Which metals will benefit from the coming lithium-ion battery boom?

The electric vehicle market alone is set to drive lithium-ion battery demand for decades to come – so what will happen when the flourishing renewable energy sector forges ahead? And more importantly, what metals stand to benefit?

Only last week, the world’s largest 100-megawatt and 129-megawatt hour lithium-ion battery storage system, capable of powering 30,000 homes, went live in South Australia to provide a back-up source of energy for the state.

Meanwhile, South Korean manufacturer Hyundai Electric and Energy Systems plans to topple this achievement with plans to push the button on its own 150MW lithium-ion system in Ulsan by February next year.

The impetus for the South Australian power system was a freak storm that left 1.7 million residents across the state without power.

In response, the South Australian Government came up with a plan for creating a massive lithium-ion battery to store renewable energy and provide backup power to the state when needed.

Windfarm developer Neoen teamed up with electric vehicle and lithium-ion battery manufacturer Tesla to create a world first system of this scale.

After securing the tender, Tesla chairman and chief executive officer renowned businessman Elon Musk threw down the gauntlet to the South Australian Government with a cocky guarantee: Tesla would deploy the battery within “100 days or its free”.

Luckily for Musk, his Tesla team and resources were able to make good on his boast with the 100MW system switched on within 63 days of inking the contract.

Tesla’s Powerpack system is now paired with Neoen’s Hornsdale wind farm. During suitable periods, the wind farm charges the lithium-ion Powerpack, with both able to deliver power into the state’s energy market.

Commenting on the feat, a Tesla spokesperson said launching the world’s largest lithium-ion battery in record time demonstrated that a sustainable and effective energy solution was possible. The spokesperson added that the South Australian project was an example for decision-makers around the world.

More massive lithium-ion battery systems on the way

Apart from the upcoming Hyundai Electric and Energy Systems battery, another manufacturer AES Energy Storage looks set to develop and install a 300MW battery system in the United States. The project is expected to be deployed in California’s new the Los Cerritos Wetlands from 2019. However, it isn’t due to be completed until 2023.

With many governments around the world looking into similar systems, it seems strongly possible this record may be beaten in the not-too-distant future.

Tesla, itself, has several more customers in its pipeline including the Kauai Island, part of the Hawaiian Islands off the US coast.

The island’s power provider Kauai Island Utility Cooperative has contracted Tesla to build a 52MWh Powerpack to work in conjunction with a 13MW SolarCity photovoltaic array. Once complete, the Powerpack system will store solar energy during the day and feed it to the grid, then after sunset, the system will lighten the diesel power load which currently serves the island’s entire energy needs.

The Kauai Island Government plans to draw half of its energy from renewable sources by the end of 2019.

Additionally, residential home owners and businesses around the world are increasing their uptake of smaller-scale lithium-ion battery systems.

In its September quarter 2017 update, Tesla reported its Powerpack system deployment had surged 138% for the period compared to the same quarter last year.

The company also stated it anticipated this market would continue growing to make up a larger part of its business, which is currently primarily electric vehicles.

Electric vehicle market continues to expand

As the world’s largest electric vehicle manufacturer, Tesla reported it had delivered its 250,000th vehicle during the September quarter.

The company pointed out its electric vehicle fleet had swelled 100 times the size it was five years ago.

Nickel major Panoramic Resources claims electric vehicles have many favourable elements compared to petroleum and gas-fuelled cars, which makes them more appealing to consumers.

According to the nickel miner, electric vehicles are 10 times cheaper to “fuel” and this figure is expected to improve as the technology gets better.

Additionally, electric vehicles have much less moving parts with about 18 compared to fuel-powered cars which have around 2,000. Fewer parts mean the vehicles are cheaper to maintain with Tesla backing this proposition with an infinite mile warranty.

Meanwhile, the International Energy Agency predicts the electric car market will transition to mass market adoption within the next 10 to 20 years, anticipating stock may range up to 70 million by 2025.

As the most ambitious electric vehicle manufacturer, Tesla, alone, is targeting 500,000 electric vehicle sales by 2018 and double that by 2020.

Lithium-ion battery market

According to Transparency Market Research, the lithium-ion battery market will be potentially worth US$77.4 billion by 2024 – driven by electric vehicles.

To support is growing electric vehicle market, Tesla has invested US$4 billion in a giga factory to manufacture batteries for its growing electric vehicle stock.

Meanwhile, consumer electronics and green energy companies also have battery manufacturing facilities in the pipeline.

More bullish than the International Energy Agency, Panoramic Resources believes as more batteries are manufactured, and capacity and technology is enhanced, the electric vehicle price will drop to a point where it is affordable to consumers by 2022 and conventional cars will be obsolete by 2030.

Whether traditional cars become obsolete in the next five years or the next 30, one thing is certain, if the electric, sustainable energy and consumer electronic markets continue booming, the lithium-ion battery industry is likely to follow, and, subsequently, graphite, cobalt and nickel.

What other minerals are poised to benefit from the lithium-ion battery market?

What hasn’t been discussed much is the critical inclusion of several other minerals in the battery’s makeup.

Labelling the device, a lithium-ion battery can be quite deceptive as only a small portion of the battery actually comprises lithium.

For those unfamiliar with the lithium-ion battery composition, it has three main components: anode, cathode and the electrolyte which is the lithium component.

The anode is graphite, and the cathode is a combination of several different formulations.

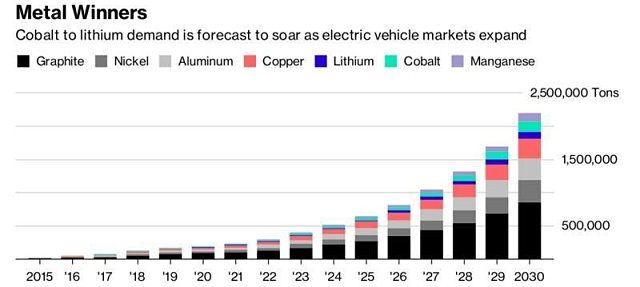

Source: Bloomberg New Energy Finance.

Tesla’s Model S vehicle battery has a cathode comprising 80% nickel, 15% cobalt and 5% aluminium, whereas Apple’s iPhone battery cathode is 100% cobalt and Tesla’s Powerwall cathode is made up of cobalt, nickel and manganese in equal portions.

In most batteries, the critical metals include lithium, graphite, cobalt and nickel. While lithium has been the centre of attention in recent years, these other three commodities are also integral to the battery’s make up.

Lithium

Lithium is a fairly opaque market with pricing negotiated between producers and buyers. Additionally, with the variety of lithium forms on the market, it is difficult to pinpoint an accurate market price.

According to Metalary, the standard metal price is US$9,100 per tonne in 2017, which is an 18% jump on 2016 levels which averaged at US$7,646.93. The metal’s price has been climbing at a minimum 13% each year since 2014, when demand for the metal took off.

Lithium consumption is projected to hit 340,000t by 2020, with the lithium-ion battery sector gobbling up half of that supply.

This is expected to almost double again between 2020 and 2025, with demand for the metal anticipated to leap to 600,000t – with the lithium-ion battery industry swallowing 70% of the portion.

Graphite

Over in the graphite space, the United States and European Union have both declared the metal a critical mineral.

China dominates the world’s graphite supply – accounting for 80%, with the US, EU, Japan and South Korea utterly dependent on mineral imports.

What many aren’t aware of is the fact that up to 40 times more graphite than lithium is used in the lithium-ion battery.

The commodity is also consumed in the steel sector, and as this industry begins to recover, it is anticipated graphite supply will tighten and prices will climb.

Similar to lithium, graphite pricing is largely opaque and based on direct negotiations between parties. However, as a guideline, large flake graphite with +80 mesh and higher than 94% carbon usually commands the highest prices.

Northern Graphite produced a rough price guide that puts extra-large flake graphite at US$1,750 per tonne (+50 mesh), large flake at US$1,150/t (+80 mesh), medium flake US$950/t (+100 to -80 mesh) and small graphite is around US$700/t (-100 mesh).

As the lithium-ion battery market continues rocketing, graphite demand is predicted to pick up, with the market accounting for about 25% of all graphite consumption. Northern Graphite anticipates this will increase with the burgeoning electric vehicle market and emerging grid storage solutions such as the South Australia’s recently commissioned battery.

Cobalt

Riding the lithium-ion battery high is cobalt, with most of the world’s supply arising out of the Democratic Republic of Congo (DRC).

The US Geological Survey claims DRC contributed 66,000t to global cobalt supplies in 2016, which is more than half the world’s 123,000t produced that year.

Other smaller cobalt operations are littered across the world and come out of China, Canada, Russia, Australia, Zambia, the Philippines, Cuba, Madagascar, New Caledonia and South Africa.

However, the DRC is under the human rights spotlight with claims of child labour. This, combined with the country’s known political instability, leaves half the world’s cobalt supply in jeopardy.

Eurasian Resources Group Tony Southgate told people attending a recent seminar it was “inevitable” many people there had a smart device in their pocket or bag that comprised cobalt derived from child labour.

As downstream users such as Tesla and Apple seek more ethically sourced cobalt, this opens the door for the rest of the world to ramp up cobalt operations to meet the supply gap and offer a more stable origin.

Cobalt has a transparent pricing mechanism with the metal sold on the London Metals Exchange.

In the past 12 months, the cobalt price has soared from US$30,000/t to break the US$70,000/t on Friday 8 December – the highest the metal has hit in almost a decade.

With a pre-global financial crisis peak above US$110,000/t, the metal has a while to climb before it reaches its former glory.

Nickel

Meanwhile, in the nickel camp, the market is undergoing a unique phase as it splinters in two.

Traditionally, nickel has primarily been consumed in the nickel pig iron industry to manufacture lower grade stainless steels.

However, a new market stream has emerged with the advent of the lithium-ion battery, which requires a high purity nickel.

As the markets separate, analysts are seeing the lower grade nickel directed to the pig iron sector, while the high grade pure nickel is snapped up by lithium-ion battery manufacturers.

Additionally, in the newer lithium-ion battery models, nickel has become an increasingly critical mineral. Analyst Roskill published a report in April this year claiming battery manufacturers were using up to eight times more nickel than cobalt, and manganese, where, previously, these were used in equal portions.

Roskill expects nickel demand could surge as much as 400,000t by 2025 and, combined with the emerging market and supply dynamics, this could lead to substantial price hikes.

However, the analyst cautions if the price soars too high then manufacturers could look for alternatives.

As with cobalt, the nickel price is transparent, with the metal sitting at US$11,300/t on 4 December.

Its lower price and easy availability providing an impetus for lithium-ion battery manufactures to incorporate larger amounts of nickel.

For 2017, the International Nickel Study Group anticipates nickel consumption will rise 5% on 2016 usage to about 2.15 million tonnes.

Although production is forecast to rise, it is 100,000t less than demand which could be why nickel stockpiles are gradually coming down.

Due to the global financial crisis, tighter lending criteria and a sluggish global economy, fewer nickel discoveries have been made or developed in the last 20 years.

Many analysts believe this could cause longer-term issues as supply tightens and current resources are depleted and companies rush to find and mine new deposits.

Optimistic future

With the booming lithium-ion battery market, it is feasible these minerals could become the “gold” of modern times.

Despite this, there is the risk a new technology could disrupt the entire lithium-ion battery market and send the commodities and their stocks plunging.

But if this doesn’t happen, you can only imagine where the lithium-ion battery market is travelling – pulling lithium, graphite, cobalt and nickel along for the ride.