Weekly review: Aussie dollar has a strong end to the year

WEEKLY MARKET REPORT

Australian shares may not be keeping up with the record-breaking US market but the Australian dollar has sprung a holiday surprise, rising sharply towards the end of the year.

At one stage the Australian dollar rose above US69.5c – the highest it has been for five months – as optimism about the US and China signing an initial trade deal started to shine through to big Chinese trading partners like Australia.

Stronger than expected jobs figures also played a part because they greatly reduced the chances that the Reserve Bank would cut interest rates further in February, with the market now dropping the likelihood of an early rate cut to just 34%.

Aussie shares higher but can’t match US markets

It would have perhaps been too much to expect Australian shares to follow the dollar upwards quite as vigorously, given low holiday turnover and an extraordinary run for the tech-heavy US Nasdaq exchange, which jumped 0.8% and leapt above the 9,000-point threshold for the first time.

The Dow Jones and S&P 500 indices were also up strongly to new records, rising by 0.4% and 0.5% respectively.

The ASX 200 couldn’t quite match that sort of record setting performance, but, nevertheless, it held its own and managed to add 27.5 points, or 0.4% to 6,821.7 points on Friday.

Big miners lead the charge

That was a good performance on light turnover in a holiday interrupted week with the share prices of the big miners all chasing the rise in oil, gold and copper prices.

BHP (ASX: BHP) was up 1.05% to $39.64, Rio Tinto (ASX: RIO) was up 0.5% to $102.51 and Fortescue Metals (ASX: FMG) was up 0.82% to $11.00.

Gold miners had a strong day with Newcrest (ASX: NCM) rising 1.37% to $29.63, Northern Star (ASX: NST) up 3.24% to $11.14 and Evolution (ASX: EVN) gaining 3.89% to $3.74.

The big four banks were all higher and even the smaller banks such as Bendigo and Adelaide Bank (ASX: BEN) and Bank of Queensland (ASX: BOQ) were up 0.3% and 1.09% respectively.

Retail sales patterns are changing

One of the features of the US market was an impressive performance by Amazon which had a record holiday shopping season after online sales continued to grab more market share.

So, while physical shops might have recorded disappointing Christmas sales, their online competitors appear to have been picking up the slack.

A similar effect has been observed in Australia, with record sales of gift cards which should lead to greater retail activity in the coming weeks as cards are redeemed for physical goods.

Both of Australia’s supermarket giants rose with Woolworths (ASX: WOW) up 0.11% to $37.41 and Coles (ASX: COL) up 0.52% to $15.33.

Small cap stock action

The Small Ords index rallied 1.21% this week to close on 2,946.3 points.

ASX 200 vs Small Ords

Small cap companies making headlines this week were:

Ellex Medical Lasers (ASX: ELX)

After an extended trading suspension, Ellex Medical Lasers revealed on Christmas Eve it had executed a binding agreement to sell its Ellex Lasers & Ultrasound business to French-based Lumibird Group SA for $100 million.

The sale includes Ellex’s Adelaide-based state of the art manufacturing facilities in addition to its various laser products for treating glaucoma, cataracts, vitreous floaters and diabetic eye disease.

Ellex is also selling its ultrasound products Ellex Eye Prime, Eye One and Eye Cubed in the transaction.

Chairman Victor Previn said post transaction Ellex would undergo a name change to reflect its new focus on the glaucoma surgery device market with its core iTrack franchise.

In addition to regulatory and shareholder approvals, the transaction is subject to Ellex completing a business restructure to facilitate the sale.

Gibb River Diamonds (ASX: GIB)

After a state government invite, Gibb River Diamonds has pegged two exploration licences at the former Ellendale diamond mine and project area in WA’s Kimberley.

The company has also applied for three mining leases, 11 prospecting licences and a miscellaneous permit at the project, with the remaining licences anticipated to be granted within two months.

Gibb believes there is “enormous potential” at the leases with “numerous exciting opportunities”.

Ellendale hosts one of the world’s largest diamond mines, which previously produced 1.3 million carats and more than half of the world’s “fancy yellow” diamonds.

Energy One (ASX: EOL)

Energy One plans to acquire French-based eZ-nergy via a €4 million (A$6.41 million) share purchase agreement.

It is expected the French software as a service company will complement and expand on Energy One’s existing software services to energy, environmental and carbon trading markets through Australia and the UK.

Headquartered in Paris, eZ-nergy services 44 customers across eight countries and the company will give Energy One greater access to the EU market.

Energy One will fund the acquisition via a mix of bank debt and €500,000 (A$800,000) in equity.

Rox Resources (ASX: RXL)

Junior explorer Rox Resources impressed investors this week with exploration results from its joint venture Youanmi gold project in WA.

Reverse circulation drilling uncovered “spectacular results” of 14m at 31.31g/t gold from 1m, including 5m at 77.03g/t gold from 1m, and 3m at 123.66g/t gold from 2m.

A further drill hole intersected 4m at 32.51g/t gold from 6m, including 2m at 57.25g/t gold from 7m.

The high-grade mineralisation was unearthed beneath and along strike of the Grace prospect, with interpretation of the results ongoing.

Lithium Australia (ASX: LIT)

It was another busy news week for Lithium Australia, which will head into the new year with an extra $5.2 million in cash after receiving the first part of its funding under the Lind Partner agreement and government R&D rebates.

All up, Lithium Australia’s R&D rebates from the Australian Tax Office totalled more than $2.1 million and the company’s majority owned Envirostream Australia also secured funding in the form of a $110,000 Sustainability Victoria grant.

The remaining $3 million comes from the first part of the $6.3 million funding agreement with The Lind Partners’ entity New York-based The Lind Global Macro Fund.

Funds will be used to advance Lithium Australia’s various business units including Soluna Australia, VSPC and Envirostream.

Lithium Australia also noted it was progressing various lithium projects in its raw materials division.

ASX floats this week

Small Caps readers who want to view upcoming IPOs or see the performance of stocks that have listed in 2019 can now do so.

The latest company to make its way onto the ASX this week was:

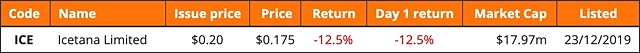

iCetana (ASX: ICE)

AI surveillance software company iCetana made its ASX debut on Monday after raising $5 million in its IPO.

iCentana has more than 20 active customers with operations in 35 locations and supports over 10,000 video surveillance cameras globally.

In its IPO, iCentana issued 25 million shares at $0.20 each to raise the $5 million, with proceeds to be used to accelerate market penetration of its AI and machine learning-based video analytics solutions.

iCentana closed out its first week on the ASX at $0.175.

The week ahead

As you would expect there is a dearth of new releases to look forward to during the holiday period as the New Year is welcomed.

There is the CoreLogic Home Value Index for December and the Markit/CBA manufacturing purchasing manager’s index but most of the interest will remain on offshore developments, particularly the US-China trade deal.

The other thing to watch out for is the minutes from the US Fed meeting which are due on 3 January.