The Australian share market has turned cautious again. Volatility has returned, sentiment has softened and many investors are stepping back. We see it differently.

Periods like this often expose valuation gaps that are easy to miss in rising markets. As macro concerns dominate headlines, several fundamentally strong ASX-listed companies are being priced as if growth has stalled indefinitely.

In our latest note, we outline where we are finding selective opportunity beneath the surface of the recent pullback. We focus on a group of stocks where balance sheet strength, structural tailwinds and corporate activity are beginning to align.

Rather than broad market calls, the article breaks down where volatility is creating mispricing, why certain sectors look increasingly attractive and how we are thinking about capital deployment in early 2026.

*We maintain a selectively positioned portfolio designed to stay ahead of evolving market trends. To learn more about our HIN-Direct wealth management services, please contact me at ++mark.elzayed@investorpulse.com.au*++

While the Aussie Market remains volatile, we see the current pullback less as a warning sign and more as a phase of recalibration. After a strong start to the year that pushed the index close to record levels, the ASX 200 has entered a short-term risk-off period. In our view, this has created a growing number of pockets where valuation, fundamentals and structural tailwinds are beginning to realign.

Source: Tradingview, ASX 200, daily chart [1]

Rather than a broad-based deterioration, the recent weakness reflects investors stepping back to reassess macro risks. History suggests that these periods often lay the groundwork for selective opportunity, particularly in stocks with resilient balance sheets, clear earnings visibility and exposure to long-term themes.

Global uncertainty drives indiscriminate selling, opening valuation gaps

Renewed concerns around global trade, including proposed US tariffs on parts of Europe linked to geopolitical frictions, have weighed on sentiment. However, the market response has been largely indiscriminate. We are seeing quality assets sold alongside more cyclical exposures, creating valuation gaps that do not fully reflect company-specific fundamentals. For long-term investors, this type of macro-driven volatility has traditionally been fertile ground for accumulation.

Inflation pressures shift the rate narrative, but not the investment case

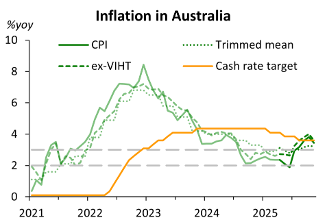

Domestically, the sharp rise in December inflation has forced a reassessment of Reserve Bank of Australia policy expectations. While the prospect of a near-term rate hike has unsettled equity markets, we see this less as a threat to earnings and more as a constraint on valuation multiples. In this environment, companies with pricing power, low leverage and strong cash generation stand out as relative winners.

Source: Macrobond and The Asia Economist (2025)

Gold’s move to record highs above US$4,700 per ounce reflects caution at the macro level, but it also underlines the selective opportunity within the resources sector. Gold producers are generating strong cash flows at current prices, while broader mining stocks have lagged. This divergence reinforces our view that stock selection, rather than sector rotation, is the key driver of returns in 2026.

Banks have weighed on the index as investors factor in higher-for-longer interest rates and potential mortgage stress. Yet capital positions remain strong, bad debt expectations are contained, and dividends continue to provide support. In our assessment, much of the near-term risk is already reflected in share prices, particularly for institutions with diversified earnings streams.

The split within resources has become more pronounced. Iron ore and industrial metals have softened on cooling demand forecasts, while gold, silver and copper miners have surged. Battery metals have been heavily sold, in some cases excessively so. This dispersion has created opportunities in commodities tied to structural demand, including manganese and high-grade magnetite, where long-term supply dynamics remain favourable despite short-term price pressure.

Technology stocks have shown relative resilience, supported by ongoing investment in artificial intelligence and productivity tools. Importantly, recent volatility has reduced valuation excesses, allowing investors to access growth at more disciplined entry points. Similarly, industrials linked to infrastructure, logistics and housing are benefiting from steady demand rather than cyclical acceleration, a profile the market often undervalues in uncertain conditions.

While discretionary spending is clearly slowing, not all consumer exposure is equal. Businesses aligned with essential or habitual spending continue to demonstrate margin resilience and reliable cash flows. In a market focused on certainty, these characteristics are regaining appeal.

Where we see opportunity emerging across listed Australian equities

Ainsworth Game Technology: Corporate activity highlights embedded value

Source: AGI, weekly chart, income statement and estimates (2025)

Ainsworth Game Technology (ASX: AGI) sits at the intersection of operational recovery and corporate interest. Competing takeover bids have established a clear valuation floor, while management continues to invest in higher-return North American gaming formats. In our view, the market is still under-pricing the optionality embedded in both outcomes.

The primary catalysts driving share price performance include the ongoing takeover tug-of-war and a strategic pivot toward the North American market. Austrian gaming giant Novomatic has extended its unconditional $1.00 cash bid until late January 2026, providing a solid psychological and financial anchor. This is countered by a rival proportional bid from Kjerulf Ainsworth at $1.30 per share, which, despite being for a smaller stake, signals deep internal belief in the company’s intrinsic value. Operationally, the expansion of High-Frequency Historical Horse Racing (HHR) units and Class II products in the U.S. remains a high-margin growth engine that offsets softer domestic performance in Australia.

Technically, AGI has exhibited a period of low-volatility consolidation, trading tightly within a 52-week range of $0.69 to $1.09. The stock is currently testing resistance near the $1.03 level, supported by the $1.00 valuation floor set by Novomatic. A sustained break above $1.05, supported by increased volume, could signal a bullish breakout toward the $1.15 zone, especially if the $1.30 partial bid gains more traction. Conversely, strong support is established at $1.00, suggesting limited downside risk for investors while corporate manoeuvres continue to play out.

Fleetwood Limited: Structural housing demand meets improved execution

Source: FWD, weekly chart, income statement and estimates (2025)

Fleetwood Limited (ASX: FWD) offers exposure to modular construction at a time when housing supply remains a national priority. The return to profitability in its Building Solutions division and improving balance sheet discipline suggest the business has turned a corner. Valuations do not yet reflect the scalability of its national footprint.

Key catalysts for FWD include the accelerating demand for social and affordable housing, where modular construction provides a high-speed, cost-effective solution to Australia's supply crunch. The Building Solutions division is also benefiting from significant government contracts and a robust pipeline in the mining and education sectors. The Community Solutions segment continues to drive cash flow through high occupancy at the Searipple Village, while a disciplined capital allocation strategy, evidenced by a solid +9% dividend yield and a debt-free balance sheet, positions the company for potential accretive acquisitions or further capital returns to shareholders.

Technically, FWD is in a medium-term uptrend, recently breaking out from a base of consolidation around the $2.50 level. The stock has established firm support at $2.65, aligned with its 20-day moving average, while the RSI (14) sitting near 63 suggests there is still room for upward momentum before reaching overbought territory. A sustained move above the recent high of $2.84 would likely open the door for a test of the $3.20 resistance zone. With the stock trading significantly below consensus fair value estimates of $3.46, the risk-to-reward ratio appears favourable for a continued breakout.

Jupiter Mines: A strengthening manganese play

Source: JMS, weekly chart, income statement and estimates (2025)

Jupiter Mines (ASX: JMS) provides focused exposure to manganese, a commodity increasingly critical to next-generation battery chemistry. While recent earnings moderated, forward pricing expectations and rising EV-related demand point to improving medium-term fundamentals that are not yet fully reflected in the share price.

The primary catalysts driving JMS are the structural deficit in high-purity manganese and the operational stability of its flagship Tshipi Borwa mine. As global battery manufacturers shift toward manganese-rich chemistries like LMFP (Lithium Manganese Iron Phosphate) to reduce costs, Jupiter is strategically pivoting to produce High-Purity Manganese Sulphate Monohydrate (HPMSM).

The recent supply disruption at South32’s Groote Eylandt, previously a dominant global producer, has tightened the seaborne market, allowing Jupiter to command premium pricing. This supply-side pressure, combined with a robust 3.75% dividend yield and an unlevered balance sheet, provides a compelling floor for the stock as it transitions from a pure steel-alloy play into a critical green-energy supplier.

Technically, JMS is in a powerful long-term uptrend, having surged over 90% in the past year to trade near its 52-week high of $0.285. The stock is currently undergoing a healthy consolidation phase, with strong horizontal support established at $0.275. Both the short-term and long-term moving averages are trending upward, with the 20-day MA acting as a dynamic floor during minor pullbacks. A decisive breakout above $0.29 on high volume would confirm the next leg of the rally, targeting the $0.32 psychological resistance level. With an RSI of 63, the stock maintains bullish momentum without yet entering overbought territory, suggesting further upside potential remains as forward earnings estimates are revised.

CTI Logistics: Steady growth overlooked in a volatile market

Source: CLX, weekly chart, income statement and estimates (2025)

CTI Logistics (ASX: CLX) continues to deliver consistent earnings growth, supported by project activity in Western Australia and improving asset utilisation. Despite this, it trades on a modest valuation and an attractive yield, a combination that tends to perform well as volatility subsides.

The primary catalysts for CLX centre on a major operational turnaround and strategic infrastructure investments in Western Australia. In late 2025, management issued a significant profit upgrade, forecasting a 55% increase in pre-tax profit for the first half of FY26. This surge is underpinned by a 7% revenue jump driven by robust demand for freight services and high-margin mining and energy project work in WA. The completion of the Hazelmere regional freight hub and a modernized, more energy-efficient fleet are now yielding substantial efficiency gains. With the company's property portfolio valued at roughly $176 million (nearly equal to its market cap), the stock offers a "margin of safety" rarely found in the small-cap industrials sector.

Technically, CLX has entered a powerful bullish phase, recently navigating near the 52-week high, around $2.40 following its positive earnings guidance. The stock is currently consolidating between $2.30 and $2.40, successfully testing the $2.30 horizontal level as new support. While the RSI (14) of 64.5 indicates strong momentum, it remains below the "overbought" threshold of 70, suggesting there is still runway for further appreciation. A decisive break above the $2.40 resistance on high volume would likely trigger a secondary rally toward historical multi-year highs. Investors are also supported by a disciplined 4.45% to 5% fully franked dividend yield, which provides a stable income floor during broader market fluctuations.

Shaver Shop Group: Defensive cash flow in an uncertain consumer backdrop

Source:SSG, weekly chart, income statement and estimates (2025)

Shaver Shop Group (ASX: SSG) remains a clear example of defensive consumer exposure. Its ability to sustain margins and dividends through cost pressures reinforces its role as a stabilising portfolio holding at a time when broader retail remains challenged.

The core catalysts driving SSG’s performance are its dominant market share in the grooming niche and a successful shift toward higher-margin private labels. The launch of its Transform-U™ private brand has exceeded internal expectations, contributing over 5% of sales in recent periods and helping push record gross margins to 45.5%. This vertical integration, combined with exclusive distribution rights for global brands like Skull Shaver, insulates the business from the price wars typical of general electronics retailers. Furthermore, a "rock solid" balance sheet with zero debt and a high net cash position supports an attractive 6.6% dividend yield.

Technically (and remarkably), SSG has exhibited remarkably low volatility, trading in a steady ascending channel between $1.35 and $1.60. The stock is currently testing a key resistance level at $1.55; a clean breakout above this point, supported by the recent trend of higher lows, would likely target the $1.68 zone. Support is firmly established at $1.48, which aligns with its 200-day moving average and acts as a historical "buy zone" for yield-seeking investors. With the RSI currently sitting around a neutral 45, the stock is neither overbought nor oversold, and suggesting a stable technical base.

Tribune Resources: Exploration success amplified by gold prices

Source: TBR, weekly chart, income statement and estimates (2025)

Tribune Resources (ASX: TBR) combines operational delivery with exploration upside. High-grade drilling results and active capital management are being amplified by elevated gold prices, creating a favourable backdrop for shareholder returns.

A primary catalyst for TBR is the record-breaking gold price environment, which has surged past the key level of US$4,500/oz in early 2026, significantly expanding margins at the East Kundana Joint Venture (EKJV). Recent exploration reports from the Sadler and Golden Hind deposits have confirmed high-grade mineralisation, offering clear resource expansion potential. Furthermore, the company’s aggressive capital management, headlined by a consistent $0.20 per share dividend and an active on-market buy-back program, reflects a "shareholder-first" approach. This is supported by a robust balance sheet featuring over $80 million in cash and listed investments, providing the flexibility to fund aggressive drilling programs in Ghana and the Philippines without diluting equity.

Technically, TBR is trading in a defined bullish channel, currently sitting near $6.7. The stock has successfully established a multi-month support base at $6.00, which acted as a springboard for its latest leg higher. Indicators show the price is trending comfortably above its 200-day moving average, with an RSI sitting mid-range this suggests healthy momentum that is not yet overextended. A decisive break above recent resistance at $6.75 would likely clear the path for a test of the psychological $7.00 barrier. With the stock still trading at a significant discount to estimated fair value, the technical setup points to a sustained "buy-on-dip" pattern as the gold bull market continues.

GWA Group: Operational Discipline and revenue growth

Source: GWA, weekly chart, income statement and estimates (2025)

GWA Group (ASX: GWA) is demonstrating how margin expansion and disciplined capital management can drive value even in a slowing construction cycle. The ongoing share buyback and improving cash conversion suggest downside risk is increasingly limited.

The primary catalysts for GWA are rooted in its successful "Win the Plumber" strategy and an aggressive capital management program. Despite a soft residential construction market, the company improved its normalized EBIT margin to 18.2% in recent reports, driven by cost efficiencies and a pivot toward high-margin bathroom and kitchen solutions. The Board’s commitment to a $30 million on-market share buyback, which commenced in late 2025 and continues through mid-2026, acts as a significant "EPS accretive" engine. With a cash conversion ratio of 111% and net debt at a seven-year low, GWA maintains a robust 6% fully franked dividend yield, making it a standout defensive play for income-focused investors in the building products sector.

Technically, GWA is in a healthy uptrend, having recently broken out from a multi-month base to test a new range between $2.60 and $2.75. The stock has established strong support at $2.58, which was previously a resistance level, and is currently trading comfortably above its 50-day and 200-day moving averages. The Relative Strength Index (RSI) is holding around 64, indicating consistent bullish momentum without being overextended. A successful push above the $2.80 key level, which represents the 52-week high, could trigger a move toward $3 per share. Given the low volatility and the floor provided by the buyback, the technical setup suggests a "grind higher" rather than a speculative spike.

Grange Resources: Mispriced exposure to green steel

Source: GRR, weekly chart, income statement and estimates (2025)

Grange Resources (ASX: GRR) offers exposure to the green steel transition with one of the strongest balance sheets in the sector. The market continues to discount near-term iron ore volatility while underappreciating the strategic value of its high-grade pellets.

The primary catalysts for GRR include its shift toward the "Green Steel" value chain and its exceptional capital position. As global steelmakers transition to Direct Reduced Iron (DRI) processes to meet 2030 decarbonization goals, the demand for Grange’s ultra-high-grade magnetite pellets, which feature low impurities and high iron content, is expected to command an increasing "green premium." This strategic moat is backed by a fortress balance sheet; with over $113 million in cash and virtually no debt, the company maintains a robust 3.4% to 4.5% dividend yield even during periods of price softness. The ongoing development of the Southdown Magnetite Project in Western Australia provides a long-term growth lever that could significantly re-rate the stock once financing or a major partner is secured.

Technically, GRR is currently consolidating within a 52-week range of $0.17 to $0.31, having recently established a firm support floor at the $0.23 level. The stock has shown resilience by bouncing off this accumulation zone multiple times in early 2026, while its Relative Strength Index (RSI) remains neutral near 50, indicating neither overbought nor oversold conditions. A decisive daily close above the $0.29 resistance level, supported by increased trading volume, would likely signal a bullish trend reversal and a re-test of the psychological $0.30 barrier. Conversely, with the Price-to-Book ratio sitting at a deep-value 0.3x, the downside risk appears structurally limited by the company's tangible asset base.

Smartgroup Corporation: Structural growth at a reasonable valuation

Source: SIQ, weekly chart, income statement and estimates (2025)

Smartgroup Corporation (ASX: SIQ) is benefiting from the rapid electrification of fleet vehicles, a trend supported by government policy rather than economic cycles. Strong returns on equity and low leverage position the company to compound earnings through 2026 and beyond.

The core catalyst for Smartgroup is the structural tailwind provided by the Federal Government’s Electric Vehicle (EV) FBT Exemption, which has fundamentally lowered the cost of ownership for novated leases. This policy has triggered a massive shift in consumer behavior, with EV and Plug-in Hybrid (PHEV) orders now making up nearly 40% of new lease quotes. Unlike traditional discretionary spending, this growth is "policy-insulated," as the tax savings remain compelling even in a high-interest-rate environment. Operationally, the business is a high-quality "capital light" compounder, boasting an impressive Return on Equity (ROE) of 31% and high cash conversion. With a debt-free net cash position and a robust 5.6% fully franked dividend yield, Smartgroup offers a rare combination of defensive yield and aggressive structural growth.

Technically, SIQ is exhibiting a strong bullish trend, trading near $9 per share and consistently making higher lows since its late 2025 breakout. The stock is currently supported by its 200-day moving average at $8.96, which has acted as a reliable floor during recent market volatility. On the upside, the immediate resistance level sits at $9.22. A sustained break above this ceiling on high volume would likely see the price target the psychological $10 mark. With the RSI currently near a neutral 52, the stock has cleared its previous "overbought" readings and established a stable base for the next leg higher. The "Golden Star" signal recorded in late 2025 remains in play, suggesting that long-term momentum continues to favour the upside.

The Market is Rewarding Selectivity Rather than Caution

We view the current environment not as a signal to retreat, but as one that rewards selectivity and patience. Volatility has compressed valuations across a wide range of fundamentally sound businesses, particularly those exposed to infrastructure, electrification, housing and resource efficiency.

From a technical perspective, many of these stocks are forming stable bases following prolonged consolidation, often a precursor to re-rating as sentiment improves. Combined with strong balance sheets and identifiable catalysts, we believe the market is quietly offering investors the chance to position for the next phase of the cycle rather than react to the last one.