The future of coal on a global level

Despite global efforts to transition to low carbon energy sources, industry research shows strong growth in the coal sectors of some regions could offset planned phase outs in others.

With climate action increasingly becoming a key policy goal for many countries around the world, it appears as if much of the globe has begun to move away from coal as a source of energy to seek cleaner alternatives.

However, market trends are proving the world is quite resistant to change with research pointing towards strong growth in Asia’s coal sector offsetting divestments in other regions.

One prime example is last month’s federal election – billed the “climate change election” – where the Coalition’s surprise victory showed us that climate change wasn’t quite the top priority for Australians as polling data made it out to be.

So, are we really as close to saying goodbye to coal as we think?

Australia

The future of the coal industry was a key issue in the lead up to the election, with Adani’s proposed Carmichael thermal coal project in Queensland dividing politics and the nation.

It is being named as a major reason for the Labor party’s lost seats in Queensland with the state’s voters ultimately alleged to favour jobs over environmental concerns.

The mine, being proposed by a subsidiary of India’s Adani Group, is intended to feed Adani’s own power plants in India including its mammoth Mundra plant with a capacity of more than 4,000 megawatts.

In addition, it is expected to create 1,500 direct jobs on the mine and rail project and another 6,750 indirect jobs in surrounding Queensland towns.

In the end, Labor’s election pledge of aggressive climate change measures, which would have likely seen the mine scrapped, lost out to the Liberal’s minimalist approach and general support for the project.

The Queensland Government approved Adani’s plan to protect an endangered bird species in the region at the end of last week, but before the mine can commence operations, there is still one final environmental approval left, which involves how the mine will manage groundwater.

Queensland Premier Annastacia Palaszczuk told media that if Adani is given the green light, it could start developing the mine “within weeks”, although Adani’s own billboards in Brisbane read: “we can start tomorrow if we get the nod today”.

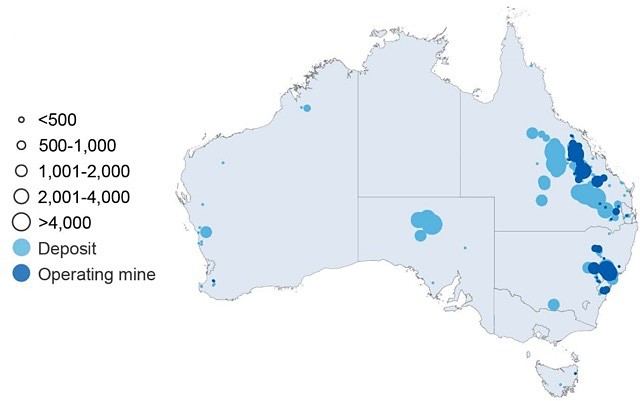

Major thermal coal deposits in Australia.

Adani was just one of nine coal projects proposed for the Galilee Basin and while it looks likely to go ahead, another developer recently threw in the towel.

Late last month, Chinese-owned MacMines Austasia voluntarily pulled out of five mining lease applications covering its planned $6.7 billion China Stone project.

Located next to Adani’s proposed Carmichael operation, it too promised to create thousands of jobs for the region with a projected 25-year mine life and an annual production capacity of 38 million tonnes.

Queensland’s mines department told media MacMines’ choice to not progress with its mining lease applications was based on a “commercial decision”.

Although the company, which is wholly-owned by China’s largest metallurgical coking coal producer Meijin Energy Group, still holds an exploration permit and can opt to reapply for mining leases in the future.

Meanwhile, other major companies are turning their back on coal, with mining giant BHP (ASX: BHP) also recently declaring its eventual divestment.

The company announced in a May strategy briefing that it planned to phase out its interests in coal “potentially sooner than expected” and said it had “no appetite” for new investments in energy coal, regardless of how attractive an asset may be.

BHP owns the Mt Arthur coal mine in New South Wales and shares the Cerrejon coal mine in Colombia with UK-listed miners Glencore (LON: GLEN) and Anglo American (LON: AAL).

These operations make up just 3% of the company’s asset base but according to BHP chief financial officer Peter Beaven, they are “two very high-quality mines which generate high margins”.

“Our focus will be on maximising value to shareholders, whether we are long-term owners or not,” he told analysts this week.

According to Mr Beaven, BHP is more interested in adding copper and nickel sulphide resources to its portfolio, with demand for these commodities expected to grow and supply sources becoming harder to discover and more expensive to develop.

Australia’s coal industry also faces a grim future with China recently cutting foreign imports of the energy source to tackle oversupply and implementing clean energy measures as well as policies favouring domestic suppliers.

Europe

Meanwhile, coal demand in Europe is expected to continue declining due to strong renewables generation, according to a 2019 coal outlook by market data firm Refinitiv.

Coal imports fell by more than 7% year-on-year for 2017 and were likely to have done the same in 2018, the firm said.

Many European countries have coal exit strategies with most of the nations that have announced their plans aiming for a phase out by 2025-2030.

Belgium was the first formerly coal-burning European Union member nation to become coal power free with its last coal plant closing in 2016.

Other countries with announced phase outs include France, which is targeting a coal-free status by 2021, the United Kingdom, Italy, Denmark, Austria, Ireland, Sweden, Finland, the Netherlands, Portugal and most recently, Germany (although it is targeting a much longer end date).

Russia

On the contrary, Russia has no plans to phase out coal and transition to low-carbon energy sources.

Instead, it is actively seeking to expand its coal industry.

The country’s government is more concerned about socio-economic consequences as some regions are heavily dependent on the coal industry for employment and power generation.

According to its ministry of energy, the Russian Government will spend an estimated total of US$123 billion (A$177 billion) on the coal sector between 2012 and 2030.

The Americas

Canada is another country leading the pack of G-20 nations planning to say goodbye to coal with a phase out target of 2030.

In the United States, President Donald Trump has been vocal in his efforts to revive the coal industry by scrapping the Obama administration’s climate change policy and pushing to replace it with a new emissions reduction target that was expected to boost output from coal-fired plants rather than lead to mass closures.

However, data from Reuters and the US Energy Information Administration (EIA) has shown that more US coal-fired power plants were shut in Trump’s first two years than were retired in Obama’s entire first term.

In total, more than 23,400MW of coal-fired generation was shut in during 2017-2018 versus 14,900MW between 2009-2012, Reuters reported.

The EIA also projected in its annual outlook that US coal production would drop 21% over the next 20 years, even further than the 18% decrease forecast two years ago when Obama’s Clean Power Plan was anticipated to come into force.

Threats to the US coal industry include growing consumer demand for cheaper energy sources like natural gas and the rising use of renewable power such as solar and wind.

According to Reuters and EIA data, US generators plan to shut around 8,422MW of coal-fired power in 2019, while adding 10,900MW of wind, 8,200MW of solar and 7,500MW of gas.

Asia

Despite this, the International Energy Agency (IEA) predicted in its latest coal market report Coal 2018 that global coal demand would remain stable over the next five years, as declines in Europe and North America are offset by strong growth in India and South East Asia.

China’s coal sector is currently positioned at the centre of the global energy stage, already accounting for 14% of global primary energy (the largest in the world) and its developments affecting coal, gas and electricity prices around the world.

The country also has an oversupply of coal with inventories reportedly at their highest levels since 2015.

However, the Chinese Government’s recent stricter environmental regulations and clean-air measures are set to constrain coal demand in the country going forward.

“We forecast Chinese coal demand to fall by around 3% over the period,” the IEA said.

To counter this, the agency has forecast significant increases in India, Indonesia, Vietnam, Malaysia, Pakistan and the Philippines with the biggest determining factor being coal’s affordability and availability.

“For many countries, particularly in South and South East Asia, [coal] is looked upon to provide energy security and underpin economic development,” IEA director of energy markets and security Keisuke Sadamori said.

Long-term global outlook

The IEA released its World Energy Outlook at the end of last year, predicting global energy demand would grow by more than a quarter by 2040.

But coal, which currently accounts for close to 40% of global energy sources, is expected to drop to about a quarter during the same timeframe.

In addition, the agency’s ‘New Policies Scenario’, which takes into account emission reduction policies and legislation, sees natural gas overtaking coal by 2030 as the second largest source of energy after oil.

However, in its World Energy Investment 2019 review published last week, the IEA said capital spending on coal (in addition to oil and gas) has bounced back in the last year while investment stalled for energy efficiency and renewables.

“Even though decisions to invest in coal-fired plants declined to their lowest level this century and retirements rose, the global coal power fleet continued to expand, particularly in developing Asian countries,” the IEA reported.

The agency said these continued investments in coal plants, which have long life cycles, “appear to be aimed at filling a growing gap between soaring demand for power and a levelling off of expected generation from low-carbon investments (renewables and nuclear)”.

“Without carbon capture technology or incentives for earlier retirements, coal power and the high CO2 emissions it produces would remain part of the global energy system for many years to come,” the IEA said.

And while coal use may be declining, it will still account for a significant portion of the world’s energy sources for quite some time, with the IEA saying “greater efforts are needed by government and industry to embrace less polluting and more efficient technologies to ensure that coal becomes a much cleaner source of energy in the decades to come.”