Weekly review: Chinese growth pushes ASX to new record high

WEEKLY MARKET REPORT

Once again China has come riding to the rescue of the Australian share market, with good news on continuing growth and a potential end to the US/China trade war pushing the market to a new record.

As you might expect the steady 6.1% of Chinese growth in 2019 pushed the shares of Australia’s big iron ore miners higher as investors contemplated another year of strong demand from Australia’s biggest trading partner.

In the end, the ASX 200 added 0.3% or 22.3 points to close at 7064.1 on Friday, producing a 1.9% rise for the week and a 5.7% jump so far this year.

Iron ore shares drive the market higher

Rio Tinto (ASX: RIO) rallied an impressive 1.8% to $105.24 after a pleasing quarterly production report, while Pilbara iron ore neighbour BHP (ASX: BHP) added 1.2% to $40.60.

The third force in iron ore – Fortescue Metals (ASX: FMG) – was even more impressive, hitting a new record high of $11.41 after pushing 3.7% higher.

Lithium-tantalum producer Pilbara Minerals (ASX: PLS) put in a large spurt, recovering 8.6% to $0.38 after heavy falls earlier in the week.

Chinese data shows a more mature global player

The most exciting part of the Chinese data was that growth had begun to accelerate near the end of 2019 with industrial output, retail sales and fixed asset investment all stronger than expected.

While the big miners had a turn to lead to market higher into record territory after it had earlier pushed through the 7000 point barrier with ease on Thursday, there was plenty of strength in other sectors with consumer staples up 1%, and even the early rally leaders of healthcare (up 0.1%) and information technology (up 0.4%) still hitting fresh highs.

The slowdown of the Chinese economy in 2019 wasn’t as bad as expected given the headwind of the US-China trade war, a headwind that may not be around in 2020 as the phase one trade deal with the US represents a truce at worse and a lasting solution at best.

The figures also showed the continuing maturation of the Chinese economy with slowing growth still representing a massive opportunity given that the Chinese economy is so much bigger than the days when China was growing at double digit rates but was much smaller.

That maturation was also shown by increasing domestic activity with net exports accounting for 11% of growth with consumption taking the lion’s share of 57.8% and capital formation 31.2% of growth.

Small cap stock action

The Small Ords index rallied 2.42% to close on 3061.5 points.

ASX 200 vs Small Ords

Small cap companies making headlines this week were:

Kalamazoo Resources (ASX: KZR)

After the high-grade 1,916g/t gold discovery at its Victorian Castlemaine project in December last year, Kalamazoo Resources attracted the interest of renowned billionaire gold investor Eric Sprott and explorer Novo Resources.

The duo became cornerstone investors, and each subscribed for 10 million Kalamazoo shares at $0.40.

Combined, the investment totals $8 million and Novo’s president and chairman Dr Quinton Hennigh will also be appointed to Kalamazoo’s technical advisory committee.

The excitement about Kalamazoo’s discovery is its similarity and proximity to Kirkland Lake Resources’ high-grade Fosterville gold mine about 45km away.

Galan Lithium (ASX: GLN)

It was a big news week for Argentinian lithium brine explorer Galan Lithium, with the company revealing high-grade assays for two targets within the Western Tenements of its Hombre Muerto project.

On Monday, Galan reported “exceptional” lithium brine grades of 670m at 946mg/l lithium at Pata Pila, with managing director Juan Pablo Vargas de la Vega stating he was “delighted” with the results.

A few days later, Galan unveiled its “remarkable” assays from the Rana de Sal licence.

A 72-hour air lift test sample from the licence identified 330m at 1,010mg/l of lithium.

Samples from both licences were also “very low” in impurities.

Again, Mr Vargas de la Vega said he was “delighted” with the results, adding the company was “excited” as the results indicate the project could be as important as the company’s more advanced flagship Candelas asset.

Apollo Minerals (ASX: AON)

Apollo Minerals has discovered new zones of high-grade zinc and lead mineralisation at the Kroussou project in Africa after a recent surface exploration program.

Geological mapping, rock chip and soil sampling were carried out late last year across the Dignali, Ofoubou and Niamabimbou targets.

At Niamabimbou, 75 rock chips were collected and returned up to 20.16% zinc-lead.

Meanwhile, mapping pinpointed new wide mineralised zones for follow up exploration.

Alt Resources (ASX: ARS)

Drilling at Alt Resources Shepherd’s Bush prospect at the Mt Ida project has unearthed numerous thick zones of gold mineralisation.

Alt said the style of mineralisation was amenable to a potential bulk-tonnage style operation.

Better intercepts from the follow up 18-hole for 1,960m drilling program were 104m at 1g/t gold from 32m, including 22m at 2.96g/t gold, 2m at 8.34g/t gold and 5m at 9.15g/t gold.

Other highlight results were 77m at 1.11g/t gold from 13m, including 12m at 3.6g/t gold and 2m at 14.75g/t gold; and 69m at 1.02g/t gold from 55m, including 16m at 1.5g/t gold.

The results, along with those from the previous drilling program, will be incorporated in a maiden resource for the prospect which is scheduled to be released before the end of the current quarter.

Lithium Australia (ASX: LIT)

Lithium Australia is a step closer to locking-in patents for its proprietary lithium phosphate process with the International Bureau of the World Intellectual Property Organisation publishing two of the company’s applications for the process this week.

Publication of the patent applications represents the fourth step in the seven-step process towards receiving the full grant, which will provide the company with international legal protection for its IP.

Lithium Australia’s technologies aim to enhance sustainability and reduce the environmental impact associated with manufacture, use and disposal of lithium-ion batteries.

The company’s technologies include SiLeach® and LieNA®, which are ultimately used to generate lithium cathode materials from feedstock generally deemed as waste.

“These technologies can facilitate vertical integration within the battery supply chain, potentially reducing the number of process steps involved and lowering costs for consumers,” Lithium Australia managing director Adrian Griffin said.

“The ability to integrate metal recovery from lithium-ion batteries and regenerate cathode materials represents a major advance for the battery industry as a whole,” he added.

Sezzle Inc (ASX: SZL)

US-based alternative payments company Sezzle has received formal approval from the California Department of Business Oversight for its lending licence in the state.

Prior to receiving the licence, Sezzle operated in the state under a retail instalment structure. This meant retailers initiated the instalment loan and transferred it to Sezzle.

Now, Sezzle is licenced to lend directly – enabling the company to continue its planned growth strategy in the region.

Sezzle works by offering interest-free instalment plans at online stores and had more than 7,500 active merchants onboard by the end of September last year.

ASX floats this week

Small Caps readers who want to view upcoming IPOs or see the performance of stocks that have listed in 2020 can now do so.

The latest company to make its way onto the ASX this week was:

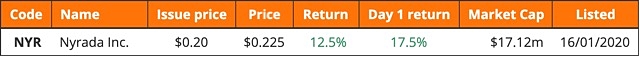

Nyrada Inc (ASX: NYR)

Noxopharm spin-off Nyrada Inc debuted on the ASX this week after raising $8.5 million in its IPO via the issue of 42.5 million CDIs at $0.20 each.

Early stage drug company Nyrada now owns Noxopharm’s non-oncology drug assets and technology.

The company specialises in discovery and development of treatments for cardiovascular, neurological and chronic inflammatory disease, with two leading research and development programs including cholesterol-lowering drug NYX-330 and neuroprotectant NYX-242.

A third drug being advanced is anti-inflammatory NYX-205 for treating neuropathic pain such as sciatica.

IPO funds will be used to accelerate development of the three drugs, with the objective of at least one drug candidate undergoing a phase I human safety, tolerability and pharmacokinetic study by the end of next year.

By the end of the week, Nyrada’s shares closed at $0.225 – up 12.5% on its IPO price.

The week ahead

US corporate earnings look set to dominate the coming week as a string of financial results are released to an expectant market.

There are sure to be some disappointments and some highlights from companies that “beat the street’’, but as the results accumulate a theme will develop which will be important in setting the direction for the US market and, by extension, global markets.

It looks set to be a quiet week in Australian economic data with consumer sentiment, household spending expectations and employment data dominating the list of scheduled releases.

China’s central bank, the People’s Bank of China, will announce its monthly loan prime rate on Monday which will provide further insight into how China’s policy of providing economic stimulus is progressing.