Bullish sentiment has tentatively reasserted its hold over world share markets, with the Australian market up for the second week in a row.

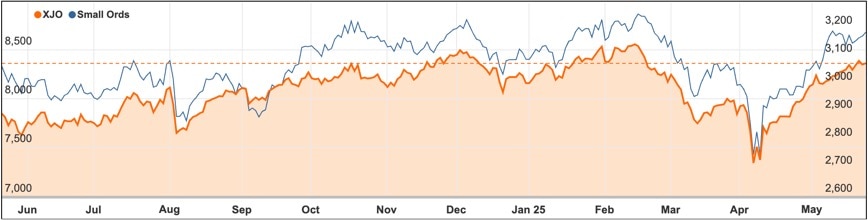

It was far from convincing with the ASX 200 up 0.2% or 12.2 points to 8360.9 points on Friday and was also up 0.2% for the week, but in the current circumstances any win is taken straight to the bank.

One of the major factors pushing markets higher was a long-awaited retreat in US Treasury bond yields as investors seemed a little less concerned about the massive pile of US government debt that continues to build.

Nerves had been frayed about the stability of US government debt following an unconvincing US$16 billion sale of 20-year bonds earlier in the week so the sizeable fall in 10-year US Treasury yields was just the news the market wanted to hear.

Lower Australian rates feeding into investor optimism

Here in Australia, new expectations of a more aggressive interest rate cut regime by the Reserve Bank also helped to boost investor sentiment.

Local investors are getting more bullish about the chances for lower interest rates in the immediate future with hopes that next week’s April consumer price index will show another decline in annual inflation to 2.3%.

Analysts and economists have been bringing forward their estimates for when interest rates will fall in Australia after RBA governor Michele Bullock was surprisingly optimistic about the outlook for lower inflation and lower interest rates.

Tech, banks and real estate stronger

This was great news for interest rate sensitive shares on the Australian market with technology, banks and real estate shares mainly stronger.

Among the banks. sector leader Commonwealth Bank (ASX: CBA) led the way with a 0.6% rise in its shares to $173.84.

Other bank shares were also stronger including NAB (ASX: NAB), up 0.9% to $37.70, Westpac (ASX: WBC) up 0.06% to $31.34 and ANZ (ASX: ANZ) up 0.8% to $29.07.

Among the property shares, Goodman Group (ASX: GMG) was up 2.2% to $32.68 while Dexus shares (ASX: DXS) were up 0.4% to $7.03.

Tech shares were one of the features with WiseTech (ASX: WTC) shares once again cracking the ton, up 1.3% to $100.05.

Technology One (ASX: TNE) shares also gained 1.6% to $38.61.

It was a mixed bag for miners with a fall below US$99 a tonne for iron ore sending shares in BHP (ASX: BHP), Rio Tinto (ASX: RIO) and Fortescue (ASX: FMG) down 0.7%, 1.6% and 2.4% respectively.

Uranium stocks flying on possible Trump order

In stark contrast. there was nothing but hope for Australia’s uranium miners following reports that U.S. President Donald Trump is preparing an executive order to kickstart the nuclear energy industry.

Paladin Energy (ASX: PDN) shares jumped 6.7% higher to $5.77, Deep Yellow (ASX: DYL) shares added 8.3% and shares in Boss Energy (ASX: BOE) beat them all with a 12.1% jump to $3.98.

Negative reports lead to price falls

Some poor broking reports about Nufarm (ASX: NUF) following its recent trading update saw its shares retreat 6.1% to $2.47.

Also disappointing investors were Origin Energy (ASX: ORG) shares which fell 1.1% to $11.05 after it foreshadowed a $55 million slide in earnings by its partly-owned Australia Pacific LNG.

Shares in global insurer QBE (ASX: QBE) were up 0.26% to $23.17 after S&P Global Ratings upgraded its long-term issuer credit rating for the company to A due to the “long-term resilience” of its earnings.

Small cap stock action

The Small Ords Index inched 0.31% higher to 3188.2 points for the week.

The week ahead

The biggest statistical release this week for Australia will be the monthly consumer price index on Wednesday.

Analysts are expecting a fall in the headline annual CPI rate of 0.1% to 2.3%.

The inflation result will be absolutely pivotal in setting expectations for official interest rates, with any disappointment sure to be bad news for share prices.

With US markets closed on Monday for Memorial Day, the focus there will move to economic growth figures which are out on Thursday, with a fall in activity expected.

The Reserve Bank of New Zealand is also widely expected to cut their official interest rates by 25 basis points to 3.25% when it meets on Wednesday.