Weekly review: Victorian lockdown leads to predictable but limited market meltdown

WEEKLY MARKET REPORT

Another one-week stage four COVID-19 lockdown in Victoria once again sent a sharp shock through the share market and this time investors knew exactly where to inflict the pain.

A veritable shopping list of travel companies, retail landlords and hospitality-aligned names all wilted in the face of the latest pandemic news that the UK variant could be spreading out in the community.

Qantas (ASX: QAN) fell a hefty 4.8% to $4.55 and Sydney Airport (ASX: SYD) was down 2.1% to $5.59.

Travel related stocks such as Webjet (ASX: WEB) fell 3.9%, Flight Centre (ASX: FLT) was down 2.7% and Corporate Travel Management (ASX: CTD) also lost 2.5%.

Damage spreads to shopping malls and toll roads

Of course, the damage wasn’t contained to just these stocks, with other companies that are leveraged to shopping and driving also down.

Toll giant Transurban (ASX: TCL) was an obvious one, falling 1.7% to $13.05 while the shopping centre owners also copped it in the neck, with Vicinity Centres (ASX: VCX), Scentre Group (ASX: SCG), Unibail-Rodamco-Westfield (ASX: URW) and Mirvac (ASX: MGR) all losing as much as 3.66%.

Could have been worse

While the news that the UK COVID-19 variant appears to have escaped Victoria’s hotel quarantine (and potentially even the state due to an infection at the airport is bad), the market’s reaction was probably more muted than in previous lockdowns and recognised that the pandemic risks had to be offset by the imminent arrival of vaccines.

Success in snuffing out virus outbreaks in South Australia, Western Australia, Queensland and New South Wales also added to the confidence that perhaps this latest outbreak could be contained.

Lack of offshore leads

Overall, the ASX 200 dropped 43 points or 0.6% to 6850 on Friday, a sign of risk in a week that started with an 11-month high before dropping to a 0.5% loss.

This was also in the same period that featured no strong leads from Wall Street and many closed Asian markets due to the Lunar New Year.

It was also a really big week for company results including the big consumer owned stocks Telstra (ASX: TLS) and Commonwealth Bank (ASX: CBA), with most results being positive without being spectacular.

The coming week will continue on with that theme with plenty of new results to drive sentiment on individual stocks.

There was not too much reporting news on Friday with shares in property developer, Mirvac Group (ASX: MGR) down 1.7% after its first half statutory profit plunged 35% to $396 million while operating profit dropped 22% to $276 million.

Shares in retailer Baby Bunting (ASX: BBN) dropped 6.6% due to a lack of forward guidance even as it lifted dividends following a 55% jump in first half net profit to $7.5 million while sales rose 17% to $217.3 million.

Outdoor retailer Kathmandu (ASX: KMD) declined 4.8% on a sales update with Rip Curl being the star performer among its brands.

At the big end of the market the mining giants BHP (ASX: BHP) and Rio Tinto (ASX: RIO) were weaker as were the big banks, which finished lower.

Small cap stock action

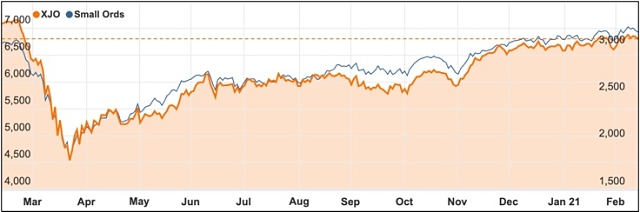

The Small Ords index dipped 0.75% this week to close on 3168.8 points.

ASX 200 vs Small Ords

Small cap companies making headlines this week were:

Alterity Therapeutics (ASX: ATH)

The Michael J Fox Foundation for Parkinson’s Research has granted US$495,000 (A$641,500) to Alterity Therapeutics to help fund the company’s research into determining the optimal dosing for its lead candidate ATH434.

Alterity will use the grant money to evaluate ATH434’s pharmacological profile in a primate model to better-determine dosages for upcoming clinical trials in treating Parkinsonian diseases, particularly, multiple system atrophy.

A phase two clinical trial evaluating ATH434 in multiple system atrophy is scheduled to start later this year.

Deep Yellow (ASX: DYL)

Uranium explorer Deep Yellow revealed a positive prefeasibility study for its Tumas project in Namibia this week and confirmed definitive feasibility work will begin later this month.

The prefeasibility study gave Tumas a post-tax net present value of US$207 million with an internal rate of return of 21.1% (also post-tax).

Underpinning the upcoming definitive feasibility study are reserves of 40.9Mt at 344ppm uranium oxide for 31Mlb of contained uranium.

Infill drilling to support the Tumas definitive feasibility is already underway with up to 800 holes planned for 15,000m.

AD1 Holdings (ASX: AD1)

SaaS provider AD1 Holdings collared a “landmark” five-year contract with an energy retailer this week.

The deal will expand on AD1’s current offering to the retailer of billing and operations SaaS solutions as well as related managed services.

Under the expanded contract, AD1 will provide sales intelligence and customer portal services. The contract is expected to generate about $2 million in revenue to AD1 a year – equating to about $10 million over the five-year term.

BlackEarth Minerals (ASX: BEM)

Aspiring graphite miner and downstream processer BlackEarth Minerals has executed a supply and marketing deal with a German company that has Volkswagen, Mercedes and Ford as some of its major clients.

Under the deal, the German company Luxcarbon will supply BlackEarth with up to 25,000Mtpa of high-grade graphite concentrate.

Additionally, Luxcarbon has exclusive marketing rights to sell BlackEarth’s proposed downstream produced material into European markets – initially supplying the EV and lithium battery sectors.

Australian Gold and Copper (ASX: AGC)

A maiden RC drilling program completed at Australian Gold and Copper’s Pattons prospect on the Moorefield licence was finished with seven holes undertaken for 1,068m.

The Pattons prospect is 3km long and comprises three, northwest-striking magnetic highs, with drilling focusing on the Pattons one anomaly, where a rock float sample returned 6.14g/t gold.

Australian Gold and Copper hit the magnetic horizon in six of the seven holes.

At Moorefield, the company is targeting Fosterville-style gold and Cobar-style polymetallic mineralisation.

BARD1 Life Sciences (ASX: BD1)

Testing of BARD1 Life Science’s licenced SubB2M technology has shown “outstanding” preliminary results in detecting ovarian cancer.

Researchers from Griffith University and the University of Adelaide collaborated on engineering the SubB2M protein which has been found to have “exquisite specificity” in binding to sugar molecule Neu5Gc, which is present in a range of cancers.

Testing data showed SubB2M can detect all ovarian cancer stages with 100% specificity and 100% sensitivity.

As well as ovarian cancer, BARD1 plans to use the SubB2M technology to detect other malignancies including breast, prostate and pancreatic disease.

The week ahead

Once again, local news will be central to how the market trades in the week ahead, particularly with some Asian exchanges still closed.

Some of the bigger company results to look out for in the week ahead include Bendigo & Adelaide Bank, Beach Energy, JB Hi-Fi, QBE Insurance, Ansell, BHP, Brambles, OZ Minerals, Scentre Group, Coles Group, Domino’s Pizza, Fortescue Metals, Rio Tinto, Super Retail Group, Tabcorp, Treasury Wine Estates, Coca-Cola Amatil, Crown Resorts, Iluka Resources, Origin Energy, Perpetual, South 32, Star Entertainment Group, Santos, Wesfarmers, Woodside Petroleum, Ardent Leisure Group, Inghams, Mayne Pharma and Platinum Asset Management to name a few.

Other things to watch out for include the Australian Reserve Bank board meeting minutes and figures, US retail spending and housing, and commentary from the US Federal Reserve.

US markets are closed on Monday for Presidents’ Day.