Despite an early dip the Australian share market jumped to a two-month high on Friday as hopes grew of a tariff deal between the US and China.

By the close of trade, the ASX 200 was up 92.5 points to 8238 points after a seven day stretch of gains.

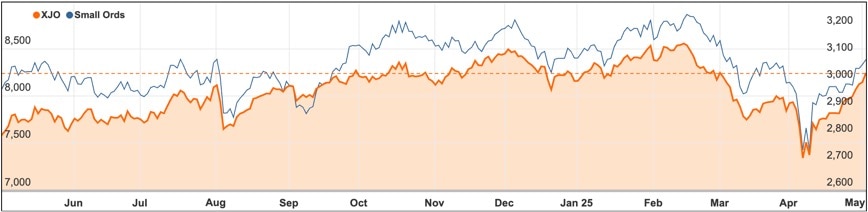

For the week the ASX 200 has added 3.4% and is now sitting on a 1.1% gain for the year – an outcome that seemed highly unlikely at the height of the market slide after US President Donald Trump imposed hefty tariffs on most of the world, including Australia.

Possible China talks fuel energy and iron ore shares

Energy stocks led the market higher but the rally was broad-based, with ten of the 11 market sectors higher.

The jump followed on from a strong performance by technology stocks in the US, which added 1.5% to the Nasdaq and 0.7% to the S&P 500, although Apple and Amazon warned of a hit to their earnings from tariffs which pushed their shares lower in extended trading.

Much of the optimism came as the Chinese commerce ministry said it was assessing the possibilities of negotiations after senior US officials repeatedly expressed a willingness to talk.

That fuelled a rise in energy stocks and oil prices, with Woodside (ASX: WDS) shares up 2% to $20.61 and Santos (ASX: STO) rising 2.7% to $6.08.

The possibility of a stronger China even boosted the shares of iron ore miners, with BHP (ASX: BHP) up 0.7% to $38.08, Rio Tinto (ASX: RIO) up 0.66% to $116.66 and Fortescue (ASX: FMG) up 1% to $16.35.

Banks flying higher before revealing earnings

It was a strong day for the big banks too in the week before three of them report earnings.

Market leader Commonwealth Bank (ASX: CBA) shares rose 1.4% to $169.66 after briefly hitting a fresh record high.

All three banks reporting next week were higher – Westpac (ASX: WBC) up 1.9% to $33.45, ANZ (ASX: ANZ) up 2% to $30.36 and National Australia Bank (ASX: NAB) up 1.4% to $36.49.

Healthcare was strong too with CSL (ASX: CSL) shares up 2.1% to $256.41 and Sigma Healthcare (ASX: SIG) shares up 3% to $3.10 on positive broker reports after the Chemist Warehouse merger.

Technology stocks followed Wall Street higher, with WiseTech (ASX: WTC) shares up 0.7% to $95 after the company confirmed reports that it is considering buying New York-listed supply chain platform provider e2open.

There were some companies that fell on poor news with shares in Corporate Travel Management (ASX: CTD) dropping 10% to $11.70 after the travel company forecast lower revenue and earnings growth due to tariff impacts on demand.

Afterpay owner Block (ASX: XYZ) continued to decline, down 26.7% to $67.50 after lowering its full-year profit guidance on Thursday.

Small cap stock action

The Small Ords Index rallied 2.98% for the week to reach 3085.4 points.

The week ahead

There is no question that this week is all about the big four banks and how they are travelling.

We start to find out on Monday with Westpac reporting its results, followed by National Australia Bank on Wednesday and ANZ Group on Thursday.

Analysts will be poring over these results for evidence of weakening profits on the back of more intense competition on mortgages and business lending as well.

The general macro environment also looks a bit more challenging for the banks with the Reserve Bank expected to continue cutting official interest rates this year, which would usually soften bank profits.

Fed expected to hold but BOE to cut

The other big news for the week is around central banks with the US Federal Open Market Committee meeting on Wednesday.

Despite or perhaps even because of the threatening words from US President Donald Trump against Fed chair Jerome Powell, the market expectation is that the Fed will hold interest rates steady before moving to begin cutting by July after checking on the uncertain wash up from the rash of tariffs announced.

With Trump now signalling that he reluctantly won’t be moving to sack Powell, the Fed is unlikely to be rushed into cutting rates, even though Trump’s impatience for lower rates is far from a secret.

No such reticence is expected when the Bank of England meets on Thursday, with most analysts tipping a 25-basis point cut to 4.25% as the bank takes out insurance against any economic weakness flowing from the US tariffs.