Telecommunications innovator Vonex (ASX: VN8) has posted record gross unaudited revenue for the three months to end June of $10.5 million, representing a year-on-year increase of 81%.

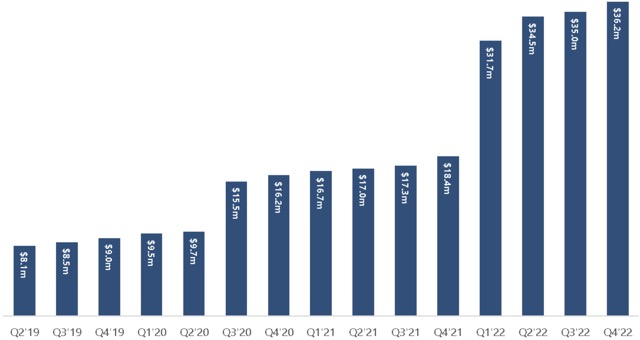

The company’s annualised recurring revenue was also up by more than 97% year-on-year to approximately $36.2 million.

Following record revenues in the previous quarter, Vonex added total contract value (TCV) of $2.37 million in new customer sales for the reporting period, representing a year-on-year growth of 47% and marking three successive quarters of more than $2 million TCV.

Vonex has now attracted more than 100,000 registered active users to its cloud-based private branch exchange (PBX) phone service, which it considers to be a key indicator of its business development progress.

The company’s wholesale division also delivered consistent growth in the quarter, with revenues for NBN with 4G backup increasing by 22% year-on-year, while its flagship IP voice product experienced revenue increase of 37% reflective of a strong cross-selling strategy.

Growth strategy

Vonex remains focused on targeting business acquisitions which offer potential for growth in revenue, profit, product diversity and entry into new markets.

In January, the company bought South Australian voice and internet service company Voiteck and by the end of June, Voitek customers had been migrated to the Vonex network.

Vonex also continued to deliver a phased migration of MNF Group customers to its network and PBX platform following the acquisition of MNF’s Direct Business in mid-2021.

The business sells cloud phone, internet and mobile services to small-to-medium enterprise and residential customers in Australia.

When the migration is complete, Vonex anticipates a net saving on staff costs to be between $600,000 and $700,000 per year.

Telco partnership

In June, Vonex partnered with local telco More to become an exclusive provider of a new hosted PBX and IP telephony enablement platform to customers of the Commonwealth Bank (ASX: CBA).

Under the agreement, Vonex will charge More a one-off fee for initial development of the customised platform, estimated to be $70,000 based on a daily development rate.

Melbourne-based More is part-owned by the Commonwealth Bank, having announced a strategic partnership last year which unlocks special benefits for the bank’s customers.

Cash at hand

At the end of June, Vonex had approximately $3.2 million cash at hand and $14.5 million drawn from a financing facility with Longreach Credit Investors.

Net operating cash inflow for the quarter was $1.3 million from cash receipts of $9.5 million.

Monthly cashflow is expected to improve by $833,000 following a final deferred payment in August for the MNF Direct Business acquisition.

Payments to related parties for the quarter included $159,215 in director fees and wages, and $13,500 in administration and accounting costs.