Weekly review: tax cuts may not be enough to keep Aussies spending

WEEKLY MARKET REPORT

Much of the immediate tax cuts promised by the Morrison government have now been delivered but they appear to be having a fairly muted effect on consumer spending.

Hailed by the Government as the main fiscal stimulus required at a time when consumer spending was tanking and interest rates were falling fast, retail spending figures out on Friday instead highlighted a reasonably modest 0.4% rise in retail spending during August, below the expected 0.5% rise.

Some areas were stronger than others with higher purchases of clothing, household goods and in department stores but this was offset by falls in spending in cafes and restaurants and on takeaway food.

It is possible that better sales in department stores and spending on clothing and footwear indicates a preference for this sort of spending over food outlets but it could also represent some statistical noise.

Victoria doing better than NSW

There were significant regional differences too with the shops in NSW doing poorly with turnover up just 0.3% in the past year while in Victoria turnover was up by 3% over the same period.

However, with the Australian Tax Office having already delivered tax refunds worth $14.5 billion to 5.4 million workers before August, it appears the stimulatory effect of those fatter than usual tax refunds has been lower than hoped for, with more money being parked in savings or used to reduce debt.

The mixed retail results saw some economists tip another interest rate cut on Melbourne Cup day with money markets now forecasting a 50:50 chance of another interest rate cut to a new record low of 0.5 per cent by November.

The market has the cut fully priced in by February, which would signal that the Reserve Bank would then be forced to begin seriously looking at unconventional monetary policy measures such as quantitative easing to pump money into the economy.

Bleak news once again helps the share market

Ironically, the bleak local and offshore economic news finally acted as a catalyst for a share market rise on Friday, with speculation over further rate cuts from the US Federal Reserve and locally helping stocks to rise strongly to end the week after enduring steep falls in the previous two days.

Nevertheless, even with a stronger finish the local market still posted its largest weekly decline since November last year, down 3% for the week.

The benchmark S&P 200 rose 0.4%, or 24.1 points, on Friday to close at 6517.1 points as bargain hunters started to picks the eyes out of what was left after the steep falls on Wednesday and Thursday.

The defensive healthcare sector was the biggest improver, with a 2.3% rise coming mainly due to a Morgan Stanley upgrade for sector heavyweight CSL Limited (ASX: CSL) which helped the stock climb 3.2% to $236.34.

The international biotherapeutics and plasma therapy company is now our second biggest listed company, coming behind the Commonwealth Bank (ASX: CBA).

Defensives becoming more expensive

Another defensive sector, Information technology, caught on to the improved performance of US tech stocks and rose by a healthy 1.1%.

As you might expect after the release of the not terribly encouraging retail sales data from August, the Australian consumer staples and consumer discretionary sectors only managed to record modest gains of 0.1 and 0.2% respectively.

Financial stocks continued their disappointing performance, slipping a further 0.1% as falling bond yields once again emphasised genuine concerns about the negative outlook for the Australian and global economy.

Financial stocks were hit hard in the past week, falling 5%, with shares in the big four banks all getting hit hard, undermined by bleak US economic news and a continued slide in bond yields.

Those falling bond yields reflect increased concern about the outlook for the Australian and global economy.

Despite the bounce on Friday, it was not enough to recover the ground lost in previous sessions, seeing the benchmark index chalk up its second consecutive weekly decline. At 3 per cent, the weekly decline was the largest seen since November 2018, driven by a near 5 per cent slump in financial stocks.

Small cap stock action

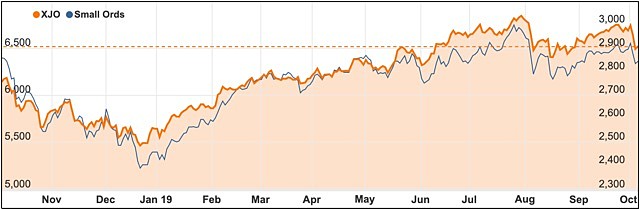

The Small Ords index fell 1.71% this week to close on 2842.4 points.

ASX 200 vs Small Ords

Small cap companies making headlines this week were:

Actinogen Medical (ASX: ACW)

Actinogen revealed this week a clinical trial using its Xanamem drug on elderly subjects had resulted in cognitive improvement.

Participants were given 20mg of Xanamem daily for 12 weeks and this was compared to a placebo.

The results showed that Xanamem at this dose reduced serum cortisol levels in participants over the trial period with no reported adverse events.

In addition to lowering cortisol levels, the Xanamem positively influenced cognition leading to improvements in working memory, visual attention and psychomotor function.

More than 50% of people over the age of 65 have elevated cortisol levels which puts them at greater risk of developing Alzheimer’s disease as well as other cognitive impairments.

Immuron (ASX: IMC)

The US Department of Defense has put its faith in Immuron and its oral immunotherapeutics further after agreeing to provide US$3.7 million (A$5.5 million) in funding for the combined development of a Campylobacter and enterotoxigenic E. coli (ETEC)-specific anti-microbial preventative for clinical evaluation.

Under the agreement, Immuron and the Department of Defense’s Naval Medical Research Centre will collaborate on the manufacture and evaluation of the new product which is designed to protect against this strain of traveller’s diarrhea.

The efficacy of the product will be tested via two controlled human infection-model clinical trials.

Infectious diarrhea is most common illness travellers experience when visiting developing countries.

4DS Memory (ASX: 4DS)

After receiving and reviewing 46x 300mm wafers in Lot 4, 4DS Memory has enhanced its understanding of the process conditions required to produce its memory on imec’s state-of-the-art production equipment, which is the same used as other memory manufacturers.

The company has also affirmed the impact of changes in process conditions on cell structure and desired memory characteristics for stand-along Storage Class Memory.

Additionally, the review provided further evidence of the repeatability in developing 4DS’ memory equipment on state-of-the-art production equipment.

As a result of the review, imec and 4DS have agreed to continue to the next development stage which will involve integrating 4DS’ memory technology with imec’s megabit platform.

Galan Lithium (ASX: GLN)

Lithium brine explorer Galan Lithium unveiled its maiden indicated resource for the North Zone of its Candelas project in Argentina.

Galan managing director Juan Pablo del la Vega said the resource of 684,850t of contained lithium carbonate equivalent had “exceeded” his expectations.

“This indicated resource forms a solid basis for the upcoming pre-feasibility study and has exceeded the company’s expectations, further validating the high-grade, low impurity nature of the Candelas project and our strategy to fast-track Candelas towards commercial development,” Mr Vargas de la Vega added.

Galan will now target the Central Zone in its upcoming drilling program, with initial pre-feasibility work about to begin.

Andromeda Metals (ASX: ADN)

Halloysite-kaolin explorer Andromeda Metals’ scoping study on its Poochera project in South Australia has confirmed the asset’s 15-year potential.

The study anticipates over the 15-year initial life, the mine will generate $1.953 billion based on an assumed selling price of $700/t.

Andromeda expects to develop a 500,000tpa operation to produce an average 187,000tpa of premium refined kaolin.

Meanwhile, capital costs are estimated at $62 million which includes initial start-up expenses and a $28 million expenditure on construction of a dry processing plant.

Change Financial (ASX: CCA)

Change Financial completed its namesake payments and card issuing platform this week, which the company claims is the only payment and card issuing platform to be completed in the last five years.

The platform contains numerous features including the ability to manage payment programs in real-time and enabling users to configure individual account settings like transaction limits and fees.

Other features include data insights, API connectivity, payments and authorisation controls and allowing providers to offer mobile banking applications under their own brand.

The payment processing capability is built on Mastercard’s new network gateway.

Paradigm Biopharmaceuticals (ASX: PAR)

Paradigm Biopharmaceuticals has found yet another benefit for its pentosan polysulfate sodium drug Zilosul, with research indicating the drug can reduce the production of pain mediator nerve growth factor in bone cells.

As a result, inhibiting nerve growth factor production in patients suffering from knee osteoarthritis leads to a reduction in pain.

The research was carried out between Paradigm and the University of Adelaide’s Centre for Orthopaedic and Trauma Research, with Paradigm noting the pain reduction results by inhibiting nerve growth factor secretion had “far-reaching” implications.

Paradigm chief executive officer Paul Rennie said the company would continue on its pathway to commercialising Zilosul, claiming the latest “ground-braking discovery” in pain reduction would “further attract commercial interest” in the drug’s development.

ResApp Health (ASX: RAP)

ResApp Health collared Therapeutic Goods Administration certification this week for its smartphone-based diagnostic test for acute paediatric respiratory diseases.

The company followed up the TGA certification with news it had been selected to join the Startup Creasphere Digital Health program in Munich which is due to begin later this month.

As its name suggests, Startup Creasphere is a 12 week accelerator program that supports start-ups.

By participating, ResApp will work with experts and mentors from the Sanofi to explore opportunities in co-creating consumer health-focused respiratory disease products.

ResApp also announced this week positive top-line results from its blinded at-home obstructive sleep apnoea study that included 308 patients.

ResApp’s algorithms correctly identified patients with obstructive sleep apnoea across the three apnoea hypopnoea index thresholds, with a sensitivity of 85%, 83% and 83%, respectively.

BetMakers Technology Group (ASX: BET)

International betting giant GVC Holdings has backed BetMakers after engaging the ASX-listed company to form a global racing partnership.

The partnership will see BetMakers’ fixed odds and price manager systems, global tote co-mingling engine, live streaming racing channel and custom-built trading platforms rolled-out through Australia and international markets.

Under the deal, BetMakers will continue servicing GVC’s Australian brands and extend its product offering, while rolling-out its products into the UK and other international markets.

“BetMakers is excited to have such a world-leading partner to roll-out our products into global markets as we continue our mission to be the best technology company for both global wagering operators and racing bodies to partner with,” BetMakers chief executive officer Todd Buckingham said.

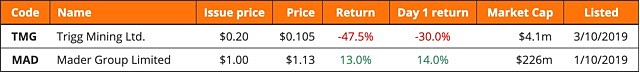

ASX floats this week

Small Caps readers who want to view upcoming IPOs or see the performance of stocks that have listed in 2019 can now do so.

The latest companies to make their way onto the ASX this week were:

Mader Group (ASX: MAD)

Skilled employment provider Mader Group started trading on the ASX this week after raising $49.8 million in its IPO via the issue of 48.36 million shares at $1 each and a further 1.6 million shares at $0.90 (for employees only).

According to Mader, it is the largest independent maintenance labour service provider for heavy mobile equipment in Australia.

The company achieved $220 million in revenue during FY2019.

Mader’s strategy behind the offer was to broaden its shareholder base and provide a liquid market for its shares.

By the end of its first week on the ASX, Mader closed at $1.13 – up 13% on its offer price.

Trigg Mining (ASX: TMG)

Sulphate of Potash (SOP) explorer Trigg Mining’s shares began trading on the ASX on Wednesday, with the company’s post-listing strategy involving advancing its SOP projects Laverton Links and Throssell Lake near Laverton in WA.

The company joined ASX ranks after raising $4.5 million in its IPO via the issue of 22.5 million shares at $0.20 each.

By developing its SOP projects, Trigg hopes to reduce Australia’s reliance on imported potassium fertilisers, by offering a naturally sourced domestic supply.

During its first week of trade, Trigg’s share price slid to close at $0.105 on Friday.

The week ahead

In the coming week, the big data points to watch for will be consumer and business confidence surveys, which may add some flavour to the disappointing retail sales figures.

There are also so construction, building and home lending figures out, which will shine a spotlight on how the housing sector is responding to a rapid-fire series of interest rate cuts.

It is a similar picture in the US with some consumer figures set to be closely watched but the two big things to watch out for – as usual – revolve around central banks and trade.

US Federal Reserve chairman Jerome Powell is making a speech on Tuesday and the US Federal Reserve minutes from the last meeting which cut US official rates will also be released on Wednesday, US time.

Also, sure to make the news is the scheduled resumption of trade talks between the US and China.

Predicting an outcome from these talks is a foolish game but at the very least the noises coming out of the US side seem to be a bit more positive.

China’s famous patience is once again being sorely tested and they must really struggle to interpret what is going on by following US President Donald Trump’s fairly erratic and hyperbole ridden Twitter feed.

Also note, daylight savings kicks in on Sunday so clocks will need to be wound forward an hour.