It was no surprise to most market speculators that the Reserve Bank of Australia decided to leave the cash rate on hold at 0.75% at its first meeting for 2020.

Commenting on the decision was RBA Governor Philip Lowe who said there are signs the global slowdown that persisted throughout 2018 and 2019 was coming to an end.

Although he noted the current soft patch would extend into early 2020, due to the ongoing drought, bushfire effects and China’s coronavirus.

For the full 2020 calendar year, Dr Lowe said he anticipated global growth to be stronger, with GDP forecast to expand 2.75% and reach 3% in 2021.

Additionally, the bank’s stance on easing monetary policy has now flowed through into the housing market, according to Dr Lowe.

He said housing prices have turned around “noticeably” with Sydney and Melbourne experiencing the biggest effects.

Despite the more optimistic outlook, Dr Lowe said the US-China trade conflict was a “continuing source of uncertainty” even though there’s been headway towards a resolution.

He also pointed to the spreading coronavirus as another source of uncertainty due to its “significant impact on” China’s economy.

Retail remains sluggish

Although the global and Australian economic outlook looks brighter than a few months ago, the Australian Bureau of Statistics revealed national retail turnover (seasonally adjusted) declined 0.5% in December 2019 following a 1% rise in November.

The drop was a larger pull back than many analysts had predicted.

According to ABS director of quarterly economy wide surveys, the November figure had been bolstered by Black Friday sales.

Meanwhile, he said the fall in December retail sales was largely due to the bushfires on Australia’s east coast.

He noted the fires had caused smoke hazes which impacted people spending money at restaurants, cafes and even takeaway services.

Other falls nationally included department stores, which dropped 2.8%, followed by footwear and personal accessories which declined 1.5%.

NSW recorded the largest fall of 1.2%, followed by South Australia (1.3%), Queensland (0.5%), Northern Territory (0.4%).

The other regions including ACT, Victoria and WA remained flat. Tasmania was the only state to post an increase, which was 1.1%.

As we head further into 2020, it is anticipated retail sales will remain flat, with the coronavirus anticipated to cut back spending as tourism falls away and many people remain in their homes.

Housing lifts

While retail turnover was sluggish in December, the ABS revealed dwelling approvals had picked up 2.1% for the month in trend terms.

Despite the increase, the number of dwellings approved for 2019 was almost 20% below 2018 levels.

The increase was driven by a 4.9% growth in private sector townhouse and apartment dwellings, while houses lifted 0.3%.

Victoria and the Northern Territory led the rises for all dwelling approvals with increases of 6.1% and 4.7% respectively.

In the RBA’s statement, Dr Lowe has attributed the turnaround in housing to the bank’s easing of monetary policy.

Impact of coronavirus in China emerging

As the coronavirus continues spreading throughout China and the world, at last count there were 28,276 confirmed cases globally.

The majority of the disease’s impact has been contained to China where 28,060 of those confirmed cases have arisen.

Throughout China, the respiratory flu-like disease has caused at least 564 deaths, but only one outside of the country.

However, the country will feel more than the personal toll, with the virus already impacting the nation’s economy.

It’s also flowing into the global economy with major companies experiencing pain from the virus.

Travel company Flight Centre (ASX: FLT) revealed on Friday that although it was too early to predict the virus’ full impact, the company’s small corporate travel operations in China, Singapore and Malaysia had already been affected.

This has been attributed to the shutdown of inbound and outbound travel as the world and, primarily, China focus on containing the virus.

Another major company to feel the virus’ impact is Tesla.

Earlier this week, Tesla’s share price hit an intraday high of US$968.99 after closing out January at US$650.57.

The rocket run had been attributed to the company’s positive December quarter and 2020 outlook, along with analysts lifting forecasts. Short sellers were also blamed for the rise.

However, as the week advanced, the company’s share price began to drop – plummeting almost 20% on Wednesday to a low of US$704.11 before lifting to end the day at US$734.7.

The fall came after the company revealed it would be delaying the delivery of Model 3 cars from its Shanghai gigafactory to Chinese customers.

As part of the Chinese Government’s virus containment measures, Tesla kept its Shanghai factory closed after the Lunar New Year celebrations ended.

The company’s February car delivery will now be postponed, but the company does expect to catch up its production once the virus situation improves.

Tesla chief financial officer Zach Kirkhorn said the delays would have minimal impact on the company’s profits, due Model 3 Shanghai remaining in early stages.

Market continues rising

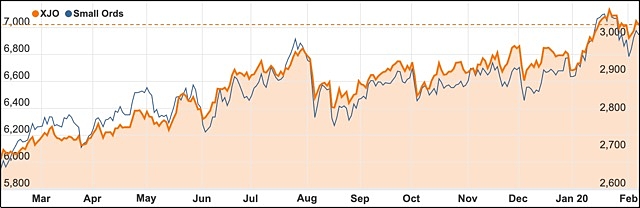

Despite coronavirus and other global headwinds, the Australian share market continued its upward trajectory this week.

The ASX 200 increased 0.46% for the week to close Friday at 7015.6, while the All Ords added 0.37% to end at 7115.6.

Small cap stock action

The Small Ords index rose this week 0.75% to reach 3009.3 points.

Small cap companies making headlines this week were:

Elixir Energy (ASX: EXR)

Coal seam gas explorer Elixir Energy has intersected 82m of net coal below the 300m cut-off at its Nomgon-1 well in Mongolia.

Within the 82m, the widest coal seam below the 300m cut-off was 51m, which started from 373m.

Site geologists described the visible coal as “highly encouraging” and better than those encountered in the Ugtaal-1 well.

Abundant gas was also seen bubbling from the recovered core, which has now been sampled and analysed.

Elixir managing director Neil Young said he was “very excited” by the results coming out of Nomgon-1, which has met the company’s goal of uncovering thick and high quality coal within the coal seam gas depth window.

BetMakers (ASX: BET)

BetMakers has expanded its presence in the US through deals with New Jersey Thoroughbred Horsemen Association and Darby Development, which operates the Monmouth Park racetrack in Oceanport.

The 10-year agreement will make BetMakers the only approved company to manage fixed odds horse racing content in Jew Jersey.

BetMakers will also be responsible for providing a solution to US racing bodies that wish to access licenced bookmakers in New Jersey.

“We have been instrumental in the roll-out of sports betting into the US and now we will be the driver of fixed odds horse racing in New Jersey and hopefully throughout the US,” Monmouth Park chief executive officer Dennis Drazin said.

“We selected BetMakers as our partner in delivering this concept due to their extensive knowledge and understanding of what is required to make this a success,” he added.

De Grey Mining (ASX: DEG)

With air core drilling ongoing, De Grey Mining revealed on Thursday it had intersected thick gold mineralised intersections at the Hemi prospect, which is part of the 1,500sq km Mallina gold project south of Port Hedland in WA.

De Grey has built up 1.7Mt of contained gold resources at the project to date, and has stated it is confident of additional discoveries.

The company revealed the first discovery late last year, which included 43m at 3.7g/t gold, which has been labelled section A.

In section B, 640m away, De Grey uncovered several more thick gold intersections including 24m at 4.2g/t gold from 36m, with all holes drilled at this target ending in mineralisation.

De Grey’s technical director Andy Beckwith said he has interpreted the two mineralised zones are structurally related – indicating a “new gold discovery”.

During the 2017 Pilbara gold rush, De Grey was one of the junior explorers to rocket on news it had uncovered conglomerate-style gold at its Pilbara project.

However, the players in the rush suffered a reality check towards the end of 2017, when Canada’s Novo Resources realised mining and processing the style of gold mineralisation was going to be as simple as first thought.

The company had reported it was not happy with the samples extracted for analysis via drilling, with trenching believed to be a better option.

Excitement regarding these discoveries has since fallen away.

Pure Minerals (ASX: PM1)

Scoping study results have confirmed for Pure Minerals that it can generate a 99.99% pure HPA as a co-product at its Townsville Energy Chemicals Hub (TECH) project.

Using 9,920tpa of aluminium hydroxide as feedstock, the study estimates the project can produce 4,007tpa of HPA, which will bring in a forecast $147.3 million in revenue.

Pure Minerals managing director John Downie noted the company’s TECH project had two clear advantages over other HPA producers.

“Firstly, by starting with an advanced intermediate product in the form of aluminium hydroxide, our capital and operating costs are significantly lower.”

“Secondly, the TECH project will be protected from any significant volatility in the HPA market due to revenue derived from its primary product streams,” he added.

Capital costs have been estimated at $89.9 million. Pure Minerals will now build on this data with a pre-feasibility study.

Tesoro Resources (ASX: TSO)

Former Australian jeweller Plukka (ASX: PKA) has morphed into a gold explorer after the company re-listed on the ASX following a reverse takeover of Tesoro Resources.

Renamed Tesoro and with a fresh board with mining and resources experience, the company debuted on the ASX on Friday after raising $4.63 million via the issue of 154 million shares at $0.03 each.

Funds from the raise will be funnelled towards advancing the Chile-based gold projects El Zorro and Espina.

About $3 million has been earmarked for exploring the assets over the next three years.

Drilling is already underway at the flagship El Zorro project, which has been previously drilled and returned thick gold mineralised intersections.

Better results were 98.3m at 1.58g/t gold, including 30.3m at 3.03g/t gold; 84.3m at 1.3g/t gold, including 4m at 8.5g.t gold; and 58.8m at 1.7g/t gold, including 20.3m at 4.5g/t gold.

The week ahead

In Australia home loan data, consumer and business confidence data are all set to be released mid week.

The dollar will be worth keeping an eye on as it trades near 11-year low levels, currently at the US66.8c mark.

On a global level impact and containment of the coronavirus will be one to watch. Despite some claiming the fears of the virus are overhyped, the impact on global economies is real.

Inflation data out of the US and China next week will help define the early trend for 2020.