Weekly review: 7000 points not far away as share market powers to a new record

WEEKLY MARKET REPORT

Wall Street has a red-hot buying fever and we are catching it in Australia as our share market follows the bullish US lead into record territory.

With concerns about a war with Iran diminishing, the share market has now broken the pre-GFC high and is also well ahead of the previous intraday record of 6893.7 set in November last year.

The ASX 200 rallied 54.8 points on Friday, or 0.8%, to reach the new closing record of 6929 points – with the 7000-point mark now tantalisingly close.

The broader All Ordinaries index has now crossed the 7000 barrier for the first time, closing at 7041.9 points.

Even more impressive was the fact that the new highs were achieved even as shares in most of the big miners fell due to falling iron ore spot prices and the gold sector was also battered by lower bullion prices.

CSL heading for the triple century

The healthcare sector was the standout performer, hitting record highs after a 2.1% lift.

That came courtesy of CSL (ASX: CSL) shares which continued their relentless rise as they almost broke through the triple century mark – closing up 2.8% to $299.30.

Now worth an amazing $132 billion in market capitalisation, the bio-therapeutics giant has certainly come a long way since it was a small Federal Government-owned Commonwealth Serum Laboratory that was privatised and over time and a raft of acquisitions turned it into a global blood products and vaccines leviathan.

Banks, IT and telcos all show positive signs

While few sectors could match the amazing 6.5% weekly rise in the healthcare index, there was plenty of strength in other parts of the market as the bullish mood from the US stoked fears of missing out for investors.

Financials also had a strong session, lifting 0.9% with all of the big four banks stronger. The most impressive of these was the Commonwealth Bank (ASX: CBA) which rose 1.2% to $82.50.

Macquarie Bank (ASX: MQG) once again closed at a record high, climbing 0.9% to $140.35.

Information technology and communications were strong sectors too, both adding more than 1%.

Shares in telco Vocus Group (ASX: VOC) jumped by an excellent 8.1% to $3.20 on news that its chief executive officer David Russell had bought 200,000 shares worth $594,399.51 using his own money, which investors saw as an incredibly bullish sign.

Vocus shares have been on a rollercoaster ride after several failed takeover bids.

Arise the fearless consumer

Consumer stocks also enjoyed a rare moment in the sun after there was a 0.9% increase in Australian retail sales in November, the biggest gain in two years.

The figures indicated that the three interest cuts from last year and the Black Friday sales had finally combined to produce a brighter retail picture, which pointed to shares in the sector having been oversold on predictions of gloomy retail sales.

Consumer staples jumped 1.6%, with Bega Cheese (ASX: BGA) up 4.5% to $4.41 after the company revealed that disruptions to its operations from bushfires were minimal.

Consumer discretionary stocks also added 1.1% with Myer (ASX: MYR) adding a noteworthy 5.3% to $0.50 and Harvey Norman (ASX: HVN) was also impressive with a 4% increase to $4.42.

Iron ore and gold miners feel the heat

Amid all of this strength, the miners struggled with a hefty fall in iron ore spot prices and lower gold prices pushing the materials sector down 0.4%.

BHP (ASX: BHP) fell 0.3% to $39.90, Fortescue (ASX: FMG) was down 1.1% to $10.70 but Rio Tinto (ASX: RIO) overcame early weakness to close up 0.2% at $102.43.

Gold miners also suffered with Resolute (ASX: RSG) falling 9% while Evolution (ASX: EVN) was down 6% after providing a slightly disappointing production update for the December quarter.

All told it has been a great start to the year for the Australian share market, which has seen the benchmark ASX 200 rise 2.9% over the first full week of the year – the best weekly gain since the week ending 8 February in 2019.

Small cap stock action

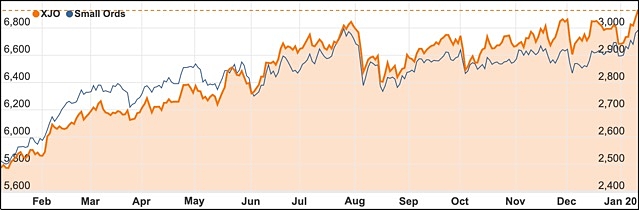

The Small Ords index rallied 1.99% to close on 2991.1 points.

ASX 200 vs Small Ords

Small cap companies making headlines this week were:

Genetic Technologies (ASX: GTG)

Genetic Technologies revealed this week that 20 medical centres across eight US states will be using its third generation nonhereditary breast cancer test GeneType.

The test is expected to be rolled-out across the centres during the current quarter, as part of a “soft launch”.

A full launch for the test is planned for the June quarter of this year with the tests to retail at US$249 each.

According to Genetic Technologies, polygenic risk scores have been more widely accepted as a tool for measuring cancer risk.

One in 500 women carry a BRCA (breast cancer gene) mutation, which represents 0.2% of the population. Genetic Technologies’ GeneType test can classify the other 99.8% of women into risk categories, with higher risk women having access to supplemental screening and prevention options.

Lake Resources (ASX: LKE)

Lithium brine explorer Lake Resources has produced a 99.9% pure lithium carbonate product from its Kachi brine using Lilac Solutions’ disruptive technology.

The “ground breaking” result comes after nine months of detailed test work, with the final product also possessing “very low” impurities such as boron and iron.

Lake will begin generating greater volumes of lithium carbonate from Kachi brines using the Lilac process, with the lithium carbonate to be used to engage potential offtake parties.

A pre-feasibility study on the Argentinian project is due for release before the end of the month, with the project already possessing a 4.4Mt resource of contained lithium carbonate, which positions it among the world’s top 10 lithium brine projects.

Gulf Manganese Corporation (ASX: GMC)

Gulf Manganese Corporation has secured a €52 million (A$84.5 million) loan facility to construct its Kupang ferro-manganese smelting hub in Indonesia’s West Timor.

The company secured the facility from Glacier International Depository, Legal and General Investment Management and HSBC Bank, with funds anticipated to be received before the end of the month.

“We now have ample capacity to fast-track high-impact mining and exploration programs targeting Indonesia’s abundance of high-grade manganese ore deposits,” Gulf managing director Hamish Bohannan said.

Mr Bohannan added securing the funds was a “transformational” step for the company and he looked for to delivering value accretive milestones over the near and long-term.

Catapult Group International (ASX: CAT)

Colombia’s football league is set to adopt Catapult Group International’s Vector monitoring platform under a “landmark deal” announced on Thursday.

As part of the deal, Catapult’s Vector product will be used by 36 teams over the next three years, with athletes to wear the 720 Vector X7 and G7 devices.

Vector records and analyses athlete information in real-time. Players wear a vest that tracks movement, heart rate and other data for coaches and trainers to analyse.

The technology aims to mitigate injury while gaining a better understanding of match demands and providing performance data for fans.

LatAm Autos (ASX: LAA)

LatAm Autos revealed its Mexican credit FinTech business Motorfy had achieved record revenue in the December 2019 quarter.

The period heralded an all-time revenue record for Motorfy Credit Mexico and all Motorfy FinTech products combined in the country.

LatAm noted that Motorfy FinTech products accounted for 60% of its total Mexican revenue in 2019, compared to 10% in 2017.

In addition to boosting revenue, LatAm said its recent cost reduction initiatives led to a 10% month-on-month fall in total costs from October 2019 to November 1019.

Winchester Energy (ASX: WEL)

Texas-focused oil and gas explorer Winchester Energy has continued its exploration success with its McLeod 17#3 well at the Lightning prospect encountering 124ft of potential pay and excellent oil and gas shows.

The well was drilled to a 5,692ft depth with initial wireline logs identifying 414ft of gross Upper and Lower Cisco Sand.

This includes 124ft of net pay discovered in the Lower Cisco Sand and exceeds the 25ft of net pay from the prospect’s Arledge 16#2 discovery well.

Winchester managing director Neville Henry said McLeod 17#3 appears to be “as good as, if not better” than Arledge.

The company is running a formation microlmager log in McLeod 17#3 and expects to uncover further pay from the Cisco Sands.

The week ahead

It is a surprisingly busy calendar of statistical releases over the coming week given that we are so early into 2020.

In Australia some of the numbers to look out for include housing, tourism, lending for housing, business and personal reasons and consumer confidence.

Investors will be hoping that the nascent sign of improvements in sentiment such as the retail sales figures will keep emerging, but it is way too early to call a trend.

China is also set for a busy week of economic releases with indicators related to international trade, industrial production, investment, retail spending and economic growth (GDP).

It’s a similar situation in the US with data releases on retail sales, inflation, production and the Beige Book.