Top 10 performing IPOs on the ASX in first half of 2017

The Initial Public Offerings (IPOs) market continued to produce positive returns for ASX investors in the first two quarters of 2017.

According to the OnMarket IPO report, the average gain in share price for IPOs in the second quarter was 11.4%.

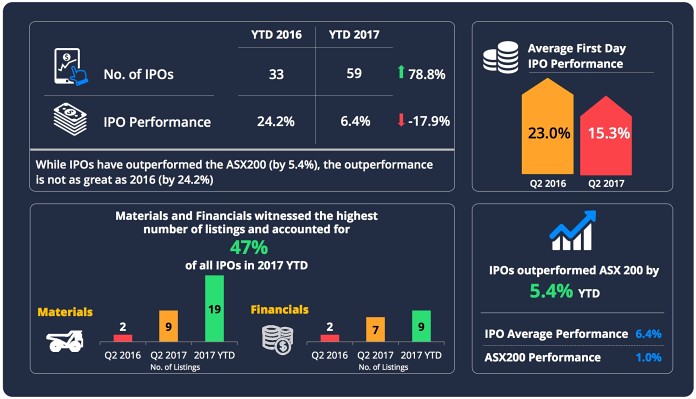

This saw the IPO market outperform the ASX 200 year-to-date (YTD) by 5.4%, whilst positive it’s not as strong as the same time in 2016 where IPOs outperformed the index of Australia’s top stocks by 24.3%

Key highlights of the IPO market to date in 2017

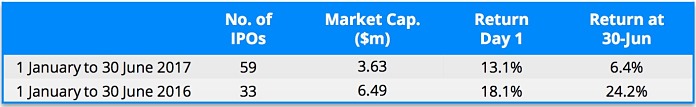

Total capital raised YTD in 2017 was $1.72 billion, down 44% from the same time last year at $2.48 billion.

Despite the drop off, the actual number of listings jumped from 33 companies a year prior, to a healthy 59 companies in 2017.

The above is highlighted by the fact that the IPO market in 2017 has so far been dominated by smaller floats.

Which sector was hot?

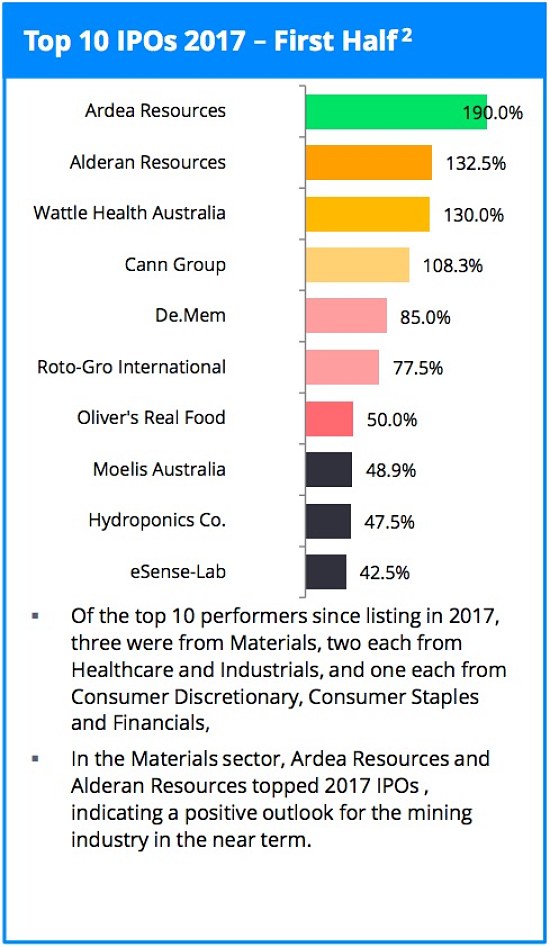

The Industrials sector led the way with a 33.2% share price gain overall 2017 YTD from its four listings. De.Mem (ASX: DEM) 85% gain since inception on the ASX being the standout.

Healthcare came in second with a total 30.3% from its six listings. Medical marijuana based companies such as Cann Group (ASX: CAN), eSense Lab (ASX: ESE) and Hydroponics Co. (ASX: THC) being the driving forces lighting up the sector.

Whilst the Materials sector scored a 2% fall, they also had the largest number of listings with 19 in total. So despite not being so impressive in terms of % gain, the sector is getting companies onto the market.

Also worth noting is Bingo Industries (ASX: BIN) from the Financials sector that raised a whopping $439.6m for its IPO.

Which sector was not?

Communications was the biggest loser seeing a 27.5% loss from its two listings.

The Real Estate sector took as dive of 25% from its sole listing of Velocity Property group (ASX: VP7).

Keep in mind that with such a small sample for these two sectors it is difficult to determine wether the lack of performance in the share price was driven by the company, the sector or a combination of the two.

The official list of the top 10 performing IPOs in the first half of 2017

As can be seen, IPOs can offer great returns and be used as a way to spread your risk portfolio across various asset classes. With that said you should always seek financial advice prior to making any investment decision and to see if it suits your unique circumstances and risk profile.

All eyes remain on the listings market to see if it will carry forward the momentum gained in the June quarter.

Which soon to be floated company will be the next big gainer?

We at Small Caps keep a list of upcoming IPOs so you can stay up-to-date with the latest opportunities on the market.