World Trade Organisation predicts global trade could plunge up to a third this year, outlook ‘ugly’

The World Trade Organisation anticipates the COVID-19 induced trade slump will exceed the one that occurred during the global financial crisis.

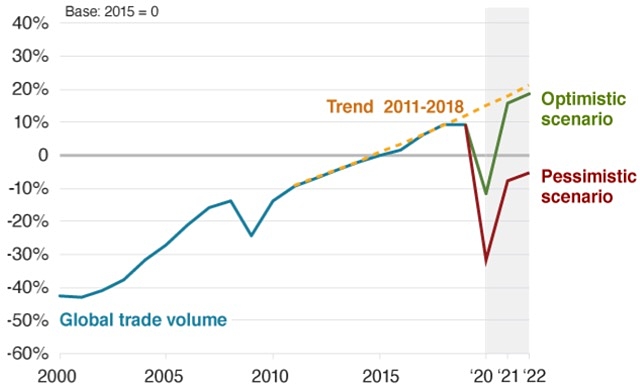

The World Trade Organisation (WTO) is expecting global trade to fall between 13% and 32% as the COVID-19 pandemic disrupts normal economic activity and life around the world.

“These numbers are ugly — there is no getting around that,” said WTO director-general Roberto Azevedo.

But, he added, a rapid, vigorous rebound was “possible” although estimates for 2021 are uncertain at this time.

Australia ranks as the world’s 21st largest exporter. China, the US, Germany, the Netherlands and Japan respectively make up the top five.

Economists at the Geneva-based WTO believe the current decline will likely exceed the trade slump brought about by the global financial crisis in 2008-09.

Mr Azevedo said the downturn in trade and output will have painful consequences for households and businesses on top of the human suffering caused by the virus itself.

Trade already slowing before virus hit

WTO figures show that trade tensions and slowing economic growth were already beginning to weigh on trade in 2019.

After rising by 2.8% in 2018, merchandise exports were down 0.1% in volume terms last year, but in dollar terms the fall in 2019 was 3% to US$18.89 trillion (A$30.28 trillion).

By contrast, trade in commercial services globally rose in 2019, up 2% to US$6.03 trillion, although that growth rate was slower than that in 2018.

This shock differs from the GFC

WTO noted that the COVID-19 shock “inevitably” invites comparisons to the GFC 12 years ago.

“These crises are similar in some respects but very different in others,” the report added.

As in 2008-09, governments have again intervened with monetary and fiscal policy and provided income support.

But, this time, restrictions on movement and social distancing mean that labour supply, transport and travel are today directed impacted in ways they were not during the GFC.

Moreover, after the GFC, trade never returned to its previous pattern or trend.

Likely scenarios vary widely

The WTO has both optimistic and pessimistic scenarios.

The former allows for a sharp drop in trade near-term but a recovery beginning in the second half of this year.

A more pessimistic scenario sees a steeper initial decline and a more prolonged and incomplete recovery.

Growth rate for global trade and WTO scenarios.

However, much better or much worse possibilities remain.

“Actual outcomes could easily be outside of this range, either on the upside or the downside.”

The WTO argued that, if the pandemic is brought under control and trade starts to expand again, most regions could experience double-digits rebounds somewhere between 21% and 24% in 2021.

Complicated supply chains will be worst hit

The WTO believes that trade is likely to fall more steeply in sectors characterised by complex value chain linkages, particularly in the electronic and automotive sectors.

Some countries could be hit badly.

The WTO showed that, in electronics, it is not just China that has a large slice of the supply chain. South Korea, Singapore, Mexico, Malaysia and Vietnam also are key players.

The report added that the COVID-19 virus is not the only factor to be kept in mind.

Localised disasters such as hurricanes and tsunamis could also add to existing disruptions.