It is hard to underestimate the importance of what is happening on the US share market at the moment.

The undisputed leader of world equities which represents more than half of the world’s listed equities is now successfully erased the sharpest and shortest bear market we have ever seen.

If we look at the S&P 500 index, it is now sitting on a record high of 3,397.16 points at the closing bell on Friday, US time.

The COVID-19 pandemic which wrestled a complacent market off its lofty perch in mid-February and dragged it down a hefty 34% is still very much with us and is causing particular human and economic damage in the US.

Market won back massive losses in record time

That hasn’t stopped the US market from winning back all of that 34% loss and then some in one of the most stunning rallies that has added more than US$9 trillion to company valuations.

A combination of a multi-trillion dollar burst of government and US Federal Reserve stimulus with an incredible vote of investor confidence in technology companies has combined to create one of the greatest market recoveries ever seen.

It is a recovery won at a time when the COVID-19 pandemic continued to cause havoc around the world and particularly in the US which has suffered more than 170,000 deaths and the US economy slumped by an annualised 33% in the June quarter.

It is also at a time when the US and China continue to face off in damaging trade wars and the US election campaign creates more instability with the chance of a change of government.

Despite these negatives, optimism about a rapid economic recovery after the pandemic and perhaps the boost coming from a vaccine all helped.

Dollar and gold indicate plenty of caution

There are, however, a few signs that this recovery is not as wholehearted as it first appears.

One is the US dollar, which has been falling all of the way through the share market rally.

That means in “constant real dollar’’ terms the market had to gain around 10% just to stand still.

Gold has also been rising in US$ terms, which is also unusual when the share market is also rising but may also reflect the extraordinary amount of “paper money” stimulus rolled out by the US Fed and some solid rises in commodities like copper.

Both the lower dollar and rise in gold could also reflect a less sanguine view on the outlook for stocks and the global economy, with some investors taking out insurance.

Tech rally close to doubling prices

Perhaps the largest contributor to the rally has been the global technology stocks that have been really flying and have come close to doubling since the market bottomed.

The booming tech stocks include many of the household name giants such as Facebook, Amazon, Apple, Microsoft, Netflix, Google and Tesla but they are also made up of many less well-known names – some of which have enjoyed dramatic and potentially permanent increases in usage since the pandemic started.

As usual with technology stocks they have been trading at lofty valuations of more than 50 times their earnings but these companies arguably have the capacity to make even these prices look cheap as they convert eyeballs into profits while their costs remain relatively fixed.

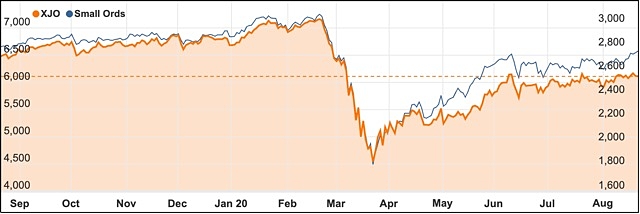

Aussie market moves a pale imitation

It was probably difficult to think of the historic US market action from an Australian perspective, given our market’s usual more lukewarm reflection of offshore events.

On Friday the ASX even managed to turn a strong US lead into a downer after a strong start ran out of steam as the day moved on.

By the market close the benchmark ASX 200 index was down 8.8 points, or 0.14%, lower at 6111.2 points and produced the first weekly loss of 0.2% for three weeks.

It wasn’t all down to a closer watch on reality but also perhaps the realisation that most of the ASX profit reports are now behind us so there is not a lot to look forward to in terms of creating price momentum.

Market still likes a positive surprise

Indeed, the straggling results tend to contain at least some shockers but at least the market showed that it appreciates a positive surprise with an 11.1% rise in Suncorp’s (ASX: SUN) share price to $9.65 after a much better than expected annual result.

Despite that, our market will always struggle to close higher when you have a series of heavyweights including the big four banks, CSL (ASX: CSL), big miners Rio Tinto (ASX: RIO) and BHP (ASX: BHP), retailers Woolworths (ASX: WOW) and Wesfarmers (ASX: WES) and merchant bank Macquarie Group (ASX: MQG) all closing lower.

Not even the market operator ASX Ltd (ASX: ASX) could hold steady, hitting a record high of $90.84 during the day but still closing 1.9% lower at $88.18.

Oz Minerals (ASX: OZL) had a particularly disappointing day, falling off recent highs to close at $14.18, down 4.6%.

Tech stocks show the way

Following on from a swag of record share prices on the NASDAQ exchange, local technology stocks were particularly bright early as Megaport (ASX: MP1), Appen (ASX: APX) and accounting software provider Xero (ASX: XRO) all reached record highs before dropping before the close.

Buy now, pay later darling Afterpay (ASX: APT) also equalled its Thursday record of $82 before dropping late while Nearmap (ASX: NEA) added an impressive 10.3% to $2.69, helping the sector to a 4.6% weekly gain.

One of the more unlikely highlights was a recovery in some of the beaten down travel stocks with Webjet (ASX: WEB) and Flight Centre (ASX: FLT) both performing very well, up 11.8% and 7.1%.

Chicken producer Inghams (ASX: ING) went out on a wing and treated shareholders to a 3% rise to $3.39 on the back of a solid earnings report.

Small cap stock action

The Small Ords index rose a stunning 2.54% this week to close at 2776.6 points.

Small cap companies making headlines this week were:

Blackstone Minerals (ASX: BSX)

Exploration success at Blackstone Minerals’ Ta Khoa nickel project in Vietnam continued this week with the discovery of the Viper nickel zone.

The mineralised zone was discovered east of the Ban Chang prospect. Blackstone’s in-house geophysics crew initially made the discovery and this was followed up by the geology team which undertook a series of trenches.

This uncovered a nickel-copper gossan and generated a float sample assaying 0.8% nickel and 0.5% copper using a portable XRF.

Blackstone managing director said the fact that Viper was a blind discovery boded well for future similar finds at the project.

“In addition to blind discovery potential, we have 25 massive sulphide targets, which are all associated with outcropping mineralisation at surface, and with our in-house geophysics team, we can generate additional blind discoveries that were not known to previous operators of the project,” he said.

Investigator Resources (ASX: IVR)

Silver explorer Investigator Resources is gearing up to drill what it claims is Australia’s highest-grade undeveloped primary silver deposit.

The company’s preparation for drilling the project known as Paris are “well advanced” with a rig to be mobilised to site early next month.

Investigator is funded for this exploration phase after a recent $8 million capital raising.

This program will comprise 15,000m of infill and exploration drilling as well as 5,000m of satellite exploration drilling.

Paris has a current resource of 9.3Mt at 139g/t silver and 0.6% lead for 42Moz silver and 55,000t lead.

Investigator managing director Andrew McIlwain noted previous drilling had resulted in improvements to grade and that he believed this campaign would have a similar outcome.

AD1 Holdings (ASX: AD1)

Recruitment technology and SaaS company AD1 Holdings has secured a three-year agreement with 3P Energy, which is expected to begin generating revenue in the December quarter.

Under the deal, AD1 will provide its full suite of SaaS solutions to 3P Energy.

It will also provide related managed services to enable customer acquisition, fully compliant billing and operations and customer analytics platform.

The agreement is for initially three years.

AD1 has previously provided consulting services to 3P Energy.

As well as the deal with 3P Energy, AD1’s chief executive officer Prashant Chandra said the company was progressing “multiple new business opportunities” with discussion expected to close in the current quarter.

BMG Resources (ASX: BMG)

Explorer BMG Resources is shouldering into the gold space after reporting it was acquiring Oracle Mining which owns three “high growth” gold projects in WA.

The assets comprise “drill ready” Abercromby in Wiluna and Invincible and South Boddington which are close to large gold deposits.

In consideration for the acquisition, BMG will issue about 40% of its capital to Oracle shareholders and raise $4 million via a placement and share purchase plan.

BMG has already outlined a work program for the projects including resource drilling at Abercromby, with the company planning to reveal a resource estimate “as soon as practicable”.

Previous drilling at Abercromby has returned 57.5m at 5.73g/t gold from 80m and 30m at 10g/t gold from 164m.

Resolution Minerals (ASX: RML)

Alaskan gold explorer Resolution Minerals has begun drilling the Echo prospect within its 64North project, which is adjacent to Northern Star’s Pogo operations.

Echo is the second priority prospect that Resolution has firmed up for drilling at the project.

First assays from Aurora, the first target, are expected by the end of this month.

The first drill hole at Echo is targeting a 180-300m deep target zone.

While this is underway a broader regional field program is being carried out to delineate drill targets at E1 and Boundary.

Resolution has appointed a new chairman with Craig Farrow expected to take up the role in the coming months. Mr Farrow replaces Len Dean who is retiring after 50 years in the resources sector.

Boss Resources (ASX: BOE)

Following a positive feasibility study at the beginning of the year, Boss Resources has revealed “significant” cost savings for its proposed Honeymoon uranium mine.

The company’s strategy is to reduce costs so that when mining begins it will be one of the world’s lowest cost uranium producers.

This week’s announced cost savings were a result of technical optimisation studies in collaboration with the Australian Nuclear Science and Technology Organisation.

As part of the review, GR Engineering Services identified a 10% or US$6.3 million cost saving in the capital expenditure, while operating costs are estimated to be reduced by US$1.20 per pound of uranium.

Boss managing director and chief executive officer Duncan Craib said the company would continue evaluating avenues for reducing costs further.

Osteopore (ASX: OSX)

Bone regeneration company Osteopore is cashed up to advance its market penetration and global growth plans.

The company announced this week existing shareholders and high-net worth institutions and investors had backed it in a $8.5 million placement.

Osteopore will issue more than 16 million shares at $0.53 each, with settlement scheduled to occur next week.

The placement is at a 13.1% discount to Osteopore’s last traded price of $0.61.

Funds along with existing cash reserves will boost Osteopore’s plans to increase revenue in current regions and expand manufacturing capabilities to meet future demand.

The company will also channel proceeds into expansion within new global markets.

The week ahead

For the coming week, once again individual stock news will continue to be very important as the reporting season continues.

Some of the results to watch out for this week include Super Retail Group (ASX: SUL), Blackmores (ASX: BKL), Seven West Media (ASX: SWM), mall owner Scentre (ASX: SCG), Ansell (ASX: ANN), Woolworths (ASX: WOW) and Afterpay (ASX: APT).

Apart from profit results, any continuation of falling COVID-19 infection rates in Victoria and NSW would be a positive.

On the statistical side, June quarter data on construction activity and business investment are sure to be hit by the pandemic while weekly card spending, consumer confidence, jobs and wages figures may provide a stronger and more forward-looking picture.