Reserve Bank Governor Dr Philip Lowe said that interest rates are heading lower not because the Australian economy is weakening but because it can do better.

And his prescription remains a popular one on the Australian share market, which this week again flirted with 11.5-year highs before taking a breather on Friday.

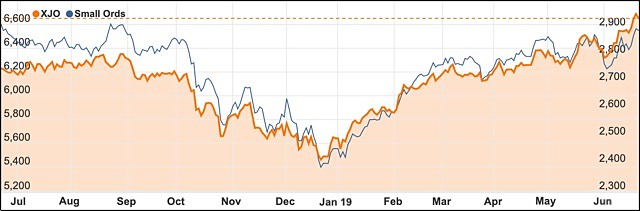

Closing in on an all-time high

At its peak on Thursday the ASX 200 was only 2.6% or 150 points off reaching its all-time resources boom peak of 6828.7 points, which it reached way back in November 2007.

Australia is one of very few share markets that have not reclaimed all-time highs.

Dr Lowe bases his prescription for lower rates on getting unemployment down to 4.5% so that wage growth can finally improve and underemployment can also be cut.

RBA new theory on low wages growth

He also outlined an interesting and new theory to explain the lack of wages growth which has caused the RBA to spend up on some research to find out more about what is going on in Australia.

The findings come in two parts – that the jobs market has become much more flexible with more part-time jobs available and increased participation by women and older Australians, with skilled migrants and New Zealanders also plugging skills gaps in areas where demand for workers is particularly strong.

“The female participation rate now stands at 61%, up from 43 per cent in 1979,” explained Dr Lowe.

“Australia’s female participation rate is now above the OECD average, although it remains below that of a number of countries, including Canada and the Netherlands.”

Flexible jobs market and higher debt to blame

The second part is that low wages growth might be linked to the large amount of personal debt that many workers carry.

That debt might make workers reluctant to move jobs because they have large debts and are concerned about being laid off if the economy turns down.

“This uncertainty means that if you have a job you want to keep it rather than take a risk with a new employer,” said Dr Lowe.

It is debatable whether slicing some points off their mortgage rates will embolden too many workers to shift jobs but as usual with central bankers, they can only use the levers that are in front of them.

Central bankers in Australia, US and Europe support markets

Dr Lowe’s comments and similar dovish speeches from US Fed Chairman Jerome Powell and European central bankers helped to push world share markets much higher this week – along with positive noises from President Trump that a China trade deal could be imminent.

Even the possibility of a conflict with Iran had some positives as it lifted the price of oil by a whopping 9.72% for the week, boosting various energy stocks.

Woodside Petroleum (ASX: WPL) advanced 5.9% to $37.11, Origin Energy (ASX: ORG) rose 4.7% to $7.35, AGL Energy (ASX: AGL) climbed 4.2% to $20.39 and Beach Energy (ASX: BPT) closed 7.1% higher at $1.96.

Gold breaks out

Gold miners had a particularly strong week with the precious metal seen as a good store of value as central banks started fretting about weak economic growth.

In Australian dollar terms, gold pierced through the A$2,000 per ounce barrier to continue making all-time highs.

Meanwhile in US dollar terms gold rose 3.66% for the week, signalling a potential breakout on the technical chart.

In response gold stocks rallied, Northern Star Resources (ASX: NST) rose 10.9% to $11.69, St Barbara (ASX: SBM) advanced 10.9% to $2.96, Newcrest Mining (ASX: NCM) added 6.2% to end the week at $32.00 and Resolute Mining (ASX: RSG) closed 7.1% higher at $1.21.

Iron ore continues climbing as exports drop

The price of iron ore has now reached US$119.5, a 70% increase over the past 6 months.

Rio Tinto (ASX: RIO) cut its predicted iron ore output from the Pilbara by as much as 23 million tonnes.

With fellow giants BHP (ASX: BHP) and Fortescue Metals (ASX: FMG) also forecasting export cuts.

The trio set to collectively ship 31 million tonnes less compared to last year.

Some big losses amid overall gains

Even among all the euphoria of broad-based price rises, there were some notable problem stocks which bucked the trend by falling.

A weakening trend for retailers was confirmed after Caltex (ASX: CTX) warned that its net profit could dive as much as 59% in the six months to June.

Retail profits are expected to halve in the first half of the year and its refinery will barely break even.

Caltex shares closed 10.5% lower for the week at $23.68.

Vocus Group shares (ASX: VOC) were big losers after AGL Energy (ASX: AGL) walked away from a potential $3 billion takeover just five days into a four-week exclusive due-diligence period.

AGL is the second suitor to walk on the telco this month after Swedish private equity firm EQT retracted its $3.3 billion offer.

Not surprisingly, Vocus shares fell a whopping 26.6% this week, closing at $3.20.

Another retailer to downgrade its profit was Adairs (ASX: ADH), with its shares shedding 33.3% for the week.

Small cap stock action

The Small Ords index rose a stunning 2.51% this week to close on 2,891.5 points.

Among the companies making headlines this week were:

Botanix Pharmaceuticals (ASX: BOT)

Making big news this week was Botanix Pharmaceuticals which revealed its CBD-based product BTX 1801 can treat serious skin infections in humans and animals including superbugs.

The BTX 1801 study found that BTX 1801 was a broad-spectrum gram-positive antibiotic with similar potency to antibiotics such as vancomycin and daptomycin and is effective against superbugs staphylococcus (staph) and methicillin resistant staph Aureus (MRSA).

CBD in the BTX 1801 was found to kill bacteria within three hours and disrupts the bacteria’s biofilm.

Thursday’s BTX 1801 news followed Botanix’s positive results the day before that showed its BTX 1308 product demonstrated anti-inflammatory and immune modulating effects in psoriasis sufferers.

Authorised Investment Fund (ASX: AIY)

Another company with a big news week was Authorised Investment Fund, which boosted its exposure to the multi-billion dollar global programmatic advertising sector by upping its stake in Asian Integrated Media (AIM) and made inroads to securing its 30% ownership of AAA Programmatic Pty.

Digital advertising company AIM is focused on securing a slice of China’s rising affluent and upper middle classes, which are increasingly consuming luxury goods.

AAA Programmatic has been established by Authorised Investment Fund, AIM and Ambient Digital Group to provide programmatic advertising for luxury goods and targeting the country’s luxury seeking consumers.

Authorised Investment Fund also reported its 30%-owned Aenea Cosmetics was about to expand its luxury epigenetic cosmetics into Eastern Europe and online through deals with Ukraine’s leading department store Sanahunt Luxury Department Store and The Rake magazine.

Jervois Mining (ASX: JRV)

It was transformational week for Jervois Mining after shareholders approved the company’s merger with TSXV-listed M2 Cobalt, with the deal giving Jervois a foothold in Uganda and diversifying its cobalt and nickel portfolio to include copper and gold assets.

The merger was officially completed on Wednesday, with M2 Cobalt shareholders receiving one Jervois share for each M2 Cobalt share held.

Jervois’ and M2 Cobalt’s tie up precedes another merger, this time with eCobalt, which is expected to be completed in July.

This final merger will make Jervois the world’s third largest cobalt company with a market cap of US$100 million.

Krakatoa Resources (ASX: KTA)

As China threatens to ban rare earth element (REE) exports in the midst of the ongoing trade war with the US, Krakatoa Resources has clinched the Mt Clere project in WA’s Gascoyne region.

The project encompasses 403sq km and is prospective for three REE-type deposits; however, Krakatoa will be targeting monazite mineralisation which often contains thorium, lanthanum, cerium, uranium, calcium, strontium, silica, lead and sometimes sulphur.

Krakatoa will carry out a review of historical exploration data and non-invasive groundwork while it awaits the exploration licence for the project.

BHP previously explored the project in the late 1980s and delineated a number of areas prospective for thorium and other REE minerals.

OBJ Ltd (ASX: OBJ)

OBJ has secured a partnership with Little Green Pharma to investigate using its transdermal patch therapy to deliver medicinal cannabis treatments.

The two companies will jointly fund and work together to pursue the development of the medicinal cannabis patches.

Research will also be backed by Curtin University, with OBJ claiming the deal represented a “unique strategic opportunity” to secure a slice of the global cannabis market which is predicted to hit $232 billion by 2027.

If OBJ, Little Green Pharma and Curtin University can successfully use OBJ’s technology to deliver the medicinal cannabis, OBJ said it could result in “one of the most advanced and effective medical cannabis delivery systems developed in the world to date.”

Silver Lake Resources (ASX: SLR)

Mid-tier gold miner Silver Lake Resources impressed investors this week with its gold discovery at the Tank South deposit, which included the thickest, high-grade intersections ever uncovered from its Aldiss mining centre in WA’s eastern goldfields.

Notable results were 17m at 24.7g/t gold, 24m at 9.39g/t gold, 10m at 10.1g/t gold and 31m at 4.44g.t gold.

“The spectacular high-grade discovery at Tank South highlights a significant exploration opportunity for Silver Lake at the Aldiss Mining Centre, given historical reconnaissance drilling along the SAT trend is sporadic and relatively shallow,” the company stated.

Silver Lake plans to carry out further drilling to determine extensions to the wide, high-grade mineralisation.

Althea (ASX: AGH)

Another medicinal cannabis company to make news this week was Althea Group, which reported its UK subsidiary had received its first patient subscription for the proprietary medicinal cannabis treatment.

Althea expects to receive more patient prescriptions in the coming days, with the company to export its products from Australia to meet demand.

The news follows Althea entering the UK earlier this year, which is expected to provide a significant new market for Althea’s Australian manufactured medicinal cannabis products.

Althea recently received the permit for its cultivation and manufacturing facility in Victoria, with first production targeted for 2020.

ASX floats this week

Small Caps readers who want to view upcoming IPOs or see the performance of stocks that have listed in 2019 can now do so.

The latest companies to make their way onto the ASX this week were:

Regal Investment Fund (ASX: RF1)

Newly established managed investment scheme Regal Investment Fund’s shares began trading on the ASX on Monday.

The company raised more than $281 million in its offer via the issue of 112.7 million units at $2.50 each.

Regal’s strategy is for the company to become a leading alternative investment vehicle listed on the ASX.

The company closed its first week on the ASX at $2.48 – down marginally on the IPO price.

Whispir (ASX: WSP)

Australian software as a service company Whispir began trading on the ASX on Wednesday giving investors access to its software platform.

The company’s platform is easy to use and allows organisations to manage, automate and optimise communication processes.

Whisper raised $47 million in its offer via the issue of 29.4 million shares at $1.60 each. Funds will be used to progress its technology and increase sales and marketing activities within North America and Asia.

Whisper’s share price was down to $1.48 by Friday’s market close.

VGI Partners (ASX: VGI)

The VGI Partners hedge fund listed on Friday after raising $75 million in its IPO, with the hedge fund already owning listed VGI Partners Global Investments (ASX: VG1).

Under the IPO, VGI Partners shares were offered to currently listed hedge fund VGI Partners Global Investments holders’, which was concurrently raising $300 million of its own funding.

Debutant VGI Partners closed its first day on the ASX at $10.24 per share – 86.2% higher than its issue price of $5.50.

The week ahead

International events look set to feature strongly in the week ahead with the G20 Summit in Osaka high on the agenda – along with the continuing military tensions between Iran and the United States.

The main game at the G20 is likely to be the resumption of trade talks between US President Donald Trump and Chinese President Xi Jinping, although predicting where this trade fight is probably difficult even for the participants.

Here in Australia Reserve Bank Governor Dr Philip Lowe will once again make the news with another speech due to be delivered on Monday.

Other than that, it is a fairly quiet week on the data front, with a reading on consumer confidence the main highlight.