A solid advance after a thumping fall on Thursday saw the Australian share market move back close to its record high but is a million miles away from where it was just a few days ago.

As the US election race revs up onto a serious contest there has also been a rapid and market changing switch out of the US tech giants and into almost everything else, at least on the US market.

Disappointing results from Tesla and Alphabet triggered a massive sell off in the US followed by a rise in many non-tech stocks as the bull run in stocks changed its emphasis.

Here in Australia this led to a hefty 0.8% or 60.1 point rise on the ASX 200 to 7921.3 points as the market recouped some of the earlier losses during the week, although not all of the thumping 1% fall on Thursday.

Somewhat surprisingly, commodity stocks featured in this rally after being an anchor on the former rally for some time.

Broad based rally

However, it was a broad-based rally with 10 of the 11 sectors showing green, echoing some of the broadening rally in the US even as bellwether tech stocks fell or took a breather.

Despite some rapid volatility during the week, by the closing bell on Friday the market finished the week down just 0.6%.

The materials sector rallied an impressive 1.4% as BHP (ASX: BHP) shares rose 2.2% to $42.10 and Fortescue Metals (ASX: FMG) shares were up 1% to $20.35

Naturally this rally came hot on the heels of a solid 2.2% rise on Singapore iron ore futures to $US102.15 a tonne on Friday afternoon – a marked contrast to the price which was below US$100 a tonne beforehand.

Some good news from Mineral Resources (ASX: MIN) indicated that it was on track to meet production guidance for the 2024 financial year saw its shares add 3.5% to $53.67.

The market seemed to warm to a 9% annual rise in production volumes to 269 million tonnes, which was well within the estimate for the year.

It wasn’t all good news for the miners with shares in Bellevue Gold (ASX: BGL) dropping a rapid-fire 21.6% to $1.44 after the Western Australia gold producer finished a $150 million institutional placement at a 15.3% discount to its closing share price on Wednesday.

Energy stocks were higher, with Ampol (ASX: ALD) up 1.5% to $33 while Santos (ASX: STO) was up 1.2% to $7.74.

Nine (ASX: NEC) dropped 1.1% to $1.39 after its print journalists voted to strike and watch the Paris Olympics at home, leaving many of the staff on the Australian Financial Review, Sydney Morning Herald and The Age to leave at 11am on Friday after rejecting the latest pay offer from management as inadequate.

Clear rotation to small caps in the US

Over on Wall Street despite continuing volatility due to the rapidly changing election campaign, there was a clear rotation out of the tech giants that have powered the S&P 500’s rally so far and into smaller companies.

That was shown most clearly by a weekly 1.6% rise on the small caps Russell 2000 index for the week, compared to a 1.06% fall in the Bloomberg Magnificent 7 Price Return Index for the week.

In Australia, investors are also looking to switch to smaller cap shares, although they will almost certainly have longer to wait for falling interest rates to provide some impetus for price rises.

Small cap stock action

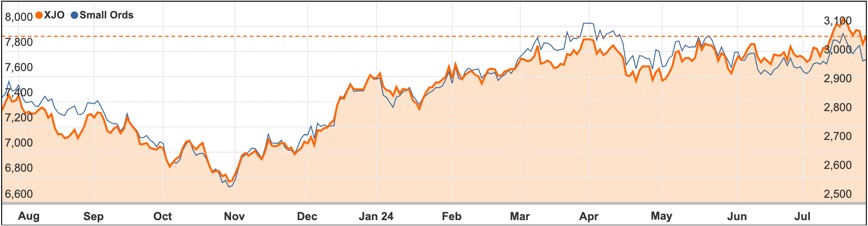

The Small Ords index fell 1.15% to 2997.6 points for the week.

Small cap companies making headlines this week were:

E79 Gold Mines (ASX: E79)

E79 Gold Mines reported exceptional copper and gold values from its maiden sampling at the Mountain Home project in the Northern Territory, with 7 out of 15 rock chips showing copper assays over 22%.

Chief executive officer Ned Summerhayes highlighted that the reconnaissance program extended the mineralised structure to over 1 kilometer.

The company plans to follow up with further exploration within the current September quarter, aiming to expand the copper system and investigate historic positive samples.

Notably, 10 of the 15 rock chips also showed anomalous gold values, which is rare for the region.

The Mountain Home project sits within the McArthur Basin, an area known for significant base metal deposits.

Quickstep Holdings (ASX: QHL)

Quickstep Holdings has implemented operational changes at its Bankstown facility, reducing production and operational headcounts by about 20% while investing in technology.

The company is transitioning to a two-shift, five-day workweek due to decreased customer demand, aiming to boost productivity and maintain high-quality deliveries.

Quickstep has expanded its Geelong facility to support space initiatives and guided weapons prototyping, aided by a grant from the “Moon to Mars” initiative.

They finalised a contract with Lockheed Martin for C-130 aircraft components from 2025 to 2029, with discussions for the next contract period already underway.

Quickstep reported record drone production and significant revenue growth, with a forecasted group revenue of $99 million, surpassing previous guidance.

Tissue Repair (ASX: TRP)

Tissue Repair has received approval from the Therapeutic Goods Administration (TGA) for its TR Pro+ cosmeceutical topical wound-healing gel, now listed for sale in various sizes.

This approval allows the company to promote its product more broadly and expand its indications to include acute wounds and other dermatological conditions.

The gel contains glucoprime, the same active ingredient in their lead drug candidate TR987 for treating venous leg ulcers.

Sales of TR Pro+ have grown significantly, with a 130% revenue increase in the June quarter and distribution expanding to over 160 clinics.

Following positive feedback and successful pilot sales, Tissue Repair is exploring potential overseas distribution agreements and continues to focus on growing its distribution network.

Alcidion Group (ASX: ALC)

Alcidion Group has been chosen as the preferred supplier for a new electronic patient record (EPR) system by North Cumbria Integrated Care NHS Foundation Trust (NCIC) in the UK.

The EPR system will enhance real-time access to patient records, streamline patient flow, and improve clinical decision-making.

Final negotiations are underway for a 10-year contract worth up to $40 million, utilising Alcidion’s Miya Precision AI-powered platform.

Miya Precision provides clinicians with actionable insights by consolidating information from various systems, enhancing patient care through its intuitive interface.

Alcidion aims to build on its eight-year relationship with NCIC, integrating their existing systems with new capabilities to support the healthcare system’s needs.

Cyprium Metals (ASX: CYM)

Cyprium Metals has partnered with Glencore International to expedite the restart of its Nifty copper project near Port Hedland, Western Australia.

This strategic partnership focuses on cathode offtake, sulphuric acid supply, concentrate sales, and technical support, ensuring revenue certainty during Nifty’s startup phase.

The agreement includes the sale of cathode products and copper concentrate to Glencore’s Townsville refinery and Mt Isa smelter, respectively.

Cyprium plans to accelerate the construction of a new surface mine at Nifty, with copper concentrate production expected by 2026.

The partnership de-risks the restart of Nifty, providing transparent pricing and access to global markets while supporting WA and Queensland jobs.

The week ahead

For local Australian investors the release of the June quarter inflation figures are the main event, with economists tipping the consumer price index will have risen 1% for the quarter and 3.7% for the year, with the trimmed mean likely to come in at around 0.9% for the quarter and 3.9% for the year. The numbers are obviously crucial with numbers around those levels possibly being enough to spur the Reserve Bank board to pull a surprise interest rate rise at its next meeting.

Other things to watch out for include statistical releases for building approvals, retail trade, private sector credit and home prices.

US Fed and Japan both meeting on rates

Looking overseas, the US Federal Reserve board has a meeting mid-week but is thought to be unlikely to cut interest rates yet, preferring to wait until September.

There will also be a range of manufacturing, home prices, employment and factory order numbers released in the US.

Chinese purchasing manager indices should give a bit of a guide to how that economy continues to slowly recover while the Bank of Japan’s policy meeting could finally bite the bullet and decide to raise official interest rates.