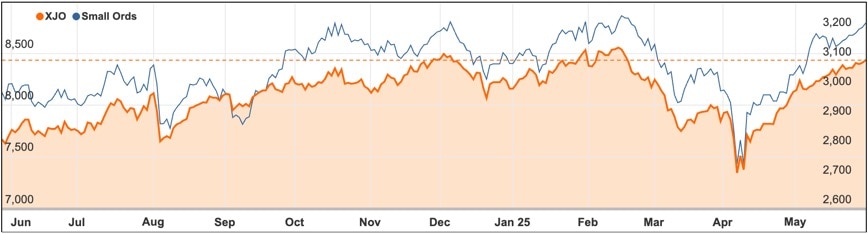

The Australian share market managed to shrug off tariff uncertainty, sky-high valuations and a sluggish mining sector to record an impressive 3.8% rally in May.

It ended the trading month in style too on Friday, with the ASX 200 up 0.3% or 24.9 points to 8434.7 points as investors gained heart from a US court decision to block a lot of President Donald Trump’s tariffs.

It didn’t seem to matter that an appeal has been lodged and in the interim tariff negotiations will continue, the mere fact that the TACO narrative (Trump always chickens out) was getting airplay and global trade tensions were receding seemed to be enough to keep the market momentum moving.

Banks stay strong

On Friday the market was up and down as the tariff news unfolded but, in the end, defensive consumer, utilities stocks and strong banks overcame weakness in energy stocks and big technology names.

As usual, the all-conquering sector leader Commonwealth Bank (ASX: CBA) added 0.9% to $175.95 and National Australia Bank (ASX: NAB) also gained 1.3% to $38.

It was a less positive story for the big technology names with WiseTech (ASX: WTC) shedding 1.5% to $107.15 and Megaport (ASX: MP1) shares down 3.1% to $13.52.

Tech withers

There was a sea of red for the energy stocks with Woodside Energy (ASX: WDS) and Santos (ASX: STO) both falling in line with the oil price, down 2.1% to $22.25 and 0.9% to $6.59 respectively.

A “bad news is good news” story emerged during the day when retail sales fell 0.1% in April – news which sent government bond yields lower and gave traders more confidence that the Reserve Bank will keep cutting interest rates.

Lithium stocks continued their prolonged fall on the back of more broker downgrades for the sector and stepped up tax loss selling with Pilbara Minerals (ASX: PLS) shares down 5.7% to $1.24 and IGO (ASX: IGO) shares down 5.4% to $3.88.

Shares in HealthCo Healthcare & Wellness REIT (ASX: HCW) jumped an impressive 7.8% to 89¢ after it struck an agreement with troubled tenant Healthscope to partially defer rental payments and said it was in talks with alternative hospital operators.

That news also helped to drive up shares in Healthscope competitor Ramsay Health Care (ASX: RHC) by 5.9% to $38.30.

And shares in payment provider Findi (ASX: FND) dropped 8.9% to $4.60 despite announcing a 54% rise in underlying profit to $6 million in the 2025 financial year.

The other thing of interest on the market was the speculation that Chemist Warehouse insiders had sold out around $2.8 billion of their unrestricted shares following the company’s merger with Sigma.

Small cap stock action

The Small Ords Index rallied 1.28% this week to close at 3229.0 points.

The week ahead

It is a busy week for economic announcements in Australia ranging from jobs to house prices but the big one will be the national accounts which are out on Wednesday.

The broad expectation is that the Australian economy will have accelerated a little to be running at around 1.5% annually, up from 1.3% in the December quarter.

Central banks will again be in the news with the European and Canadian banks both expected to shave their official interest rates by 25 basis points during the week.

The last interest rate cut by our own Reserve Bank will be explained with the release of the board minutes from the two-day board meeting and US Federal Reserve chair Jerome Powell also giving a speech during the week.

Then of course there are bound to be any number of tariff speculations with rumours that a couple of national deals may well be announced, which should set off all sorts of global reactions.