Iron ore continues to propel the Aussie market higher

BHP (ASX: BHP) and Rio Tinto both finished higher (up 0.42% to $37.92 and 0.63% to $104.14 respectively) but it was their more focussed competitor Fortescue Metals (ASX: FMG) which really put on a performance, closing up closing up 1.74% or 28c to a record $16.39.

It was a stellar week for Andrew “Twiggy” Forrest’s company, which added an impressive 10.4% for the week to close with a market capitalisation of $50.46 billion.

Investors have been attracted to Fortescue not just by the strength of the iron ore trade with China but also by its strong dividend yield at a time when other big dividend payments by the banks and other stocks are falling fast.

Once again volumes were low with the market responding to headlines around COVID-19 while waiting for the real information in the form of company earnings reports to begin so that some real numbers can be examined.

Legal cases hit Kogan, Westpac

Banks were mixed with Commonwealth Bank (ASX: CBA) and ANZ (ASX: ANZ) both falling 0.1% while NAB (ASX: NAB) rose 0.2% and Macquarie Group (ASX: MQG) added 0.4% to $125.18.

Westpac (ASX: WBC) was probably the pick of the banks, up 8C or 0.45% to $17.89 despite being hit by a class action from law Maurice Blackburn around its controversial payment of “flex commissions” to car dealers between March 1, 2013 and 31 October 31, 2018.

Kogan.com (ASX: KGN) was another noteworthy stock for bad news, falling 83c or 4.66% to $17.00 after the Federal Court upheld claims by the ACCC that the online retailer breached consumer laws.

During the end of financial year promotion in 2018, Kogan offered a 10% discount coupon but was found to have increased prices just before the discount was made available.

Small cap stock action

The Small Ords index dipped slightly by 0.44%, to close on 2639.9 points for the week.

Small cap companies making headlines this week were:

Incannex Healthcare (ASX: IHL)

Cannabinoid drug development company Incannex Healthcare published positive results from its animal study into IHL-675A against sepsis-associated acute respiratory distress syndrome (SAARDS) – currently the leading cause of COVID-19 mortality, according to World Health Organisation statistics.

The study was designed to test the responses of rodents with sepsis to varied doses of cannabidiol (CBD) and hydroxychloroquine (HCQ), a drug typically used to prevent and treat malaria but which has picked up headlines in recent weeks following US President Donald Trump’s declaration the drug could be used to treat COVID-19 sufferers.

Compared to the baseline result – untreated rodents with no induction of sepsis – CBD reduced cytokine levels by 31- 90% relative to the response created by the delivery fluid used to deliver the drug. Meanwhile, compared to the baseline rodents, HCQ reduced cytokine levels by 39-88%.

Respiri (ASX: RSH)

Healthcare technology developer Respiri signed an exclusive agreement with global respiratory pharmaceutical firm Cipla for the sales and distribution of Respiri’s wheezo asthma product to its target markets.

The five-year agreement will focus on a minimum order of 2,000 wheezo units in October 2020 for marketing to initial markets of Australia and New Zealand, with further orders possible to meet demand and a first right of refusal for Cipla to distribute into extended territories including the United States, Europe and India.

First delivery is targeted for October with product revenues commencing shortly after.

Gross margins of up to 40% are expected to be generated from the start of 2021 and forecast to improve with increased volumes.

AnteoTech (ASX: ADO)

The surface chemistry company has developed a proof of concept COVID-19 and flu multiplex test platform that can detect whether patients have been, or are currently, infected with the coronavirus.

The test remains a work in progress despite passing proof of concept, with AnteoTech confirming it is actively seeking further partnerships to advance development.

The next phase of development will take a further six to nine months before a finalised test can be supplied to the market.

OpenPay (ASX: OPY) and 1st Group (ASX: 1ST)

This week, the companies unveiled a three-year partnership which will see Openpay’s Buy Now Pay Later payment option rolled out in phases across the MyHealth1st platform used by healthcare practices.

Openpay will earn an undisclosed fee for each referral and will pay for all platform functionality to be established.

Both companies plan to share revenues generated from new customer generation.

In addition, OpenPay announced its total transaction value grew to a record $192.8 million in the 2020 financial year, up 98.2% compared to 2019 and up 119% for the quarter.

G Medical Innovations (ASX: GMV)

Four US university hospitals have committed to taking on G Medical’s independent diagnostic testing facilities (IDTF) platform to assist patients who need remote monitoring of their health.

Once referred, patients will commence individualised monitoring ranging from a 24-hour period to 30 days or longer for services such as mobile cardiac telemetry, Holter monitoring and ambulatory electrocardiography.

The hospitals have already processed a combined 2,000 patient referrals.

Trigg Mining (ASX: TGM)

Trigg managing director Keren Paterson this week described the company’s wholly-owned Lake Throssell project in Western Australia as the “jewel in the crown” of its sulphate of potash portfolio.

The company has commenced a helicopter-supported drilling program at Lake Throssell to follow-up on results from an auger sampling program last year.

It will be followed by an off-lake air core drilling program with the results expected to feed into a potential maiden JORC inferred resource.

Dreadnought Resources (ASX: DRE)

It’s been 109 years since gold was discovered at Metzke’s Find within the Illaara project in Western Australia, but Dreadnought has finally broken the drought, announcing this week a series of high-grade hits at the deposit.

Dreadnought managing director Dean Tuck said four out of six recent holes have so far returned positive assays, producing “significant” results from the fresh bedrock lode under the historical workings.

The results are believed to extend over a strike length of 250m and the mineralisation remains open along strike and at depth, with the potential for multiple lodes.

Upcoming listings

Looking to make its way onto the ASX bourse in the near future is 4DMedical.

4DMedical

The Australian medtech is preparing to list on the ASX next month, using its innovative lung imaging technology as the drawcard for a $55.8 million initial public offering.

The company is developing a non-invasive X-ray imaging platform known as XV Technology, which scans a patient’s respiratory system to help improve the ability of physicians to diagnose and manage lung diseases.

The platform will be delivered via a software-as-a-service model, making it a lower-cost option to current procedures and one which doesn’t require capital expenditure to be compatible with existing hospital and clinical equipment.

4DMedical’s is targeting the United States as its primary market, with a secondary focus on Australia.

The week ahead

It is a very busy week of economic news coming up both in Australia and the US.

Locally, the big events include a Tuesday speech by the Reserve Bank Governor, Dr Philip Lowe and the much-awaited Federal Budget update on Thursday.

So far Dr Lowe has been remarkably upbeat about Australia’s economic prospects through the COVID-19 pandemic so there will be a lot of attention on whether he has become more gloomy after the announcement of Melbourne’s second lockdown when he speaks on the effect of the virus on employment and public sector balance sheets.

The Federal Government balance sheet will be very much the centre of attention on Thursday when Treasurer Josh Frydenberg outlines the significant damage the pandemic and associated recession has wrought on the government coffers.

Of particular interest will be any projections on preliminary 2019/20 financial estimates and also any news on an extension to the JobKeeper scheme which has been providing a floor under large sectors of the jobs market.

An extension of JobKeeper to the end of the year or further would certainly be welcomed by many, even if the program was limited to certain sectors of the job market.

Other things to look out for include retail trade and international trade in goods, labour market statistics, the RBA board minutes, consumer confidence numbers and household spending intentions and credit and debit card usage.

In the US, the quarterly earnings season starts with some of the companies to watch out for including Haliburton, IBM, Coca-Cola, Lockheed Martin, Novartis, United Airlines, Biogen, Hilton, Philip Morris, Microsoft, Tesla, eBay, Kimberly Clark, Royal Caribbean, Twitter, Amazon, Resmed, American Airlines and American Express to name a few.

There is no substitute for some genuine numbers about how well or otherwise companies are performing through the COVID-19 lockdowns and this week could be something of an acid test for world markets on that front.