The Australian share market copped another tough lesson about the absolute dominance of Wall Street on Friday.

All it took was a promised reduction from three to two in the number of future interest rate cuts in 2025 by the Federal Reserve – together with an actual interest rate cut – and Wall Street was off having a taper tantrum like it was 2013.

Wall Street then recovered a bit on Thursday, although that small detail seemed to have been totally overlooked by bearish local traders.

Being the ever-obedient cousin once removed, the Australian market took all of these details on board and did exactly what Wall Street did only with added sauce, falling 1.2% on Friday to 8067.7 points – its lowest level since September.

That took the loss for the week to almost 3%, with a broad selloff in banks and consumer discretionary stocks doing the most damage on Friday.

Even CBA catches cold

Even the surprising Aussie wonder stock of the past year – Commonwealth Bank (ASX: CBA) – seemed to temporarily lose its ability to defy gravity with its shares down a hefty 3.1% to $150.26.

That led the rest of the sector down with shares in ANZ (ASX: ANZ) and NAB (ASX: NAB) shedding more than 2% with Westpac (ASX: WBC) shares down a more modest 1.2%.

Not even gold was a safe space to hide in the Australian market with the falling gold price due to the rising US dollar hitting all of the gold miners and particularly shares in Bellevue Gold (ASX: BGL) which shed a hefty 5.6%.

Ironically, one of the few bits of good news was a 3.2% rise in the share price of HMC Capital (ASX: HMC) after the stock was hammered earlier in the week after the lacklustre float of DigiCo (ASX: DGT).

Still HMC shares remain at a two-month low and there is little cheer in its major shareholding in DigiCo, which fell a further 0.7% to $4.42, well shy of the $5 float subscription price.

Mesoblast cut down to size

Even the booming aura that has surrounded Mesoblast shares (ASX: MSB) after US regulators gave the green light to a first-of-its-kind cell therapy developed by the biotech dimmed a little, with the shares down 21.5% after soaring on Thursday.

Still, the stock is still much higher than it has been and it now has a string of potential therapies in the pipeline that now have a better chance of being approved for use.

In other individual stock moves, Integral Diagnostics (ASX: IDX) shares rose 1% after the company announced it had completed a merger with Capitol Health.

Wesfarmers (ASX: WES) shares fell 3.7% after the Bunnings owner announced it is selling its Coregas business for $770 million.

Shares in De Grey Mining (ASX: DEG) defied the falling gold price, rising 1.4% on news that the gold explorer’s Hemi Gold project could lead to underground production.

Woodside (ASX: WDS) shares were up 1.3% after the energy giant sold its interest in a $34 billion LNG venture to Chevron on Thursday.

ASX settlements stall

To top off a mainly forgettable day the ASX had to notify its regulators, the Reserve Bank and the Australian Securities and Investments Commission, about an issue that has caused a delay to settlement processes on Friday afternoon.

A failure in the ASX CHESS batch processing systems meant that payments for trades made on Wednesday, and the transfer of equity ownership title, were initially not going through on Friday as planned.

CHESS remained open beyond the standard end-of-day settlement time to give CHESS users a chance to complete settlement processes after the issue was hopefully resolved.

Time will tell how much of an issue the settlement difficulties turn out to be – particularly with the market closing early on Tuesday and no trade on Christmas Day and Boxing Day.

Obviously, there are all sorts of ramifications when settlements don’t go through as planned and the stakes are even higher with holidays looming.

Small cap stock action

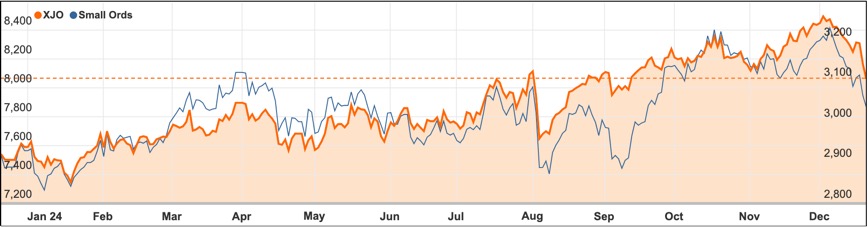

The Small Ords index fell 3.02% for the week to end at 3039.2 points.

The week ahead

With Christmas during the coming week and two full days of no trade and an early close on Tuesday, this is sure to be a week of very thin trade in Australia.

Still, there are some economic indicators to watch out for including Australian inflation and retail sales and also Chinese purchasing manager numbers and US jobs numbers.

Also out are the minutes of the last Reserve Bank board meeting which softened its hawkish stance and held out more hope of some interest rate cuts in 2025,

The minutes of the US Federal Reserve decision to cut rates but prepare for fewer rate cuts in 2025 will also be released.