Viridis Mining and Minerals (ASX: VMM) has achieved a key milestone with the release of a maiden ore reserve estimate for the Colossus rare earths project in Brazil.

The JORC-compliant resource study has confirmed Colossus as a tier-one ionic clay rare earth project with 201 million tonnes at 2,640 parts per million total rare earth oxides (TREOs).

The project also hosts a significant 740ppm mixed rare earth oxides (MREOs), enough to support the company’s plans to become a supplier to the rare earth magnet market.

Long Open-Pit Mine Life

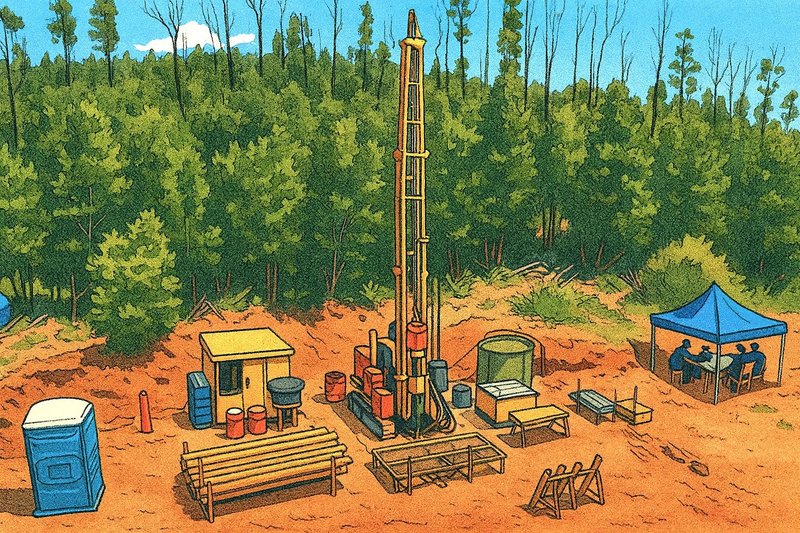

The new resource, which falls entirely under the Probable classification under the 2012 JORC Code, underpins a 40-year shallow open-pit operation targeting an average 5.0 Mtpa ore feed with a low 0.45:1 strip ratio.

The mine plan prioritises magnet rare earth oxides to maximise basket value, aligning it with assumptions as per the most recent pre-feasibility study (PFS) including process flowsheet, recoveries, product specification, payability and logistics.

Backed by a recent $11.5 million capital raising that included a cornerstone $5 million commitment from Brazil’s JGP Asset Management, the impressive resource estimate will help Viridis advance Colossus from exploration status into project execution.

Upon settlement of the placement, Viridis will hold a cash position of up to $58.5m, leaving it well placed to accelerate development through the final investment decision and into early execution.

‘Immense Growth Potential’

Managing director Rafael Moreno said the release of the maiden JORC reserve is another important milestone for Viridis.

“This reserve covers only a fraction of our landholding, with high-grade zones like Tamoyo yet to be included, underscoring Colossus’ immense growth potential and strategic significance as a globally critical source of magnet rare earths,” he said.

To help advance the project, Viridis has formed strategic partnerships with ORE Investments, Régia Capital, BNDES (the Brazilian National Bank for Economic and Social Development) and FINEP (the federal agency for studies and projects).

The recent PFS included plans for a centrally located production facility designed to process ore from multiple pits across the company’s tenements in Brazil’s Poços de Caldas Alkaline Complex, where critical infrastructure is already in place and an experienced local mining workforce and services ecosystem, along with the presence of tier-one operators such as Alcoa and Companhia Brasileira de Aluminio, all support execution readiness for Colossus in a world-class mining hub.