Weekly review: Will Santa help out investors?

WEEKLY MARKET REPORT

Will Santa Claus come to the rescue of struggling share markets before Christmas?

It would certainly be a welcome visit after a bruising last half of the year in which the Australian market entered a correction.

The Santa Claus rally – or Santa bump – is quite a common event that sometimes leaves investors with a sack full of goodies but is also occasionally capable of delivering a lump of coal.

The classic theory behind the Santa bump is that people feel psychologically happy as the year draws to a close and these feelings overflow onto the share market.

Other theories include short sellers going on holiday, a rush of cash as Wall Street brokers invest their bonuses before the holidays and also an anticipation of the January effect which often causes a global stock rally after US tax loss selling is out of the way.

No sign of Santa bump yet

However, there was little sign of a Santa bump yesterday as the ASX 200 ended a three day rally with a disappointing 59 point slump to close the week at 5602 points – down 1.1%.

The combination of bad days on Friday and Monday was enough to force the index down 1.4% for the week, despite better conditions midweek.

The selling was fairly broad based with losses across financials, telco, energy and consumer stocks.

Pharmacy action for API – Sigma

One positive was shares in Australian Pharmaceutical Industries (ASX: API) which jumped 8.5% to $1.595 after it made a $726.5 million bid for Sigma Healthcare (ASX: SIG).

Sigma runs several retail chemist chains including Amcal, Guardian and Pharmasave and the proposed merger involves API offering 0.31 API shares and 23c in cash for each SIG share, valuing the business at $726 million.

Sigma shares soared 43.2% or 17.5c to $0.58.

That was a rare market positive with shares in Nine Entertainment (ASX: NEC) slumping 8.9% to $1.485 after major investor Deutsche Bank sold down half of its stake in the media group, which has just merged with Fairfax.

CSR shares (ASX: CSR) fell 4.3% to $2.69 after announcing the departure of its chief executive Rob Sindel amid difficult trading conditions and shares in Villa World (ASX: VLW) plunged 10% to $1.665 after the residential property developer admitted it won’t meet its 2018/19 net profit guidance of $40 million.

China slows down

Weak numbers out of China saw markets sell off late in the week, with the Nasdaq and Dow both losing more than 2%.

Chinese retail sales grew 8.1% in November, well short of the expected 8.8%. Meanwhile manufacturing took a hit with industrial production coming in at a mere 5.4% from an expected 5.9%.

With losses posted late on the boards in overseas markets we could see the ASX open under pressure on Monday.

Looking more longer term and signs of a global economic slowdown are starting appear, how the next two weeks play out could provide a forecast of what’s to come in 2019.

Santa rally may set the tone

Another reason to watch for the Santa rally is that its existence often signals a good or bad year to come.

On the US market, which sets the tone for world markets, years in which there was no Santa rally over the last five trading days of the year and the first two trading days after New Year have not gone well.

For example, the four per cent decline during the Santa Claus rally period of 1999 ushered in a 33% retreat in the ensuing bear market and the decline at the end of 2007 also ushered in a nasty bear market.

Small cap stock action

The small cap index finished the week up almost a full per cent to close at 2,510.4 points.

Offering investors some respite following weeks of selling off.

ASX 200 vs Small Cap index.

A handful of small cap companies made headlines this week, including:

Impression Healthcare (ASX: IHL)

It’s been a busy month for Impression Healthcare, with new developments helping affirm its position in the oral dental products space, as well as its latest role in the growing medical cannabis market.

On Wednesday, the company formally lodged an application to possess, supply, import and exports cannabinoids in Australia.

At the same time, it unveiled a sales and distribution agreement with Hong Kong-based Pace Sports which will see Impression proprietary oral products such as mouthguards and teeth whiteners throughout the region’s pharmacy retail sector, as Impression looks to enter the China market.

Impression has also executed a licensing agreement with UK-based Resolution Chemicals to support the production, registration and commercialisation of generic drug Dronabinol in the US, Canada and Australasia.

The agreement will signal Impression’s debut on the US medical cannabis market.

Ramelius Resources (ASX: RMS)

Gold miner Ramelius Resources this week reported a bonanza gold interval grading 1,271 grams per tonne at its Mount Magnet gold project in Western Australia.

The 7m intersection was pulled from the project’s Stella open pit during exploratory drilling to test for a potential high-grade ore shoot.

Just days after the news, Ramelius upped the ante in its off-market takeover bid for advanced gold explorer Explaurum (ASX: EXU), in an effort to gain control of Explaurum’s promising Tampia Hill gold project in WA, which has a 700,000 ounce resource.

The two companies are at loggerheads over development options for Tampia Hill.

Explaurum (ASX: EXU)

Explaurum has continued to fend off Ramelius Resources (ASX: RMS) after Ramelius launched another bid for the company in an attempt to get its hands on Explaurum’s Tampia Hill gold project.

Ramelius’ new takeover offer values Explaurum at $0.134 per share.

In response, Explaurum issued a “take no action” to its shareholders until it provides a formal recommendation.

However, the board did say it was considering the proposal.

On Friday, Explaurum released a feasibility update for Tampia which indicates an initial $111 million capital development cost to produce a 103,157oz gold per annum to generate free cash flow of $226 million.

Anteo Diagnostics (ASX: ADO)

Australian nanotechnology company Anteo Diagnostics has signed an agreement with a Chinese pharmaceutical products distribution firm to market, sell and distribute its range of AnteoBind products within China’s in-vitro diagnostics market.

Shanghai GeneoDx Biotechnology will conduct a promotional campaign targeting prospective major Chinese customers with the purpose of gathering market-based feedback to refine the value proposition of Anteo’s products.

China’s in-vitro diagnostics market is forecast to double in size from $4.4 billion in 2017 to nearly $8.3 billion by 2022.

Pure Minerals (ASX: PM1)

In its ongoing bid to become a cobalt and nickel producer, Pure Minerals, this week, completed due diligence on the New Caledonian ore supply its future subsidiary Queensland Pacific Metals has locked-in.

QPM is a private entity which has five-year ore supply agreements with two New Caledonian-based cobalt and nickel producers.

Xenith Consulting completed the due diligence report, which confirmed the New Caledonian producers use “industry standard mine planning and geology processes”.

Pure Minerals hopes to finalise its acquisition plans in early 2019.

Dubber Corporation (ASX: DUB)

Dubber posted record monthly revenue for November after it broke the $500,000 barrier for the first time in its seven-year history.

The company attributed its November revenue of $517,000 to ongoing developments with Cisco’s BroadCloud platform as well as relationships with IBM and other telco service providers.

Dubber had secured 30,000 users by the end of the 2018 financial year, which represented annual growth of 241%.

A recent $5 million capital raising has positioned the company to fully-fund any business arising from existing and new agreements.

Birimian (ASX: BGS)

Advanced lithium explorer Birimian has collared an offtake agreement for 55% of its planned lithium production from its Goulamina project in Mali’s south.

The memorandum of understanding was signed with General Lithium Corporation, paving the way for General Lithium to purchase 200,000tpa of 6% spodumene concentrate from Birimian at global market prices.

Birimian has also secured a strategic partnership with China’s Changsha Research Institute of Mining and Metallurgy to look at progressing Goulamina including project financing, off-take and engineering, procurement and construction matters.

Changsha will provide Birimian with its expertise with the parties’ goal to advance Goulamina in a “mutually beneficial” manner.

Northern Cobalt (ASX: N27)

Northern Cobalt impressed investors on Friday with news it had uncovered a 55m copper and cobalt intersection that ended in mineralisation at the Running Creek prospect.

The 55m intersection graded 0.78% copper and was from surface. It comprised 33m at 1.08% copper from 11m, and 13m at 2.01% copper from 11m.

A 12m cobalt interval was also present that graded 380ppm from 22m. Meanwhile, at another site, drilling returned 5m at 1,604ppm cobalt from 20m.

According to Northern Cobalt, the 55m intersection was drilled above a chargeable anomaly that was identified through an induced polarisation survey. The company plans to test the anomaly as soon as possible.

Transaction Solutions International (ASX: TSN)

Transaction Solutions International announced it plans to acquire cloud and cloud security services provider Cloudten Industries Pty Ltd for $8.6 million in cash.

Cloudten designs, optimises and troubleshoots cloud infrastructure as well as migrating cloud infrastructure to Amazon Web Services. The company also designs, deploys and manages cloud security architecture.

The company generated $3.8 million in revenue during the 2018 financial year and this revenue is expected to grow.

To Fund the first $3 million payment of the acquisition, Transaction Solutions is undertaking a $2 million capital raising. The remaining portion of the $3 million payment will be funded from existing cash reserves.

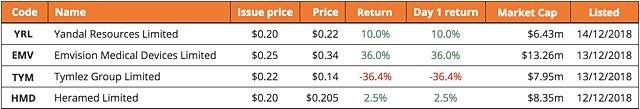

IPOs this week

Small Caps readers who want to view upcoming IPOs or see the stocks that have listed in 2018 and how they are performing can now do so.

The latest companies to make their way onto the ASX this week were:

EMvision Medical Devices (ASX: EMV)

Stroke and brain injury victims may be able to get appropriate treatment sooner if this week’s ASX debutant EMvision Medical Devices gets its way.

The Brisbane-based company raised $6 million in an oversubscribed IPO, with each share valued at $0.25.

EMvision will use the IPO funds to advance its innovative portable medical imaging technology, which is a non-evasive and cost-effective way of scanning a patient’s brain to rapidly diagnose stroke and brain injuries.

“The brain ages about 3.6 years every hour that appropriate stroke treatment is delayed, so reducing the time of diagnosis and treatment makes our brain scanner a very attractive proposition for the healthcare industry,” EMvision chief executive officer Dr Ron Weinberger said.

By the end of its first trading week, EMvision’s share price had risen 36% from its IPO offer price to close at $0.34.

Tymlez Group (ASX: TYM)

Tymlez Group started ASX life on Thursday after attempting to raise $8 million by issuing more than 36 million shares at $0.22 each.

However, on admission, Tymlez had raised $5.32 million.

The company is targeting the addressable blockchain market, which is anticipated to be worth US$176 billion by 2025 and $3.1 trillion by 2030.

Offer proceeds will be used to drive sales and licences for Tymlez’s blockchain enterprise platform, which is designed for business.

Tymlez opened on the ASX at $0.16 before slipping further to finish Friday at $0.14.

HeraMED (ASX: HMD)

Med-tech ASX newcomer HeraMED raised $6 million in an oversubscribed IPO to fund the commercialisation of its HeraBEAT product in Israel, the UK and Germany.

HeraMED has lodged patents for HeraBEAT, which is TGA approved, and enables pregnant women and their partners to listen to and monitor the foetal heartbeat at home.

World-renowned Mayo Clinic is a shareholder in HeraMED, with both organisations working closely to advance the technology.

HeraMED issued 30 million shares at $0.20 each and began trading on Wednesday at $0.20.

By the end of the week, HeraMED’s share price was marginally up at $0.205.

Yandal Resources (ASX: YRL)

Yandal Resources listed on the ASX on Friday, after raising $5 million via the issue of 25 million shares at $0.20 each.

Proceeds from the IPO will finance exploration activities across the company’s wholly-owned four gold projects in WA: Ironstone Well, Barwidgee, Mt McClure and Gordons.

Several of the projects have historic gold workings.

Yandal expects the IPO proceeds will fund two years’ worth of exploration and evaluation across the four projects as well as provide general working capital and administration costs.

The company opened at premium of $0.21 during its first day of trade before closing at $0.22.

The week ahead

We are looking forward to a fairly busy week on the data front before the Christmas/New Year statistical lull.

Of most interest will be the Federal Government’s Mid-Year Review released on Monday, which will show how close the Government is getting to running a budget surplus.

On the same day there will also be data on overseas arrivals and departures while on Tuesday the Reserve Bank will release the minutes of its last board meeting.

Also on Tuesday ANZ and Roy Morgan will release the weekly consumer confidence data and on Thursday annual population growth and labour market numbers will show how well we are absorbing new arrivals into the workforce.

On Friday there will be more detailed jobs data which show the figures on employment by industry ad will give a detailed look at which sectors are thriving or contracting.

It is a busy time in the US with the Federal Reserve Open Market Committee meeting on Tuesday and Wednesday to make an interest rate decision which will be announced on Thursday morning our time.

A rate hike is likely but not locked in so there is scope for a positive market surprise if rates are held steady.

A swag of other US data is released during the week including existing home sales, unemployment, economic growth (GDP), personal income & spending, durable goods orders, manufacturing, house prices and consumer sentiment.