Weekly review: market ignores Trump’s higher China tariffs with a slight rise

WEEKLY MARKET REPORT

It’s official – the US and China are now locked in a punishing tariff war – but after a brief dip the Australian market took the news in its stride.

The US will now increase the tariff rate on a range of Chinese goods worth $200 billion from 10% to 25% and will move to tax nearly all of China’s imports while the Chinese are going to introduce a range of retaliatory measures as well.

In a statement shortly after the US announcement, the Chinese Government said it “deeply regrets that it will have to take necessary countermeasures.”

Market sells off but then recovers

The news initially sparked a sell off on the Australian share market but it was short-lived, with the ASX 200 closing up 15 points or 0.25% to 6,310 points, although it drooped by 0.4% during the week.

That wasn’t the only headwind the market negotiated with the Reserve Bank announcing a cut in its near-term economic growth forecasts in its statement on Monetary Policy.

RBA cuts forecasts

The RBA now expects annual GDP growth to June of 1.75% compared to the 2.25% it flagged six months ago, while the December target has been downgraded from 3% to 2.75%, while the core inflation target has also been cut to 1.7% by December, well short of its target of 2-3%.

Economists are now divided about whether the RBA has shifted to an easing bias, with some reading the tea leaves of the growth downgrade and this week’s board minutes as confirming that official interest rates are heading down, while others see it remaining on the sidelines unless employment weakens.

Despite the RBA leaving rates on hold for a record 32nd consecutive month, across the Tasman this week, the Reserve Bank of New Zealand lowered its official cash rate 25 basis points to join the RBA at 1.5% – signalling what may occur back at home in the near future.

Either way, there was plenty of movement in individual companies due to a range of regulatory and other factors.

Telco merger woes

TPG Telecom’s (ASX: TPM) $15 billion merger with Vodafone Hutchison Australia (ASX: HTA) was blocked by the Australian Competition and Consumer Commission, sending its shares lower this week.

Both companies will challenge the ACCC decision in the Federal Court, but that didn’t stop TPG’s shares falling 7% to $6.35 and Hutchison Australia crunching 21.2% lower to 13¢.

One of the beneficiaries of the decision, major telco Telstra (ASX: TLS), enjoyed a 0.9% rise in its shares to $3.41.

There were some other market disappointments with building products group Adelaide Brighton (ASX: ABC) slumping 17.9% to $3.62 after the company warned its 2019 profits could be up to 15% lower than the previous year due to weaker residential construction demand.

Shareholders in GrainCorp (ASX: GNC) also had a bad week after Long Term Asset Partners walked away from a $3.3 billion takeover bid for the grains company and it announced a first-half loss of $59 million.

Drought and international trade issues were cited by GrainCorp for the weak result and its shares tumbled 15.1% to $7.54.

BHP (ASX: BHP) has been hit with the largest damages claim in the UK of $7.2 billion for its part in the 2015 Fundao tailings dam failure in Brazil. Despite the lawsuit, the miner remained flat for the week on $36.80 per share.

Not all bad news

It wasn’t all bad news with News Corp (ASX: NWS) shares up 1% to $16.75 after the company reported a 36% rise in third quarter pre-tax earnings to US$247 million.

Revenue for the media group was up 17% to US$2.46 billion.

News’ majority owned REA Group (ASX: REA) also had a reasonable third quarter result with revenue up 7% to $198.6 million, even though listings fell by 9%.

While the real estate advertising company warned that “market conditions are not expected to improve in the short term”, traders still pushed the share price up 0.9% to $81.88.

Retail sales drag

According to the Australian Bureau of Statistics retail sales for the March quarter rose 0.3% in seasonally adjusted terms, beating the expected 0.2%.

The upward lift came from an increase in price of food sales, which is the largest category by dollar spend.

However, when measured in volume, sales for the entire quarter were actually down. With January seeing the largest slump when sales came in at 0.1%, well short of the 0.4% forecast.

With the consumer sector accounting for roughly 60% of Australia’s economy, retail sales will be one of the bell weathers to watch regarding a potential future rate cut from the RBA.

Small cap stock action

The Small Ords index diverged from the All Ords to take a slim 0.38% drop for the week, closing on 2,791.7 points.

ASX 200 vs Small Ords

Among the companies making headlines this week were:

Orthocell (ASX: OCC)

Regenerative medicine company Orthocell has revealed an 83% improvement in muscle power for clinical trial patients treated with its CelGro collagen medical device platform.

With the trial ongoing, the preliminary results indicate the CelGro platform can be used to guide and promote “tensionless nerve regeneration in damaged peripheral nerves of the hand and upper limb”.

CelGro is used to improve soft tissue regeneration and can also be used in repair applications.

The platform has received European CE Mark authorisation, enabling it to be marketed and used throughout the region.

Genetic Technologies (ASX: GTG)

Genetic Technologies has launched two cancer risk assessment tests for detecting colorectal and breast cancer known as GeneType for Colorectal Cancer and GeneType for Breast Cancer.

The two tests work by combining information from genetic markers knowns as single nucleotide polymorphisms and assessing how a person’s genetic make-up affects their risk of developing the disease.

GeneType for Colorectal Cancer evaluates a patient’s age, family history, along with the genetic markers to provide five-year, 10-year and life-time risk assessments. While the GeneType for Breast Cancer test evaluates family history, breast density and the genetic markets.

Genetic Technologies plans to introduce the test to healthcare providers via its global network of distribution partners in the coming months.

Pure Alumina (ASX: PUA)

HPA hopeful Pure Alumina’s future Canadian subsidiary Polar Sapphire reportedly shipped commercial quantities of 99.999% (5N) HPA to sapphire producers this week.

Polar’s Toronto 150tpa pilot plant, which uses the company’s patented process, produced 10t of the 99.999% HPA after a two-week run at full capacity.

Pure Alumina has a binding term sheet to acquire Polar for C$13.75 million (A$14.5 million) in Pure Alumina shares and C$12 million (A$12.6 million) in cash.

The company plans to raise $30 million through debt and equity and once the transaction is complete, Pure Alumina will expand the plant to 1,000tpa in the first year and 5,000tpa within three years.

Ava Risk Group (ASX: AVA)

This week, Ava Risk Group finally received the purchase order for its major military cybersecurity data network project with the Indian Ministry of Defence.

Ava received official notice on Thursday that its in-country manufacturing partner SFO Technologies had received the purchase order for Ava’s future fibre technologies.

It is anticipated Ava will receive US$11.9 million (A$16.86 million) in paid licence fee revenue from the order over the next 14 months.

“This large-scale deployment of our data network security solution will generate further interest in our cybersecurity solutions and contribute significant earnings in FY2020 and beyond,” Ava chief executive officer Scott Basham said.

Flexigroup (ASX: FXL)

Australian finance provider Flexigroup has unveiled a string of deals for its new Humm Buy Now Pay Later (BNPL) platform.

The Afterpay and Zip Co rival has revealed new partnerships with Myer, Ikea, JB Hi-Fi New Zealand, Strandbags, Solmon’s Carpets, National Dental Plan, National Hearing Plan and City Fertility.

Humm accounts for 17% of Australia’s BNPL transaction volumes and 40% of receivables and distinguishes itself from competitors by providing finance for the “little things” and the “big things”.

Flexigroup chief executive officer Rebecca James said the addition of the new brands reinforces the company’s offering and affords retailers new growth opportunities.

King Island Scheelite (ASX: KIS)

Emerging tungsten miner King Island Scheelite has revealed the results of financial and economic modelling of its Dolphin open cut tungsten project in Tasmania’s King Island.

According to King Island chief executive officer Johann Jacobs, the project’s forecast economics were “impressive” and reiterate that the company has “chosen to develop the right project with the right commodity in the right place and time”.

The modelling shows that estimated Dolphin operating costs are among the lowest of global tungsten miners.

“The King Island Scheelite team has actively progressed and de-risked the 100%-owned Dolphin tungsten project, both technically and commercially,” Mr Jacobs said.

Bubs Australia (ASX: BUB)

Bub Australia has announced it will be the first company to produce Australian-made organic grass-fed infant formula.

The company has entered a long-term supply and manufacturing agreement with Fonterra Australia to produce its new formula range that will be called Bubs Organic.

Fonterra will supply Bubs with organic milk powder that has been sourced from its New Zealand organic milk pool then manufactured in Victoria.

The Bubs Organic formula is expected to be available at Chemist Warehouse pharmacies and online in the next three months.

Envirosuite (ASX: EVS)

Latin America’s largest coal mine Carbones del Cerrejon has called on Envirosuite to provide an additional service at the operation.

The company will now provide continuous remote monitoring of the ground water, which will bring in about $84,000 in subscription revenue and a hardware purchase worth $240,000.

“Our relationship with Cerrejon has evolved over the past three years as they have implemented different Envirosuite solutions that have subsequently proved their value,” Envirosuite chief executive officer Peter White said.

Envirosuite plans to use Cerrejon as a proof of concept and case study, which other companies could emulate – which would bring in new clients and revenue for Envirosuite.

Alt Resources (ASX: ARS)

A review of historic drill data has revealed high-grade gold potential at Alt Resources’ Boags South deposit.

The deposit lies to the south of the Bottle Creek mining lease and is along strike from the historic Boags open pit.

Notable intersections identified in the review were: 7m at 9.03g/t gold, including 2m at 28.2g/t gold from 58m; 6m at 8.75g/t gold from 32m; and 14m at 2.81g/t gold from 20m.

Alt plans to test these results by drilling at Boags South during the September quarter.

Bryah Resources (ASX: BYH) and OM Holdings (ASX: OMH)

After recently announcing that OM Holdings was farming in on Bryah Resources manganese tenements, the duo reported that drilling has kicked-off at the first target – the Horseshoe South manganese mine.

The historic mine lies on Bryah’s Bryah Basin project in central WA, with OM earning up to 70% of the project’s manganese rights by spending $7.3 million on exploration.

Stage one drilling will involve a minimum of 3,000m and will include Horseshoe South, Brumby Creek and Devils Hills.

The Horseshoe South mine has been operated intermittently since the 1950s and produced about 1Mt of high-grade manganese during its life-time.

Poseidon Nickel (ASX: POS)

As it awaits the nickel price resurgence, Poseidon Nickel is firming up its resources and reserves, with recent drilling below its Black Swan pit in WA uncovering 223.1m at 1.02% nickel from 900m.

The thick intersection includes a 74m interval at 1.5% nickel, with another hole intercepting 292m of disseminated sulphide mineralisation.

Poseidon claims the new holes confirm previous drilling which returned 180m at 0.74% nickel, including 42m at 1.22% nickel; and 109m at 1.01% nickel, including 51m at 1.36% nickel on the hanging wall.

The company’s strategy is to investigate the opportunity that exists below the open pit and assess the viability of moving the operation underground once the resource of 30.7Mt at 0.6% nickel has been depleted.

FBR (ASX: FBR) and Brickworks (ASX: BKW)

The FBR and Brickworks joint venture has officially started, with the duo to provide Wall as a Service operations to Australia’s construction sector via the equally owned joint venture entity Fastbrick Australia.

Pilot operations will begin by testing the duo’s custom designed brick in FBR’s Hadrian X autonomous brick laying robot.

The pilot program will involve Fastbrick Australia engaging with building companies to provide the structural brickwork for residential homes using the Hadrian X.

“Fastbrick Australia provides FBR with an opportunity in Australia to demonstrate the capabilities of the Hadrian X with the new optimised blocks developed with Brickworks and also to demonstrate and test our business model for the commercialisation of Wall as a Service, which we intent to scale on a global basis,” FBR chief executive officer Mike Pivac said.

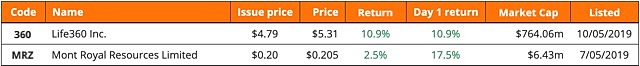

IPOs this week

Small Caps readers who want to view upcoming IPOs or see the performance of stocks that have listed in 2019 can now do so.

The latest companies to make their way onto the ASX this week were:

Life360 (ASX: 36O)

Trading of Life360 CHESS Depository Interests (CDIs) started on Friday after the company raised $145.4 million via the issue of 23.52 million new CDIs and the transfer of more than 6.8 million existing CDIs at an offer price of $4.79.

Life360’s core offering is its mobile app for families, which provides direct messaging, driver safety monitoring and location sharing services.

The app has a “freemium” model which is available to users at no charge, with premium subscriptions also offered.

More than 18.5 million people actively use the app each month, with Life360’s ultimate gold to disrupt the multi-billion dollar security and insurance markets by building a global user base of security conscious families.

On its first day of trade, Life360 rocketed to an intraday high of $5.55 per CDI, before closing its first day on the ASX and the week at $5.31 – an 10.9% premium to the offer price.

Mont Royal Resources (ASX: MRZ)

Gold explorer Mont Royal Resources launched onto the ASX on Tuesday after an oversubscribed $5 million IPO that issued 25 million shares at $0.20 each.

Mont plans to use the funds to explore for gold at its two WA projects – Edjudina and Yule River.

Edjudina is 170km north-east of Kalgoorlie and is prospective for Archaean lode style gold mineralisation, while Yule River is 50km south of Port Headland and considered prospective for Archaean mesothermal lode gold.

Mont closed out its first week on the ASX at $0.205 – up slightly on its IPO price.

The week ahead

The biggest event in the coming week is the last week of the Federal Election campaign, although the results won’t be obvious until after all of the votes are in on 18 May.

Other than the vigorous last days of campaigning, there are some economic releases to keep an eye on with the wages figures out on Wednesday and the job market numbers out on Thursday.

Both could feed into the election campaign and also into the calculations about whether the RBA will cut rates or not.

Given the trade war, a brace of Chinese figures on Wednesday covering investment, production and retail sales will also be worth keeping an eye on.

Spot fires to lookout for include the political turmoil and US intervention in Venezuela, North Korea firing off missiles again and tensions building between Iran and the US which has seen military assets deployed in the region.