Weekly review: market delivering returns despite US missiles flying in Iran

WEEKLY MARKET REPORT

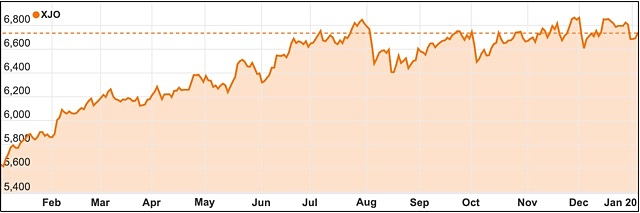

Many happy returns is often the sentiment expressed around the New Year and the share market has delivered just that in the first few days of January.

Not even a US missile strike which killed a top Iranian general Qassem Suleimani could erase the gains with Friday’s market ending up 42.9 points or 0.64% higher at 6733.5 points on the ASX 200.

ASX 200 chart

That was closer to a 100-point gain before news of the missile strike in Baghdad hit but not even that event could erase the optimism that infused the market as it swallowed news of further Chinese stimulus measures and renewed optimism about trade between the two largest world economies – the US and China.

All sectors of the Australian market were up.

Oil and gas stocks find strength

As you might expect from such an emerging complicated picture of positivity and turmoil, oil and gas stocks were the strongest performers as they reacted to trouble in the Middle East with the sector as a whole lifting 1.7% on Friday.

Oil prices hit a seven-month high after jumping 3% and local energy stocks were quick to follow with Beach Energy (ASX: BPT) and Oil Search (ASX: OSH) both outperforming with a 3.1% lift.

Woodside Petroleum (ASX: WPT) rose 0.9% to $34.77 and Santos (ASX: STO) was up 2.3% to $8.41.

Big pit news helps the gold sector

Gold stocks were also very solid performers as the combination of low interest rates and some global tension drove demand for an alternative “currency’’.

Northern Star (ASX: NST) stood out with a 5.7% gain which was really helped after it finalised its move to buy half of the famous Kalgoorlie super pit mine from Newmont.

Northern Star has carved a very profitable niche from buying established gold mines from major companies and then improving mine efficiency and adding to gold ounces in the ground through brownfields exploration and investors are comfortable that the Super Pit will not be an exception.

Silver Lake (ASX: SLR) was also a great performer, jumping 4.5% and shares in Saracen Minerals (ASX: SAR) also jumped 4.2% higher.

Not every gold miner shared the happy times with Evolution (ASX: EVN) shares down 2.1%.

There were other tiny areas of weakness too, with gaming company Aristocrat (ASX: ALL) down 1.2% and hard running buy now, pay later company Afterpay (ASX: APT) also falling 1.2%.

In other parts of the mining sector BHP (ASX: BHP) was up 0.5% to $39.15, Rio Tinto (ASX: RIO) added 0.2% to $101.36 while fellow iron ore miner Fortescue Metals (ASX: FMG) fell 0.3% to $10.75.

The big banks were also stronger, with Commonwealth Bank (ASX: CBA) up 0.5% to $80.31, Westpac (ASX: WBC) and ANZ (ASX: ANZ) both up 0.7%, to $24.36 and $24.73, respectively, and NAB (ASX: NAB) climbing 0.6% to $24.72.

International blood products giant CSL (ASX: CSL) returned to its winning ways with a 0.8% rise to $277.30 while dominant telco Telstra (ASX: TLS) rose 0.3% to $3.59.

Fire smoke reaches the share market

Smoke from Australia’s tragic bushfires also wafted on to the share market as insurance giant, Insurance Australia Group (ASX: IAG) said that it expected to pay around $400 million in insurance claims for the first half of the year.

That is a very big chunk of the owner of brands including NRMA and CGU given that its full year claim allocation is $641 million but the market remained confident of IAG’s ability to manage risk and claims and pushed its shares up 3c or 0.4% to $7.61.

Meanwhile, the Australian dollar has fallen back from recent five-month highs and is buying 69.60 US cents, from 70.01 US cents on Thursday.

The week ahead

As the New Year enters its second week there are some statistics that will let us know how the economy was ticking along near the end of 2019 that will be closely watched.

In Australia, there will be some big indicators retail trade, international trade, building approvals and quarterly job vacancies that should provide a bit more guidance about how our tepid economy ended the year.

It is a similar situation in the US with a range of statistics including jobs, international trade and factory orders.

Things are fairly quiet in China with the Caixin’s services gauge the highlight, although he continuing ramifications of the US missile strike in Iran and the US/China trade situation will continue to drive markets.