Weekly review: late sell-off as Australian share market closes in on all-time high

WEEKLY MARKET REPORT

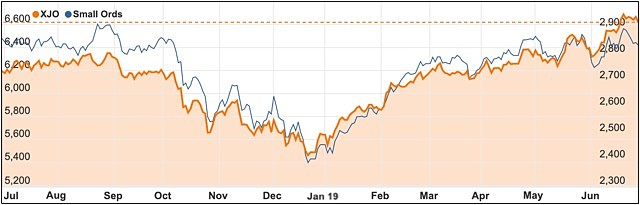

The ASX 200 continues to close in on its all-time highs at the pre-GFC peak of 6828.7 points.

Having started off the week strong, the market sold off late on Friday afternoon to close down 0.70% at 6618.8.

Over in the United States the Dow Jones is tinkering on potentially breaking through key technical resistance levels.

A larger move is expected in either direction in the near future, which is likely to be influenced by fundamental macro factors.

On the upside this may include a rate cut by the Federal Reserve, but to the downside, escalating geopolitical tensions with either China and the ongoing trade war, or an actual threat of war with Iran.

World leaders meet at G20 Summit

The G20 Summit is being held this weekend in Osaka, Japan.

Hosted by Japanese Prime Minister Shinzo Abe, representatives from 19 countries and the EU will converge on Osaka to discuss global issues including the economy, trade, investment, employment, women’s empowerment, the environment and energy and health.

However, it is expected the ongoing trade war between US President Donald Trump and China’s President Xi Jinping will dominate talks.

Market spectators believe if Trump and Jinping make little progress towards ending the trade war this weekend, finance markets could suffer, however a resolution is likely with both nations dependent on each other.

Trump’s meeting with Russia’s president Vladimir Putin will see the mainstream media in a frenzy with ongoing claims of election interference.

Despite no evidence to back these claims being presented for over three years now despite ongoing investigations and media hype, and complete disregard for the fact that the CIA does this all over the world on a daily basis meddling in foreign elections.

Bitcoin surge reinvigorates crypto market

The notorious cryptocurrency rose to the fore with investors again this week after the cryptocurrency pushed past US$11,000 to reach a high of US$13,796.5 on Wednesday, before sliding back late on Friday to US$11,182.8.

Helping to push Bitcoin to 12 months highs was Facebook’s announcement last week, with the social media giant revealing its own cryptocurrency ambitions via the launch of Libra.

The price of Bitcoin has surged 190% higher in 2019, with talks of the digital currency continuing its trajectory also on the rise.

Lenders target first home buyers with 40-year mortgages

Meanwhile, Australian homebuyers are being targeted to take up 40-year mortgages with their lenders.

The standard home loan repayment period in Australia is 30 years, but mortgage comparison website RateCity has revealed about six lenders on its site offer 40-year terms and first home buyers are their primary target.

A lower monthly repayment is what appeals to first homebuyers attempting to get a foothold in the market, but borrowers have been warned they can expect to pay much more interest over the longer term.

This comes at a time when billionaire hedge fund manager Ray Dalio is warning Australians of the “mini property bubble”.

New car sales continue fall

According to the Federal Chamber of Automotive Industries (FCAI), new car sales have continued to decline with new vehicle sales down 8.1% in May 2019 compared to the previous year.

FCAI chief executive officer Tony Weber said the May figures followed the same trend as the first five months of the year.

He attributed the downward trend to the economic slowdown, drought, political events, lack of confidence in the market and tightening of financial lending.

The new car sales market is also impacted by the rise in car-sharing services such as GoGet where one shared car can replace up to 10 private vehicles.

Household wealth rises

Despite gloomy talk about Australia’s economy, the Australian Bureau of Statistics reported this week that household wealth actually increased in the March quarter to $10.24 trillion – pushed by real gains on financial assets, mainly in the stock market, but offset by losses in residential real estate.

The growth comes after a 2.1% drop the December quarter, which fell after the September period recorded its highest ever household wealth figure of $10.42 trillion.

However, on a household wealth per person basis, it fell $1,500 for each individual.

Small cap stock action

The Small Ords followed the rest of the market this week to close in the red at 2,834.6 – down 1.45%.

ASX 200 vs Small Ords

Despite the blip, small cap companies were making headlines this week, including:

PNX Metals (ASX: PNX)

In a big week for mineral explorers PNX Metals was one stand out with news it had intersected wide, high-grade zinc and gold mineralisation during diamond drilling at the Iron Blow deposit within the Hayes Creek project in the Northern Territory.

PNX drilled three holes into the eastern and western lodes of the deposit, with results confirming the company’s geological model and unearthing mineralisation in both lodes.

The eastern lode returned 85.22m at 11.87% zinc, 4.19g/t gold, 309g/t silver, 1.94% lead, and 0.49% copper from 115.9m.

Over at the western lode, drilling intercepted 48.07m at 5.67% zinc, 2.45g/t gold and 90.6g/t silver from 230.3m; and 21.42m at 1.98g/t gold and 161g/t silver.

Impression Healthcare (ASX: IHL)

Impression Healthcare is a step closer to starting a world first trial using cannabidiol-based toothpaste and mouthwash to treat gum disease and gingivitis.

The company announced this week it had registered the trial with the Australian and New Zealand Clinical Trial Registry and that patient recruitment was scheduled to begin in August.

US-based AXIM Biotechnologies will manufacture the CBD formulation for the phase 2a randomised clinical trial, which will evaluate the safety and efficacy of the CBD-based mouthwash and toothpaste on 40 people suffering from gingivitis and gum disease.

Impression is confident the trial will generate peer-reviewed data to enable sales of the products via Australia’s special access scheme and development of further products in this space for commercialisation.

The company followed up the trial news with an announcement on Friday it would supply the Gameday FitGuard impact monitoring mouthguard and platform to Boxing Australia.

Boxing Australia will use the head impact technology to monitor boxers in training and in competition and will promote the mouthguards across its public mediums.

Additionally, Impression will partner with Boxing Australia to research the impact of CBD oil to remediate concussion and traumatic brain injury.

Eden Innovations (ASX: EDE)

Eden Innovations had a win this week when Colorado’s City of Denver Public Works Department mandated Eden’s proprietary EdenCrete carbon-strengthened concrete additive to be used in a new project at the Evergreen Golf Club.

The city department mandated EdenCrete by incorporated in the gold course’s new cart building slab and surrounding apron work.

This latest mandate follows Eden reporting “significant” year-on-year growth in demand for its project within Colorado.

Eden also said uptake for its EdenCrete product had increased in Utah as well as Georgia and Texas, with the company anticipating rising sales throughout the US in the coming months.

Winchester Energy (ASX: WEL)

Winchester Energy continued its positive news flow momentum after the company reported it was preparing its White Hat 20#3 oil and gas well for gas sales after “outstanding” continued production rates.

The company noted it had achieved initial gross production over 30 days (IP30) of 259 barrels of oil per day from the well, which is in Texas’ Permian Basin.

As well as oil, the well has been flowing gas at 100,000-140,000 cubic feet per day – equating to 17-23bpd of oil equivalent.

As part of its ongoing exploration in the Permian Basin, Winchester said it was gearing up to start drilling a well on the Lightning prospect within its Arledge oil lease.

The Arledge 16#2 well is scheduled for spudding in July.

Leigh Creek Energy (ASX: LCK)

After hailing its syngas pre-commercial demonstration plant a “great success”, emerging gas developer Leigh Creek Energy has completed decommissioning of the South Australian plant.

The plant helped Leigh Creek prove synthesis gas “syngas” could be produced at commercial levels via in-situ gasification, which involves converting coal to gas.

As part of the plant’s decommissioning, Leigh Creek said its monitoring regime had started with no reported environmental impact or safety issues.

Leigh Creek is currently progressing commercial talks with potential joint venture partners and gas sale customers as it moves to its next phase of monetising its large gas reserve.

Bubs Australia (ASX: BUB)

Bubs Australia has executed a strategic partnership with China’s premier baby retailer Kidswant, which held an event at its headquarters to formalise the agreement.

The partnership with Kidswant is the first major project under the Bubs and Beingmate joint venture which was established last month.

Kidswant has 275 physical stores across 60% of China’s urban areas and under the partnership, Bubs organic food products are now available throughout the stores.

“The cooperation with Kidswant is the most important project that has been signed and implemented since the establishment of our joint venture company with Bubs,” Beingmate chief executive officer Xiufei Bao said.

Sandfire Resources (ASX: SFR) and MOD Resources (ASX: MOD)

MOD Resources has succumbed to Sandfire’s takeover advances, with the Botswana explorer finally agreeing to Sandfire’s latest offer that values MOD at $167 million.

This latest bid follows Sandfire’s first offer that valued MOD at $94.5 million and was rejected, with MOD claiming it “significantly undervalued” the company and its assets including the T3 copper project in Botswana.

In this new offer, MOD managing director Julian Hanna said Sandfire’s bid was “compelling” for MOD shareholders, who will benefit from Sandfire’s platform to take T3 into production.

“We see this partnership as providing the opportunity to maximise value from T3, which can be funded from Sandfire’s balance sheet and cash flows,” Mr Hanna said.

Jervois Mining (ASX: JRV)

It was another big news week for Jervois Mining, which recently merged with M2 Cobalt, with the company reporting it was already on the ground advancing the Ugandan assets it acquired through the merger.

Drilling is underway at the Bujagali project, with the program targeting the Bombo nickel, cobalt and copper and Waragi copper and cobalt anomalies.

At the Kilembe project, Jervois is completing grid soil sampling across the Eagle and Senator prospects where previous rock chips have assayed up to 37.8% copper and 18.2g/t gold.

A second merger is due for completion next month, this one with eCobalt Solutions and Jervois has kicked-off a $15 million equity raising.

The company reported on Friday the capital raising was oversubscribed and that it had secured $16.5 million at an 8% premium ($0.20 per share) to its closing price on Thursday of $0.185 – boosted by strong demand from current and new institutional investors.

Once eCobalt has been absorbed into Jervois, the company will be the world’s third largest cobalt company, with eCobalt bringing to the combined entity its Idaho cobalt project.

The week ahead

Markets will be responding to any significant developments from the G20 meeting over the weekend.

Trade balance numbers are out here in Australia on Monday, however the big news to look out for will be the Reserve Bank of Australia’s decision on interest rates on Tuesday.

The RBA, having cut rates by 25 basis points to 1.25% last month, which was the first time rates were changed in over 33 consecutive months, may cut rates further as Australia’s economy is showing clear signs of struggle.

Many analysts are predicting that we will see another rate cut, if not next week, soon on the horizon to take the official cash rate to 1%.

Retail data for May will be announced on Thursday. A slight bounce is forecast, following -0.1% sales decline in April.

Manufacturing numbers are due next week from both China and the United States, which may be telling as to where the trade war heads to next.

The US also has payroll numbers and balance of trade data out.