As tin consumption continues to grow in renewable energies, electric vehicles and innovative, a new market has been spawned for one of the world’s oldest metals giving it another time to shine and renewing interest in the metal for numerous ASX stocks.

Tin is often referred to as the “spice element” because small amounts of the mineral are present in a vast array of items essential to everyday life.

And the metal’s importance is expected to intensify as the electric vehicle, renewable energy and technology revolutions take off.

Rio Tinto and the Massachusetts Institute of Technology recently conducted a study that ranked tin as the number one critical metal in new technologies.

The duo found more tin was required in autonomous and electric vehicles, advanced robotics and computing, and renewable energy than most other battery minerals.

Speaking with Small Caps, International Tin Association market intelligence manager Tom Mulqueen said it was tin’s versatility combined with its “large variety of technical properties”, which made it a highly sought-after material in many applications including new technologies.

A brief history

The use of tin dates back to around 3000BC when the Bronze Age began. The earliest bronze objects contained around 2% tin and the rest copper.

Bronze makers found that by adding more tin, it made the casting process easier by lowering the melting temperature and making the material more malleable, which allowed the creation of more complex shapes.

The metal was first believed to be mined from the United Kingdom’s Cornwall region. Additionally, tin mines have been traced to Inca and Aztec regions in South and Central America prior to Spanish colonisation.

Fast-forward to current times and tin is used in several key applications including solder (a low-melting alloy), chemicals, tinplate, batteries, and copper alloys.

What is tin?

Tin is a silvery-white or grey metal and has a similar chemical composition to lead and geranium. The mineral is the world’s 49th most abundant element.

The metal is sought for its non-toxic, ductile and malleable properties. It melts at lower temperatures than other metals and can adhere to iron, steel and copper.

The primary commercial source of tin is cassiterite (SnO2), though small quantities of the element are extracted from other ores. Tin is mined from alluvial and hard rock deposits with common mining methods comprising dredging and open pits.

Although resistant to water corrosion, tin is eroded by acids and alkalis. The mineral is often used as a protective coating on other metals. It also acts as a catalyst when oxygen is in a solution and can accelerate chemical reactions.

Market dynamics

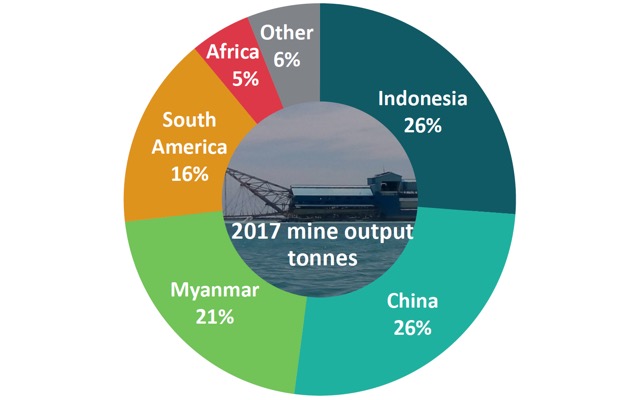

Compared to other commodities, the global tin market is small and worth around US$7 billion, with tin production amounting to about 320,000 tonnes in 2017.

The majority of the world’s tin arises from China and Indonesia, with both countries contributing 26% each to global production last year.

Myanmar is another large tin producing nation accounting for 21% of mined tin in 2017, while South America’s global output was 16% and Africa’s was 5%.

Similar to other commodities, China is the largest tin consumer – eating up almost half of the world’s tin.

However, Mr Mulqueen said refined tin consumption within China had weakened as a result of US and China trade tensions, slower growth and stricter environmental policies.

Despite the weakened consumption in China, Mr Mulqueen pointed out tin demand outside of China remained positive.

Other large tin consuming regions comprise the European Union, United States, Japan, and Asia.

“Overall, the [tin] market remains broadly in balance, as it was in 2017,” Mr Mulqueen said, adding provisional estimates are tin consumption growth for 2018 will be about 0.5%.

As we look further ahead, the International Tin Association anticipates refined 99.85% tin rise between 1% and 2% per year.

However, higher extraction costs and lower grades are expected to lead to continued declines in tin production and a market deficit is anticipated to widen through to 2021, with few new tin mines in the pipeline.

Various deficit scenarios have been published, with advanced tin explorer Elementos forecasting a 40,000tpa production shortfall by 2020.

The company also expects the tin price will go above US$23,000/t by 2019, which is above the World Bank’s prediction of US$20,605/t.

Tin prices

Tin is traded on the London Metal Exchange, with the commodity’s price currently attracting US$19,150 per tonne.

The metal’s price is up 1.32% on the previous month’s low of US$18,900, but down more than 12% on it US$22,100/t price at the end of January this year.

International Tin Association attributes the fall to escalating trade tensions between the US and China, as well as an increase in Indonesian tin exports.

Despite the fall, the metal’s price is up almost 45% on its January 2016 collapse of US$13,215/t.

Looking ahead, BMI Research’s view is the tin price will reach US$22,500/t by 2021 underpinned by the widening supply deficit, while the World Bank believes the price will average US$20,386/t.

Key applications

As the spice element, tin finds its way into numerous applications, with the solder sector accounting for almost half at 47%. This market is where tin is used in solar cells, automotive and electronics applications.

Additionally, the move to lead-free soldering under regulatory directives has driven demand for tin in recent years, with the amount of tin in solders rising from 60% to 96%.

Meanwhile, chemicals is the second largest end-use for tin swallowing up 18% of tin mined in 2017, while tinplate accounted for 14%, batteries 8%, copper alloys 5% and other less known end-users making up 8%.

Tin to play ‘significant’ role in lithium-ion battery

According to Mr Mulqueen, tin has been largely overlooked as a battery metal because it is a smaller market and more likely to be used a as a performance additive than a stand-alone material.

However, he expects tin will eventually play a “significant” role in the lithium-ion battery sector.

“Tin use in lithium-ion could start to positively impact on tin demand significantly from around 2025,” Mr Mulqueen explained.

“In the meantime, tin is already benefitting from its addition in advanced automotive lead-acid batteries needed for higher performance, especially in hybrid vehicles.”

Mr Mulqueen anticipates the commodity’s use in lead-acid batteries will grow rapidly in the short-term and will probably peak somewhere between 2025 and 2030.

Although new markets like the lithium-ion battery sector are predicted to lift tin demand, Mr Mulqueen says the metal’s primary growth drivers will be expansion and diversification within its existing markets for solder and tinned copper as energy and electronics industries evolve.

“Expanding electronics markets include robotics, automation, drones, Internet of Things, 5G, advanced computing, renewable energy, and electric vehicles,” Mr Mulqueen said.

New markets

In addition to these latest breakthrough applications, new uses for tin are also on the horizon with the International Tin Association calculating about 5,000 scientific papers and patents on tin related technologies were published in 2017.

The association says this demonstrates a strong future for the material, with any one of the innovative technologies potentially impacting the small market.

Tin stocks on the ASX

With the vast majority of tin production arising out of other regions, Australian investors are left in a unique position with limited exposure to this increasingly critical element.

Small Caps has collated a list of the ASX-listed stocks that are either producing tin or possess tenements prospective for the mineral.

These stocks include:

Alliance Resources (ASX: AGS)

Drilling at the Zealous tin prospect within Alliance Resources’ 79.01% Wilcherry project in South Australia intersected tin in one hole back in 2016 after gravity surveys identified anomalies.

The project encompasses 1,200sq km and the company is focussed on exploring for gold and graphite in the area.

Andromeda Metals (ASX: ADN)

Formerly known as Adelaide Resources, Andromeda Metals owns the Davenport Ranges project in the Northern Territory.

The project covers 540sq km in the area and is believed prospective for several minerals including tin; although, lithium and tungsten are the primary exploration focus.

Ardiden (ASX: ADV)

Ardiden is advancing its Seymore Lake lithium project in Canada.

Preliminary testwork on a bulk ore sample from the project in 2017 returned tin.

However, the company is focused on the project’s lithium mineralisation.

Aus Tin Mining (ASX: ANW)

One of the few specifically tin focussed stocks on the ASX, Aus Tin Mining spent the past 12 months advancing its Taronga and Granville tin projects, in New South Wales and Tasmania, respectively, with a view to becoming the “tin stock of choice” on the ASX.

Taronga has a world-class resource of 57,000 tonnes of contained tin, 26,400t of contained copper and 4.4 million ounces of silver and was demonstrated in a 2014 pre-feasibility study to be technically and economically feasible.

Earlier this year, Aus Tin Mining received local council approval on a development application for Taronga stage one, which will comprise a trial mine and pilot plant to process approximately 336,000t of ore and produce a saleable concentrate over a two-year period.

Over at the Granville project, which Aus Tin Mining acquired on a care and maintenance basis in 2016, exploration activities have been in progress to expand and extend the life of mine.

AVZ Minerals (ASX: AVZ)

According to AVZ Minerals, Manono is “the largest undeveloped hard rock lithium project globally in terms of grade, mine life and expandability.”

The company’s maiden resource estimate for Manono totals 259.9Mt grading 1.63% lithium for 4.25Mt of contained lithium.

In addition to lithium, the resource includes 219,00t of tin and 11,200 tantalum.

Although, the company has not established the value of tin in terms of by-product credits, AVZ anticipates the inclusion of these credits in a definitive feasibility study which it anticipates will wind up mid-2019.

BBX Minerals (ASX: BBX)

BBX Minerals is advancing its projects in Brazil, which are prospective for multiple minerals including tin.

Hydrometallurgical testwork on a 1kg sample from Ema yielded 103.4g/t tin as well as gold, silver, palladium, platinum and copper.

BBX is focussed on unlocking the precious metals component at the projects at this stage and has applied for a trial mining licence.

Carnavale Resources (ASX: CAV)

Carnavale Resources is a Western Australian company pursuing a 70% share in the Kikagati (Isingiro) tin project in southern Uganda.

The acquisition is part of the company’s strategy to secure a foothold in the new era electric vehicle and storage battery sectors.

The tin project has not previously been drilled and Carnavale is optimistic about the location – likening it to two other world-class tin deposits. A 2,000m diamond drilling campaign is underway at the project, which is anticipated to reach completion in December 2018.

Carpentaria Resources (ASX: CAP)

Carpentaria Resources has a 20% interest in the Temora Barellan joint venture project with private entity Cape Clear holding the other 80%.

The project is in NSW and is believed prospective for several minerals including tin.

Carpentaria hasn’t reported any recent developments regarding the asset.

Consolidated Tin Mines (ASX: CSD)

Currently suspended from trading until it completes all ASX compliance requirements, Consolidated Tin Mines is mining zinc, lead and copper from its Mount Garnet operation, in Queensland, which includes a 1Mtpa processing plant.

The company is advancing several assets including the Gillian, Pinnacles, Windermere Deadmans Gully tin deposits at Mt Garnet, which have combined resources of 12Mt at 0.40% tin.

A pre-feasibility study was carried out on Gillian and Pinnacle in 2013 and indicates the deposits can underpin a nine-year 1Mtpa mine to generate 2,944tpa tin in concentrate at 68% purity.

Consolidated Tin Mines believes there is potential to extend the mine life by developing the remaining deposits and expanding exploration activities across its portfolio, which includes tenements within Queensland’s historic Herberton tin fields.

Core Exploration (ASX: CXO)

Lithium-focussed Core Exploration owns a 100% interest in the Anningie and Barrow Creek lithium projects, which comprise five exploration licences spanning 2,500sq km in the Northern Territory’s north Arunta region.

The region is known for its tin, tantalum and pegmatite fields and hosts historic tin mines.

However, at this stage, Core is focussed on exploring for lithium.

Crater Gold Mining (ASX: CGN)

Crater Gold Mining owns the Croyden polymetallic project in Queensland.

Several anomalies have been identified at Croyden for further evaluation with a drill intersection at the A2 prospect returning 5m grading 8% zinc, 180g/t silver, 0.58% tin and 0.57% copper.

Crater claims the prospect has similarities to the Dajing deposits in inner Mongolia that have produced tin, silver and base metals for more than 40-years.

Crusader Resources (ASX: CAS)

Gold-focussed Crusader Resources owns the Manga lithium project in central Brazil and the Gaia lithium project in Portugal.

The projects are at early exploration stages but have been identified as prospective for tin.

However, at this stage, Crusader is actively advancing its gold assets.

Cullen Resources (ASX: CUL)

Multi-commodity mineral explorer Cullen Resources is actively firming up targets at its Wongon Hills project in WA.

Cullen owns 90% of the project, which is prospective for several commodities including tin.

Preliminary exploration has generated targets for drilling, however the company is negotiating access with landholders and can’t begin drilling until it has pinned down the appropriate agreements.

Dart Mining (ASX: DTM)

Dart Mining has lodged exploration licence applications encompassing 460sq km in north east Victoria.

The projects Empress and Eskdale will add to the company’s existing licenses in the area which are have been mined historically for tin.

Although previously exploited for tin, Dart is hoping to unlock the lithium value within the region.

DGR Global (ASX: DGR)

DGR Global has a 18.24% holding in Aus Tin Mining.

Please refer to the Aus Tin Mining entry for tin exploration and production details.

Elementos (ASX: ELT)

Elementos’ flagship, the 100% owned Cleveland project in Tasmania, is an historic tin mine in which production was “about 24,000t of tin in concentrate and about 10,000t of copper in concentrate.”

Latest results from diamond drilling has spurred a revised JORC hard rock combined open pit and underground resource of 7.47Mt at 0.75% tin and 0.3% copper for 56,100t of contained tin and 22,200t of contained copper.

The company is largely focussed on the retrieval of tin, but will also be extracting the copper and tungsten that are present. Feasibility studies are underway at the project.

Elementos recently acquired the Oropesa tin project in Andalucía, Spain, which has a JORC Resource of 67,520t tin.

The company is also in the early stages of acquiring an interest in a third mine, Temengor in Malaysia, having secured a farm-in agreement with Empire Tin Mining Sdn Bhd for the asset.

Enterprise Metals (ASX: ENT)

Enterprise Metals’ Yalgoo project comprises exploration licence 59/2076 and is prospective for gold and base metals, including tin.

The project is at an early exploration stage in an area that has had little modern exploration.

However, Yalgoo pegmatites with tin and tantalum workings are immediately north-east of the licence.

European Metals Holdings (ASX: EMH)

European Metals Holdings is developing the Cinovec lithium-tin project in the Czech Republic, which hosts a combined inferred and indicated resource containing 7.18Mt lithium carbonate equivalent and 262,600t of tin.

In October 2017, drilling of the upper section of the main lithium interval at Cinovec was reported to contain significant tin and tungsten mineralisation with 15.85m averaging 0.70% lithium oxide, 0.29% tin and 0.073% tungsten.

European Metals hopes to produce high-value lithium hydroxide from Cinovec due to its increasing use in lithium-ion batteries, with tin extracted as a by-product.

Force Commodities (ASX: 4CE)

In mid-2017, Force Commodities entered an agreement to secure 70% of the Kitotolo and Kiambi lithium projects in the Democratic Republic of Congo.

Although actively exploring for lithium, the projects are believed prospective for tin and tantalum.

The project is along strike from AVZ’s Manono project where tin has been identified as a potential by-product.

Galan Lithium (ASX: GLN)

Galan Lithium has applied for an exploration licence known as the Greenbushes South project, which is 15km south of the Greenbushes lithium mine in WA.

The project covers 43sq km and is considered prospective for tin, lithium and tantalum, with numerous old tin mines in the area.

According to Galan, the project has similar mineralisation to the nearby Greenbushes mine. Once it has been granted it licence, Galan plans to begin exploration.

Havilah Resources (ASX: HAV)

Another multi-commodity explorer Havilah Resources owns 16,586sq km of tenements across South Australia, which host several minerals including tin.

Havilah has a 65% stake in the Prospect Hill joint venture and can earn up to 85% by funding a bankable feasibility study.

Prospect Hill has a historic resource of 172,000t at 1.15% tin and Havilah aims to develop the project into one of South Australia’s first modern tin mines.

Hipo Resources (ASX: HIP)

Hipo Resources is farming-in to the Kamola lithium project in the DRC, which is close to AVZ’s Manono lithium project, which was originally mined for tin between 1919 and 1980.

Reviews of previous geological work have confirmed Hipo’s DRC tenements are prospective for similar minerals to Manono including tin.

The company plans to start exploring the tenements in early 2019.

Impact Minerals (ASX: IPT)

Drilling at Impact Minerals’ Silica Hill prospect, which is part of the Commonwealth project, uncovered tin mineralisation along with silver, zinc, lead, copper, molybdenum, antimony and bismuth.

The mineralisation was found in a high-grade feeder vein, which was 116m thick.

Impact plans to carry out further drilling to better-understand the mineralisation at the NSW project.

Infinity Lithium (ASX: INF)

Infinity Lithium is another lithium explorer with tenements in a historic tin producing region.

The company has a 50:50 joint venture with Valoriza Mineria to advance the San Jose lithium-tin project, which is in Spain’s west near the town of Caceres.

San Jose has a resource of 111.3Mt at 0.28% lithium, 0.61% lithium oxide and 206ppm tin.

Infinity has the option to earn up to 75% in the project by completing a feasibility study.

Jadar Lithium (ASX: JDR)

Jadar Resources owns the 92.8sq km Cer project, which is about 10km north of Rio Tinto’s renowned Jadar project in Serbia.

The region has a long tin mining history with the mineral extracted along its rivers since the Bronze Age.

Jadar wholly-owns similar projects in the area including Bukulja, Rekovac, Krajkovac and Vranje with all displaying elevated tin mineralisation and anomalies.

The company is actively exploring the projects for lithium pegmatites.

Jervois Mining (ASX: JRV)

Nickel and cobalt focussed Jervois Mining owns 100% of the Khartoum tin project, which includes six tenements in Queensland’s Atherton Table Lands.

The area was historically mined for tin and Jervois has completed a surface exploration program at the project as well as preliminary mapping and reviewing existing diamond drill core and data.

Jervois said the results “show good potential for economic mineralisation” at the project and is current in the process of trying to find a partner.

Kasbah Resources (ASX: KAS)

In July, Kasbah Resources completed a definitive feasibility study for the Achmmach tin joint venture project in Morocco (Kasbah 75%, Toyota Tsusho 20%, Nittetsu Mining 5%).

The study supports an initial 10-year mine life via an underground operation and using ore-sorting and high-pressure grinding roller technology to deliver 77% tin recovery.

Kasbah also owns the Bou El Jaj project, approximately 14km south-west of Achmmach, which has had 55 holes drilled into it previously and is highly-prospective for tin mineralisation which could provide ore feed to Achmmach’s processing plant, thereby extending its life further.

Korab Resources (ASX: KOR)

Korab Resources owns the Rum Jungle suite of tenements in the Northern Territory.

The suite includes Geolsec, Batchelos and Green Alligator projects, which are believed to have “great exploration potential” for tin, nickel, copper, lead and other metals.

Lepidico (ASX: LPD)

Lepidico wholly-owns Euriowie in NSW.

The project comprises 49sq km and is 60km north of Broken Hill. It hosts historic tin mines, but the company is exploring the region for its lithium-content.

Lithium Australia (ASX: LIT)

Disruptive technology developer Lithium Australia owns 100% of the Sadisdorf lithium-tin project in Germany.

The German authorities approved the project’s transfer to Lithium Australia in September 2018 from Tin International AG.

Sadisdorf hosts a historic tin mine and a JORC resource of 3.36Mt grading 0.44% tin.

Lithium Australia is hoping to unlock the value of the project’s tin, tungsten and lithium, focusing on using its proprietary SiLeach process to produce lithium carbonate equivalent for the burgeoning European lithium-ion battery market.

Metals X (ASX: MLX)

As part of its stake in the Bluestone Mines Tasmania joint venture, Metals X owns a 50% interest in Renison – believed to be Australia’s largest tin operation, based around a world-class, long-life underground mine which produces tin concentrate and has approximately eight years of ore reserves through extensional exploration to replenish production.

During the year, Metals X commissioned a purpose-built three stage crushing, screening and ore-sorting plant designed to expand tin production at Renison by up to 20% through the rejection of waste prior to the processing plant.

The company is planning further growth at the project with the Renison tailings retreatment project, which is intended to increase tin production by a further 40% through the re-treatment of approximately 100,000t of tin in historic tailings.

Mineral Resources (ASX: MIN)

Mineral Resources has found pegmatites within the former Wodgina tantalum and tin project, located in the northwest of WA.

The pegmatites are rich in spodumene lithium minerals.

The Wodgina ore body was previously mined for tin, tantalum and beryl, but it is now being explored for lithium.

New Age Exploration (ASX: NAE)

New Age Exploration has a 50% interest in Cornwall Resources, which is actively exploring the Redmoor tin-tungsten project in Cornwall’s southeast.

Cornwall Resources has a 15-year exploration licence for the project, with an option for a mining licence.

The project has a mineral resource of 4.5Mt at 1% tin equivalent and preliminary mining studies have been positive.

Cornwall’s technical consultants have estimated an exploration target between 4Mt and 6Mt grading 0.9% tin equivalent to 1.3% tin equivalent.

Piedmont Lithium (ASX: PLL)

Piedmont Lithium is advancing its namesake project in Carolina.

The company claims the project lies within Carolina’s historic tin and spodumene belt. Despite laying within a region known to be prospective for tin, Piedmont’s feasibility studies have not addressed unlocking the mineral as a by-product.

RMA Energy (ASX: RMT)

Although relinquishing most of its tenements in 2018, RMA Energy has retained the Macauley prospect (EPM 19736), which was part of the Macauley Creek project in Queensland’s north.

The region hosts narrow vein type tin mineralisation.

At the time of writing, RMA Energy was evaluating restructuring and refinancing avenues.

Rolek Resources (ASX: RLK)

Formerly Shaw River Manganese, Rolek Resources is waiting to list on the ASX after lodging a prospectus in September.

As part of the relisting, Rolek has agreed to acquire several exploration projects across WA’s mid west and northern regions.

The Mount Dockrell and Lamboo project in the Kimberely includes historic tin workings.

Rolek was looking to raise $5 million via an IPO to advance the projects and hopes to begin trading on the ASX before the end of March 2019.

Stellar Resources (ASX: SRZ)

Stellar Resources is developing the high-grade Heemskirk tin project in Tasmania, and earlier this year considered the construction of an exploration decline into the Lower Queen Hill and Severn prospects to allow underground drilling and bulk sampling in order to define an ore reserve.

The company will advance exploration targets by conducting limited surface drilling until conditions improve enough to fund decline development.

In January, Stellar acquired the advanced Mount Razorback exploration licence which contains the historic Razorback and Grand Prize tin mines and a tailings dam.

The company said its initial focus within the exploration licence will be on the known tin assets, with sampling of the tailings dam and mine pit floor to determine tin grade, distribution and metallurgical performance.

Taruga Minerals (ASX: TAR)

Taruga Minerals has lodged exploration applications WA’s south-west, with the licences believed prospective for lithium, tantalum and tin.

The licences include the historic Yeraminup tin, tantalum and lithium prospect. Once, granted Taruga plans to undertake a detailed exploration program across the tenements.

Of interest, former AVZ chairman Klaus Eckhof is an adviser to the company, while his daughter Sheena is an executive director.

Thomson Resources (ASX: TMZ)

Thomson Resources is focussed on developing the Bygoo tin project, near the historic Ardlethan tin mine in southwestern NSW, which previously produced over 31,500t of tin.

In November, Thomson commenced drilling to define and extend the newly-discovered Dumbrells greisen at the Bygoo North target as well as several other targets in the Big Bygoo area, around 2km south of Bygoo North and Bygoo South and occurring as outcropping greisens running for several hundred metres each.

Thomson also has interests in the Bald Hill tin project, 20km south of Bygoo, where tin mineralisation has been intersected at shallow depths, with the best result being 15m at 0.4% tin from 19m.

In addition, the company has conducted preliminary fieldwork at the Gibsonvale exploration licence, 75km north of Bygoo, which is known to contain extensive historic alluvial deposits of hard rock-tin, tin-tungsten and tin-gold occurrences but none has recorded production of more than 5t of tin.

Follow-up activities are planned for 2019, with shallow bedrock geochemistry to establish trends of the mineralised greisens and veins.

Thundelarra (ASX: THX)

While drilling at the 90%-owned Red Bore prospect in WA, Thundelarra uncovered numerous minerals and elevated tin was found in the mix.

Private entity W Richmond is farming into the project and is conducting a drilling campaign focused on copper in the area.

TNT Mines (ASX: TIN)

TNT Mines holds a suite of tin-tungsten assets in northern Tasmania at Aberfoyle (including Storey’s Creek, Royal George and Aberfoyle-Lutwyche-Kookaburra historic mines) and the flagship Great Pyramid tin project with an inferred mineral resource estimate of 5.2Mt at 0.20% tin.

Results of the first diamond hole drilled at Great Pyramid in July confirmed “a substantial veining and alteration system” typical of previously reported tin mineralisation, with silicification extending well beyond limits of past drilling.

TNT said it will continue to evaluate optimal programs to progress the Lutwyche-Kookaburra prospect as well as other prospects on the Aberfoyle licence.

Todd River Resources (ASX: TRT)

Northern Territory-focused Todd River Resources wholly-owns the Walabanba lithium project in the Anningie tin field.

Previous activities at the project comprised tin and tantalum mining, but Todd River is exploring for lithium across the tenements.

Todd River’s Soldiers Creek project is also prospective for tin.

Toptung (ASX: TTW)

Toptung said “no appreciable levels” of potentially valuable by-product minerals have been encountered in silexite bulk samples taken from the Mt Everard workings at its flagship Torrington tungsten project in northern NSW.

This includes tin, which was detected in assays at approximately 0.6%.

Trek Metals (ASX: TKM)

Although focused on lithium and cobalt within the Arunta project, Trek Metals anticipates the project is prospective for other minerals including tin.

The project is located in the Northern Territory. In the company’s latest report, it stated reviewing historic data had yielded few encouraging targets.

Trek plans to dispose of much of the project’s tenements during the current quarter.

Tungsten Mining (ASX: TGN)

Earlier this year, Tungsten Mining acquired the Watershed tungsten project in north Queensland (which had potential for associated tin mineralisation) from Vital Metals for $15 million cash.

The company has not reported any other tin-related activities.

Tyranna Resources (ASX: TYX)

Formed after a merger between Ironclad Mining and Trafford Resources, Tyranna Resources holds a 20.99% interest in the Wilcherry Hill base metals project in South Australia, comprising seven tenements considered prospective for base metals including tin.

Alliance Resources (ASX: AGS, 79.01%) is the manager and operator of Wilcherry, and is focused on developing the project’s gold and graphite potential.

Variscan Mines (ASX: VAR)

Variscan Mines’ Beaulieu exploration licence covers 278sq km over a tin-rich region in France and includes the historic Abbaretz tin mine.

Tin is believed to have been mined from the region since 1200BC over 100km strike with the most prolific part a 20km section around the Abbaretz deposit.

In 1957, the Société Nantaise des Minerais de l’Ouest (SNMO) mined approximately 2,700t of tin from Abbaretz.

Variscan said its immediate priority targets include the Beaulieu and Chenaie tin prospects where former work has generated pre-JORC compliant resources.

Venture Minerals (ASX: VMS)

Venture Minerals operates the Mount Lindsay tin-tungsten project within north-west Tasmania’s highly-prospective Meredith Granite, between the world-class Renison Bell tin mine (operated by Metals X, ASX: MLX) and the Savage River magnetite mine (Grange Resources, ASX: GRR).

In April, Venture commenced a detailed re-assessment of the high-grade portion of the tin-tungsten resource at Mount Lindsay in a bid to address high demand from the fast-growing electric vehicle market for battery metals such as tin.

A feasibility study was completed during the September 2018 quarter, with comprehensive metallurgical testwork delivering grades of 75% tin concentrate, which the company believes is “likely to attract price premiums”.

Mount Lindsay remains one of the largest undeveloped tin resources in the world, containing more than 80,000t of the metal.

Venus Metals (ASX: VMC)

During the year, Venus Metals conducted a review of historical reports from 1973 and 1992 for the Poona lithium-tantalum project, in WA’s Murchison mineral field, which revealed geochemical data for approximately 500 stream sediment analyses – of these, six high-priority target areas for lithium based on tin anomalies were identified for drilling.

Venus continues exploring for tin as an associated metal to its main focus of vanadium, cobalt-nickel, gold and lithium.

Victory Mines (ASX: VIC)

Despite the solid fundamentals of Victory Mines’ Bolivia tin project, its lack of geographic proximity to Australia (where Victory’s six other projects are located) was a material deciding factor in its classification as a non-core asset during the year.

The project is under care and maintenance and Victory has begun discussions to divest the asset.

Vital Metals (ASX: VML)

Historical mining and intensive exploration work at Vital Metals’ Aue project in Germany demonstrated high prospectivity for tin mineralisation, as well as cobalt, tungsten, uranium and silver.

Soil and rock chip sampling results reported in October however, identified significant geochemical anomalies for only bismuth, silver, lead and arsenic.

Earlier this year, Vital sold its interests in the Watershed tungsten project in north Queensland (which had potential for associated tin mineralisation) to Tungsten Mining for $15 million cash.

Wolf Minerals (ASX: WLF)

Currently under a trading suspension, Wolf Minerals owns the Drakelands open pit tungsten and tin mine in England’s south-west.

The mine is part of the Hemerdon project and during the June quarter 2018 produced 70t of tin.

Because the company is under voluntary administration, an audited financial report for 2018 is not expected to be lodged till April next year.

**SEE ALSO:

– Gold stocks on the ASX

– Silver stocks on the ASX

– Lithium stocks on the ASX

– Cobalt stocks on the ASX

– Graphite stocks on the ASX

– Nickel stocks on the ASX

– Rare earth stocks on the ASX

– Zinc stocks on the ASX

– Vanadium stocks on the ASX

– Uranium stocks on the ASX

– Mineral sands stocks on the ASX

– High Purity Alumina stocks on the ASX

– Tungsten stocks on the ASX

– Hydrogen stocks on the ASX

– Oil and gas stocks on the ASX

– Cannabis stocks on the ASX

**