Central banks might be cutting interest rates and governments are arguing over tariffs but all of that gloom only added to the buying pressure before the Queen’s Birthday long weekend.

With even the Reserve Bank now agreeing that interest rates are set to stay low and trending lower, the hunt for higher yields was on across the share market with all sectors bar the consumer discretionary stocks joining the party.

Almost every sector on the Australian share market ended up higher as a rally sent the ASX 200 up 60.9 points, or 1%, to 6443.9 points.

There were some hefty gains right across the market before it closed for a three-day break.

Heavyweight miner BHP Group (ASX: BHP) was up a very solid 2.1%, Macquarie (ASX: MQG) jumped 1.7% and CSL (ASX: CSL) added 1.5%.

There were some even bigger gains at the smaller end with GrainCorp (ASX: GNC) up 6% and Magellan Financial Group (ASX: MFG) up 4.6%.

Oil market finally bounces

One of the big factors behind the market rise was a rally in the oil price after Russian President Vladimir Putin said his country had differences with OPEC over what was a fair price for oil.

Woodside Petroleum (ASX: WPL) was up 1.7% to $34.64 and Santos (ASX: STO) was up 1% to $6.79.

There was plenty of company news around too with shares in roller coaster stock Marley Spoon (ASX: MMM) flying up 68% to $0.74 after the meal kit company signed a $30 million deal with supermarket giant Woolworths (ASX: WOW), which closed up a more sedate 0.6% to $31.51.

It is not too hard to see the strategy behind this deal with Woolworths able to expand its range of fast selling prepared meal kits while Marley Spoon gets access to a massive consumer market.

Such a big rise will be welcome for Marley Spoon investors but is still a far cry from previous trading levels above $1.

Vicinity Centres (ASX: VCX) shares closed up 0.4% to $2.61 after it reported that a professional valuation of its 62 retail properties has sliced its portfolio value by 1.3% or $202 million.

That was obviously a smaller valuation haircut than the market was expecting.

Telstra continues to swing the axe

Telstra (ASX: TLS) has trimmed the fat some more as it moves towards its T22 transformation plan.

The telco giant revealed this week that 10,000 contractors were due to be laid off from its workforce over the next two years.

This figure does not include the further 8,000 permanent jobs set to be eliminated under the T22 plan.

With a saturated market and limited growth opportunities mergers and acquisitions followed by cost cutting seems the only way forward.

Gold glitters

With central banks cutting rates and the economy looking dim, gold shined in its role as a safe haven asset.

The precious metal reaching all time highs to be trading over $1,900 per ounce in AUD.

With global production set to fall after an anticipated record production year in 2019, the stars appear to be aligning for gold.

Small cap stock action

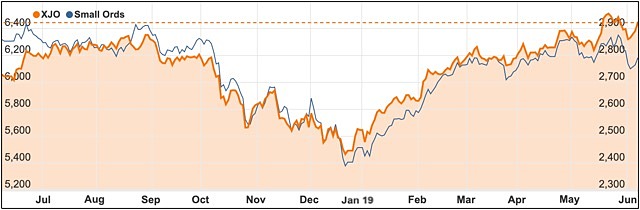

The Small Ords index bounced this week, up 0.78% to close on 2,790.3 points.

Among the companies making headlines this week were:

Creso Pharma (ASX: CPH)

TSXV-listed medicinal cannabis entity PharmaCielo has launched a takeover offer for Creso Pharma, which Creso’s board has unanimously backed and values the company at A$122 million.

The share and option scheme offer equates to A$0.63 per Creso share – representing a 50% premium to Creso’s closing price on Thursday of $0.42.

Creso shareholders will hold about 13% of the merged entity once the deal has been completed.

The rationale for the takeover is to create an entity with an expanded medicinal cannabis product offering and global distribution channels.

Impression Healthcare (ASX: IHL)

Impression Healthcare had a big news week including a deal to supply Force Impact Technologies’ FitGuard mouthguard system to customers in Australian, New Zealand and Hong Kong.

The system includes a custom-fitted mouthguard which measures cranial acceleration in athletes, while an app and cloud monitory and track impact history and cognitive performance.

Meanwhile, Impression inked an agreement with AXIM Biotechnologies to supply its cannabidiol-based toothpaste and mouthwash products.

The products have been designed to treat gum disease which affects around 20% of Australians and is rising due to poor dietary habits and dental hygiene.

Neurotech (ASX: NTI)

Neurotech has debuted a pilot virtual clinic which enables doctors to interact with autism patients and their carers and monitor progress remotely.

The online clinic has been designed for patients and carers to make video conferencing appointments with doctors.

Neurotech has created the world’s first home-based complementary therapy for autism sufferers and is clinically proven to increase engagement and relaxation in autistic children.

The lightweight Mente device is wireless and was made to reduce excessive activations of low and high frequency brainwaves, which have been observed in people with learning difficulties and neurodevelopmental disorders.

Predictive Discovery (ASX: PDI)

West Africa gold explorer Predictive Discovery revealed drilling had exceeded expectations at the Ouarigue South prospect at its Ferkessedougou North project in Cote D’Ivoire.

Drilling unearthed notable intersections of 45.3m at 3.16g/t gold from 45.9m, including 9m at 10.31g/t gold; 45m at 1.52g/t gold from 42.1m; and 59.7m at 1.35g/t gold from 49.5m, including 4.5m at 5.83g/t gold.

Predictive expects the results are from an orebody that is 100m wide and 210m long.

The company anticipates deeper drilling along strike to the south may generate higher gold grade.

Paradigm Biopharmaceuticals (ASX: PAR)

After a phase 2a clinical trial, Paradigm Biopharmaceuticals has reported its injectable pentosan polysulfate sodium (iPPS) drug resulted in “near remission” of symptoms for Ross River virus sufferers.

The company revealed that at the three-month follow-up, 72.7% of sufferers that were treated with iPPS displayed “near remission” of Ross River virus induced arthralgia (joint pain or stiffness). This compares to 14.3% in the placebo group.

Additionally, the trial demonstrated the safety of iPPS in Ross River virus patients, with no clinical differences seen in those receiving iPPS compared to those with a placebo.

“We are very pleased to see that this small pilot Ross River virus study has yielded very promising safety data and key efficacy outcomes in the reduction of disease symptoms in this debilitating chronic phase of the disease,” Paradigm chief executive officer Paul Rennie said.

Fremont Petroleum (ASX: FPL)

Oil and gas explorer Fremont Petroleum made news this week after reporting it had hit crude oil while drilling the Amerigo Vespucci #1 well in Colorado, US.

Fremont said it had removed all 199 joints of drill string used to drill the well to its 5,977ft depth and noted that 154 of the strings were “covered in crude oil”.

According to the company, this indicates drilling has intersected a significant fracture network that is producing crude oil under pressure and then liberating it into the wellbore.

Due to the “substantial” amount of oil, Fremont will deploy logging tools to firm up the zones where the oil originated.

King Island Scheelite (ASX: KIS)

Tungsten developer King Island Scheelite released an updated feasibility study and mineral reserve estimate for its Dolphin open cut tungsten project on Tasmania’s King Island.

The updated study estimates the project has a base net present value of $146 million and a 47% internal rate of return.

King Island is looking to commission an eight-year open cut mine that would process 400,000tpa to generate 3,500tpa of tungsten oxide concentrate.

“The impressive indicative economics reiterate that we have chosen to develop the right project with the right commodity in the right place and time,” King Island chairman Johann Jacobs said.

Woolworths Group (ASX: WOW), Marley Spoon (ASX: MMM)

Woolworths Group is delving into the subscription-based meal kit space after agreeing to invest more than $30 million in Marley Spoon via structured debt and equity.

As part of the investment, the companies will work together to expand Marley Spoon’s brands in Australia.

Initially a five-year partnership, Marley Spoon expects to benefit from Woolworths’ industry experience and large engaged consumer base.

Meal kit provider Marley Spoon is targeting profitability by 2020 and hopes to secure a large slice of the food and grocery eCommerce market which is purportedly worth more than $5,000 billion.

ASX floats this week

Small Caps readers who want to view upcoming IPOs or see the performance of stocks that have listed in 2019 can now do so.

The latest companies to make their way onto the ASX this week were:

Viva Leisure (ASX: VVA)

Health club owner Viva Leisure debuted on the ASX on Friday after raising $20 million via the issue of 20 million shares at $1 each.

According to the company’s chief executive officer and managing director Harry Konstantinou, Viva Leisure is the first dedicated health club operator to list on the ASX.

The company operates in 33 different locations across Australia, with IPO funds to primarily go towards expansion opportunities.

Viva Leisure opened its first day of trade at $1.145 before dipping to close at $1.08 – an 8% premium to the offer price.

Renergen (ASX: RLT)

Emerging liquid helium and LNG producer Renergen listed on the ASX this week after raising $10 million.

The ASX-listing is the company’s secondary listing and involved the issue of 12.5 million CDIs at $0.8 each.

Renergen is developing South Africa’s first commercial LNG project, which also has one of the highest helium concentrations recorded worldwide.

The company’s IPO funds will finance drilling of additional production wells in Tetra4’s proven gas reserves, with the aim of producing gas to operate the new plant at the LNG and helium project.

Renergen closed out its first week on the ASX at $1.00 – up 25% on the offer price.

PKS Holdings (ASX: PKS)

Healthcare technology company PKS Holdings raised $20.9 million in an oversubscribed IPO and listed with a market cap of $24.2 million and 121.141 fully paid ordinary shares on issue.

The company has developed a proprietary clinical decision support system called RippleDown, which automates decision making processes in healthcare organisations.

PKS will use IPO proceeds to purchase DPP Holdings and hire additional human resources to execute the company’s growth plans.

The company finished its first week on the ASX at $0.18 – down 10% on its IPO price of $0.20.

The week ahead

Following the Queen’s Birthday public holiday on Monday in which the ASX is closed, the big announcement to watch out for is the May employment report on Thursday.

Given that the Reserve Bank Governor Dr Philip Lowe has been focussed on employment figures as the key for setting the future level of interest rates, a weak result would heighten the chance that the RBA would cut again from the current official cash rate of 1.25%.

There are also a series of business and consumer surveys which will hopefully reveal a bit of a bounce following the surprise Federal Election result.

Overseas, there is a range of Chinese economic data on trade, inflation and May activity while in the US the big releases to watch out for are inflation, industrial production and retail spending figures.