Weekly review: market rising despite coronavirus headwinds, Vodafone-TPG merger approved as Telstra’s earnings sink

WEEKLY MARKET REPORT

Despite coronavirus headwinds, Australian markets continued rising this week.

The ASX 200 closed out Friday up 1.53% for the week at 7130.2 points, while the All Ords rose 1.48% to 7227.1 points.

It was a mixed bag news-wise this week, with Vodafone and TPG shareholders celebrating a win in Australia’s Federal Court, while the finance sector continued to feel the impact of the Banking Royal Commission.

Vodafone-TPG merger gets greenlight

The proposed merger between Vodafone Hutchison Australia’s parent company Hutchison Telecommunications (ASX: HTA) and TPG Telecom (ASX: TPG) has finally been approved after a protracted legal battle.

Both companies welcomed the Australia Federal Court’s ruling the tie-up was “not likely to” substantially lessen competition in the country’s telecommunications sector.

The Australian Competition and Consumer Commission had banned the $15 billion merger in May last year, citing it would reduce competition and contestability in the sector.

After the decision was handed down, the companies pursued a challenge in the federal court, which has resulted in this week’s ruling allowing the tie-up to proceed.

With the merger now getting a major regulatory green-light, Hutchison and TPG have urged shareholders to vote in favour of the proposed scheme of arrangement.

The tie-up is expected to be completed by mid-2020.

Vodafone chief executive officer Inaki Berroeta said the combined entity would enable greater investment in next generation networks including 5G.

“We have ambitious 5G roll-out plans and the more quickly the merger can proceed, the faster we can deliver better competitive outcomes for Australian consumers and businesses.”

Not everyone was pleased with the court’s decision, with ACCC chair Rod Sims saying that although he supports the ruling, he doesn’t regret opposing the merger last year.

Meanwhile, former ACCC chairman Allan Fels said that a merger like TPG and Hutchison’s would not be approved in “serious jurisdictions” like the UK or US.

He added that Justice John Middleton who presided over the federal court case had relied too heavily on TPG executive chairman David Teoh’s “self-serving” evidence.

Telstra tumbles on 1H results

Over at major telecom Telstra (ASX: TLS), shareholders were left disappointed with 1H FY 2020 net profit after tax falling 6.4% to $1.2 billion, while underlying EBITDA declined 6.6% to $3.9 billion.

However, the company said results were in line with expectations and that it was making “strong progress” in cost reduction and its T22 strategy, which includes rolling-out its 5G network and establishing Telstra InfraCo.

A large contributor to the results was the $360 million NBN headwind. According to the major telco, if this was excluded underlying EBITDA would have risen by $90 million.

Additional impacts on the business have been felt by the recent bushfires and ongoing drought on the east coast.

Despite the lacklustre 1H FY 2020, Telstra reconfirmed its fully franked interim dividend of $0.08 per share for the period.

Finance sector struggles to shake off Royal Commission findings

In the finance sector, it has been 12 months since the final report into the Banking Royal Commission was handed down.

It was obvious in AMP’s (ASX: AMP) full year results published this week that it was still struggling under the weight of the commission’s findings and its damaged reputation.

Although Commonwealth Bank of Australia (ASX: CBA) fared better, its 1H 2020 results were lacklustre.

Beleaguered fund AMP posted a hefty 32% fall in underlying profit to $464 million for FY 2019 – down from $680 million in FY 2018.

This led to a FY 2019 net loss of $2.5 billion – largely due to $2.35 billion in impairments taken in 1H 2019 to address legacy issues.

A further $190 million in payments to AMP’s client remediation program were made during 2H 2019.

AMP anticipates the client remediation program will be completed in 2021.

The wealth management fund has been in disarray since the Banking Royal Commission began in late 2017 investigating misconduct within the banking, superannuation and financial services industry.

In the lead up to the commission’s final report, which was released in February last year, investors fled taking almost $4 billion in cash out of AMP during 2018 alone.

The report found that AMP had charged high fees for financial advice that was never delivered in what was known as the “fees-for-no-service” scandal, which included charging dead customers.

AMP was also found to have misled ASIC – claiming it was paying fees back to investors when it hadn’t.

To recoup its reputation with investors and the sector, AMP implemented a three-year transformation program to turn the company around.

AMP chief executive officer Francesco De Farrari said 2019 was essentially a fundamental year for resetting the business.

This resulted in the company stating it would not be issuing a final dividend for FY 2019.

However, the wealth management fund raised investors’ ire by declaring a 200% increase in short-term incentive remuneration to Mr De Farrari’s base salary.

It wasn’t just AMP that was caught up in the fee-for-no-service scandal, with Westpac (ASX: WBC), National Australia Bank (ASX: NAB), Commonwealth Bank and New Zealand Banking Group (ASX: ANZ) all fingered during the commission.

Although named in the commission, the Commonwealth Bank has escaped relatively unscathed compared to AMP, posting a 34% increase to its statutory net after tax profit, which reached $6.16 billion for the 1H 2020.

However, cash net profit after tax dropped 4.3% to $4.5 billion.

This result was underpinned by flat operating income of $12.4 billion and slightly higher operating expenses of $5.4 billion.

Despite this, the board has agreed to deliver its previously promised interim dividend of $2 per share.

Pick up in coronavirus outbreak continues to impact market

As the finance sector continues to fight off the ongoing effects from the Banking Royal Commission, the coronavirus (now COVID-19) outbreak has picked up pace in China, with flow-on affects beginning to be felt by the region’s economy and its trading partners.

In the World Health Organisation’s latest Situation Report there are now 46,997 confirmed cases worldwide.

Of those, 46,550 have been identified in China, resulting in 1,368 deaths.

Although the virus hasn’t spread as rapidly outside of the country, the financial impact from the world’s largest economy, which is currently in shutdown is being felt by many major and small companies alike.

ASX companies weathering the virus’ impact include airports and airlines, which rely on one of the world’s largest outbound travel markets for their bread and butter.

Sydney Airport (ASX: SYD) is down 4.45% for the month to $8.58, while airline Qantas Airways (ASX: QAN) has tumbled over 9% during the last four weeks to $6.43.

Flight Centre Travel Group (ASX: FLT) has dropped more than 12% over the same period after reporting its small corporate travel operations in China, Singapore and Malaysia had been “adversely affected”.

The travel agency noted it would be watching closely for the virus’ impact in its 2H 2020 trading.

It’s not just travel companies and airlines that will be impacted, it is expected major iron ore miners BHP Group (ASX: BHP), Rio Tinto (ASX: RIO) and Fortescue Metals Group (ASX: FMG) will feel the pinch as many Chinese plants remain closed and workers stay at home – potentially triggering force majeure on iron ore contracts.

However, it isn’t all doom and gloom, with many innovative ASX-listed stocks standing to benefit commercially from the virus.

Small cap Zoono Group (ASX: ZNO) is up 175% to $1.54 over the last four weeks on news it was ramping up production of its antimicrobial skin and surface sanitisers to meet increasing demand that includes a distribution agreement with Beijing Youmeng Technology and Development.

This will involve Zoono supplying its products to China’s childcare and hotel sectors.

Zoono shares are up a whopping 1,874.36% over the past six months.

Micro-X (ASX: MX1), which supplies digital mobile x-ray units has also run on the coronavirus outbreak, with the company revealing this week it had received a large order from two Asian countries fighting the virus.

The company’s shares were up almost 35% this week to $0.195.

Small cap stock action

The Small Ords index rallied 1.59% this week to close on 3057.1 points.

ASX 200 vs Small Ords

Small cap companies making headlines this week were:

Exopharm (ASX: EX1)

Exopharm’s exosome platform has undergone BioMap testing which has found its Plexaris and Cevaris products have “different and distinct” activities compared to 4,500 other experimental and sold medicines.

Testing found Plexaris to be safe with “notable biological activity” including tissue remodelling, immunomodulatory and inflammatory effects.

Meanwhile, the Cevaris product was also found to be safe and possessing the same biological activities.

The different activities to comparison drugs confirm Exopharm’s view that its exosome-based treatments are potentially a new class of medicine.

Exosome-based drugs are natural cellular particles secreted by stem cells, which are then purified using Exopharm’s technology.

The company revealed on Friday it was testing its exosomes on restoring erectile function by reversing post-operative tissue damage.

Erectile dysfunction is a condition frequently found in men aged in their 50s and older and brings with it psychological and emotional damage.

Nyrada (ASX: NYR)

ASX newcomer Nyrada’s cholesterol-lowering drug pre-clinical study results have been published in the international medical journal Bioorganic and Medicinal Chemistry.

The results demonstrate Nyrada has been able to identify a small molecule that inhibits PCSK9 production in-vitro – causing cholesterol levels to decrease in blood plasma in mice in-vivo models.

According to the company, researchers have been challenged for years in designing a small molecule that can bind to and inhibit the function of PCSK9.

PCSK9 is a blood protein involved in regulating cholesterol in the blood stream by reducing a body’s ability in removing low-density lipoprotein cholesterol.

This is often the “bad” cholesterol, which is associated with increased risk of heart disease and stroke.

Nyrada’s chief executive officer James Bonnar spoke with Small Caps with week on the podcast.

Moho Resources (ASX: MOH)

Gold explorer Moho Resources has unearthed up to 24.61g/t gold from a second reverse circulation drilling campaign at the East Sampson Dam prospect near Kalgoorlie in WA.

Drilling comprised 29 holes for 2,600m and identified gold along 225m of strike, with mineralisation remaining open and extending the known strike about 25m to the north and south of previous drilling.

Better assays from the December program were 15m at 4.71g/t gold from 88m, including 3m at 15.18g/t gold from 100m; and 5m at 10.36g/t gold from 59m, including 2m at 24.61g/t gold from 56m.

The company has planned further drilling to begin in April at East Sampson Dam to define the prospect’s gold mineralisation limits.

Sky Metals (ASX: SKY)

Another gold junior that has struck substantial gold mineralisation during drilling this week was Sky Metals, which uncovered “outstanding results” at its Cullarin project in NSW.

The results were from two diamond holes drilled about 200m apart to test historic results at the Hume prospect.

Better assays were 93m at 4.24g/t gold from 56m, including 36m at 2.88g/t gold and 14m at 20.2g/t gold.

Sky’s chief executive officer Mark Arundell said the results were “outstanding” and validated the company’s strategy and targeting methodology.

The following day, an ASX announcement revealed soil sampling had identified a geochemical anomaly at Hume.

Impression Healthcare (ASX: IHL)

Medicinal cannabis company Impression Healthcare has placed an order for 3,000 bottles of cannabinoid oils, which will be sold to patients under the Incannex brand via Australia’s Special Access Scheme.

Additionally, Impression has introduced three new products to its mix including Nutralesic, Inflammex and Releafia, which contain varying ratios of CBD, THC and other cannabinoids.

According to Impression, the new products have been designed to gain the “greatest possible patient coverage” based on existing market conditions and patient need.

Impression also plans to purchase a further two medicinal cannabis products to add to its range, which will comprise a CBD-based soft gel capsule for elderly patients.

Alt Resources (ASX: ARS)

Junior explorer Alt Resources released an updated global resource for its wider Mt Ida project, near Leonora in WA, with contained gold now exceeding 500,000oz.

The update represents a 22% increase to global resources which now total 10.5Mt at 1.54g/t gold from 519,000oz and 3.78Moz silver.

Underpinning the resource upgrade was six months of drilling comprising 6,768m across Mt Ida South, Bottle Creek, Tim’s Find, Shepherds Bush and VB North deposits.

Alt chief executive officer James Anderson pointed out the project-wide average gold discovery cost was $9.30/oz.

“We have now reached the 500,000oz milestone and this latest upgrade continues to support our strategy to move towards the development of a treatment plant at Mt Ida,” he added.

SciDev (ASX: SDV)

Chemical technology company SciDev received an order worth US$1.4 million (A$2.08 million) for its proprietary solids-liquid separation chemistry.

The order was from Phoenix Process Equipment Company, which is the largest integrated chemical and dewatering equipment supplier worldwide.

Phoenix has ordered a three-month supply of the product, which Sky’s China-based partner Nuoer Group will manufacture.

In mid-2019, Phoenix initially placed a $120,000 trial order, and with this latest order, volumes are expected to growth over the agreement term.

Lithium Australia (ASX: LIT)

Under the federal government’s Co-operative Research Centre Project Lithium Australia and its subsidiary VSPC received a combined $2.9 million in funding to advance their respective technologies.

On Wednesday, Lithium Australia revealed VSPC will receive $1.6 million in government grant funds to assist with a $5 million program focused on developing fast-charging lithium-ion batteries for trams.

Working on the research with VSPC will be the Commonwealth Scientific and Industrial Research Organisation (CSIRO), University of Queensland (UQ) and Soluna Australia, which will all contribute in kind.

A day later, Lithium Australia revealed it had been the recipient itself under the same government grant program.

Lithium Australia will receive $1.3 million to advance its proprietary LieNA® process to a commercialisation stage.

The research will involve Lithium Australia collaborating with ANSTO and other organisations including Pioneer Resources, ALS Metallurgy, Murdoch University, Curtin University, and VSPC to assist with providing samples, processing, research and testing.

Oventus Medical (ASX: OVN)

Oventus Medical has launched its lab in lab model across a further three US sites, brining its total number of launched sites to 14 out of 36 contracted sites.

The obstructive sleep apnoea treatment provider now has newly operating sites in South Carolina, Texas and Illinois.

With much higher patient scheduling and a doubling of unit sales from the lab in lab program between December and January, Oventus noted its deal pipeline had now increased to more than $33 million from $20 million at the end of last year.

The company followed up the positive lab in lab roll-out news with an announcement that its O2Vent Optima device had been approved by the US Centres for Medicare and Medicaid for Medicare reimbursement.

Oventus anticipates this reimbursement will help the company in treating a larger population of obstructive sleep apnoea sufferers, with about 30 million sufferers in the US.

ASX floats this week

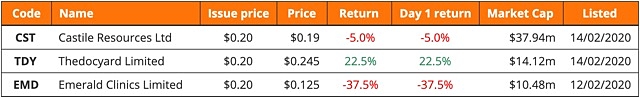

Small Caps readers who want to view upcoming IPOs or see the performance of stocks that have listed in 2020 can now do so.

The latest companies to make their way onto the ASX this week were:

Emerald Clinics (ASX: EMD)

Unique healthcare company Emerald Clinics’ securities began trading on the ASX this week after it raised $6 million in its IPO via the issue of 30 million shares at $0.20 each.

The company has established four patient focused clinics across Australia in Sydney, Melbourne, Perth and the Northern Rivers region of NSW.

What sets Emerald Clinics apart from other healthcare providers is its focus on providing safe access to unregistered medicines including cannabinoid drugs in collaboration with referring doctors.

As part of this initiative Emerald Clinics co-creates anonymous, independent, ethically sourced and “high-quality” real-world evidence with its patients using its unique data platform.

According to Emerald, the data it collates is in demand from many sectors within the healthcare and medical industry including treatment developers, producers, regulators, insurers and prescribers.

IPO proceeds will be used to fund further development of Emerald Clinics’ platform, as well as establishing new clinics, trials and expanding into the UK.

The company closed its first week on the ASX at $0.125 – down 37.5%.

Castile Resources (ASX: CST)

Castile Resources began official quotation on the ASX on Friday after raising almost $20 million to advance its polymetallic assets in the Northern Territory.

The company was formed via a demerger from Westgold Resources (ASX: WGX), with IPO proceeds to be used to carry out exploration while looking for potential growth projects.

Castile’s current projects comprise Rover and Warumpi, which are prospective for copper-gold and other base metals.

Rover is located 80km south-west of Tennant Creek in the NT. The asset comprises five exploration licences and two retention licences.

A mobile exploration camp has been established at the Rover 1 prospect and six targets have been identified for drill testing across the wider project.

Warumpi is 300km west of Alice Springs and includes three exploration licences. The grass roots asset is close to roads and the small Mount Liebig settlement.

Initial exploration at Warumpi will include surface geochemical surveys and mapping which will be followed by a small drill program.

The company issued 99.85 million shares in its IPO at $0.20 each. By close of trade Friday, Castile’s shares were down 5% to $0.19.

thedocyard (ASX: TDY)

Another company to list on Friday was thedocyard, which raised $4.1 million in its IPO via the issue of 20.8 million shares at $0.20 each.

According to thedocyard, it has created a cloud-based deal platform for managing the entire lifecycle of corporate and commercial transactions.

The Australian-based technology company is targeting legal and financial sectors with its platform, which handles global trends relating to regulatory reach, data security and certainty in transacting.

IPO proceeds will be used to fund sales and marketing to boost customer numbers in Australia and internationally.

The company ended Friday at $0.245 – up 22.5% on the offer price.

The week ahead

Coming up in the week ahead investors can look for the Reserve Bank’s meeting minutes out on Tuesday and employment numbers on Thursday.

The unemployment rate has fall over the past two months from 5.3% to 5.1%; however, analysts are predicting we’ll see a rise to 5.2% in next week’s numbers.

With reporting season in full swing, eyes will be on blue chip companies to see how the broader market is faring.