Tax cuts and new infrastructure the key 2019 Federal Budget measures

The estimated $7.1 billion surplus for 2019-20 will be the first time the budget has entered positive territory since 2007-08.

Treasurer Josh Frydenberg has dangled some appealing tax cuts combined with a budget surplus and plenty of infrastructure spending as the main attractions for re-electing the Liberal/National party Coalition Government.

In doing so he has reasonably effectively walked a tightrope between enticing the electorate with meaningful benefits while still claiming the moral high ground as being the best economic manager anyone could vote for.

Just how that resonates in the electorate given the Federal Government’s underdog status in the looming election remains to be seen but at the very least the Federal Budget has given Prime Minister Scott Morrison a fighting chance to shake off the impression of leading a deeply divided party and achieve an unlikely victory.

Tax cuts the main election plank

The central element of the budget is tax cuts worth up to $1,080 a year for 10 million low and middle-income earners, with the first instalment coming in the tax return later this year.

Small businesses also get a 2.5% tax cut to 25% by fiscal 2022 but like many of the promises, it will take time and a re-elected Government for them to be delivered.

$100 billion will be spent over the next decade on building transport infrastructure.

Pensioners also get a one-time payment of $75 for singles and $125 for couples to help pay their energy bills and spending on roads, railways and airports has been boosted by $100 billion over a decade.

Queensland and Victoria – both key turnaround states for securing an unlikely coalition election victory – are both well represented in road and rail projects in a bid to woo voters.

Tax cuts will reduce the surplus

The promised tax cuts come at a significant cost of $158 billion over the next decade and come on top of the $144 billion of tax relief that was passed into law last year.

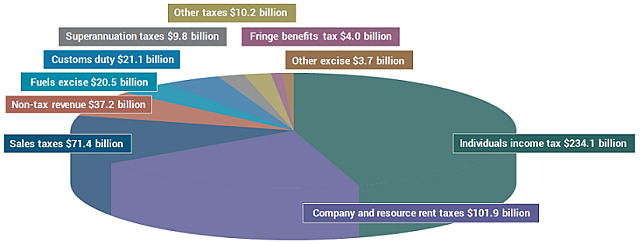

Where government revenues will come from.

That leaves a serious dent in the budget but it is nevertheless still projected to reach a surplus of $7.1 billion for 2019/20 as the booming price of iron ore and continuing strong employment levels keep filling the government coffers.

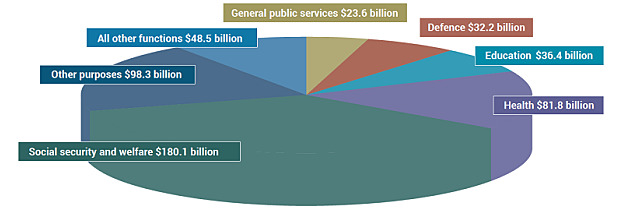

Where taxpayers money will be spent.

There is little doubt that Treasurer Josh Frydenberg’s claim that the “budget is back in black and Australia is back on track” is correct on the surface but there are still some risks and worrying signs no matter who wins the looming election.

Plenty of risks to forecasts

One is that treasury’s previous record of inaccurate forecasts could continue, particularly in an environment in which as the Reserve Bank has noted there is significant weakness in consumption due to stagnant incomes and falling house prices.

We have been promised a budget surplus for a very long time now by treasurers of various political persuasions and we still haven’t recorded one – and there is still the not insignificant matter of $373.5 billion of net debt built up since the GFC first dragged our budget into deficit.

Treasurer Frydenberg has promised to work that debt down to zero by 2030 but such a forecast is heroic in nature, given the difficulty in predicting revenues even a year ahead, let alone a decade.

Budget assumptions are rosy

Some of the other economic assumptions this budget is built on appear equally hairy chested.

Wage growth has been stagnant for five years now but this budget somehow assumes it is about to leap by a full percentage point.

Similarly, jobs growth is predicted to continue at the current trajectory which seems a little unlikely and consumption is predicted to hold up, which even the Reserve Bank has expressed concern about.

All told we are in for an interesting political and economic contest, which will really get going in earnest with the budget reply speech by Labor leader Bill Shorten on Thursday night effectively the starter’s gun for the election campaign between the two sides to begin.