Afterpay rival Zip Co (ASX: Z1P) has accelerated its global expansion strategy by signing a $403 million agreement to acquire the remaining shares in New York-based buy now-pay later provider QuadPay Inc.

Zip already owns a 14% interest in QuadPay, inherited in August following the purchase of New Zealand-based instalment payments provider and QuadPay equity holder PartPay Limited.

On completion of the acquisition, QuadPay shareholders will be entitled to receive up to a maximum of approximately 119 million fully paid ordinary Zip shares, equivalent to 23.3% of the issued share capital of Zip.

Zip has agreed to issue additional shares to QuadPay’s co-founders subject to the satisfaction of prescribed performance and tenure milestones as part of retention arrangements.

The performance milestones align the delivery of Zip shares awarded to the co-founders with Zip’s ambitious growth targets.

The new combined group will have operations in Australia, New Zealand, the US, UK and South Africa and annualised total transactions volume of $3.0 billion.

Its annualised revenue is expected to reach approximately $250m, from business generated by 3.5 million customers and 26,000 merchants.

Generational change

QuadPay is one of the leading BNPL platforms in the US’ $7.35 trillion retail market.

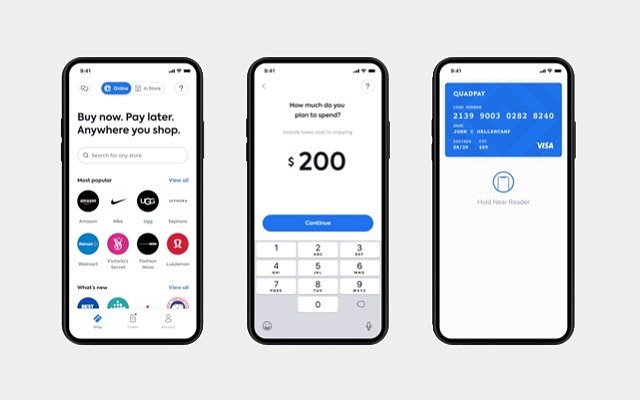

The company’s business model QuadPay Anywhere enables customers to pay for their online and in-store purchases in four interest-free instalments over six weeks, in partnership with payment instalment platform Stripe.

Zip chief executive officer Larry Diamond said the QuadPay acquisition comes at a time when a “generational change” in payment methods is underway, with customers leaving behind credit cards in preference of interest-free instalment plans.

“As a strategic investor in [QuadPay], we have spent considerable time with the founders and share a united vision of disrupting the outdated credit card [market] with a digital and fairer alternative,” he said.

“The US is a critical part of our global strategy and we have been impressed by QuadPay’s continued innovation – [the company] was first to market with a virtual card solution in the BNPL space and has continued to evolve and innovate its offerings.”

Mr Diamond said the combined group would use its resources, geographic coverage, data capabilities, category leadership and experience to drive growth in the US and other markets.

Capital raising

Zip has also entered into an agreement with US-based CVI Investments Inc, a subsidiary of financial services giant Susquehanna International Group, to raise up to $200 million through the issue of convertible notes and the exercise of warrants.

The notes will have an initial conversion price of $5.5328, representing a 50% premium to the one-day volume weighted average price of Zip shares on 29 May, while the warrants will have an initial exercise price of $5.1639, or 40% on the VWAP.

Mr Diamond said the capital raising would help accelerate Zip’s US growth plans.

“This investment from Susquehanna will allow us to hit the ground running as we scale up our global operations while protecting shareholder interests by limiting dilution,” he said.

“The terms of the investment are a strong endorsement of the growth potential of our business and we look forward to working with such a highly-regarded [company].”