“Oil, oil and more oil,” sounds like an investment tip from 100 years ago and not last week, but that’s what Jeff Currie is advising and he’s the commodity guru at the world’s leading investment bank, Goldman Sachs.

Currie’s love of oil is hardly surprising, even if it is politically incorrect at a time of energy transition and the rise of renewable energy and battery metals, which are supposed to replace old energy, especially oil and coal.

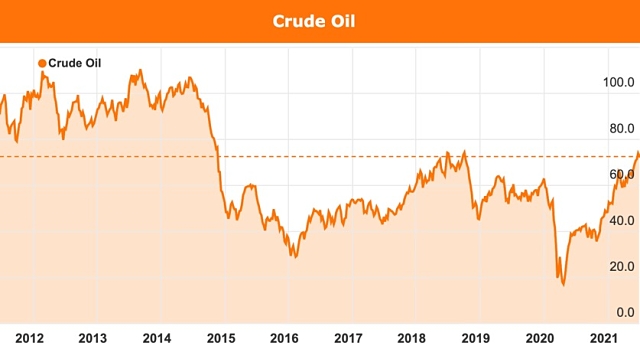

However, in a remarkable flashback to an earlier era, oil and coal have been star performers since the start of the year rising by 45% and 130% respectively. This means that investors who might have stuck with old energy should have enjoyed a surprise win – except they haven’t.

Most oil stocks have been poor investments even as the price of their underlying commodities have recovered from last year’s sharp shock, which saw the oil price crash to US$20 a barrel (and negative in one futures contract).

Whether large or small, companies exposed to oil (and its close associate, natural gas) have struggled, either because oil is not an acceptable investment for environmentally conscious investors or its mercurial price moves mean that it’s too slippery or believed to not be sustainable.

But if oil is staging a comeback, as some professionals such as Currie believe is the case, then it becomes hard to ignore the value gap opening between the commodity price and most share prices.

Since January, oil (as measured by Brent-quality crude) has risen to a three-year high of US$75/bbl (A$99/bbl) while thermal coal is at a 10-year high of US$125 a tonne (A$166/t).

OPEC meetings could determine oil price’s direction

That oil price increase has also opened the door to the return of the almost forgotten price-fixing cartel, the Organisation of the Petroleum Exporting Countries (OPEC).

Over the next few days investors can expect to hear a lot more about the Arab-led OPEC as it conducts a series of meetings with its best friend and another oil-rich country, Russia.

Conferences of OPEC and Russia (snappily referred to as OPEC+) once created a media frenzy at the organisation’s head office in the Austrian capital, Vienna, but with COVID-19 in the air they have become a dull affair conducted by computer link.

The current round of OPEC meetings promises to be anything but dull with the primary focus being a plan for members of the organisation to make a modest increase in output to alleviate what is a rapidly emerging oil shortage caused by OPEC-encouraged production restrictions.

Currie reckons the global economy is emerging so rapidly from the Covid slowdown that oil consumption has risen from 95 million barrels per day to 97MMbpd in just a few weeks with an oil glut created during the slowdown being quickly drained.

The next few days will determine the direction of the oil price. Currie reckons it will hit US$80/bbl (A$106/bbl), but there is also talk in the market of US$100/bbl (A$133/bbl) possible by Christmas, especially if OPEC is miserly with its proposed supply increase or demand continues to rise quickly – or both.

On the Australian stock market, there are a handful of big oil producers which have been disappointing performers since the start of the year.

Woodside Petroleum (ASX: WPL) is down 3% to $22.28. Beach Energy (ASX: BPT) is down 31% to $1.26, while Santos (ASX: STO) has managed a modest 12% rise to $7.21 – and those moves are against a backdrop of a 45% oil price increase.

It isn’t much better at the small end of the oil sector, though it’s down there that maximum leverage can be generated if OPEC fails to deliver a significant supply response.

Small cap oil stocks to watch

Warrego Energy (ASX: WGO) and Strike Energy (ASX: STX) – totally separate companies but joined at the asset base by a shared gas field near Dongara, a coastal Western Australian town north of Perth.

Discovery of the West Erregulla field (and the nearby Waitsia field) put Dongara back on the gas map more than 50 years after the first find was reported, followed by a brief boom and a long decline, which is the nature of most oil and gas fields.

But owning 50% of a new gas discovery does not mean the owners are delivering synchronised investment performance with Warrego valued at $234 million while Strike has steamed ahead to $625 million.

The difference might be explained by what the two owners of West Erregulla propose to do with the gas they will start producing in the next few years. Warrego plans to sell its gas into the WA pipeline system, supplying big gas users such as Alcoa, while Strike is proposing to invest in downstream processing to produce chemicals and fertiliser.

Since the start of the year, Warrego’s share price has fallen by half-a-cent (down 2%) to $0.24 while Strike is up $0.025 (up 8.6%) to $0.32.

Carnarvon Petroleum (ASX: CVN) was a stock market star three years ago when it shared with Santos in the discovery of the Dorado oilfield off the northwest WA coast. However,Carnarvon has faded this year even as development of Dorado moves closer.

Santos, which owns 80% of the field (Carnarvon has 20%), announced last week that front-end engineering and design had started for the Dorado development, which is expected to cost around $2 billion to bring online at an initial flow rate of between 75,000 and 100,000 barrels of high-quality crude a day.

At that upper-level Carnarvon, with its lowly stock market value of $399 million and a share price of $0.24, will be the recipient of 20,000 barrels of oil a day valued at US$1.5 million per day (A$1.99 million/day).

Adding to Carnarvon’s appeal is a busy exploration schedule that includes drilling the Buffalo prospect in the waters of East Timor later this year.

Once a company active in its namesake Cooper Basin of central Australia, Cooper Energy (ASX: COE) today is an offshore Gippsland Basin gas producer fully exposed to the Australian east coast gas shortage.

The key asset in Cooper is the Sole gas platform which is delivering gas via the onshore Orbost processing centre to customers in Victoria and New South Wales.

Last year’s oil price crash and the slow completion of the Sole project saw Cooper’s share price plunge by 61% from $0.63 early last year to last sales at $0.24 but as revenues rise, Cooper might enjoy a re-rating and an increase to its modest market value of $383 million.

A micro cap to watch is Triangle Energy (ASX: TEG), a small fry in market terms but the owner of the largest acreage holding in the Perth Basin, both on and offshore including the already producing Cliff Head oilfield.

Another thing going for the company is its substantial equity interest in State Gas (ASX: GAS), which aims to take advantage of the east coast gas supply opportunity by developing the Reid’s Dome project in Queensland. First gas production is targeted for 2023.

Triangle recently raised $10 million in a share placement, noting that the “tremendous” interest from new and existing investors was in recognition of the company’s Perth Basin expansion strategy and this stake in State Gas.

It’s also worth noting that while its market cap is currently $14.7 million, its investment in State Gas is worth around $25 million.

A wild card with big ambitions and a remarkably well-connected management team, Empire Energy Group (ASX: EEG) is a minnow today with a stock market value of $141 million but a foot on what could be Australia’s next big oil and gas producing region, the Beetaloo Basin of the onshore Northern Territory.

In exploration terms, Beetaloo is “elephant” country with enormous theoretical potential but with a lot of scientific analysis and drilling required to prove the concept of the area becoming an economically viable source of oil and gas.

For fearless punters looking for maximum bang for their buck, Empire could be one for a rewarding ride, especially if its technical team can crack the hard rocks of the Beetaloo.