Weekly review: a topsy turvy week ends lower as COVID-19 deaths increase

WEEKLY MARKET REPORT

It was a week of two halves with some solid rises early on followed by some weakening as the week wore on and COVID-19 deaths in Victoria rose by seven on Friday alone.

The sum total was that the ASX 200 finished 1.2% or 70.5 points lower on the Friday session at 6024 points, losing 0.2% for the week as Asian markets tumbled on news China had ordered the US to close its consulate in Chengdu.

That move was in retaliation to a US order for China to shut down its consulate in Houston, Texas, over allegations it had stolen US research – setting up plenty of room for further diplomatic action between the two sparring superpowers as the US election draws closer.

Index still up for the month

Despite the weekly fall, the ASX 200 is still up 2.1% for the month of July but it has been a topsy turvy experience with most up days followed by a down day.

On Friday technology and property were both on the nose but were also joined by the banking and mining heavyweights, with the big banks all falling at least 1% and the miners overall down by 0.9%.

Profit warnings hit stocks hard

Profit warnings were like kryptonite for individual stocks with Insurance Australia Group (ASX: IAG) and shopping centre owner Vicinity Centres (ASX: VCX) both warning that their results would be hit by the coronavirus.

IAG flagged a 70% profit drop and ditched its final dividend to end down 7.8% or 45c to $5.32 while Vicinity cut property valuations by 11.3% and weakened 3.5c or 2.49% to $1.37.

Overall, property stocks lost 1.8% as other mall owners fell in sympathy with Vicinity centres.

Not even the tech stocks had a good day with the index following the NASDAQ down by 2.1% as buy now, pay later firm Afterpay (ASX: APT) shed 3% to $69.81.

Gold and silver enjoying time in the sun

One particularly bright spot on world markets has been gold and silver prices which have been flying amid growing global instability but the big Australian gold stocks all took a breather on Friday.

Newcrest (ASX: NCM), Evolution (ASX: EVN), Northern Star (ASX: NST), Saracen (ASX: SAR), Regis (ASX: RRL) and St Barbara (ASX: SBM) were all down by up to 7.7% , although it would be a brave investor who bet against the rising gold price trend at the moment.

Gold exchange traded security (ASX: GOLD) still added $4.54 or 1.85% to $249.70, continuing a stellar run since June 9.

Small cap stock action

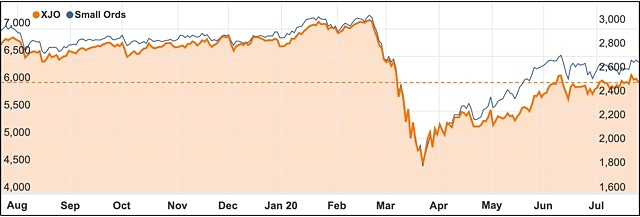

The Small Ords index closed up 2.07% for the week, despite a fall on Friday, to close on 2694.6 points.

ASX 200 vs Small Ords

Small cap companies making headlines this week were:

Traka Resources (ASX: TKL)

Explorer Traka Resources has collared the gold rights to lithium major Galaxy Resources’ Mt Cattlin North tenements.

Under the deal, Traka’s 20% free carried interest in Galaxy’s Mt Cattlin North asset has now been exchanged for 100% of the gold rights and other mineral potential – excluding the pegmatites, of course.

The Mt Cattlin North tenements host historical gold mines and have not been actively explored for decades.

“What was originally turn-of-the-century prospector-scale activity on 18 separate mines has, with modern day exploration and improved gold prices, become a rare opportunity for substantial up-scale,” the company stated.

Traka plans to immediately follow-up the numerous targets across the tenements.

Immuron (ASX: IMC)

Biopharmaceutical company Immuron’s core IMM-124E formulation has been found to have neutralising activity against SARS-CoV-2 the virus that causes COVID-19.

The result was identified during in-vitro testing using the formulation against the virus across four production lots.

In all four lots, IMM-124E was found to inhibit the virus at safe concentrations, while also “greatly enhancing” cell viability compared to the placebo.

Immuron’s IMM-124E is key to the company’s commercially over-the-counter Travelan and Protectyn products, which have been developed as immunotherapeutics to prevent travellers’ diarrhea and other gastrointestinal and digestive issues.

Immuron chief executive officer Dr Jerry Kanellos noted many COVID-19 patients are presenting with gastrointestinal symptoms.

He added IMM-124E may be useful in treating this and warrants further investigation.

Immuron plans to top up its cash reserves to fund its ongoing research activities via a US$20 million registered direct offering.

Tesserent (ASX: TNT)

Cybersecurity company Tesserent has signed a binding agreement to acquire Seer Security – making it the largest cybersecurity provider in Canberra.

Under the deal, Tesserent will issue 76.9 million shares and make a $5 million cash payment split over three instalments.

Tesserent will fund the acquisition through a $15 million debt facility and expects Seer will immediately start generating revenue, with the company achieving $2.2 million in sustainable earnings for FY 2020.

The acquisition is expected to expand Tesserent’s cybersecurity capabilities and increase its strong presence across Australian Government departments including defence and law enforcement.

“We are delighted to welcome Seer to the group, particularly in light of the [government’s] $1.35 billion Cyber Enhanced Situational Awareness and Response package to combat foreign cyber threats to Australian sovereignty, recently announced by Prime Minister Scott Morrison,” Tesserent chairman Geoff Lord said.

Sultan Resources (ASX: SLZ)

Sultan Resources revealed its Lake Grace project in WA forms part of a zone that hosts the recent Chalice Gold Mines’ Julimar nickel, cobalt, platinum group elements discovery.

Since the discovery, major mining and exploration companies including Anglo American have pegged up tenements around Lake Grace.

“This zone hosts Julimar and also encompasses Sultan’s entire Lake Grace tenement portfolio,” the company stated.

Other explorers rushing to the region include Impact Minerals and Gold Road Resources.

Sultan’s Lake Grace tenements cover 690sq km in the region and are prospective for gold with drilling also showing evidence for nickel and cobalt-bearing sulphides.

The company noted that the south-west Yilgarn Terrane, part of the Yilgarn Craton, which hosts Julimar, is also home to the Newmont Mining’s Boddington gold deposit.

Sultan claims the region remains under-explored.

Freehill Mining (ASX: FHS)

Chile-focused Freehill Mining has begun a geophysics survey at its soon to be acquired El Dorado project, which is adjacent to the company’s advanced high-grade Yerbas Buenas magnetite project in the region.

Despite awaiting the final shareholder approval for the El Dorado acquisition, Freehill is confident it will get the go-ahead and has fast-tracked low cost exploration activities.

First up is the geophysics survey to identify the magnetite structures across the 750-hectare tenements.

Results from the survey will be used to define the parameters for a follow-up induced polarisation survey which aims to identify copper sulphide structures.

Additionally, Freehill has completed surface sampling across the southern, mid and north-eastern section of the project – focusing on geological structures identified in previous rock chip sampling that uncovered up to 45% iron, 4.85% copper and 22.8g/t gold.

“Initial indications from previous sampling and other reconnaissance work has reaffirmed our belief that El Dorado has the potential to add considerable grade and scale to our existing footprint at Yerbas Buenas, whilst also providing exposure to the copper-gold mineralisation on offer within Chile’s world-class iron-oxide-copper-gold belt,” Freehill chief executive officer Peter Hinner said.

Argent Minerals (ASX: ARD)

With the silver price exceeding US$22/oz this week, Argent Minerals’ resumption of drilling at Kempfield is timely as the company searches for more silver as well as lead, zinc, gold and copper.

Kempfield is Argent’s flagship project and is located 40km south of Newcrest Mining’s Cadia operation in NSW.

The project hosts a JORC resource of 52Moz silver equivalent and has been designated by the NSW Government as a significant development for the state.

Previous exploration at Kempfield unearthed lead-zinc grades up to 17.9% and a 1m at 1,065g/t gold intersection.

Argent managing director and chief executive officer George Karageorge said the company was “excited” to be on the ground with its planned 11,000m program covering its for key projects.

Lithium Australia (ASX: LIT)

Lithium Australia’s path to positive cash flow is a step closer with its 50%-owned subsidiary Soluna Australia reporting first sales and installation of its battery storage systems across Perth in WA.

The installation and sales follow Soluna receiving its first product shipment earlier this month.

Lithium Australia managing director Adrian Griffin claims the units are the most advanced available in Australia.

The company anticipates Soluna will be cash flow positive by the December quarter.

Meanwhile, the company is looking to generate revenue from its proprietary LieNA® lithium extraction technology.

Earlier this week, Lithium Australia said it was seeking expressions of interest to commercialise the technology.

Lithium Australia has spent more than $12 million on advancing the technology which can process low-specification spodumene and reduce waste.

Current methods are unable to process this material resulting in up to 50% of the lithium mined ending up in tailings dams.

Another revenue stream is also anticipated from Lithium Australia’s subsidiary Envirostream Australia, which is the only mixed battery recycling company in the entire Australasia region.

It is expected Envirostream will post significant revenue growth and transition to cash flow positive in the second half of FY 2021.

Upcoming listings

Looking to make its way onto the ASX bourse in the near future are: Pan Asia Metals, DUG Technology and Forbidden Foods.

Pan Asia Metals

Pan Asia Metals is a lithium and tungsten explorer with a difference – focusing on low cost assets in South East Asia.

The company owns the Khao Soon tungsten project in Thailand’s Nakhon Si Thammarat Province which has an existing historic mine that accounted for much of the country’s output during its operation.

Khao Soon was closed due to depressed tungsten prices and Pan Asia hopes to develop the project and add value by downstream processing the ore.

Pan Asia’s other high priority project is Reung Kiet which is prospective for lithium in lepidolite. The project is 70km from Phuket and was previously mined for tin.

At Reung Kiet, Pan Asia hopes to develop a low cost mining operation and process the ore into lithium chemicals at its own plant which will be created in either Malaysia or Thailand which both host sophisticated industrial economies despite being low cost.

Pan Asia also has two medium priority project – Bang Now in Thailand, which is also prospective for lithium, and Minter in Australia, which hosts tungsten occurrences.

To fund its plans, Pan Asia has launched an IPO to raise up to $6 million via the issue of 30 million shares at $0.20.

The company plans to list on the ASX in late September under the ticker PAM.

DUG Technology

Supercomputing company DUG Technology has unveiled a $26 million IPO via the issue of 19.26 million shares at $1.35 each – giving the company an estimated market cap of $134 million on its ASX listing.

DUG purportedly began in a Perth “back shed” in 2003 before expanding into the business it is today with more than 300 staff across four international officers.

According to DUG, it owns and operates some of the largest and greenest high-performance supercomputers in the world.

The company’s primary business involves analysing seismic data and imaging for the oil and gas sector.

It plans to use its IPO proceeds to expand into other sectors, which requires more supercomputing power.

DUG’s ASX listing is scheduled for late August and the company will use the code DUG.

Forbidden Foods

Targeting health conscious consumers with its “better for you” products Forbidden Foods hopes to raise $6 million in its IPO.

The company is offering 30 million shares at $0.20 to give investors a chance to secure exposure to its differentiated products and exotic ingredients.

Forbidden Foods’ sells its products under the brands Forbidden, Sensory Mill and Funch, which all have various ranges.

The Forbidden products include microwavable sweet and savoury rices and a flour selection comprising rice flour and other mixes and blends.

Sensory Mill has developed plant-based flours, powders and grains, while Funch focuses on packet mix products and gut health smoothie blends.

Forbidden Foods sells its ranges throughout 3,500 major and independent retailers including Woolworths and Costco. The products are also sold to 500 restaurants and some of the world’s leading food service and manufacturing operators.

The company exports to New Zealand, Ireland, the US and Singapore.

Forbidden Foods’ listing date is pencilled for the 31 August, under the proposed ticker of FFF.

The week ahead

History is always interesting and there will be plenty of it being reported in the coming week.

Here in Australia the main item of historical interest is the inflation reading for the June quarter, which is expected to come in somewhere around minus 1.9%, taking the annual rate to minus 0.4%.

This is what you would expect amid collapsing demand due to the COVID-19 recession and particularly as petrol prices fell dramatically, cutting the prices of transporting many goods.

Of course, we don’t know what the number will be until we see it on Wednesday but the real interest will come later when we see the effect of the subsequent recovery – albeit held back somewhat by the second lockdown in Melbourne.

It is a similar story in the United States, with economic activity in the June quarter as measured by GDP to be released on Thursday with consensus numbers suggesting a 34% pullback.

That savage retreat is unsurprising in the face of the COVID-19 recession but it is the speed and durability of the more recent improvement that is of more interest.

Other things to watch out for locally this week include a speech by RBA Assistant Governor Christopher Kent and figures on credit card spending, consumer confidence, building approvals and producer prices while in the US the Federal Reserve meeting is not expected to produce an interest rate change but will still be closely watched.

Chinese industrial profits and purchasing manager numbers plus US home prices, consumer confidence and income and spending will also be released.

The tit for tat diplomatic machinations between the US and China will also continue to drive markets.