Weekly review: share market rises to 11-year high despite election headwinds

WEEKLY MARKET REPORT

The Australian share market ended the week with a strong day, with the ASX 200 rising by 37.5 points or 0.6% to 6,365 points – reaching an 11-year high after a solid week that added 1.08%.

The market was buoyed by a number of factors – the potential of an RBA interest rate cut in June, stronger commodity prices, particularly iron ore, and a rising oil price.

Middle East tensions have been on the rise after Saudi Arabia accused Iran of an attack on a pumping station this week which briefly stopped the nation’s main oil pipeline.

All of this sent the prices of all of the big miners and oil companies higher, which was a significant positive for the market, along with an apparent easing of trade tensions between the US and China.

Underneath this overall strongly positive flavour, there were some interesting stock and sector negatives working their way through the system.

Banking sector continues to weaken as New Zealand bites ANZ

One was a continued weakness in the banking sector, particularly after the Reserve Bank of New Zealand (RBNZ) came down particularly hard on ANZ (ASX: ANZ) for not complying correctly with reserve capital requirements.

Under the New Zealand – and Australian – system, the big banks are able to use internal models and controls to ensure that they comply with the amount of capital reserve required.

It turns out that ANZ had not been doing this correctly so the RBNZ will now insist that it takes a standardised approach, which will increase its capital requirements by about 60% to NZ$760 million.

While ANZ New Zealand said it was “disappointed’’ that the error had occurred, the share market had an even stronger reaction, hammering ANZ shares down by 3.04% or 81c a share to $25.85.

The share market also took into account that the RBNZ might increase capital requirements for all other banks, which would be bad news for the four big Australian banks which all own New Zealand banks.

All the major banks fell, with Commonwealth Bank (ASX: CBA), National Australia Bank (ASX: NAB) and Westpac (ASX: WBC) all down by as much as 1.5%.

Analysts have warned that the higher capital requirements could have a material impact on the Australian banks.

The banking sector was also weaker due to three of the big banks going ex-dividend during the week.

Bad news for aviation

The other sector specific news came in the form of a profit warning from Virgin Australia (ASX: VAH).

Shares in Australia’s smaller airline slumped hard, falling 5.4% to 17.5c after the profit warning, which said Virgin expects underlying earnings for FY19 to will be at least $100 million lower than FY18’s restated $64.4 million.

The reasons for the lower earnings were due to an uncertain domestic market and fuel and foreign exchange headwinds of at least $160 million.

The bad news seemed to be contagious, with investors assuming the same headwinds would apply to Qantas (ASX: QAN), marking down its shares by 12c or 2.24% to $5.23.

Founders collect cash

Bubs Australia (ASX: BUB) founder and chief executive officer Kristy Carr took advantage of the company’s strong performance this year and sold $5,920,000 worth of shares on the market to purchase a new home.

The company has recently made inroads into China and expanded its organic range for infants and toddlers.

Not to be upstaged, Fortescue Metals Group (ASX: FMG) founder and chairman Andrew “Twiggy” Forrest picked up a lazy $654 million in dividends, after the company announced it would return a 60c out of cycle dividend.

This adds to Twiggy’s $327 million he received in March from the combined 30c per share interim and special dividend.

Small cap stock action

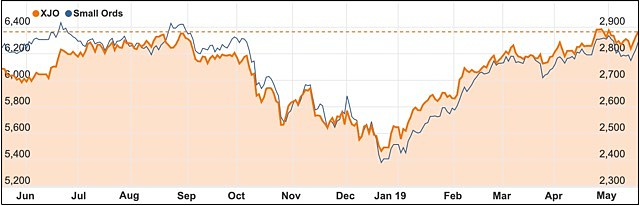

The Small Ords index rallied this week to close up 1.7% to 2,843.2 points.

ASX 200 vs Small Ords

Among the companies making headlines this week were:

Neuren Pharmaceuticals (ASX: NEU)

Neuren Pharmaceuticals is powering ahead with its NNZ-2591 drug candidate, with latest pre-clinical results revealing the drug has a positive impact on Pitt Hopkins and Angelman syndromes.

From both pre-clinical tests, which involved treating defective mice for six weeks, Neuren noted that all positive confirmatory measures involving the drug were “statistically significant”.

As a result of these tests, Neuren plans to apply for orphan drug designation as well as filing an investigational new drug application with the US FDA.

Neuren is targeting phase two clinical studies using NNZ-2591 for the second half of next year.

Redflow (ASX: RFX)

Redflow is expanding into China under a collaboration with ZbestPower Co Ltd, with Redflow charged with deploying a large 100kWh zinc-bromine flow battery storage solution for Haidong Transportation Group’s smart grid project in Qinghai Province.

Under the agreement, Redflow will initially provide 10 ZBM2 zinc-bromine flow batteries for six months.

Redflow expects to deploy the batteries next month and will assist with site preparation, testing, installation, commissioning, operation, ongoing monitoring, reporting and technical support.

With flow battery storage solutions identified as an important part of China’s renewable energy future, Redflow anticipates the deployment will act as a springboard to develop other projects in the country.

Crowd Media (ASX: CM8)

Cash strapped Crowd Media will provide its digital marketing and digital influencer services to four new renowned international brands PJ Masks, Expedia, N26 and Pasta Garofalo.

The new brand sign ups come after Crowd Media reported poor financial performance in 2018, which led to an operational transition to focus the business on its social media and influence market division.

A cost-cutting review is also underway, with $1.5 million in savings identified and to be implemented before the end of the current financial year.

Additionally, in further attempts to turn the business around, debt refinancing was completed in the March quarter with BillFront, giving Crowd Media an 11.3% interest rate for its €1.3 million (A$2.1 million) debt.

Chase Mining Corporation (ASX: CML)

Formerly known as TopTung, Chase Mining has made a potential nickel discovery at its Zeus project in Canada after a VTEM survey noted six strong massive conductors.

The airborne geophysical survey was flown over the Lorraine and Alotta-Delphi-Zullo targets and identified multiple anomalies.

Chase plans to conduct further modelling of the anomalies to determine if there are untested extensions to known mineralisation.

Lorraine hosts a historic nickel-copper mine where 600,000t of ore was processed between 1964 and 1968.

Zoono Group (ASX: ZNO)

Zoono Group will supply its Zoono Z71 Microbe Shield surface sanitiser product to MicroSonic LLC for distribution into automotive and cruise industries.

The duo inked a 10-year distribution deal where MicroSonic will supply Zoono antimicrobial products to Turtle Wax Inc for cash wash and automotive applications.

MicroSonic also has rights to supply the microbial products to the cruise sector which has known issues with bacterial and viral outbreaks.

Over the first four years, MicroSonic will purchase a minimum of US$12 million (A$17.17 million) worth of product from Zoono.

Zoono has also secured an agreement to supply its proprietary poultry formulation which contains Z71 Microbe Shield to The Z Factor Ltd, which is based in New Zealand.

Yojee (ASX: YOJ)

Yojee expanded its Asia Pacific footprint this week after signing a three-year master services agreement with Geodis Singapore Pte Ltd.

Under the agreement, Yojee will provide its software-as-a-service logistics and supply chain management technology on standard commercial terms.

The terms are on a project-by-project basis and include set up, subscription, professional service and transaction fees.

Geodis is a top 10 global forwarder specialising in sear, air, and road freight with more than 1,000 Asia Pacific partners. The contract between Yojee and Geodis will commence immediately.

Also, this week, Yojee appointed David Morton to its advisory board, with the board to focus on strategic and operational growth.

Andromeda Metals (ASX: ADN) and Minotaur Exploration (ASX: MEP)

Andromeda Metals and Minotaur Exploration plan to work together on developing new technology and applications for halloysite nanotube material.

The companies will establish a 50:50 joint venture entity that will undertake research and development into the technology and applications for halloysite nanotubes with both companies to put in $350,000 cash towards the expenses by 2020.

“Using the new company as a research and development vehicle will greatly assist the development of these new emerging high-tech uses of the halloysite component of the Poochera kaolin resource, thereby creating new product and market openings,” Andromeda explained.

Applications for halloysite nanotube material have been identified in emerging industries including carbon dioxide capture from the atmosphere, batteries, super capacitators, water purification, medicine, construction and agriculture.

Alt Resources (ASX: ARS)

Alt Resources enjoyed a positive week after Orior Capital released a report claiming Alt was a “compellingly cheap” value proposition with its multi-million ounce gold opportunity.

The report gave Alt an $0.08 per share valuation for its global resource base of 6.8Mt at 1.82g/t gold for 406,000oz.

The report’s author Simon Francis compared Alt’s resources to other explorers in the region, which trade at an average enterprise value of $46/oz.

He pointed out that Alt’s EV per ounce was just $13/oz, noting the company was planning to firm up a reserve at the project this year and complete a feasibility study.

The week ahead

This week the local share market will be dominated by the result of the Federal Election and reading the tea leaves out of the Reserve Bank of Australia.

As the results of the election become apparent there will be lots of potentially market moving things to consider.

One big one is the makeup of the Senate and the ability of the Government to turn its legislative program into law, another will be the likely appointments to cabinet and other ministerial positions and through all of that the likely impact of the various policy changes and their effects on various parts of the economy – particularly housing and banking.

As for the Reserve Bank, Governor Dr Philip Lowe is making a speech in Brisbane on Tuesday which comes on the same day that the RBA board minutes from the May meeting are released.

Markets are now firming on the chances of the RBA board cutting official interest rates by 0.25% at its June meeting after unemployment rose, so even the smallest hint will be a big deal.

The potential for lower official interest rates has been sending the Australian dollar below US70c so this cross rate will be sensitive to any hints of a policy shift.

There are also some broader issues expected to move markets in the coming week, US-China trade tensions have been adding to volatility and will be expected to continue to do so.

Adding to that picture is a speech by US Federal Reserve chair Jerome Powell and the release of the US Federal Open Market Committee (FOMC) minutes from its 30 April-1 May meeting that could also become pivotal, particularly if the Fed indicates that it is tending to copy Australia and consider easing monetary policy by cutting interest rates.