Weekly review: Australian shares smashed by bad news

WEEKLY MARKET REPORT

Australian shares were smashed down to a two year low on the back of a rash of unfavourable news that saw the ASX 200 index fall 2.4% to 5467.6 this week.

The departure of Donald Trump’s defence secretary, James Mattis, was just one of a number of negatives that finally pulled the rug out from the Australian market’s remaining resistance to weak offshore leads.

Also weighing on the market is continuing uncertainty around the US interest rate policy, China’s slowdown and difficulties negotiating a trade deal with the US, a looming US Government shutdown and a range of US corporate problems.

Banks hit by higher interest rates

The major banks were particularly hard hit as the US Federal Reserve’s rate hike pushed up their cost of funds and slammed global markets:

– ANZ (ASX: ANZ) was the worst of a bad bunch, down 6% to $23.30,

– Westpac (ASX: WBC) lost 4.2% to $23.83,

– NAB (ASX: NAB) lost 1.08% to $22.84 after a horror week in which shareholders voted heavily against its remuneration report,

– Commonwealth Bank (ASX: CBA) slid 0.5% to $68.48,

– investment bank Macquarie (ASX: MQG) slid 2.3% to $104.82.

There was precious little respite anywhere on our share market with Insurance shares crunched heavily by the damage reports rolling in from Sydney’s hail storms and slumping oil prices were also unforgiving for local oil and gas stocks.

Not many winners except gold

One rare beneficiary of the global sell-off was shares in gold miners which rose strongly in harmony with a strengthening gold price, currently at US$1,255.6 per ounce.

With fear and uncertainty on the horizon investors made their way into gold stocks:

– Newcrest Mining (ASX: NCM) was up 2% to $21.26,

– Northern Star Resources (ASX: NST) climbed 10.4% to $8.91,

– Evolution Mining (ASX: EVN) lifted 7.3% to $3.53,

– Regis Resources (ASX: RRL) advanced 10% to $4.63,

– St Barbara (ASX: SBM) closed the week 7.3% higher at $4.54 and

– Resolute Mining (ASX: RSG) ended the week’s trade at $1.17, up 10.4%.

I feel better now

Another small ray of sunshine in an otherwise bleak market was Medibank Private (ASX: MPL), with its shares up 6.9% to $2.49.

The rose followed a Federal Court decision to dismiss an appeal by the ACCC and found that Medibank had not misled customers about their out-of-pocket health insurance costs.

The ACCC first took the company to court in June 2016, alleging the insurer had engaged in misleading and deceptive conduct.

Small Cap stock action

The Small Cap index took a battering this week, down 6.06%, to close at 2389.9 points.

ASX 200 vs Small Cap index

Despite the overall slump, numerous companies made progress on a fundamental front:

Authorised Investment Fund (ASX: AIY)

Pooled development fund Authorised Investment Fund had a big week with two of its investees reporting market and sales growth.

Authorised Investment’s investee Aenea Cosmetics secured a global digital distribution partnership to boost its exposure and sales in the US$16.31 billion epigenetics market.

Aenea’s epigenetics products can externally modify an individual’s DNA without altering the code. The skin products are designed to combat aging from pollution, UV radiation, stress and unhealthy life-style habits such as drinking and smoking.

Authorised Investment’s other investee Asian Integrated Media launched its digital advertising company Travel Elite into China.

Asian Integrated Media has gained access to China’s programmatic advertising industry, which is usually closed-off to outsiders like Google.

Shares in Authorised Investment Fund started the week at $0.029 and finished up 140% at $0.07.

Northern Cobalt (ASX: N27)

Cobalt explorer Northern Cobalt has ventured into the booming vanadium space after reporting it had acquired the Snettisham project tin Alaska.

Snettisham was a low-cost acquisition requiring Northern Cobalt to merely peg-up the ground. The project was previously subject to iron ore exploration, but a review of historical data revealed high-levels of vanadium.

Northern Cobalt will carry out a drone-based, low-level magnetic survey across the entire project.

In the new year, Northern Cobalt will then review the data and undertake detailed modelling to firm up drill targets for testing before mid-2019.

Paradigm Biopharmaceuticals (ASX: PAR)

A phase 2b clinical trial has confirmed the potential of Paradigm Biopharmaceutical’s injectable pentosan polysulfate sodium (iPPS) drug in treating knee osteoarthritis pain.

The phase 2b trial took a little over 12 months to complete and involved 112 patients – generating “clinically meaningful and statistically significant results” compared to a placebo.

Results from the trial have been consistent with those reported by 183 patients who’ve been treated with iPPS under the Therapeutic Goods Administration’s Special Access Scheme.

Paradigm plans to kick-off the phase 3 clinical trial in 2019.

Tando Resources (ASX: TNO)

Tando Resources debuted a maiden resource estimate for its flagship SPD vanadium project in South Africa.

Beating the historic SAMREC resource, Tando’s JORC resource for SPD was 588Mt at 0.78% vanadium pentoxide.

The maiden resource also included a high-grade surface component of 80Mt at 1.07% vanadium pentoxide.

Phase two drilling at the deposit has been completed, with the results to feed into an updated resource – due to be released before the end of the March 2019 quarter.

Impression Healthcare (ASX: IHL)

Impression Healthcare has teamed up with an “established and reputable” Canadian pharmaceutical company, which specialises in extraction and purification of cannabis concentrates.

Under the memorandum of understanding, the unnamed pharmaceutical company will supply wholesale cannabis oil in formulated, filled and labelled bottles for Impression to distribute.

According to Impression, the Canadian manufacturer works with established cultivation partners to produce the pharmaceutical grade cannabis oils.

The company’s chief executive officer Joel Latham said the agreement was a “natural follow-on” from last week’s medical cannabis licence application.

American Patriot Oil & Gas (ASX: AOW)

American Patriot Oil & Gas’s monthly activities report revealed record monthly production of 300 barrels of oil per day, with November production totalling 2,993bbl of oil.

Underpinning the record production was American Patriot’s new acquisitions: Peak Energy, Magnolia and Burnett, which it bedded down in October.

November production generated US$194,094 for American Patriot, which was up 10-fold on September quarter results.

With further acquisitions to be finalised in January, American Patriot chief executive officer Alexis Clark said 2019 would see the company doubling or even tripling production over the course of the year.

Australian Vanadium (ASX: AVL)

Earlier this week, Australian Vanadium’s pre-feasibility study for its flagship Gabanintha project was unveiled, revealing a “world class” project.

Australian Vanadium also released a maiden reserve for Gabanintha of 18.24 million tonnes grading 1.04% vanadium pentoxide, with 9.82Mt at 1.07% vanadium pentoxide classified as proven and 8.42Mt at 1.01% vanadium pentoxide identified as probable.

The highly comprehensive feasibility study estimated Gabanintha could produce about 22.5 million pounds of vanadium pentoxide flake annually for 17 years.

Key highlights of the study include an operating cost of US$4.15/lb of 98% vanadium pentoxide and a post-tax net present value for the project of $1.4 billion using a US$20/lb pricing scenario – below the current price, which is hovering above US$23/lb.

Phosphagenics (ASX: POH)

Phosphagenics revived investors’ hopes after it reached a settlement with Mylan Laboratories.

The company plunged more than 90% during intraday trade in early November after it reported it had been unsuccessful in its arbitration proceedings against Mylan regarding intellectual property rights to a lyophilised tocopheryl phosphate mixture (TPM) and daptomycin formulation that it developed with Mylan’s predecessor Agila Specialties in 2012.

Phosphagenics and Mylan have now agreed to forego all claims including arbitration costs and to terminate the original master and licensing agreements.

A new agreement will give Mylan full rights and discretion to licence, market and sell TPM-daptomycin. However, Mylan must pay Phosphagenics a 5% royalty on net sales.

Meanwhile, Phosphagenics will also have the ability to licence, market and sell the formulation and must pay Mylan a 5% royalty on net sales.

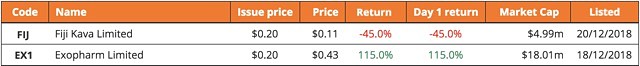

IPOs this week

Small Caps readers who want to view upcoming IPOs or see the stocks that have listed in 2018 and how they are performing can now do so.

The latest companies to make their way onto the ASX this week were:

Fiji Kava (ASX: FIJ)

A much anticipated ASX debut this week was Fiji Kava which raised $5.2 million in an oversubscribed IPO.

The company issued 26 million shares at $0.20 each and is targeting the US$15 billion benzodiazepine market with its natural kava products.

Fiji Kava’s Therapeutic Goods Administration and FDA-compliant products will be marketed as a natural alternative to anti-anxiety prescription medications such as Valium and Xanax with an Australian launch due early next year.

Additionally, following on from many years of research with notable institutions including the University of Melbourne, Fiji Kava will undertake clinical trials in Sydney to test the efficacy of the kava cultivars in treating different medical conditions.

Fiji Kava’s first week on the ASX didn’t fare well, with the company slipping more than 45% on its IPO price to close Friday at $0.11.

Exopharm Ltd (ASX: EX1)

Exopharm joined ASX ranks on Tuesday 18 December after raising $7 million in a fully subscribed IPO resulting in the issue of 35 million shares at $0.20 each.

The company will use the IPO proceeds to fund the development and commercialisation of its regenerative medicines and LEAP technology in treating health span-related medical conditions.

Exopharm believes it is the only company in the emerging exosome treatment field on the ASX.

By the end of its first week of trade, Exopharm had sky rocketed more than 100% on its IPO price to close at $0.43.

The week ahead

As you might expect, even statisticians take a few days off for the Christmas holidays.

Nevertheless, there are some events on the Australian economic calendar to look forward to.

The Reserve Bank’s read on November private sector credit growth is out on December 31, with most analysts expecting a lift of around 0.4%, which would take the annual rate to 4.5%.

One particular thing to look for is a continuation of the solid growth in business credit.

As property markets deflate and home loan demand and supply continue to shrink amid tightening lending conditions, growth in business lending is becoming more important for both the banks and the economy.

It is strictly a little ahead of our forecast period but on January 2 the Core Logic House Price Index is worth watching out for with a decent fall in prospect for Sydney and a smaller one for Melbourne.

In the US, there is not too much rest with a string of releases on December 27 including jobless claims, consumer confidence and new home sales.

On Monday (Christmas Eve) the market will close early at 2:10pm AEST. Christmas Day the market is closed, same for Boxing Day, except for those in South Australia.