There is one burning question after a very interesting week on the Australian share market – are the big banks pulling the market down as the good times appear to be at an end?

Friday was an excellent example of the trend with a fall in the share price of market heavyweight Commonwealth Bank plus a bleaker outlook for consumer discretionary stocks driving the market lower.

By the close, the ASX 200 had lost 0.3%, or 26.6 points to reach 8296.2 points, marking a 3% fall in the index since it hit a record high last Friday.

A sell-off in the shares of the previously untouchable Commonwealth Bank (ASX: CBA) gathered pace, with the stock down a hefty 2.6% to $151.73 to hit a five-week low as investors reacted to falls in the prices of other banks which disappointed with their profit results.

On this occasion though it was Commonwealth that bore the most of the big bank pain, with ANZ (ASX: ANZ) the next worst with a fall of 1.4% and shares in Westpac (ASX: WBC) and NAB (ASX: NAB) down less than 1%.

Is the banking sector correcting?

The financials sector is now down 7.55% this week after a series of poor earnings results.

The other interesting point to note is that this is part of a gathering global trend, with shares in US banks also weaker.

Could it be that Australia’s big banks are correcting?

It is too early to say at this stage but they are well on the way to a 10% fall and the sector merits close monitoring.

The other weak spot on the Australian market which sent it into retreat after a positive start was weakness in consumer discretionary stocks which followed on from lower-than-expected sales and profits for big US chain Walmart.

Wesfarmers (ASX: WES), which owns Bunnings and Kmart was caught in the downdraft, shedding 1.93% to close at $76.12 as the sector lost 1.54%.

By the close on Friday, six of the 11 sectors were in the red with consumer discretionary stocks falling the most.

There were counterpoints to the bleak share price moves for banks and retailers with excellent share price gains by QBE and Telix Pharmaceuticals.

Shares in insurer QBE (ASX: QBE) gained 3% to $20.68 after it announced a higher net profit and raised its dividend while Telix (ASX: TLX) shares jumped an impressive 13.8% to $30.12 on a beefed up revenue forecast of up to $1.23 billion in fiscal 2025.

Iron ore miners were also stronger on the back of higher iron ore prices, as the Singapore benchmark April futures contract held at US$108 a tonne.

BHP (ASX: BHP) shares were up 2.8% to $41.26, Fortescue (ASX: FMG) rose 2.3% to $18.65 and Rio Tinto (ASX: RIO) rose 2.8% to $123.49.

An “overweight” upgrade from broker Barrenjoey saw shares in Mineral Resources (ASX: MIN) jump 5% to $27.13, with the broker saying investors have punished the company too severely following its half-year result.

Takeover drives Domain

By far the most impressive share price move on the ASX though was a 40.1% price rise for Domain (ASX: DHG) to $4.37 after US real estate giant CoStar lobbed a bid to acquire the property platform.

The bid also pushed shares in Domain owner Nine Entertainment (ASX: NEC) up 20.1% to $1.73 while shares in Domain competitor REA (ASX: REA) fell 11.4% to $236.18.

Shares in Mexican food chain Guzman y Gomez (ASX: GYG) slumped 14.3% to $38.58 after half-year underlying earnings of $26.8 million fell short of market consensus.

The chain’s American outlets suffered a fall in sales, casting doubt over co-founder Steven Marks’ aim to crack the world’s biggest market.

Shares in broadband provider Spark New Zealand (ASX: SPK) fell 19.3% to $2.13 after the company lowered its 2025 earnings guidance, citing poor performance from the company’s enterprise and government division.

Yancoal (ASX: YAL) shares rallied 3% to $5.91 after the coal miner announced plans to deploy its $1.8 billion war chest from the coal boom to buy new assets potentially outside of Australia and even beyond the coal sector.

Small cap stock action

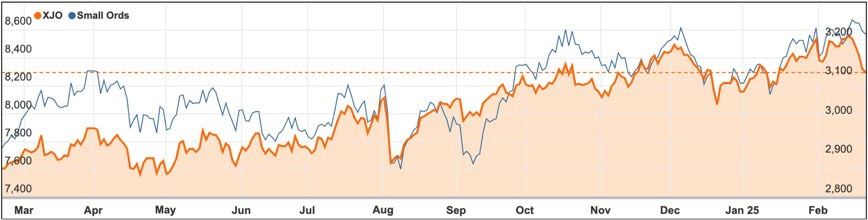

The Small Ords index slipped 0.53% this week to close at 3218.0 points.

The week ahead

The big news for the coming week in Australia will be the monthly consumer price index (CPI), which is expected by most observers to rise slightly in both the headline and trimmed mean measures of inflation.

With the Reserve Bank of Australia cautioning that it will not consider further interest rate cuts unless inflation keeps falling, the results should be a good guide to the potential or otherwise for further interest rate cuts.

The other big market moving events for the week will be the continuation of the Australian corporate reporting season with around 170 ASX listed companies due to report their earnings in the final week of February.

Similarly, the US market will see the end of their fourth quarter earnings season with stocks including chipmaker Nvidia, Salesforce and HP all interesting in terms of their AI spending and growth potential.

Wall Street will also be looking carefully at the US Federal Reserve’s preferred inflation measure the core personal consumption expenditures price index (PCE) which will be released on Friday.