Weekly review: Woolworths’ billion dollar sale, traumas for Lendlease, Altura signs lithium offtake deal

WEEKLY MARKET REPORT

Australia’s share market continued a tepid recovery this week, managing to climb 1.2 per cent despite a lacklustre Friday which saw the ASX 200 index slip 6 points.

It was the first daily fall for the past ten sessions and the main culprit dragging the bourse lower was the energy sector, which was hit by falling oil prices which have now shed around 20 per cent since peaking in October.

Concerns about slowing global growth and increasing oil stockpiles was behind the oil slump and local oil stocks felt the heat.

Gas and oil giant Woodside (ASX: WPL) put in a poor performance, shedding 1.3 per cent or 45c to $33.77.

Santos (ASX: STO) also had a bad day, losing 7c or almost 1.1 per cent to $6.42.

Woolworths sells petrol business for $1.7 billion

Woolworths (ASX: WOW) shares will be worth watching at the open on Monday after the supermarket giant announced it had sold its petrol business for $1.725 billion to EG Group.

Pending Foreign Investment Review Board approval, the 540 Woolworths-owned fuel convenience sites will be transferred to EG Group, which operates around 4,700 sites across Europe and North America.

EG employs more than 28,000 people globally and as part of the deal the existing 4c a litre shopping docket discounts and reward points from Woolworths stores will still work in the petrol stations as part of a 15 year commercial alliance between the two companies that covers fuel discount redemption, loyalty and wholesale product supply.

The deal was announced just after the share market had closed and up until then Woolworths shares had firmed 7c or 0.24 per cent to $29.42.

This deal effectively replaces an earlier one with BP that was halted by competition concerns and is likely to be welcomed by investors because it greatly simplifies the Woolworths business, along with the closure of the troubled hardware chain Masters.

Traumas for Lendlease

It was not a good day for Lendlease (ASX: LLC), with shares falling 18.3 per cent to $14.25 after its chief executive admitted he was embarrassed by problems that have forced the construction company to take a $350 million post-tax impairment in its first-half results.

Lendlease also announced a review of its engineering and services unit following problems on projects including Sydney’s NorthConnex motorway tunnel.

Recovery for takeover target and lithium

It wasn’t all bad news on the market with APA Group (ASX: APA) adding 3.6 per cent to $8.88, after tumbling 9.9 per cent on Thursday on the back of Treasurer Josh Frydenberg’s initial view that CK Infrastructure’s planned purchase of APA is against the national interest.

Lithium miner Altura Mining (ASX: AJM) also soared 36.1 per cent to 24.5c after signing a long term offtake agreement with a Chinese battery maker.

Under the deal the miner will supply 70 thousand tonnes a year for three years with the potential for a 10 year extension.

Small cap stock action

The Small Cap index outperformed the ASX 200 and All Ords this week – putting on 2.94 per cent to close Friday at 2,680.2 points.

Numerous small caps stocks had notable news out, including:

Bod Australia (ASX: BDA)

Medical cannabis stock Bod Australia impressed investors this week with news it has begun dispensing its proprietary cannabis oil in Chemist Warehouse stores throughout Australia.

According to Bod, Chemist Warehouse is Australia’s largest pharmacy retailer with 450 stores around the country.

The pharmacy retailer will now stock Bod’s MediCabilis product as well as other Bod products from its health and skin care range.

As part of the initiative, Bod will begin a comprehensive training program to educate pharmacists about all aspects of MediCabilis.

Suda Pharmaceuticals (ASX: SUD)

Suda Pharmaceuticals hopes to commercialise its SUD-001 migraine spray in the US after securing an agreement with Strides Pharma Global.

The company’s spray is based on its proprietary OroMist hydrotrope, which is an oral mucosa delivery platform.

In this instance, the platform will be used to administer sumatriptan to migraine sufferers.

Suda claims its proprietary platform can deliver the migraine drug more easily, with a faster response time, lower required dosage and reduced side-effects.

Paradigm Pharmaceuticals (ASX: PAR)

Paradigm Pharmaceuticals reported more positive findings this week from trials on its injectable Pentosan Polysulfate Sodium (iPPS) drug, with participants revealing an average 51.2% reduction in chronic knee pain.

The company tested the drug on participants who had suffered osteoarthritic pain for a minimum of six-months and had not responded to conventional treatment.

The positive results showed that 126 patients (86.8%) responded with a reduction in joint pain and 132 (91%) showed an improvement in knee function.

These results are a precursor to a 110-patient, phase 2b clinical trial with Paradigm anticipating results to be in by the end of the year.

Pure Minerals (ASX: PM1)

Pure Minerals’ future subsidiary, Queensland Pacific Metals Pty Ltd has defined an optimum processing flowsheet for the extraction of battery-grade cobalt and nickel from New Caledonia ore.

Queensland Pacific Metals recruited the help of the CSIRO which, by using its DNi process, was able to investigate the best method for converting the mixed hydroxide precipitate into battery-grade nickel and cobalt sulphate.

The evaluation supports Queensland Pacific Metals’ scoping study into the development of a 600,000 tonne-per-annum processing plant in Townsville, Queensland.

New Caledonia-based Societe des Mines de la Tontouta and Societe Miniere Georges Montagnat SARL will supply Queensland Pacific Metals with ore for five-years under a binding agreement.

Purifloh (ASX: PO3)

Purifloh received a $9.6 million boost from a US investor paving the way for commercial development activities to kick-off for its Free Radical Generator (FRG) technology.

The company’s share price lifted 380% when 4 million Purifloh shares were purchased by Upjohn Laboratories, a family investment company owned by billionaire William Parfet.

A further 1,271,601 shares will be transferred, off-market to Upjohn, giving the investment vehicle a subsequent 16.6% stake in Purifloh.

The placement was carried out at $2.40 per share, with shares in Purifloh trading at a mere 50c the day prior.

Purifloh’s FRG technology creates free radicals which remove pollutants from the air and water and can be manipulated to suit a given situation.

The company believes that the FRG technology will be more successful in combating bacteria, such as gram-positive, gram-negative and antibiotic resistant than established methods without any chemicals or producing harmful by-products.

Invictus Energy (ASX: IVZ)

Invictus Energy announced a maiden resource at the Cabora Bassa gas and condensate project in Zimbabwe.

The African oil and gas explorer owns 80% of the project which gives the company a net prospective resource of 680 million barrels of oil equivalent.

Invictus Energy’s independent analysis reveals an enormous possibility in terms of recoverable commodity of up-to 2.2MM boe gross “and confirms Mzarabani as potentially the largest undrilled seismically defined structure [in] onshore Africa.”

The company expects a final independent prospective resource report, which will include the entire SG 4571 permit area, to be ready early next year.

Esports Mogul (ASX: ESH)

Esports Mogul announced it will organise and stage online esports tournaments for ONE eSports, which Esports Mogul calls Asia’s largest esports champion series.

ONE Championship, one of Asia’s top sports media companies, has committed to an investment of up-to US$50 million in creating ONE eSports.

Esports Mogul and its partner Razer Inc will assist ONE eSports together with Singtel and other industry players, with Esports Mogul to be responsible for organising and staging the online tournaments.

ONE eSports named former UFC flyweight champion and one of the best pound-for-pound mixed martial artists Demetrious “Mighty Mouse” Johnson as its chief brand ambassador. With the MMA star recently having left the UFC to join ONE Championship over in Singapore.

Additionally, this week, Esports Mogul its online platforms has rebranded to ‘Mogul’ in a move to create a recognisable and durable “umbrella term” synonymous with the gaming world.

IPOs this week

Small Caps readers who want to view upcoming IPOs or see the stocks that have listed in 2018 and how they are performing can now do so.

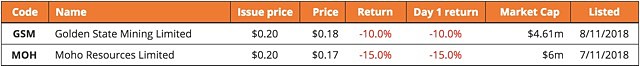

The latest companies to make their way onto the ASX this week are:

Moho Resources (ASX: MOH)

Moho Resources is the latest mineral explorer to debut on the ASX this year, with the company raising $4.5 million to fund nickel, copper and gold exploration.

The company issued 22.5 million shares at $0.20 each to give investors a chance to be exposed to its three projects in Queensland and WA.

Moho is looking for gold in Queensland, while in WA it is pursing nickel and gold mineralisation close to Poseidon Nickel’s (ASX: POS) Silver Swan high-grade nickel deposit.

The company opened its first day on the ASX at $0.16 before entering a trading halt on Thursday, leaving it to close the week at $0.17.

Golden State Mining (ASX: GSM)

Similar to Moho, Golden State Mining joined the ASX after raising $4.5 million by issuing 22.5 million shares at $0.20 each.

Golden State has three projects in WA and will use the IPO funds to advance its Cue, Yule and Four Mile Well gold projects.

Cue encompasses 46sq km and will be Golden State’s first exploration focus.

After opening its first day of trade at $0.17, the company’s share price lifted slightly to close Friday at $0.175.

The week ahead

In Australia next week we should some clues about whether our job market is following the US into overdrive.

The wage price index is released on Wednesday while the October monthly data on the labour force – employment and unemployment – is issued on Thursday.

Other events to watch out for include the release of credit & debit card lending and lending finance numbers, the NAB Business survey and Westpac’s consumer confidence index.

Internationally, both the US and China will release indicators of retail sales and industrial production which may give an inkling to the damage caused by the continuing trade war between the two countries.