Zoono shares soar as world races to shield against coronavirus

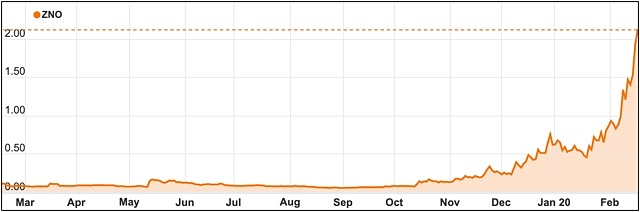

Zoono’s share price has risen over 3000% in the past 6 months.

Antimicrobial company Zoono Group (ASX: ZNO) is one of a few biotech stocks appearing to benefit from the latest outbreak of coronavirus, now being named COVID-19, with its shares surging dramatically and deals snapping up pronto.

The New Zealand business develops, manufactures and distributes a suite of antimicrobial products including hand and surface sanitisers that have been confirmed effective against the coronavirus family.

While the company’s shares have climbed more than 80% in the last week and tripled in price in the last month, Zoono’s stock has been steadily rising since December last year – before the announcement of the virus outbreak.

Speaking with Small Caps, Zoono managing director and chief executive officer Paul Hyslop said he is confident that once the mass panic diminishes, Zoono’s sales will remain strong because the outbreak has driven awareness about protection.

Successful testing

Zoono’s share price run appeared to start in early December after the company announced its ZOONO Z71 Microbe Shield product was confirmed through laboratory testing to be more than 99.99% effective against the African Swine Fever virus that has been decimating pig populations globally.

This lab testing was conducted in conjunction with in-field testing in China, where Zoono-treated pens of pigs were compared to non-treated pens. There were no recorded fatalities in the Zoono-treated pens, compared to numerous infected and deceased pigs in the non-treated control pens over the same 21-day period.

“At that stage, we appointed a distributor for China in that vertical market for animal health and the share price started to take off then,” Mr Hyslop said.

Then he said the coronavirus hit the company’s shares “like a thunderbolt” since Zoono’s products had previously tested effective against the bovine coronavirus, which is similar to the latest strain.

Compared to six months ago, Zoono’s shares have increased more than 3,000%.

Zoono’s share price performance over the past 12 months.

Zoono is currently waiting for lab results from Germany to confirm whether its products have successfully tested effective against the COVID-19 strain.

Mr Hyslop said there is currently a “big queue” but results are anticipated in the next one to two weeks.

“I’m reasonably confident that it will be effective because it’s a similar coronavirus to what we’ve already tested against and been very successful against,” he said.

“In fact, under the European testing standards for viruses, they actually dilute your products with water and test it again and our product was still highly effective [against the bovine coronavirus] even at the 50% strength dilution.”

Recent deals and sales

Zoono quickly locked in distributor deals, including an exclusive agreement inked with Beijing Youmeng Technology and Development for the childcare and hotel markets in China last week.

Today, the company announced the appointment of Linco Investments as an exclusive distributor for Singapore.

Mr Hyslop said Zoono is also currently negotiating with airlines and big hotel groups globally and its products are already in the London Underground.

Additionally, Zoono recently announced it is ramping up production and has also alluded to a huge increase in revenues, with Mr Hyslop adding that online sales are currently between “$40,000-$50,000 a day” with the majority being daigou sales in Australia and Hong Kong.

“I’ve just bought another 4 million bottles to put our product into. We’ve got enough raw material to make 3 million litres, so we are trying to stay ahead of the game and ahead of the orders,” Mr Hyslop said.

What happens when the coronavirus panic ends?

Mr Hyslop said the issue with viruses is they can never be completely eradicated since they have the ability to morph and reappear as new strains. Therefore, being aware about protection will continue to be important.

“You can’t completely eliminate a virus. They go and hide in the corner for a while and reinvent themselves then pop up again. What this has done is made people far more aware of the issue and far more aware about protection,” he said.

According to Mr Hyslop, the key difference between Zoono’s technology and other products on the market is its ability to protect, as well as react. The products are designed to instantly kill bacteria but then protect the surfaces they have been applied to afterwards.

“In the case of skin, it will last for 24 hours; in the case of surfaces, we test up to 30 days,” he said.

“We’re hoping that a lot of the distributor deals we’re signing up now and customers that are coming on board – when the mass panic is over – will still remain as customers and still buy products off us because there’s an awareness factor now.”

Taking advantage of this building need for protection, Mr Hyslop said Zoono is currently moving into much larger premises and has recently employed more staff.

“We’re ramping up as fast as we can and we’re staying ahead of the game … we’re confident that even after [the coronavirus outbreak] is over, our sales and market awareness will continue to be strong especially amongst the Chinese people,” he said.

Investors will be eager to see if the Zoono’s sales performance can justify the now somewhat $300 million market capitalisation for the company.