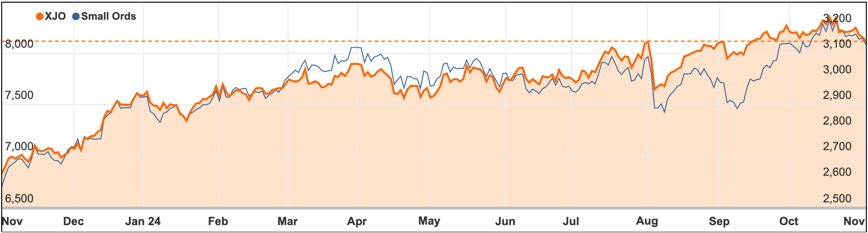

Markets saw a dip this week, with the ASX 200 declining 1.13% to close at 8118.8 points.

However, the index remains up 6.44% for the year.

The losses across investors’ screens were primarily driven by mixed tech earnings from the US.

Amazon reported growth in its cloud and advertising sectors, while Google-owned Alphabet posted solid revenue gains, yet Apple narrowly missed expectations.

Microsoft and Meta faced setbacks due to cautious outlooks, as companies in the tech sector plan to boost spending on AI infrastructure, raising investor concerns about short-term profitability due to higher costs.

AI chipmaker AMD also faced pressure despite strong sales in data centre and PC markets, as investors sought faster growth comparable to NVIDIA, the current leader in the chip sector.

Inflation cools

Inflation has dropped to its lowest point since the early pandemic, reaching the Reserve Bank’s target range for the first time since 2021, though an interest rate cut is still unlikely.

New data from the Australian Bureau of Statistics shows the annual consumer price index (CPI) fell to 2.8% in September, down from 3.8% in June, the lowest rate since March 2021.

Quarterly inflation came in at just 0.2%, a level last seen in June 2020, influenced at the time by COVID-related policies like free childcare.

Monthly CPI figures also indicate easing cost-of-living pressures, with inflation further slowing to 2.1% by September.

Small cap stock action

The Small Ords index fell 1.11% to 3136.7 points for the week.

Small cap companies making headlines this week were:

Green Critical Minerals (ASX: GCM)

Green Critical Minerals has acquired advanced very high-density (VHD) graphite technology, positioning it as a major player in high-performance graphite production.

The technology, developed by Professor Charles Sorrell, produces high-quality graphite at lower costs and in just 24–36 hours, promising significant thermal and electrical advantages for applications in thermal energy storage, semiconductors, and more.

The acquisition was structured with deferred payments tied to revenue milestones, ensuring financial stability during commercialisation.

Over the next year, GCM plans to bring this technology to market through a staged commercialisation strategy, anticipating growth in premium graphite markets and diverse high-performance sectors.

FireFly Metals (ASX: FFM)

FireFly Metals has upgraded its mineral resource estimate by 42% at the Green Bay copper-gold project in Canada, now totalling 59 million tonnes at 2% copper-equivalent.

This increase includes 1Mt of copper, 550,000 ounces of gold, and 5.4Moz of silver, achieved through a low-cost, rapid growth strategy since acquiring the project in 2023.

Approximately 40,000m of drilling over a 2-kilometre strike length has been completed, with mineralisation remaining open and potential for further extensions.

FireFly plans to continue expanding the resource with a 130,000m drilling campaign, targeting high-grade areas and resource updates in the coming year.

Li-S Energy (ASX: LIS)

Li-S Energy has advanced its lithium-sulfur battery technology, achieving an energy density of 498Wh/kg on first discharge and 456Wh/kg after formation cycling in full-size 10Ah cells produced at its Victoria facility.

This breakthrough represents a significant improvement for lithium-sulfur chemistry, aimed at markets where lightweight, high-density batteries are crucial, such as drones, defence and electric aviation.

The cells incorporate third-generation cell chemistry and have been delivered to key partners for validation in aerospace battery packs.

Wisr (ASX: WZR)

Wisr reported a 54% increase in loan originations to $77.3 million for Q1 FY2025, with secured vehicle loans up 67% and personal loans up 49%, highlighting a strong scaling opportunity.

Despite the rise in originations, Wisr’s total loan book decreased by 15% to $753 million, reflecting a moderated growth strategy, while quarterly revenue fell slightly to $22.5 million.

The company maintained a robust average credit score of 782 and achieved a net interest margin expansion to 5.64% through pricing and funding improvements.

The week ahead

The US election is set to dominate headlines over the next couple of days, as we find out who is set to lead the world’s largest economy.

Taking place on Tuesday 5 November, the markets will be eagerly awaiting the outcome of the election to see how the next four years might look for the country which dominates so much of world trade.

In Australia, Tuesday will see ‘the rate that stops the nation’, with the Reserve Bank of Australia set to make a decision on interest rates.

Australia’s cash rate is tipped to stay at the current 4.35% level.

On one hand, inflation is now easing from higher levels but the country in a per capita recession, with mass immigration the ‘solution’ of choice by the current Federal Government to keep things ticking along.

The US election is expected to dominate the news in the coming days as the world awaits the decision on who will lead the largest global economy.

Scheduled for Tuesday 5 November, markets are highly anticipating the election results, looking to gauge what the next four years might hold for a nation so influential in global trade.

Meanwhile in Australia, Tuesday will feature the much-anticipated interest rate announcement from the Reserve Bank of Australia, or ‘the rate that stops the nation.’

The cash rate is predicted to remain steady at 4.35%. Although inflation has started to ease from its peak, Australia faces a per capita recession, with the current Federal Government leaning on mass immigration to help drive economic momentum.