Texas-focused oil producer Winchester Energy (ASX: WEL) has revealed another strong period of growth for the December 2019 quarter, recording significant increases in revenue and oil production.

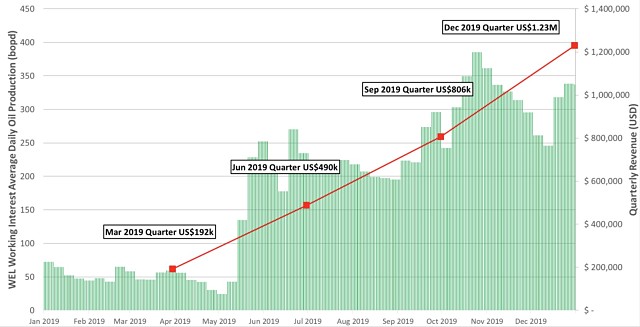

The company today announced a 50% growth in net oil and gas sales revenue to US$1.23 million (A$1.79 million), up from the September quarter’s working interest revenue of US$806,218.

Revenue has lifted significantly over the past nine months, up more than 540% from the March 2019 quarter’s total of US$192,000.

Quarterly net oil production also rose 40% to an average daily rate of 312 barrels of oil per day, or 28,702 barrels in total.

This has been the result of the company significantly expanding its production base at its East Permian Basin acreage and adding two new production horizons – the Fry sand in the Strawn formation at the Mustang oilfield and the Cisco sands at the Lightning oilfield.

Winchester has also recently been encouraged by strong oil and gas shows at the Arledge 16#2 well at Lightning and the newly drilled step-out well, McLeod 17#3, which hit 124 feet of potential pay earlier in the month.

New oil production

Following the significant discovery made at the Arledge 16#2 well in the Lightning oilfield, production testing continued during the December quarter, moving from the Lower Cisco to the Upper Cisco sands.

During testing, about 6,000bbls of oil was produced and sold from the Lower Cisco sands, Winchester reported.

The 165ft Upper Cisco sand interval, where “good to excellent” oil and gas shows were encountered, remains to be tested and produced. According to the company, this interval has an estimated total of 50ft of net pay potential.

The new McLeod 17#3 well was drilled at the Lightning field in early January with initial wireline logs indicating 414ft of gross Upper and Lower Cisco sand section.

Winchester identified 124ft of net conventional sand as potential pay with excellent oil and gas shows – far exceeding the 25ft of net pay discovered in the corresponding zone at the Arledge 16#2 well.

Meanwhile, recently drilled wells at the Mustang oilfield in Winchester’s White Hat Ranch oil lease have produced more than 110,000bbls of oil (gross) to date.

The latest Mustang well, White Hat 39#2, was drilled in December with wireline logs indicating 30ft of gross pay in the Fry sand and good to excellent oil and gas shows. This well has been fracture stimulated and is currently flowing back.

On the horizon

Winchester plans to test the Lower sand at McLeod 17#3 in January after the Arledge 16#2 Upper sands tests are completed.

It also expects to start drilling the next Mustang development well, White Hat 20#6, before the end of January.

In addition, the company is continuing with a 3D seismic reprocessing program it commenced in December and has identified 20 additional locations for potential future exploration across its 17,000 acres.

Winchester said it is currently in the process of exploration target ranking and is planning to drill an exploration well in the current quarter.