Weekly review: dovish central banks drive markets higher

WEEKLY MARKET REPORT

The tug of war between dovish central banks and a potential economic slowdown down the track continued to rage on the share market with the doves winning the day and the week.

The ASX 200 index ended the week up 20 points, or 0.3%, to 6195.2 points after the US Federal Reserve decided to take the rest of the year off and not change interest rates at all.

When you think about it that is the classic good news/bad news conundrum – on the one hand the easy money policies that have driven the long bull run are back and boosting stocks, but on the other hand economic growth is spluttering and faltering so much that central banks are getting worried.

Well, markets had a good think about it and decided to run with the good news but maybe not as hard as they would have in the past.

Miners on the rise

Certainly, the big miners were strong with BHP (ASX: BHP) up 3% for the week and Rio Tinto (ASX: RIO) and Newcrest Mining (ASX: NCM) both up 2.7%.

The banks were stronger too as the ASX 200 rose 28 points or 0.5% for the day, with most of the big banks adding around 0.5% with Westpac (ASX: WBC) outperforming with a 0.7% rise.

Healthcare stocks were strong as well with global blood products and vaccines giant CSL (ASX: CSL) up 1.5% to $197.19.

Estia Health (ASX: EHE) kept its strong run intact, jumping an impressive 17.3% to $2.85 this week, after chief executive officer Ian Thorley snapped up a further 50,000 shares in the company on market recently.

Some bad news as well

It wasn’t all great news though, with Eclipx Group (ASX: ECX) rising slightly on Friday but not enough to overcome the fact that it has shed more than half of its market value this week.

Since the previous Friday, Eclipx has lost more than $300 million of market value as its shares fell 60.5% to $0.74.

Shareholders have been warned that its financial performance has deteriorated markedly and it now looking at possibly selling Grays and Right2Drive, which it only bought in the past three years.

Another company that disappointed investors was coal exporter New Hope Corp (ASX: NHC) with its half-year results leading to a 26.3% share fall to $3.25 after the company said China’s shipment squeeze on Australia was putting downward pressure on prices in all of the Pacific markets.

Guru selling down his own company

Another really interesting move on the Australian market was top fund manager Kerr Neilson and his wife Judith Neilson who sold a $300 million stake in the company they founded, Platinum Asset Management (ASX: PTM).

The sale took the pair below 50% ownership of the company for the first time.

At the time they sold Platinum had been trading at $5.50 a share and the stock was sold at a 9% discount price of $5, but by the end of the week, that looked like a good price with the stock dropping to $4.86.

Small cap stock action

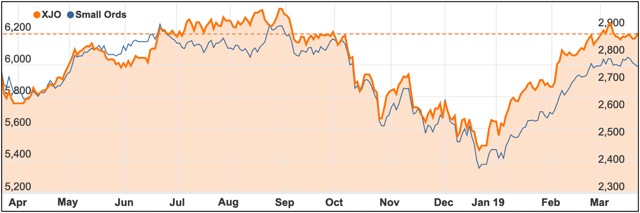

The Small Ords finished the week down 1.2% to close at 2,762.7 points. One of the few weekly closes in the red having made strong gains in 2019.

ASX 200 vs Small Ords

Among the companies making headlines this week were:

Impression Healthcare (ASX: IHL)

Impression Healthcare will work with Australia’s largest medical cannabis clinic network Cannvalate under a new deal.

Cannvalate will purchase and distribute Impression’s licenced medical cannabis products throughout its network of more than 1,000 prescribing doctors and 600 pharmacies.

Additionally, Cannvalate will provide the majority of funds needed for four proposed medical cannabis clinical trials including: studying the impact of synthetic CBD oil on traumatic brain injury and neuro-cognitive function, dronabinol on obstructive sleep apnoea, CBD chewing gum on severe gum disease, and CBD oil on temporomandibulor joint disease (TMJ).

Impression chief executive officer Joel Latham said the new partnership gave Impression the leverage to open new markets within the medicinal cannabis sector.

Alt Resources (ASX: ARS)

Gold explorer Alt Resources plans to bring the historic Bottle Creek gold mine in WA back online within two years.

During its 18-months of operation, Bottle Creek produced 93,000oz gold from two shallow open pits.

Alt is looking to develop a 500,000tpa plant at the site with the asset projected to have an initial eight-year mine life.

Stage one pit optimisation work has been carried out on Emu and Southwark deposits and indicates Alt could extract 74,000oz gold and 215,000oz silver from these targets.

Emerge Gaming (ASX: EM1), iCandy Interactive (ASX: ICI), Fatfish Blockchain (ASX: FFG)

Fatfish Blockchain’s investee iCandy Interactive and Emerge Gaming have teamed up to take on the mobile eSports market.

The joint venture paves the way for the duo to collaborate using Emerge Gaming’s technology and iCandy’s content to create a new eSports business with a co-developed ArcadeX Platform branded iLeague.

It is envisaged iLeague will become a mobile eSports tournament platform and marketed to an international audience – with the goal of boosting user acquisition for both companies and, as a result, increased revenue.

“Our vision is to become a leading mobile casual gaming eSports provider worldwide,” Emerge Gaming chief executive officer Gregory Stevens said.

Meteoric Resources (ASX: MEI)

Cobalt explorer Meteoric Resources launched into the gold space this week with news it has entered an agreement to acquire the Juruena and Novo Astro projects in Brazil’s prime gold territory the Alta Floresta Belt.

Meteoric managing director Dr Andrew Tunks told Small Caps he had scrutinised many potential projects around the world before deciding on Juruena and Novo Astro.

Previous exploration at Juruena has unearthed up to 1m at 1,992g/t gold and the project has a resource of 1.3Mt at 6.3g/t gold for 261,000oz gold.

Once the $3 million acquisition has been completed, Meteoric plans to hit the ground running with immediate work to include reviewing exploration data, building 3D models and identifying priority drill targets.

Alcidion Group (ASX: ALC)

Alcidion Group has secured its first major contract outside of Australia after winning a major deal with the UK’s Dartford and Gravesham NHS Trust.

Under the agreement, Alcidion will roll-out its Miya Precision platform integrated with Smartpage and Patientrack across the Trust’s wards.

Alcidion’s technology opens the door for electronic patient observations, electronic charts, clinical assessments and notes, patient flow, bed management and electronic discharge summaries.

Only a few days later, Alcidion reported it had added Brighton and Sussex University Hospitals NHS Trust to its UK clientele after the hospitals contracted Alcidion’s Patientrack technology.

First Au (ASX: FAU)

Another gold explorer with news this week was First Au with an announcement it had made a significant lode discovery at its Gimlet project near Kalgoorlie.

Notable drilling assays were 3m at 4g/t gold from 48m; 4m at 2.9g/t gold from 98m; 15m at 7.2g/t gold from 93m, including 2m at 16.4g/t gold from 101m, and 2m at 17.4g/t gold.

Mineralisation has now been identified over 440m of strike and First Au is focused on calculating a JORC resource.

First Au followed up its drilling success by lodging a mining lease application over the Gimlet mineralised zone later in the week.

Cann Group (ASX: CAN)

Pot stock Cann Group has altered its expansion plans and selected a site for its large-scale greenhouse in north-west Victoria’s Mildura region, as opposed to the original site at Melbourne’s Tullamarine Airport.

Cann Group has inked an agreement to purchase the Mildura site for $10.75 million and expects to construct a $130 million facility that can produce about 50,000kg per annum of dry cannabis flower.

“The Mildura site offers other important advantages, including a lower total build cost and lower ongoing operating costs, due to the dryer climate and higher sunlight hours resulting in reduced power use,” Cann chief executive officer Peter Crock explained.

Cann Group also secured an offtake agreement with one of the world’s fastest growing and largest cannabis companies Aurora Cannabis, where Cann will supply dry flower, extracted resin and medicinal cannabis products until 2024.

Tando Resources (ASX: TNO)

Large-scale test work has led to Tando Resources generating a 2.2% vanadium concentrate from its SPD project in South Africa, which Tando claims is one of the highest-grade vanadium concentrates reported globally.

Bulk samples of SPD ore were treated using Tando’s proposed flowsheet and processing route and compared well with previous laboratory scale Davis Tube tests, which returned notable assays of 25m at 2.42% vanadium from 23m, including 8m at 2.32% vanadium (for mass recovery of 41%) and 35m at 2.15% vanadium from 21m (mass recovery 45%).

Additionally, SPD’s entire vanadium content reports to the magnetic concentrate.

“Therefore, the test work results also provide confirmation that whole rock assay results reported by the company are representative of the recoverable vanadium content across the project,” the company stated.

Kingsgate Consolidated (ASX: KCN)

Beleaguered former gold miner Kingsgate Consolidated has had a win after the NSW Supreme Court awarded it more than $82 million in damages following a lawsuit against its political risk insurers.

The Thailand Government illegally expropriated Kingsgate’s Chatree gold mine in 2016 and Kingsgate’s subsequent claim to the insurers under a political risk policy was denied.

With the court awarding in Kingsgate’s favour, the insurers will hand over $77 million in cash to Kingsgate by mid-April and a further $4.93 million contribution to the Thailand-Australia Free Trade Agreement. This will also be paid to Kingsgate on a pro-rata basis.

Kingsgate executive chairman Ross Smyth-Kirk said the settlement had been a long time coming.

Fluence Corporation (ASX: FLC)

Wastewater treatment company Fluence Corporation has secured a contract to design and build a desalination plant that will service up to 250,000 people in Egypt.

The contract was awarded to Fluence’s Egyptian joint venture and is valued at US$74 million and the completed plant will be ready to support New Mansoura city’s water needs within about 18-months.

Meanwhile, Fluence also launched its SUBRE submerged membrane aerated biofilm reactor (MABR) solution to global markets, which will be available as a retrofit upgrade and as a new greenfield plant.

Fluence has already clinched its first orders for the solution, which will see it installed in two new housing developments in Jamaica.

The week ahead

We are in for one of those weeks when offshore announcements have the greatest chance of moving markets.

Key US economic growth and inflation measures out on Thursday will give some perspective on the US Fed’s decision to effectively take interest rate rises off the table this year and to keep its balance sheet much larger than previously planned.

There might be some news out of China as well with industrial profit data out for January and February.

Back in Australia, in the lead up to the budget, there will be no doubt be plenty of spending promises being made and there will also be some releases on consumer sentiment and job vacancies.