Australian medical technology company Uscom (ASX: UCM) has posted a 35% drop in total revenue figures for the half-year ending December 2019, underpinned by a restructure to its China-based distribution model.

In January, the company commissioned a new subsidiary office in Beijing with first imports of its 1A cardiovascular monitoring devices into the market occurring later in the period and creating delayed sales and revenues.

Further delays were incurred in appointing regional distributors as a result of a drawn-out approval process by China’s National Medical Products Administration (formerly the China Food and Drug Administration), which regulates new drugs and medical devices.

Uscom received a five-year NMPA approval at the end of the half-year period, after which it re-signed all previous distributors to revised contracts with increased margins and volumes.

The contract changes, plus the issuance of six new China National Health and Medical Commission Coronavirus Guidelines since the beginning of February, combined to create a rapid increase in cash receipts following the close of the period.

Cash on hand at the end of February was $2 million – growing $520,000 in eight weeks.

Global restructure

Uscom’s European office experienced little growth during the reporting period as slow regulatory approvals followed by a relocation earlier this year resulted in reduced international sales.

The company said the office is “beginning to gain traction [and] sales opportunities are expected to increase” as approvals start to roll in.

In the US, Uscom contracted an additional 28 sales personnel in December to sell devices into more than 80% of the world’s largest medical device market.

New staff numbers resulted in increased sales leads and product demonstrations and could potentially lead to new sales.

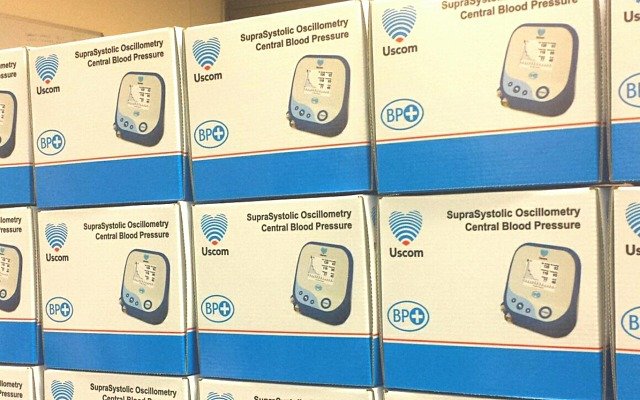

Restructured distribution models across China, Europe and the US will prepare the company for a new wave of regulatory approvals prior to the introduction of Uscom BP+ and Uscom SpiroSonic digital ultrasonic spirometry technologies to these markets.

Uscom executive chairman and associate professor Rob Phillips said the company is geared up to “begin generating results and significant incoming cash”.

“The new China distribution model has increased per unit margins for devices and increased the number and scale of our distributors,” he said.

“Revenue from all these initiatives is expected to be further enhanced as our new devices move toward NMPA and FDA approvals.”

Industry endorsement

In February, Uscom received global professional endorsements reflecting 20 years of commitment to the improved care of infectious diseases.

The Chinese government’s new National Coronavirus Guidelines recommend Uscom’s 1A monitoring device for treating severe cases of the virus in children and adults.

The government is currently making moves to install the devices into Chinese hospitals.

The US-based Society of Critical Care Medicine has also included the 1A device in its newly-published International Paediatric Sepsis Guidelines.

The endorsements are expected to further stimulate clinical adoption and sales of 1A over the next 12 months.

“Recognition for the years of science [behind the development] of 1A demonstrates we are changing global practice,” said Mr Phillips.

“We are reviewing our operating strategies and plan on shifting manufacturing into top gear to meet anticipated demand.”

At midday, shares in Uscom were up 22.58% to $0.38.