Weekly review: Aussie dollar feeling the coronavirus pain

WEEKLY MARKET REPORT

The Australian dollar has emerged as something of a whipping boy in world markets, plunging to 11-year lows last seen at the height of the global financial crisis.

Investors are now growing confident that the worsening unemployment numbers reported this week and a weakening Australian economy will push the Reserve Bank to cut interest rates yet again, which forced the Australian dollar below US66c on Friday.

The Australian Bureau of Statistics showed a rise in the jobless rate from 5.1% to 5.3%, which could push the Reserve Bank into action given that it has long said that a consistent increase in the unemployment rate was the most likely trigger for another interest rate cut.

Last year the RBA cut rates three times to a record low of 0.75% and despite better than anticipated job creation, the expectation of the coronavirus causing a weakening in the next jobs numbers to be released in March helped drag the dollar to as low as US65.94c in Friday trade.

Currency analysts see even more potential Aussie dollar weakness to come as well with the US dollar gaining plenty of momentum and nothing much on the horizon to lift the local currency.

Share market follows suit

It may not have been as dramatic as the 1% slump in the dollar to below US66c but the Australian share market also caught on to the lack of confidence.

Following on from weak sentiment on global markets due to the increasing spread of the coronavirus, Australian stocks took a slight turn for the worse with the China exposed companies bearing the brunt of falls.

The benchmark ASX 200 index fell 23.5 points or 0.33% to 7139 points.

Weakness followed a record

That wasn’t such a bad result given that the market had hit a second successive record close on Thursday, with losses occurring across a range of sectors including consumer discretionary, energy, IT and health stocks.

Predictably, the big mining companies were down with BHP (ASX: BHP) weakening $0.30 or 0.78% to $38.22 while Rio Tinto (ASX: RIO) was also down $0.45 or 0.46% to $97.69.

There was one bright spot on the market, with financial shares again rising with Commonwealth Bank (ASX: CBA) once again forging a path for others to follow with a 1.08% or $0.95 rise to $88.80.

That helped the overall market to remain up for the week, despite the softer end to the period.

Other stocks that followed Commonwealth’s lead included ANZ Bank (ASX: ANZ) which was up 0.8%, Insurance Australia Group (ASX: IAG) which lifted by 1.8% and Queensland based financial services firm Suncorp Group (ASX: SUN), which was up 1.1%.

Theme parks show their wares

After a hectic week of profit reports for the February reporting season, it was the turn of the theme park operators to show their wares.

Ardent Leisure (ASX: ALG), which owns Dreamworld, lifted 4% despite a first half loss that rose to $22.5 million with investors concentrating instead on a revenue lift of 16% to $263.2 million.

Village Roadshow (ASX: VRL) which owns Movie World and Sea World, fell 2% after it reported a larger than expected net loss of $25.8 million with revenue falling 7%.

Profit results not too bad

Both companies are expecting their second half earnings to be slowed by the coronavirus outbreak.

Overall, most analysts seem fairly happy with the reporting season, particularly a number of stocks that are increasing dividends and share buybacks.

Considering the headwinds created by the bushfires, floods and the coronavirus, most results held up as well or better than expected – particularly after the Blackmores profit warning that began the season.

Corporate profit growth predictions for the year have remained steady at around 3%, leaving the future path of the coronavirus as the big variable that could impact on those predictions.

In the coming week, there are some other high-profile names reporting including Seek, Blackmores, Woolworths, Afterpay and FlightCentre.

Galaxy loses millions

Investors reacted positively to a plan by lithium miner Galaxy Resources (ASX: GXY) to dramatically scale back production to cope with low prices.

Galaxy shares rose $0.055 or 5.31% to $1.09 despite revealing a $430 million loss for the full year and a 55% decline in revenue to US$69.5 million.

Much weaker spodumene prices and a 17% decrease in sales volumes helped to produce the net loss after tax of US$283.7 million, which was largely the result of non-cash write downs and impairments of US$245.9 million.

The average selling price for spodumene was US$502/dmt, down from US$927/dmt a year earlier.

Galaxy has earlier announced that it paused mining at its Mt Cattlin mine and will scale back mining operations by 60% throughout 2020.

The company decided to wind back production levels to conserve mineral resources until market conditions improve.

Small cap stock action

The Small Ords index rose 0.31% for the week to close on 3068.7 points.

ASX 200 vs Small Ords

Small cap companies making headlines this week were:

Paradigm Biopharmaceuticals (ASX: PAR)

Paradigm Biopharmaceuticals has now dosed the first patient in the US under its FDA-approved expanded access program for its Zilosul drug also known as injectable Pentosan Polysulfate Sodium.

The program involves primarily ex-NFL players suffering from knee osteoarthritis and bone marrow edema lesions, with each patient to receive two injections weekly over six weeks.

All up, 10 patients will be treated, with last patient final dosing anticipated in the September quarter.

“This is an important milestone for Paradigm as we continue to progress toward the commencement of the phase 3 pivotal study and commercialisation of Zilosul as a potential first line treatment for knee osteoarthritis,” Paradigm chief executive officer Paul Rennie said.

Meanwhile, Paradigm has reported a positive and informative pre-investigational new drug meeting with the FDA, which involved discussing development and market authorisation plans for Zilosul.

Vital Metals (ASX: VML)

Rare earth explorer Vital Metals impressed investors this week after revealing it had unearthed some of the highest rare earth grades globally at its Nechalacho project in Canada.

The high-grade rare earth oxides were intersected at the project’s North T deposit and returned 2.4m at 38.4% total rare earth oxides (TREO) from 13m, including 8.1% neodymium and praseodymium (NdPr); 5.1m at 22.9% TREO from 12m, including 5.2% NdPr; and 5.4m at 19% TREO from 2m, including 4.3% NdPr.

“The exceptional REO grades, with up to 8.1% NdPr, are being reported almost at surface, an ideal outcome for our plan to produce a high-grade REO concentrate from Nechalacho,” Vital managing director Geoff Atkins said.

These latest drill results will be incorporated into an updated resource, which is due to be published before the end of March.

Nechalacho has a current light REO resource of 94.7Mt at 1.46% TREO.

Freehill Mining (ASX: FHS)

Freehill Mining has uncovered more high-grade magnetite within extremely thick intersections at its flagship Yerbas Buenas project in Chile.

The latest assays from drilling late last year have returned 86m at 24.1% iron from 128m, including 18m at 31.1% iron and 20m at 31.6% iron; and 129.5m at 31.9% iron from 22.5m, including 22m at 47.8% iron and 15.9m at 41.6% iron.

Freehill chief executive officer Peter Hinner pointed out the magnetite mineralisation encountered during drilling was easily upgradable to a high-grade concentrate that can be readily sold into the local market.

Mr Hinner also noted the company had received increasing interest from third parties regarding Yerbas Buenas.

National Stock Exchange of Australia (ASX: NSX), iSignthis (ASX: ISX)

National Stock Exchange of Australia and iSignthis inked an agreement to form joint venture entity ClearPay, which will be charged with developing and implementing a same-day share clearance platform based on blockchain technology.

Initially, the National Stock Exchange will own 41% of ClearPay by investing $3.2 million in the subsidiary.

iSignthis will hold the other 59% and contribute its intellectual property, in addition to its subsidiary Probanx Solutions being responsible for designing and implementing the platform.

The National Stock Exchange can then lock-in a 50% interest in ClearPay by contributing a further $1.3 million.

ClearPay will enable the National Stock Exchange to offer same-day settlement capability, which will supersede the current process offered by other exchanges.

iSignthis has also made a strategic investment in the exchange – scooping up a 12.96% stake by investing $4.2 million at $0.145 per share.

The Food Revolution Group (ASX: FOD)

The Food Revolution Group is taking advantage of the hand sanitiser shortage caused by the coronavirus outbreak.

On Thursday, the company revealed its distribution partner Careline Australia had received a $2 million order for its planned Sanicare-branded hand sanitiser.

Careline will distribute Food Revolution’s hand sanitisers through its daigou network and by fulfilling orders from supermarkets and other distribution customers.

A few days earlier on Tuesday, Food Revolution announced Careline had received “unprecedented demand” for hand sanitiser in Australia and China.

Food Revolution noted it had decided to take advantage of this demand by utilising its recently upgraded Mill Park plant in Melbourne, which has a recently installed bottling line.

Commissioning of the bottling line is underway, with Food Revolution planning to begin hand sanitiser production before the end of the month.

It’s expected the $2 million order will be filled in the next four weeks.

Chant West Holdings (ASX: CWL)

Chant West Holdings has agreed to sell its namesake superannuation research and consultancy business to Zenith Investment Partners for $12 million.

The Chant West superannuation division is one of the company’s two core businesses.

According to Chant West Holdings’ chief executive officer Brendan Burwood, it had fielded a number of enquiries for the superannuation business for some time.

Once the business has been sold, Chant West Holdings will retain its financial planning and technology business Enzumo, while returning a cash surplus of around $0.10 per security to shareholders.

Lake Resources (ASX: LKE)

A Bill Gates-led $1 billion fund, Breakthrough Energy Ventures, has made news by heading up a US$20 million investment round in Lake Resources’ lithium processing technology partner Lilac Solutions.

In addition to Mr Gates, several other investors in the fund comprise several of the world’s business leaders including Amazon founder Jeff Bezos, co-founder of Alibaba Jack Ma, and Bloomberg founder Michael Bloomberg.

Lake is planning to use Lilac’s lithium brine processing technology to extract lithium from brine at its Kachi project in Argentina.

Lilac’s technology offers a “sustainable solution” to produce lithium carbonate for batteries from brine operations.

The process extracts lithium directly from the brine and returns the brine back to its aquifer.

This method eliminates the need for traditional evaporation ponds and is “significantly faster, cheaper and more scalable”.

ASX floats this week

Small Caps readers who want to view upcoming IPOs or see the performance of stocks that have listed in 2020 can now do so.

The latest company to make its way onto the ASX this week was:

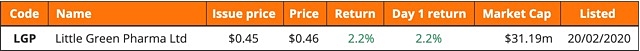

Little Green Pharma (ASX: LGP)

Medicinal cannabis company Little Green Pharma was the latest stock to debut on the ASX this week after raising $10 million via the issue of 22.2 million shares at $0.45 each.

Little Green Pharma was the first Australian company to sell locally-grown GMP-manufactured medical cannabis products – distributing its first products in mid-2018.

The company has a WA-based indoor cultivation facility with capacity to produce up to 15,000 bottles and plans to expand this 110,000 this year.

Little Green Pharma’s IPO strategy was to build its profile, while boosting its financial flexibility and executing its growth strategy, which includes completing the expansion of the cultivation facility.

The company also plans to build its own manufacturing plant as well as building its product range to include various medicinal cannabis forms and delivery systems.

Other plans include expanding sales into the UK, Canada, New Zealand and Germany and ongoing clinical development.

Little Week Pharma celebrated its first week on a high, with its share price lifting to close Friday at $0.46.

The week ahead

Other than the company results there is not much to look forward to on the statistics side of things, leaving the continued direction of the dollar and the progress of the coronavirus as the major influencing factors.

The release highlight is probably the business investment data that is released on Thursday with other things to watch for including the construction work data on Wednesday and the Reserve Bank’s private sector credit figures on Friday.

There is a plethora of releases in the US, however, including home prices, economic growth and durable goods orders.

There should be some impact of the coronavirus on economic activity in China’s factory and services activity gauges for February.